Payday loans offer quick cash with high interest rates and fees, often leading to a cycle of debt, while Earned Wage Access (EWA) provides employees with timely access to their earned income without high costs or long-term financial risks. EWA services improve financial well-being by allowing users to manage cash flow more effectively, reducing the need for expensive short-term borrowing. Choosing Earned Wage Access over payday loans promotes better financial stability and avoids predatory lending practices.

Table of Comparison

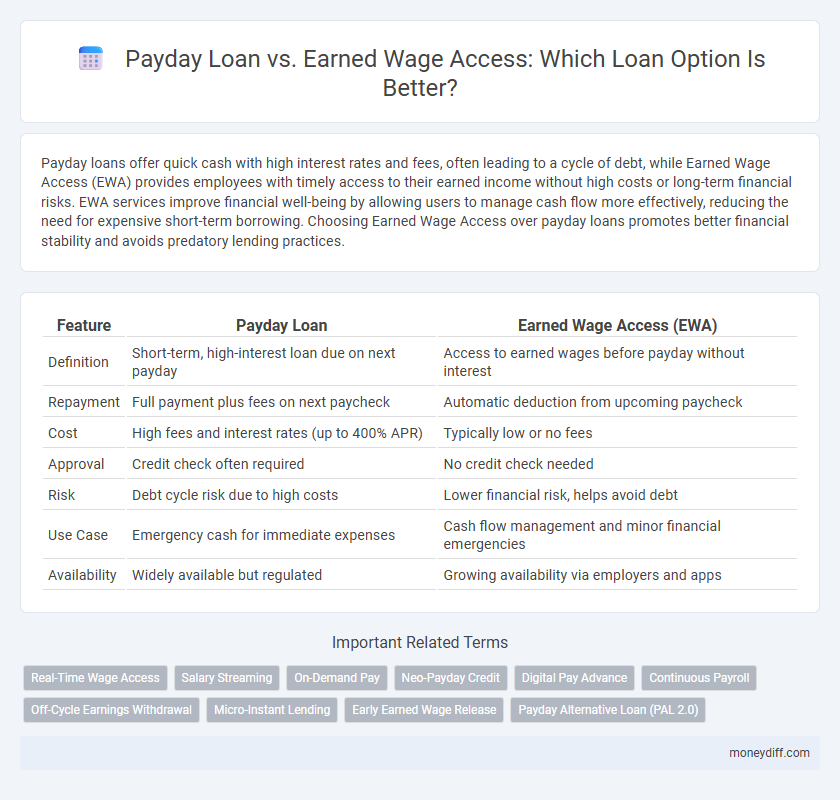

| Feature | Payday Loan | Earned Wage Access (EWA) |

|---|---|---|

| Definition | Short-term, high-interest loan due on next payday | Access to earned wages before payday without interest |

| Repayment | Full payment plus fees on next paycheck | Automatic deduction from upcoming paycheck |

| Cost | High fees and interest rates (up to 400% APR) | Typically low or no fees |

| Approval | Credit check often required | No credit check needed |

| Risk | Debt cycle risk due to high costs | Lower financial risk, helps avoid debt |

| Use Case | Emergency cash for immediate expenses | Cash flow management and minor financial emergencies |

| Availability | Widely available but regulated | Growing availability via employers and apps |

Understanding Payday Loans and Earned Wage Access

Payday loans are short-term, high-interest loans designed to be repaid on the borrower's next payday, often leading to a cycle of debt due to exorbitant fees and interest rates sometimes exceeding 400% APR. Earned Wage Access (EWA) allows employees to access a portion of their earned wages before the scheduled payday without the high costs associated with payday loans, promoting financial flexibility and reducing reliance on predatory lending. Understanding the fundamental differences between payday loans and EWA helps consumers make informed financial decisions conducive to greater economic stability.

Key Differences Between Payday Loans and Earned Wage Access

Payday loans are short-term, high-interest loans typically due on the borrower's next payday, often leading to debt cycles due to high fees and interest rates. Earned Wage Access (EWA) allows employees to access a portion of their earned wages before the scheduled payday without interest, promoting financial flexibility without traditional loan costs. Unlike payday loans, EWA services focus on wage advances tied directly to work hours rather than borrowing, reducing the risk of predatory lending practices.

Interest Rates: Payday Loan vs Earned Wage Access

Payday loans typically carry interest rates that can exceed 400% APR, making them one of the most expensive borrowing options. Earned Wage Access (EWA) services, in contrast, often provide access to earned income with little to no interest or fees, offering a more affordable alternative for short-term cash needs. Comparing the effective cost, payday loans impose high financial burdens, while EWA minimizes borrowing costs by allowing users to access wages they have already earned.

Eligibility Requirements for Each Loan Option

Payday loans typically require proof of steady income, a valid ID, and an active bank account, making them accessible to borrowers with immediate financial needs but often higher interest rates. Earned Wage Access (EWA) services allow employees to access a portion of their earned wages before payday without the need for credit checks, relying primarily on employer participation and payroll integration. Eligibility for payday loans centers around income verification and borrower creditworthiness, whereas EWA eligibility depends on employment status and employer agreements rather than traditional credit criteria.

Speed of Access: Which Is Faster?

Payday loans typically provide funds within 24 hours but often involve lengthy application processes and approval times. Earned Wage Access (EWA) offers near-instant access to wages as they are earned, often delivering funds within minutes through app-based platforms. Speed of access favors Earned Wage Access due to its direct integration with payroll systems, reducing wait times compared to payday loans.

