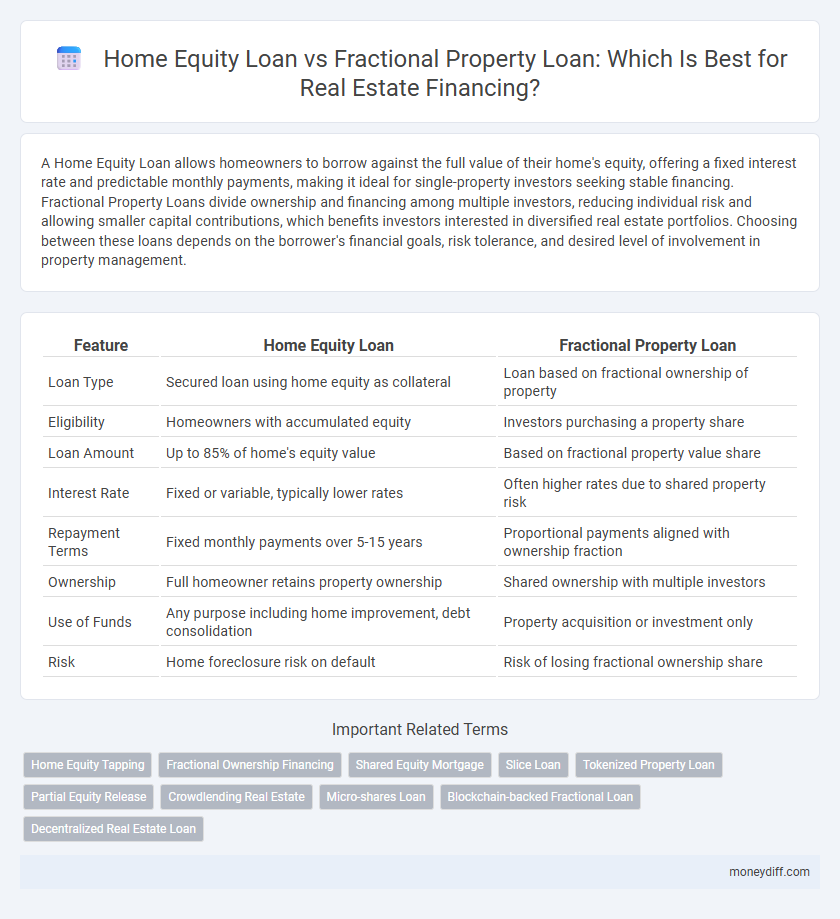

A Home Equity Loan allows homeowners to borrow against the full value of their home's equity, offering a fixed interest rate and predictable monthly payments, making it ideal for single-property investors seeking stable financing. Fractional Property Loans divide ownership and financing among multiple investors, reducing individual risk and allowing smaller capital contributions, which benefits investors interested in diversified real estate portfolios. Choosing between these loans depends on the borrower's financial goals, risk tolerance, and desired level of involvement in property management.

Table of Comparison

| Feature | Home Equity Loan | Fractional Property Loan |

|---|---|---|

| Loan Type | Secured loan using home equity as collateral | Loan based on fractional ownership of property |

| Eligibility | Homeowners with accumulated equity | Investors purchasing a property share |

| Loan Amount | Up to 85% of home's equity value | Based on fractional property value share |

| Interest Rate | Fixed or variable, typically lower rates | Often higher rates due to shared property risk |

| Repayment Terms | Fixed monthly payments over 5-15 years | Proportional payments aligned with ownership fraction |

| Ownership | Full homeowner retains property ownership | Shared ownership with multiple investors |

| Use of Funds | Any purpose including home improvement, debt consolidation | Property acquisition or investment only |

| Risk | Home foreclosure risk on default | Risk of losing fractional ownership share |

Understanding Home Equity Loans

Home equity loans allow homeowners to borrow against the accumulated equity in their property, providing a fixed interest rate and predictable monthly payments ideal for major expenses or renovations. Fractional property loans involve multiple investors owning shares in a property, which can dilute control but offer diversified risk and potential returns. Understanding home equity loans is crucial for real estate financing, as they leverage existing property value for accessible capital without selling ownership interest.

