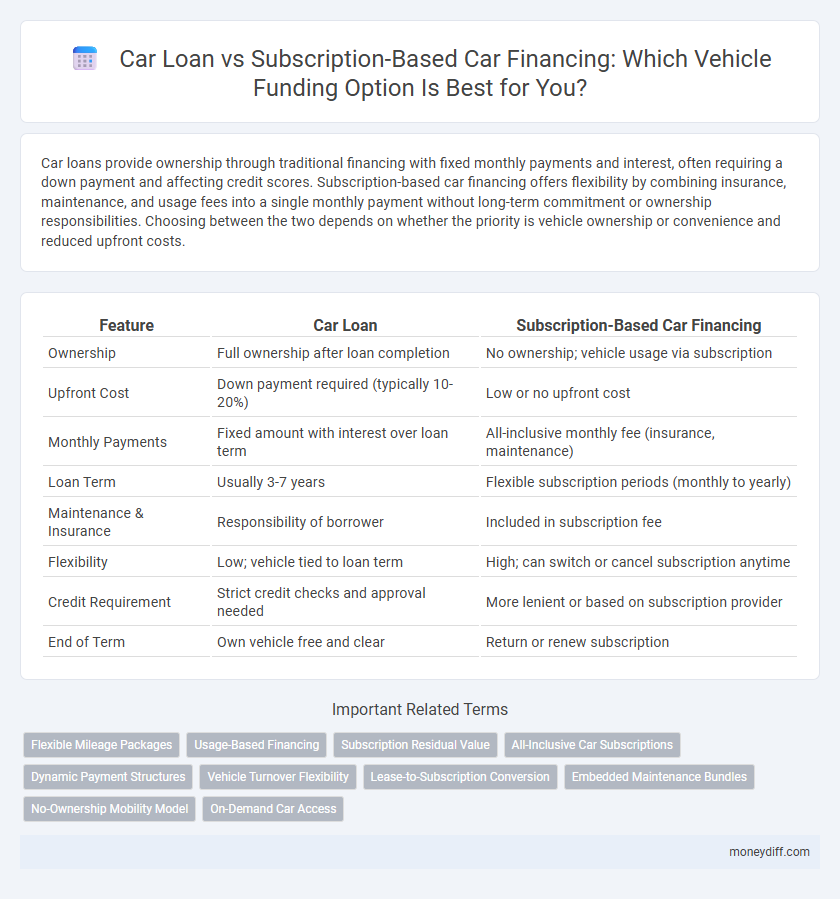

Car loans provide ownership through traditional financing with fixed monthly payments and interest, often requiring a down payment and affecting credit scores. Subscription-based car financing offers flexibility by combining insurance, maintenance, and usage fees into a single monthly payment without long-term commitment or ownership responsibilities. Choosing between the two depends on whether the priority is vehicle ownership or convenience and reduced upfront costs.

Table of Comparison

| Feature | Car Loan | Subscription-Based Car Financing |

|---|---|---|

| Ownership | Full ownership after loan completion | No ownership; vehicle usage via subscription |

| Upfront Cost | Down payment required (typically 10-20%) | Low or no upfront cost |

| Monthly Payments | Fixed amount with interest over loan term | All-inclusive monthly fee (insurance, maintenance) |

| Loan Term | Usually 3-7 years | Flexible subscription periods (monthly to yearly) |

| Maintenance & Insurance | Responsibility of borrower | Included in subscription fee |

| Flexibility | Low; vehicle tied to loan term | High; can switch or cancel subscription anytime |

| Credit Requirement | Strict credit checks and approval needed | More lenient or based on subscription provider |

| End of Term | Own vehicle free and clear | Return or renew subscription |

Understanding Car Loans: Traditional Vehicle Financing Explained

Car loans involve borrowing a fixed amount from a lender to purchase a vehicle, typically repaid through monthly installments with interest over a set term. Traditional vehicle financing offers the advantage of vehicle ownership once the loan is completed, allowing full control over the car's use and potential resale. Interest rates, loan terms, and down payment requirements are key factors that influence the total cost and affordability of car loans compared to subscription-based car financing.

