Payday loans offer immediate cash but often come with high interest rates and fees, making them a costly short-term liquidity option. Early wage access allows employees to access earned wages before payday without expensive charges, providing a more affordable and flexible alternative. Choosing early wage access can help avoid debt cycles commonly associated with payday loans.

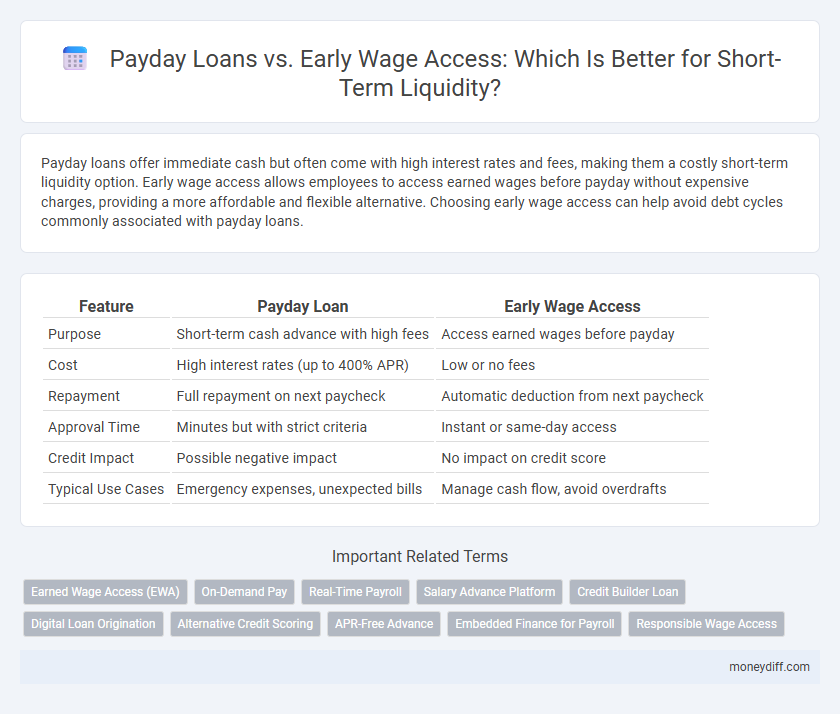

Table of Comparison

| Feature | Payday Loan | Early Wage Access |

|---|---|---|

| Purpose | Short-term cash advance with high fees | Access earned wages before payday |

| Cost | High interest rates (up to 400% APR) | Low or no fees |

| Repayment | Full repayment on next paycheck | Automatic deduction from next paycheck |

| Approval Time | Minutes but with strict criteria | Instant or same-day access |

| Credit Impact | Possible negative impact | No impact on credit score |

| Typical Use Cases | Emergency expenses, unexpected bills | Manage cash flow, avoid overdrafts |

Understanding Short-Term Liquidity Needs

Payday loans offer quick cash but often come with high interest rates and fees that can lead to debt cycles. Early wage access provides employees immediate access to earned wages without extra costs, promoting responsible short-term liquidity management. Evaluating financial needs and repayment ability is crucial to choosing the most sustainable option between these solutions.

What Are Payday Loans?

Payday loans are short-term, high-interest loans designed to provide immediate cash advances based on a borrower's next paycheck, often with repayment due within two to four weeks. These loans typically feature high fees and interest rates that can lead to a cycle of debt if not repaid promptly. Unlike early wage access, payday loans do not involve borrowing wages already earned, making them a more costly option for short-term liquidity.

What Is Early Wage Access?

Early Wage Access (EWA) allows employees to access a portion of their earned wages before the regular payday, providing immediate liquidity without the high-interest rates typical of payday loans. Unlike payday loans, EWA services often partner directly with employers to offer transparent, fee-free or low-cost advances, reducing financial stress and reliance on debt. This solution enhances short-term cash flow management by leveraging earned income rather than incurring new credit obligations.

Key Differences Between Payday Loans and Early Wage Access

Payday loans typically involve high-interest rates and fees with repayment due on the borrower's next paycheck, often leading to a cycle of debt; early wage access provides employees with the ability to access earned wages before the standard payday without excessive fees or interest. Payday loans are offered by third-party lenders and carry significant credit risks, whereas early wage access is usually facilitated by employers or partnered financial services, reducing the risk and cost. The key differences lie in cost structures, repayment terms, and the impact on financial health, making early wage access a more sustainable option for short-term liquidity.

Eligibility Criteria: Payday Loans vs Early Wage Access

Payday loans typically require borrowers to have an active bank account, proof of income, and be at least 18 years old, often with limited credit checks, making them accessible to individuals with poor credit scores. Early Wage Access programs generally require employment with a participating employer, a steady income, and enrollment in the payroll system, offering funds based on wages already earned but not yet paid. Eligibility for payday loans is broader but riskier, while early wage access is more restrictive yet safer and integrated within employer payroll.

Fees and Interest Rates Comparison

Payday loans typically charge exorbitant fees and annual percentage rates (APRs) that can exceed 400%, making them a costly short-term borrowing option. Early Wage Access services offer a more affordable alternative by allowing employees to access earned wages before payday with minimal or no fees and significantly lower or zero interest rates. Comparing both options, Early Wage Access provides better financial terms, reducing the risk of debt spirals often associated with payday loan fees and interest.

