Student loans provide a fixed amount of money upfront with set interest rates and repayment schedules, making budgeting predictable but potentially increasing debt burden. Income-share agreement loans require repayment as a percentage of future income, aligning payments with earning capacity and reducing the risk of unmanageable debt. Choosing between these options depends on a student's financial stability, career prospects, and preference for fixed versus flexible repayment terms.

Table of Comparison

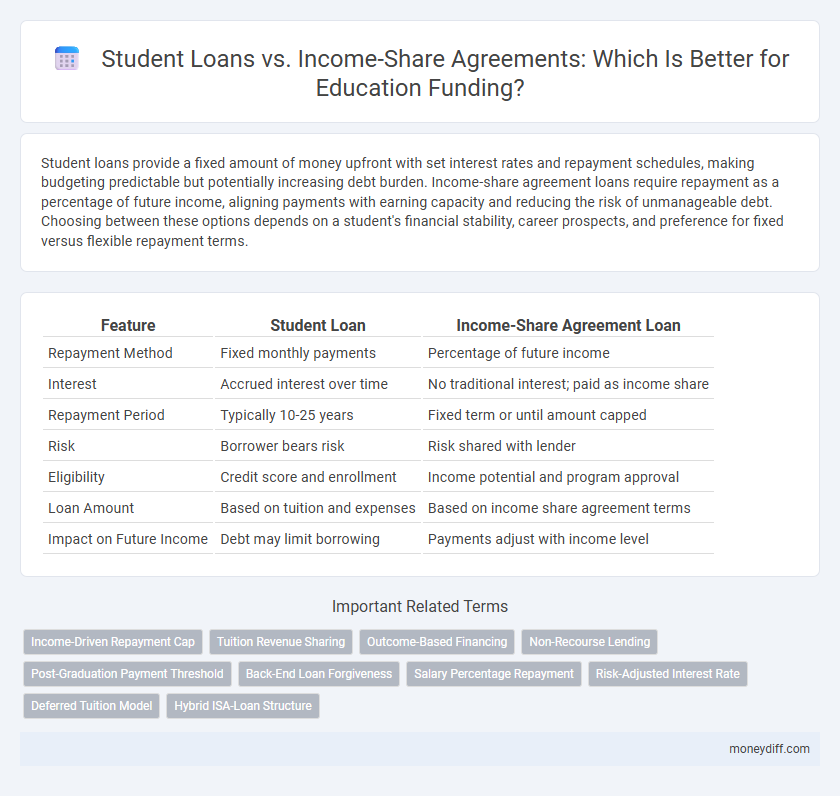

| Feature | Student Loan | Income-Share Agreement Loan |

|---|---|---|

| Repayment Method | Fixed monthly payments | Percentage of future income |

| Interest | Accrued interest over time | No traditional interest; paid as income share |

| Repayment Period | Typically 10-25 years | Fixed term or until amount capped |

| Risk | Borrower bears risk | Risk shared with lender |

| Eligibility | Credit score and enrollment | Income potential and program approval |

| Loan Amount | Based on tuition and expenses | Based on income share agreement terms |

| Impact on Future Income | Debt may limit borrowing | Payments adjust with income level |

Understanding Student Loans and Income-Share Agreements

Student loans involve borrowing a fixed amount of money with set interest rates and repayment terms, typically requiring monthly payments regardless of income. Income-Share Agreements (ISAs) offer an alternative where repayment is based on a percentage of the borrower's future income for a fixed period, reducing financial risk if earnings are low. Understanding the key differences in repayment structure, interest accumulation, and financial impact helps students choose the best education funding option.

Key Differences Between Student Loans and ISAs

Student loans require fixed monthly repayments with interest based on the borrowed amount, while Income-Share Agreements (ISAs) involve paying a percentage of future income for a set period, with no traditional interest. Student loans typically accumulate debt regardless of income level, whereas ISAs adjust payment amounts according to earnings, potentially reducing financial strain during low-income periods. Unlike student loans that contribute to credit history, ISAs often do not impact credit scores, influencing future borrowing capabilities.