What Is Subscription-Based Car Financing?

Subscription-based car financing offers a flexible alternative to traditional car loans by allowing customers to pay a monthly fee that covers the vehicle, insurance, maintenance, and often roadside assistance. This model eliminates the long-term commitment and upfront costs associated with purchasing or leasing a car through a loan, providing convenience and ease of use for drivers who prefer changing vehicles frequently. Unlike car loans that require credit checks and lengthy approval processes, subscription services streamline vehicle access with simplified eligibility criteria and all-inclusive pricing.

Key Differences Between Car Loans and Subscriptions

Car loans involve borrowing a fixed amount with set interest rates and monthly payments, leading to vehicle ownership after full repayment. Subscription-based car financing offers flexible access to vehicles with monthly fees covering insurance, maintenance, and roadside assistance, without long-term commitment or ownership. The key differences lie in ownership rights, payment structure, and included services, impacting financial planning and vehicle usage preferences.

Vehicle Ownership: Loan vs Subscription Models

Car loans grant full vehicle ownership after completing payments, allowing drivers to customize and keep the car long-term. Subscription-based car financing offers temporary access without ownership, featuring flexible terms and inclusive maintenance services. Choosing between these models depends on preferences for asset control, financial commitment, and vehicle usage duration.

Cost Comparison: Upfront and Ongoing Expenses

Car loans typically involve a larger upfront down payment and fixed monthly installments with interest over a set term, resulting in predictable but potentially higher overall costs due to finance charges. Subscription-based car financing offers lower initial fees and a single monthly payment that includes insurance, maintenance, and depreciation, but this convenience may lead to higher cumulative expenses over time. Evaluating total cost of ownership requires careful consideration of interest rates, insurance premiums, maintenance coverage, and the duration of vehicle use under each financing model.

Flexibility and Commitment: Choosing the Right Option

Car loans offer fixed repayment schedules and long-term ownership, providing stability but less flexibility in vehicle changes. Subscription-based car financing allows for short-term use with options to switch vehicles frequently, catering to those valuing flexibility and minimal commitment. Evaluating your driving habits and financial stability helps determine whether the structured repayment of a car loan or the adaptable, all-inclusive subscription model meets your vehicle funding needs.

Credit Score Impact: Which Option Is Better for Your Credit?

Car loans typically have a more significant impact on your credit score due to the hard inquiry and monthly payment history that can boost your credit mix and payment record. Subscription-based car financing often involves less stringent credit checks and may not consistently report payments to credit bureaus, resulting in a minimal effect on your credit profile. Choosing between these options depends on whether you aim to improve your credit score through regular, reported payments or prefer a flexible arrangement with limited credit reporting.

Maintenance and Insurance: Who Covers What?

Car loans typically require the borrower to handle all maintenance and insurance costs independently, providing full ownership and flexibility but also full responsibility for expenses. Subscription-based car financing often includes maintenance and insurance within the monthly fee, offering hassle-free management but limited ownership rights and potential restrictions on usage. Choosing between these options depends on preferences for control over vehicle upkeep versus convenience and predictable costs.

Ideal Users: Who Should Choose Loans or Subscriptions?

Car loans are ideal for buyers seeking full ownership and long-term use, especially those with strong credit and stable income who prefer traditional financing with fixed monthly payments. Subscription-based car financing suits individuals valuing flexibility, short-term usage, and all-inclusive services like maintenance and insurance, making it perfect for urban residents or those who frequently change vehicles. Understanding personal financial goals and usage patterns guides the choice between ownership through loans and convenience via subscriptions.