Impact on Credit Scores

Payday loans often lead to high-interest debt that can negatively affect credit scores if repayments are missed, as lenders typically report defaults to credit bureaus. Early Wage Access (EWA) provides employees with access to earned wages before payday without impacting credit scores, since it does not involve traditional borrowing or credit checks. Choosing EWA over payday loans reduces the risk of credit damage while offering short-term liquidity solutions.

Speed and Ease of Access

Payday loans provide quick cash with approvals often within minutes, but typically require a formal application and credit check, leading to potential delays and higher fees. Early wage access offers faster and easier liquidity by allowing employees to access earned wages directly through employer partnerships or apps without credit checks. This method reduces financial stress by delivering funds instantly or within a day, making it a more convenient alternative for short-term borrowing.

Risks and Potential Pitfalls

Payday loans often carry high-interest rates and aggressive repayment terms, leading to a cycle of debt and financial strain for borrowers. Early wage access offers a more flexible alternative, but risks include potential overdraft fees and employer restrictions that can limit availability. Both options require careful consideration of fees, repayment capacity, and long-term financial impact to avoid exacerbating short-term liquidity challenges.

Choosing the Right Solution for Short-Term Cash Flow

Payday loans often come with high interest rates and fees, making them an expensive choice for short-term liquidity. Early Wage Access (EWA) allows employees to access a portion of their earned wages before payday without interest or hidden charges, providing a safer and more affordable option. Evaluating immediate cash needs against long-term financial impact is crucial when choosing the right solution for short-term cash flow management.

Related Important Terms

Earned Wage Access (EWA)

Earned Wage Access (EWA) provides employees with immediate access to wages they have already earned, offering a cost-effective alternative to high-interest payday loans for short-term liquidity needs. Unlike payday loans that often involve exorbitant fees and debt cycles, EWA enhances financial wellness by allowing workers to avoid predatory lending and better manage cash flow between paychecks.

On-Demand Pay

On-demand pay options provide employees with immediate access to earned wages before the standard payday, offering a cost-effective alternative to high-interest payday loans for short-term liquidity. Unlike payday loans that often carry steep fees and interest rates, early wage access programs facilitate financial flexibility without the burden of debt, promoting healthier cash flow management.

Real-Time Payroll

Payday loans often carry high-interest rates and fees, while Early Wage Access (EWA) provides employees with real-time payroll access, allowing them to withdraw earned wages before the official payday without incurring debt. Utilizing real-time payroll technology, EWA enhances financial flexibility and reduces reliance on costly payday lending by offering instant liquidity tied directly to hours worked.

Salary Advance Platform

Salary advance platforms offer early wage access by allowing employees to withdraw a portion of their earned wages before payday, providing short-term liquidity without the high fees and interest rates typical of payday loans. Unlike payday loans that often require borrowing against future income with costly repayments, salary advances promote financial wellness through transparent, flexible, and employer-integrated solutions.

Credit Builder Loan

Credit builder loans help improve credit scores by reporting timely payments to credit bureaus, making them a smarter choice than payday loans, which often carry high interest rates and fees. Early wage access provides quick liquidity without impacting credit, but lacks the credit-building benefits crucial for long-term financial health.

Digital Loan Origination

Digital loan origination platforms streamline payday loan applications by enabling instant credit decisions and fund disbursement, often at high interest rates and fees. Early wage access services leverage employer payroll integration to provide workers with a portion of earned wages before payday, offering a cost-effective alternative without traditional loan burdens.

Alternative Credit Scoring

Payday loans rely heavily on traditional credit scoring and often involve high interest rates, while early wage access solutions utilize alternative credit scoring methods such as employment history and wage verification to provide short-term liquidity with lower financial risk. These alternative credit scoring models enable more inclusive access to funds, reducing dependence on predatory lending practices common in payday loan markets.

APR-Free Advance

Payday loans often come with extremely high APRs exceeding 400%, leading to costly short-term borrowing, whereas Early Wage Access services provide APR-free advances by allowing employees to access earned wages before payday, minimizing financial strain without high-interest fees. Opting for APR-free Early Wage Access reduces dependence on predatory lending and improves short-term liquidity management through transparent, fee-free wage advances.

Embedded Finance for Payroll

Embedded finance in payroll offers Early Wage Access as a seamless, low-cost alternative to payday loans by enabling employees to access earned wages before payday directly through their employer's platform. Unlike traditional payday loans with high interest rates and fees, Early Wage Access improves financial wellness by providing immediate liquidity without debt, leveraging payroll integration for faster, transparent, and affordable short-term financing.

Responsible Wage Access

Responsible Wage Access provides short-term liquidity by allowing employees to access earned wages before payday without high-interest fees or predatory lending practices typical of payday loans. This approach promotes financial well-being through transparent fees and flexible repayment, reducing debt cycles and supporting sustainable cash flow management.

Payday Loan vs Early Wage Access for short-term liquidity Infographic

moneydiff.com

moneydiff.com