Repayment Terms and Flexibility Comparison

Payday loans typically require repayment in full on the borrower's next payday, often within two weeks, leading to high fees and limited flexibility. Earned wage access (EWA) allows employees to access a portion of their earned wages before payday with minimal or no fees and flexible repayment aligned with the actual payday. EWA provides a more manageable repayment structure, reducing the risk of debt cycles common in payday loan scenarios.

Impact on Credit Score: Payday Loan vs Earned Wage Access

Payday loans typically have a negative impact on credit scores due to high interest rates and potential for missed payments reported to credit bureaus. Earned Wage Access (EWA) services generally do not affect credit scores since they provide early access to wages without involving credit checks or traditional loan structures. Choosing EWA over payday loans can protect credit health while offering timely financial relief.

Cost Comparison and Hidden Fees

Payday loans often carry exorbitant interest rates exceeding 400% APR and include hidden fees such as loan origination charges or rollover fees, significantly increasing the overall cost. Earned Wage Access (EWA) services typically charge low, transparent flat fees or small subscription costs without interest, making them a more affordable alternative. Consumers seeking short-term liquidity should weigh the steep expenses and potential debt cycles associated with payday loans against the predictable, lower-cost structure of EWA programs.

Risks and Consumer Protections

Payday loans often carry high interest rates and fees, leading to potential debt cycles due to short repayment terms and limited consumer protections. Earned Wage Access (EWA) provides employees access to earned wages before payday, typically without interest or fees, reducing the risk of debt accumulation and offering greater transparency. Consumer protections for EWA include compliance with wage deduction laws and data privacy standards, whereas payday loans face stricter regulations to curb predatory lending practices.

Choosing the Right Option for Your Financial Needs

Payday loans offer immediate lump-sum cash with high interest rates, suitable for urgent, short-term expenses but can lead to debt cycles. Earned Wage Access (EWA) provides employees early access to earned wages without interest, promoting financial stability and avoiding high fees. Evaluating repayment terms, fees, and personal financial discipline helps determine the best option for your financial needs.

Related Important Terms

Real-Time Wage Access

Real-time wage access through Earned Wage Access (EWA) offers employees immediate availability of their earned income without the high-interest fees commonly associated with payday loans. This innovative financial solution promotes responsible borrowing by providing transparent, fee-free access to wages, reducing reliance on predatory lending practices and improving overall financial well-being.

Salary Streaming

Payday loans offer quick, short-term cash advances with high-interest rates, often leading to debt cycles, whereas Earned Wage Access (EWA) provides employees with real-time access to earned but unpaid wages, promoting financial flexibility without traditional loan fees. Salary streaming through EWA platforms enables smoother cash flow management by allowing workers to tap into their earnings before payday, reducing reliance on costly payday loans.

On-Demand Pay

Payday loans offer immediate cash but often carry high interest rates and fees, leading to debt cycles, whereas Earned Wage Access (EWA) provides on-demand pay by allowing employees to access earned wages before the regular payday without traditional loan interest. On-demand pay solutions promote financial wellness by reducing reliance on high-cost credit and improving cash flow management for workers facing unexpected expenses.

Neo-Payday Credit

Neo-Payday Credit offers an innovative alternative to traditional payday loans by leveraging Earned Wage Access, allowing employees to access a portion of their earned income before payday without high interest rates or hidden fees. This approach reduces financial stress and predatory lending risks, providing transparent, flexible short-term borrowing tailored to modern workforce needs.

Digital Pay Advance

Payday loans typically involve high-interest rates and short repayment terms, leading to potential debt cycles, whereas Earned Wage Access (EWA) offers employees a digital pay advance by allowing access to earned but unpaid wages without interest or fees. Digital pay advance platforms leverage technology to provide instant, transparent, and low-cost advances that enhance financial wellness and reduce the need for predatory lending options.

Continuous Payroll

Continuous payroll integration enhances Earned Wage Access by enabling real-time advances on earned wages, reducing reliance on high-interest payday loans that often trap borrowers in cycles of debt. This seamless connection with payroll systems ensures timely, flexible access to funds without the excessive fees and short repayment terms commonly associated with payday loans.

Off-Cycle Earnings Withdrawal

Payday loans offer quick cash but typically charge high fees and interest, leading to costly debt cycles, whereas Earned Wage Access (EWA) allows employees to withdraw a portion of their earned wages before payday without high interest, promoting financial flexibility. Off-cycle earnings withdrawal through EWA reduces reliance on high-cost payday loans by providing timely access to earned income based on actual hours worked or salaries accrued.

Micro-Instant Lending

Micro-instant lending solutions like payday loans provide quick cash advances with high-interest rates and short repayment terms, often leading to debt cycles for borrowers. Earned wage access offers employees immediate access to wages earned before payday, reducing reliance on predatory loans and promoting better financial stability without excessive fees.

Early Earned Wage Release

Early Earned Wage Release allows employees to access a portion of their earned wages before the payday loan due date, reducing reliance on high-interest payday loans. This financial option provides a cost-effective and flexible alternative, helping to improve cash flow and avoid the predatory fees typically associated with payday lending.

Payday Alternative Loan (PAL 2.0)

Payday Alternative Loan (PAL 2.0) offers a safer, federally insured option with lower interest rates and longer repayment terms compared to traditional payday loans, reducing the risk of debt cycles. Unlike Earned Wage Access, which provides early access to wages without additional interest, PAL 2.0 ensures regulated borrowing with consumer protections and transparent fees tailored for emergency financial needs.

Payday Loan vs Earned Wage Access for loan. Infographic

moneydiff.com

moneydiff.com