What is a Fractional Property Loan?

A Fractional Property Loan allows multiple investors to collectively finance a real estate asset, dividing ownership into shares that correspond to their investment amount. Unlike a Home Equity Loan, which uses the borrower's existing property as collateral, a Fractional Property Loan spreads risk and capital commitment across several parties, enabling access to higher-value properties. This loan model facilitates diversified investment opportunities and can provide more flexible repayment terms tailored to each investor's share.

Key Differences Between Home Equity Loans and Fractional Property Loans

Home Equity Loans allow homeowners to borrow against the accumulated equity in their property with fixed interest rates and predictable monthly payments, typically used for major expenses or debt consolidation. Fractional Property Loans involve multiple investors owning shares in the property, distributing both risks and profits proportionally, often favored for real estate investments with flexible repayment options. Key differences include loan structure, ownership implications, risk distribution, and repayment terms, making Home Equity Loans suitable for personal financing and Fractional Property Loans ideal for collaborative real estate ventures.

Loan Eligibility Requirements Compared

Home Equity Loan eligibility typically requires a substantial amount of home equity, a credit score above 620, and a low debt-to-income ratio, ensuring borrowers have sufficient collateral and financial stability. Fractional Property Loan eligibility depends on shared ownership structure, requiring clear agreements among investors and often a higher minimum investment but may allow for more flexible credit requirements. Both loans necessitate proof of income, property appraisal, and compliance with lender-specific underwriting standards, but Home Equity Loans prioritize individual borrower creditworthiness while Fractional Property Loans emphasize collective investment credentials.

Interest Rates: Home Equity vs Fractional Property Loans

Home equity loans typically offer lower fixed interest rates compared to fractional property loans, making them more cost-effective for borrowers with significant home equity. Fractional property loans often carry higher and variable interest rates due to the shared ownership structure and increased risk for lenders. Borrowers should carefully compare interest rate terms and potential fluctuations when choosing between these real estate financing options.

Risks and Rewards of Each Loan Type

Home equity loans provide a fixed interest rate and predictable payments but risk foreclosure if property value declines and repayments fail. Fractional property loans diversify investment risk by allowing multiple owners to share equity, though they involve complex legal agreements and potential disputes over property management. Assessing market volatility and personal financial stability is crucial to balancing the rewards of leveraging property assets against the inherent risks.

Repayment Terms: What to Expect

Home equity loans typically offer fixed repayment terms ranging from 5 to 30 years with predictable monthly payments, providing stability for homeowners. Fractional property loans often feature more flexible repayment structures, including shorter terms and variable payment schedules tied to property performance or rental income. Borrowers should carefully evaluate the repayment timelines and conditions of each loan type to align with their financial goals and cash flow expectations.

Best Use Cases for Home Equity Loans

Home equity loans are best suited for homeowners seeking a fixed loan amount with predictable payments, ideal for funding major home improvements or consolidating high-interest debt using the existing property's equity. Unlike fractional property loans, which involve shared ownership and potential profit-sharing, home equity loans enable borrowers to retain full property control while leveraging accumulated home value. These loans often offer lower interest rates compared to unsecured loans, making them a cost-effective financing option for long-term real estate investments.

Ideal Scenarios for Fractional Property Loans

Fractional property loans are ideal for real estate investors seeking to diversify ownership and reduce individual financial risk while accessing larger capital pools. These loans work best when multiple parties prefer shared responsibility and profits from property investment, particularly in commercial or high-value residential developments. Fractional loans provide flexibility for partial property acquisition, enabling buyers to invest according to their budget while capitalizing on market appreciation.

