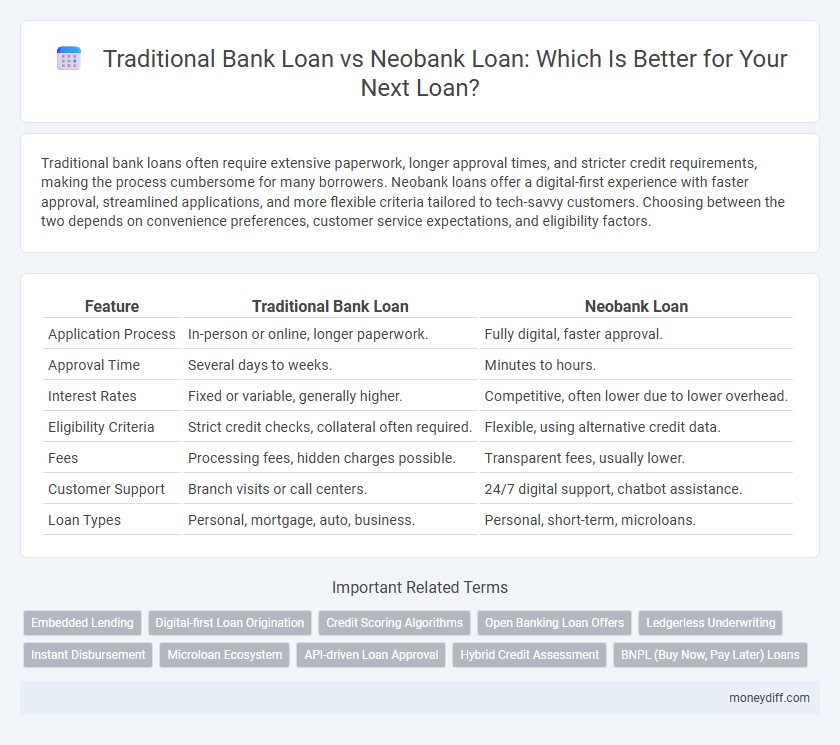

Traditional bank loans often require extensive paperwork, longer approval times, and stricter credit requirements, making the process cumbersome for many borrowers. Neobank loans offer a digital-first experience with faster approval, streamlined applications, and more flexible criteria tailored to tech-savvy customers. Choosing between the two depends on convenience preferences, customer service expectations, and eligibility factors.

Table of Comparison

| Feature | Traditional Bank Loan | Neobank Loan |

|---|---|---|

| Application Process | In-person or online, longer paperwork. | Fully digital, faster approval. |

| Approval Time | Several days to weeks. | Minutes to hours. |

| Interest Rates | Fixed or variable, generally higher. | Competitive, often lower due to lower overhead. |

| Eligibility Criteria | Strict credit checks, collateral often required. | Flexible, using alternative credit data. |

| Fees | Processing fees, hidden charges possible. | Transparent fees, usually lower. |

| Customer Support | Branch visits or call centers. | 24/7 digital support, chatbot assistance. |

| Loan Types | Personal, mortgage, auto, business. | Personal, short-term, microloans. |

Understanding Traditional Bank Loans

Traditional bank loans typically involve a rigorous application process with thorough credit checks and require collateral or a strong credit history, ensuring lower risk for lenders. These loans often feature fixed interest rates and longer repayment terms, making them suitable for borrowers seeking stability and predictable payments. Understanding traditional bank loans is crucial for comparing their structured approval criteria and regulatory compliance against the more flexible, technology-driven neobank loan alternatives.

What Are Neobank Loans?

Neobank loans are digital-only financial products offered by online banks that operate without physical branches, providing streamlined application processes and faster approval times compared to traditional bank loans. These loans often feature competitive interest rates and transparent fee structures, leveraging advanced technology and data analytics to assess creditworthiness more efficiently. Neobank loans cater to tech-savvy borrowers seeking convenience, lower costs, and personalized loan options through mobile apps or web platforms.

Key Differences Between Traditional and Neobank Loans

Traditional bank loans typically require extensive paperwork, longer approval times, and in-person visits, whereas neobank loans offer streamlined digital application processes with faster approval and disbursement. Interest rates and fees can vary, with neobanks often providing more competitive rates due to lower overhead costs. Security and regulatory compliance remain robust across both, but traditional banks benefit from established trust and physical branch support.

Loan Application Process: Brick-and-Mortar vs. Digital

Traditional bank loans require in-person visits to branch offices for paperwork verification, credit checks, and approval processes, often resulting in longer wait times. Neobank loans feature fully digital application processes through mobile apps or websites, enabling instant credit assessments, document uploads, and faster approval decisions. The digital-first approach of neobanks streamlines loan disbursement and reduces administrative overhead compared to the manual processes of conventional banks.

Interest Rates: Traditional Banks vs. Neobanks

Traditional bank loans generally feature higher interest rates due to extensive operational costs and stringent risk assessments, often resulting in fixed or variable rates influenced by regulatory policies. Neobank loans typically offer lower interest rates driven by reduced overhead expenses and streamlined digital processes, making them attractive for borrowers seeking cost-effective financing solutions. Comparing APRs, neobanks often provide more competitive rates, but borrowers should consider loan terms and credit score requirements when choosing between these options.

Eligibility Criteria: Which Is Easier?