Eligibility Criteria: Student Loan vs Income-Share Agreement

Student loans typically require credit checks, proof of enrollment, and sometimes a co-signer, making eligibility dependent on financial history and academic status, while income-share agreements (ISAs) base eligibility primarily on the potential future income of the student, assessing career prospects rather than creditworthiness. ISAs often target students in high-demand fields with strong income potential, reducing barriers for those with limited credit history. These differing criteria impact accessibility, with student loans offering broader eligibility but potentially higher financial risk, whereas ISAs limit eligibility but provide income-contingent repayment terms.

Repayment Terms and Flexibility

Student loans typically require fixed monthly payments with set interest rates, often starting repayment shortly after graduation, which can lead to financial strain if income is low. Income-share agreements (ISAs) offer repayment flexibility by tying payments directly to a percentage of the borrower's future income over a specified period, reducing the risk of default. Unlike traditional student loans, ISAs adjust repayment amounts based on actual earnings, providing adaptable terms that can better accommodate variable income levels.

Interest Rates vs Income Percentage: Financial Implications

Student loans typically carry fixed or variable interest rates that accrue over the loan term, potentially increasing the total repayment amount regardless of the borrower's income. Income-share agreements (ISAs) require repayment based on a fixed percentage of the borrower's future income for a set period, aligning payments with earnings but possibly leading to higher costs if income rises significantly. Evaluating the financial implications involves comparing the predictability and cost-effectiveness of interest rates against the flexibility and income sensitivity of percentage-based repayments.

Cost Comparison: Long-Term Financial Impact

Student loans often involve fixed interest rates and monthly payments, potentially leading to significant debt accumulation over time, especially if repayment extends beyond the standard term. Income-share agreements (ISAs) require a percentage of future income rather than fixed payments, which can offer more flexible repayment but may result in higher total costs if income increases substantially. Evaluating the long-term financial impact depends on factors such as projected earnings, loan interest rates, repayment term, and overall economic conditions affecting affordability and debt burden.

Risks and Benefits of Student Loans

Student loans offer immediate access to education funding with fixed repayment terms but carry the risk of accruing high-interest debt regardless of post-graduation income. Benefits include potential deferment options and credit building, while risks involve long-term financial burden and possible default affecting credit scores. Comparing to Income-Share Agreements, student loans provide predictability in repayment amounts but lack flexibility tied to actual earnings.

Risks and Benefits of Income-Share Agreements

Income-Share Agreements (ISAs) offer education funding without traditional debt, requiring students to pay a percentage of future income instead of fixed loan repayments, reducing the risk of overwhelming debt for low earners. However, ISAs carry the risk of paying more than a traditional loan if the student's income rises significantly, and income variability may complicate repayment planning. Benefits include flexibility tied to actual earnings and no obligation to repay if income remains below a certain threshold, unlike conventional student loans with fixed interest and repayment schedules.

Who Should Choose Student Loans?

Students planning to attend traditional universities or programs with clear tuition costs and repayment terms should choose student loans for education funding. Borrowers who prefer fixed interest rates, predictable monthly payments, and eligibility for federal loan benefits like income-driven repayment plans are ideal candidates for student loans. Those expecting stable income post-graduation or seeking to build credit history through conventional borrowing often find student loans more suitable than income-share agreements.

Who Benefits Most from Income-Share Agreements?

Income-Share Agreements (ISAs) benefit students pursuing high-demand, high-earning fields by linking repayments to a fixed percentage of their income, reducing financial risk if earnings are low. Unlike traditional student loans with fixed interest and payments, ISAs offer flexibility for graduates in uncertain job markets or variable income careers. Students aiming for degrees in technology, healthcare, or business often gain the most from ISAs, as their potential for higher income ensures manageable repayment terms aligned with their earnings.