Making the Smart Choice: Evaluating Your Vehicle Funding Needs

Car loans offer ownership with fixed monthly payments and eventual full ownership, making them ideal for long-term vehicle use and equity building. Subscription-based car financing provides flexibility with inclusive services like maintenance and insurance, catering to short-term needs and those who prefer hassle-free driving. Evaluating your financial stability, usage patterns, and preference for ownership versus convenience is essential for making the smart choice in vehicle funding.

Related Important Terms

Flexible Mileage Packages

Car loans require fixed monthly payments and often penalize excess mileage, limiting flexibility for drivers with varying needs. Subscription-based car financing offers flexible mileage packages that adapt to different usage patterns, providing more control over costs and avoiding overage fees.

Usage-Based Financing

Usage-based financing in car loans allows borrowers to repay based on actual vehicle use, offering flexible payment terms tied to mileage or fuel consumption, which can lower overall costs compared to fixed monthly payments in subscription-based car financing. Subscription-based models include bundled services like maintenance and insurance but often have higher monthly fees and less flexibility in payment adjustments based on usage patterns.

Subscription Residual Value

Subscription-based car financing offers flexible monthly payments often tied to the vehicle's residual value, which can reduce upfront costs and provide an option to switch or upgrade cars more frequently. In contrast, traditional car loans require fixed monthly payments based on the loan principal and interest, with full ownership transfer but potentially higher financial commitment compared to managing subscription residual values.

All-Inclusive Car Subscriptions

All-inclusive car subscriptions provide flexible vehicle access with fees covering insurance, maintenance, and taxes, eliminating large upfront costs associated with traditional car loans. Unlike car loans, which require long-term financial commitments and impact credit, subscription-based financing simplifies budgeting and allows easy vehicle swaps without ownership responsibilities.

Dynamic Payment Structures

Car loans typically feature fixed monthly payments over a predetermined term, while subscription-based car financing offers dynamic payment structures that adjust based on mileage, usage, or subscription tier. This flexibility allows consumers to better match payments to their driving habits and budget, providing a more personalized vehicle funding experience.

Vehicle Turnover Flexibility

Car loans typically involve fixed terms and ownership commitments, limiting vehicle turnover flexibility, while subscription-based car financing offers customizable plans with the option to switch vehicles frequently, catering to consumers seeking adaptability. This model enhances user convenience by allowing access to multiple vehicle types without long-term financial obligations, optimizing cash flow management and reducing depreciation risks.

Lease-to-Subscription Conversion

Lease-to-subscription conversion offers flexible vehicle funding by allowing consumers to switch from traditional car loans or leases to subscription-based models, which include maintenance and insurance services within a monthly fee. This hybrid approach optimizes cost efficiency and convenience, appealing to users seeking adaptable payment structures without long-term commitments typical of conventional financing.

Embedded Maintenance Bundles

Car loans typically separate vehicle financing from maintenance costs, requiring additional service contracts, whereas subscription-based car financing often includes embedded maintenance bundles that cover routine repairs and servicing within a single monthly fee. This integration reduces unexpected expenses and simplifies budgeting, making subscription models increasingly attractive for consumers seeking hassle-free vehicle funding.

No-Ownership Mobility Model

Subscription-based car financing offers a no-ownership mobility model where users pay a monthly fee for vehicle access without long-term commitment or depreciation concerns, contrasting with traditional car loans that require ownership and involve interest payments and resale risk. This model enhances flexibility and convenience for consumers seeking short-term, hassle-free vehicle use without the financial burdens of ownership.

On-Demand Car Access

Car loans provide full vehicle ownership through fixed monthly payments and long-term financing, while subscription-based car financing offers flexible, on-demand car access with bundled services like insurance and maintenance for a monthly fee. Subscription models prioritize convenience and short-term use without ownership commitments, ideal for those seeking versatile vehicle options without long-term financial obligations.

Car Loan vs Subscription-Based Car Financing for vehicle funding. Infographic

moneydiff.com

moneydiff.com