Traditional bank loans often require extensive documentation, strong credit scores, and stable income proof, making eligibility criteria stricter and more time-consuming. Neobank loans typically offer more flexible eligibility standards by leveraging digital verification methods and alternative data sources, enabling faster and easier approval processes. Borrowers with limited credit history or unconventional income streams generally find neobank loans more accessible compared to traditional bank loans.

Loan Approval Speed Compared

Traditional bank loans typically require extensive documentation and in-person verification, leading to slower loan approval speeds that can take several days to weeks. Neobank loans leverage advanced algorithms and digital processes to offer rapid loan approvals, often within minutes to hours. This significant difference in approval speed highlights the efficiency advantage of neobanks in meeting urgent borrowing needs.

Customer Support: Human vs. AI Interaction

Traditional bank loans offer personalized customer support through human interaction, providing borrowers with tailored advice and the reassurance of speaking to a knowledgeable representative. Neobank loans rely heavily on AI-driven customer service, offering 24/7 support via chatbots and automated systems that ensure quick responses but may lack the empathetic understanding of complex financial needs. The choice between traditional and neobank loans often hinges on borrowers' preference for human touch versus the convenience and speed of AI technology.

Security and Fraud Prevention in Loans

Traditional bank loans offer robust security measures, including multi-layered authentication, regulatory oversight, and well-established fraud detection systems, resulting in minimized risks for borrowers. Neobank loans leverage advanced AI algorithms and real-time transaction monitoring to detect fraudulent activities quickly, though they may face challenges due to their fully digital nature and evolving regulatory frameworks. Both options emphasize secure loan processing, but traditional banks benefit from longstanding experience in fraud prevention, while neobanks provide innovative, technology-driven security solutions.

Choosing the Right Loan for Your Money Management Needs

Traditional bank loans offer established reliability and face-to-face customer service with typically stricter credit requirements and longer approval times. Neobank loans provide faster application processes, digital-first experiences, and often more flexible eligibility criteria, appealing to tech-savvy borrowers seeking convenience. Evaluating interest rates, repayment terms, and customer support features is crucial to selecting the right loan tailored to your financial goals and money management preferences.

Related Important Terms

Embedded Lending

Traditional bank loans often involve lengthy application processes and require visits to physical branches, while neobank loans leverage embedded lending technology to streamline approvals through digital platforms. Embedded lending integrates loan offers directly within financial apps, enabling faster access to credit with personalized terms and minimal paperwork.

Digital-first Loan Origination

Neobank loans leverage digital-first loan origination platforms, enabling faster approval and seamless application processes compared to traditional bank loans, which often rely on manual paperwork and in-branch visits. This digital innovation enhances user experience and accessibility, making neobank loans more efficient for tech-savvy borrowers seeking quick financing solutions.

Credit Scoring Algorithms

Traditional bank loans typically rely on established credit scoring algorithms using credit history, income verification, and debt-to-income ratios, which can limit access for those with thin credit files. Neobank loans leverage advanced machine learning models analyzing alternative data such as transaction patterns and social behavior, enabling more inclusive and faster credit assessments.

Open Banking Loan Offers

Traditional bank loans typically rely on extensive manual credit assessments, resulting in longer approval times, while neobank loans leverage Open Banking APIs to instantly access real-time financial data, enabling faster, more personalized loan offers. Open Banking integration allows neobanks to provide competitive interest rates and flexible repayment terms by using comprehensive, transparent customer financial profiles.

Ledgerless Underwriting

Traditional bank loans rely on manual, ledger-based underwriting processes that require extensive paperwork and time-consuming credit assessments, often resulting in slower approval times and limited accessibility. Neobank loans utilize ledgerless underwriting powered by real-time data analytics and AI algorithms, enabling faster credit decisions, enhanced risk evaluation, and streamlined user experiences through digital platforms.

Instant Disbursement

Neobank loans offer instant disbursement by leveraging advanced digital platforms and automated credit assessments, enabling borrowers to access funds within minutes. Traditional bank loans typically involve longer processing times due to manual verification and regulatory compliance, often resulting in delays spanning several days.

Microloan Ecosystem

Traditional bank loans often involve lengthy approval processes, higher interest rates, and stringent credit requirements, which can limit access for microloan borrowers. Neobank loans leverage digital platforms with faster approval, lower fees, and flexible terms, promoting greater inclusion and efficiency in the microloan ecosystem.

API-driven Loan Approval

API-driven loan approval in neobanks offers faster decision-making and enhanced customer experience compared to traditional bank loans, which often rely on manual processing and extensive paperwork. Leveraging real-time data integration and automation, neobanks streamline credit assessments, reducing approval times and enabling instant loan disbursal.

Hybrid Credit Assessment

Traditional bank loans rely heavily on standardized credit scores and extensive documentation, often resulting in longer approval times and limited flexibility. Neobank loans leverage hybrid credit assessment models that combine traditional data with alternative metrics like transaction history and real-time financial behavior, enabling faster decisions and personalized lending options.

BNPL (Buy Now, Pay Later) Loans

Traditional bank loans often involve stringent credit checks and lengthy approval processes, whereas neobank loans, especially BNPL (Buy Now, Pay Later) options, leverage digital platforms to offer faster, more flexible financing solutions tailored to instant purchase needs. BNPL loans through neobanks provide consumers with interest-free or low-interest installment plans, enhancing affordability and driving higher consumer spending via seamless integration at checkout.

Traditional Bank Loan vs Neobank Loan for loan. Infographic

moneydiff.com

moneydiff.com