Related Important Terms

Income-Driven Repayment Cap

Income-Share Agreement (ISA) loans offer an income-driven repayment cap where borrowers repay a fixed percentage of their income for a set period, potentially reducing financial burden compared to traditional student loans with fixed monthly payments. This model aligns repayment with actual earnings, providing flexibility and minimizing default risk for graduates in variable or lower-income careers.

Tuition Revenue Sharing

Tuition revenue sharing under Income-Share Agreement (ISA) loans offers a flexible repayment model where students pay a fixed percentage of their future income instead of traditional loan interest, reducing financial risk compared to standard student loans. This approach aligns the lender's returns with the graduate's success, promoting an equitable funding solution that adjusts based on actual earnings rather than fixed payment schedules.

Outcome-Based Financing

Student loans require fixed repayments with interest regardless of post-graduation income, potentially leading to financial strain, while income-share agreement (ISA) loans offer outcome-based financing where repayment is a percentage of future earnings, aligning costs with actual income and reducing financial risk for students. ISAs provide flexibility tailored to career success, promoting affordability and supporting diverse education funding needs through risk-sharing between the student and the funding institution.

Non-Recourse Lending

Student loans typically require borrowers to repay the full amount regardless of future income, whereas Income-Share Agreement (ISA) loans offer non-recourse lending that ties repayments to a fixed percentage of the borrower's post-graduation income, reducing financial risk. This non-recourse structure provides flexibility by eliminating repayment obligations if the borrower's income falls below a certain threshold, aligning education funding with actual earning potential.

Post-Graduation Payment Threshold

Student loans typically require fixed monthly payments regardless of income, whereas income-share agreement loans initiate repayment only after graduates surpass a specified post-graduation payment threshold, often linked to a percentage of their income. This threshold structure in income-share agreements reduces financial strain during early career stages by aligning payments with actual earnings.

Back-End Loan Forgiveness

Student loans typically offer back-end loan forgiveness programs that discharge remaining debt after a set period of qualifying payments or public service, while income-share agreement loans generally do not provide traditional forgiveness but instead cap repayments based on a fixed percentage of the borrower's future income over a designated time frame. Borrowers seeking back-end forgiveness benefits should carefully evaluate the terms of federal student loans such as Public Service Loan Forgiveness (PSLF) against income-share agreements that prioritize income-based repayment without debt write-off options.

Salary Percentage Repayment

Student loans require fixed monthly payments regardless of income, which can strain borrowers during low-earning periods, while Income-Share Agreements (ISAs) adjust repayments based on a fixed percentage of the borrower's salary, providing flexibility tied directly to income fluctuations. The ISA model typically aligns repayment amounts with actual post-graduation earnings, potentially lowering financial stress for graduates with variable or lower salaries compared to traditional student loans.

Risk-Adjusted Interest Rate

Student loans typically have fixed or variable interest rates based on creditworthiness and loan terms, often resulting in higher risk-adjusted interest rates due to potential default risk; income-share agreement loans, however, adjust repayments according to the borrower's income, potentially lowering the risk-adjusted interest rate by aligning payment obligations with actual earning capacity and reducing default probability. This alignment creates a more flexible repayment structure that can mitigate financial strain and is particularly beneficial for borrowers entering uncertain or variable income careers.

Deferred Tuition Model

The Deferred Tuition Model allows students to fund their education through Income-Share Agreements (ISAs), repaying a fixed percentage of future income instead of accruing traditional debt with interest. This contrasts with conventional Student Loans by minimizing upfront costs and aligning repayment obligations with post-graduation earnings, reducing financial risk during unemployment or low-income periods.

Hybrid ISA-Loan Structure

The Hybrid ISA-Loan Structure combines fixed loan repayments with income-share agreement components, offering students a balanced approach to education funding by capping repayment amounts based on income fluctuations. This model mitigates borrower risk compared to traditional student loans while providing lenders predictable returns through predefined payment schedules.

Student Loan vs Income-Share Agreement Loan for education funding. Infographic

moneydiff.com

moneydiff.com