Choosing the Right Loan for Your Real Estate Goals

Home equity loans provide a fixed lump sum with stable interest rates, ideal for homeowners seeking predictable payments to finance renovations or consolidate debt. Fractional property loans allow investors to purchase shares in real estate, offering flexibility and lower upfront costs but with variable returns depending on property performance. Selecting the right loan depends on your financial goals, risk tolerance, and whether you prioritize full ownership or diversified investment in real estate assets.

Related Important Terms

Home Equity Tapping

Home equity loans leverage the borrower's accumulated home value, allowing access to substantial funds based on the property's appreciated worth, often at fixed interest rates and predictable repayment terms. Fractional property loans divide ownership into shares, offering partial financing but potentially complicating repayment structures and limiting direct access to full equity tapping benefits.

Fractional Ownership Financing

Fractional Ownership Financing enables multiple investors to pool resources and share equity in real estate, offering a flexible alternative to traditional Home Equity Loans, which rely on individual property ownership and creditworthiness. This model reduces the financial burden on a single borrower and diversifies investment risk, making it an attractive option for acquiring high-value real estate with limited upfront capital.

Shared Equity Mortgage

A Shared Equity Mortgage allows homeowners to access funds by selling a percentage of their property's future value, offering an alternative to traditional Home Equity Loans that require fixed repayments. Unlike Fractional Property Loans, which involve co-ownership of the property, Shared Equity Mortgages provide flexible repayment terms tied to the property's market performance, reducing monthly financial strain.

Slice Loan

Slice Loan offers a fractional property loan that enables investors to purchase shares of real estate assets, providing liquidity and diversified exposure compared to traditional home equity loans that tap into a homeowner's existing property value. Unlike home equity loans, Slice Loan's fractional ownership model reduces upfront capital requirements and mitigates risk by allowing partial investment in multiple properties rather than leveraging a single home's equity.

Tokenized Property Loan

Tokenized Property Loans enable fractional ownership and investment in real estate by dividing properties into digital tokens, offering greater liquidity and accessibility compared to traditional Home Equity Loans that rely on existing property equity as collateral. This innovative blockchain-based financing approach reduces entry barriers and facilitates seamless transfer of property stakes, making it ideal for diversified real estate portfolios and smaller investors.

Partial Equity Release

Partial equity release through a home equity loan allows homeowners to borrow against their property's accumulated value, providing immediate funds while retaining full ownership. Fractional property loans involve selling a percentage of the property's future value to investors, enabling access to capital without monthly repayments or increased debt.

Crowdlending Real Estate

Home equity loans provide borrowers with a lump sum based on the appraised value of their property, often featuring fixed interest rates and repayment terms, while fractional property loans through crowdlending platforms enable multiple investors to collectively fund real estate projects, diversifying risk and enhancing access to capital. Crowdlending real estate models facilitate fractional ownership and flexible investment options, making them ideal for investors seeking lower entry thresholds compared to traditional home equity financing.

Micro-shares Loan

Micro-shares loans allow investors to purchase fractional ownership in real estate, offering flexibility compared to traditional home equity loans that leverage the borrower's property's full value. These fractional property loans reduce risk exposure and lower entry barriers by enabling smaller, shared investments in real estate assets.

Blockchain-backed Fractional Loan

Blockchain-backed fractional property loans enable investors to acquire partial ownership in real estate through tokenized assets, offering enhanced liquidity and transparency compared to traditional home equity loans, which rely on the borrower's accumulated home equity as collateral. By leveraging decentralized ledger technology, fractional loans reduce entry barriers, facilitate seamless asset transfer, and improve security, making them an innovative alternative for diversified real estate investment.

Decentralized Real Estate Loan

Decentralized real estate loans offer enhanced transparency and reduced intermediaries compared to traditional home equity loans, enabling borrowers to leverage fractional property ownership through blockchain-based platforms. Fractional property loans provide flexible investment opportunities by dividing real estate assets into smaller shares, increasing liquidity and accessibility compared to single-asset home equity loans.

Home Equity Loan vs Fractional Property Loan for real estate. Infographic

moneydiff.com

moneydiff.com