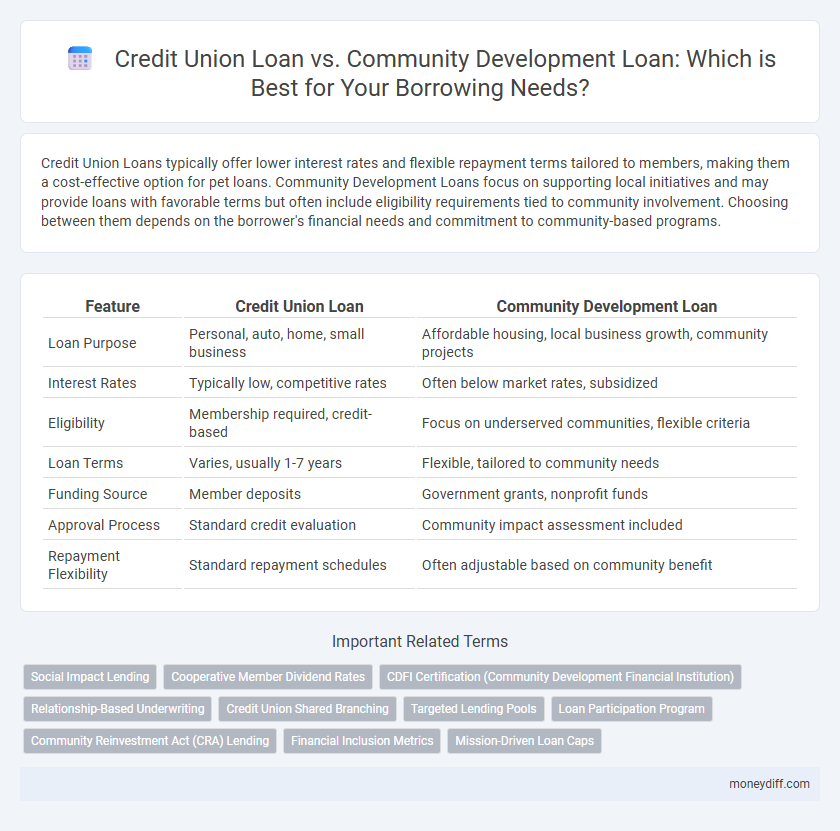

Credit Union Loans typically offer lower interest rates and flexible repayment terms tailored to members, making them a cost-effective option for pet loans. Community Development Loans focus on supporting local initiatives and may provide loans with favorable terms but often include eligibility requirements tied to community involvement. Choosing between them depends on the borrower's financial needs and commitment to community-based programs.

Table of Comparison

| Feature | Credit Union Loan | Community Development Loan |

|---|---|---|

| Loan Purpose | Personal, auto, home, small business | Affordable housing, local business growth, community projects |

| Interest Rates | Typically low, competitive rates | Often below market rates, subsidized |

| Eligibility | Membership required, credit-based | Focus on underserved communities, flexible criteria |

| Loan Terms | Varies, usually 1-7 years | Flexible, tailored to community needs |

| Funding Source | Member deposits | Government grants, nonprofit funds |

| Approval Process | Standard credit evaluation | Community impact assessment included |

| Repayment Flexibility | Standard repayment schedules | Often adjustable based on community benefit |

Understanding Credit Union Loans

Credit union loans typically offer lower interest rates and more flexible terms compared to traditional community development loans, making them accessible for members with varying credit backgrounds. These loans often emphasize member benefits, such as lower fees and personalized service, fostering financial growth within the community. Understanding credit union loans involves recognizing their cooperative structure that prioritizes member needs over profit, which can translate to more favorable repayment options and customer support.

What Are Community Development Loans?

Community Development Loans are designed to finance projects that promote economic growth and improve living conditions in underserved areas, often supporting affordable housing, small businesses, and community facilities. These loans typically offer favorable terms and lower interest rates compared to traditional financing, targeting low-to-moderate income neighborhoods. Credit Unions may also provide loans with similar community-focused goals but usually serve members specifically, while Community Development Loans aim at broader regional impact.

Key Differences Between Credit Union and Community Development Loans

Credit union loans typically offer lower interest rates and flexible repayment terms due to their member-owned structure, prioritizing financial well-being. Community development loans focus on revitalizing underserved areas by financing small businesses, affordable housing, and community projects, emphasizing social impact over profit. While credit union loans prioritize individual borrowers, community development loans target community growth and economic development.

Loan Eligibility Requirements Compared

Credit Union loans typically require membership eligibility based on geographic location, employer, or association affiliation, with a focus on credit history and income verification. Community Development loans target underserved or low-income areas, often emphasizing borrower creditworthiness alongside community impact and local residency criteria. Both loan types prioritize responsible lending but vary in eligibility scope, reflecting their distinct missions and borrower demographics.

Interest Rates: Credit Union vs Community Development Loans

Credit Union loans generally offer lower interest rates compared to Community Development loans due to their nonprofit structure and member-focused approach. Community Development loans may have slightly higher rates, reflecting increased risk and targeted funding objectives in underserved areas. Borrowers seeking affordable financing often prefer Credit Union loans for their competitive interest rates and personalized terms.

Loan Terms and Repayment Options

Credit union loans typically offer lower interest rates and more flexible repayment terms compared to community development loans, which may have stricter eligibility requirements but often provide longer repayment periods and tailored assistance for borrowers in underserved areas. Credit union loans usually allow members to choose from multiple repayment schedules, including monthly, bi-weekly, or customized plans, enhancing borrower convenience. In contrast, community development loans emphasize structured repayment options aligned with community goals, often incorporating financial education and support services to ensure successful loan fulfillment.

Accessibility and Application Process

Credit Union Loans offer easier accessibility to members with simplified application processes and lower eligibility requirements, often requiring proof of membership and basic credit checks. Community Development Loans target underserved areas with flexible criteria, prioritizing community benefit, and may involve more extensive documentation to verify the impact of the loan. Both provide valuable financing options but differ in accessibility ease and the thoroughness of application procedures.

Community Impact and Member Benefits

Community development loans prioritize local economic growth and social impact by funding projects that create jobs and improve infrastructure, directly benefiting underserved neighborhoods. Credit union loans offer personalized financial solutions with lower interest rates and member-focused terms, enhancing individual financial well-being and promoting savings. Both loan types foster community resilience, but community development loans emphasize broader societal benefits while credit union loans focus on member-centric financial empowerment.

Pros and Cons: Credit Union Loan vs Community Development Loan

Credit Union Loans offer lower interest rates and flexible terms due to member-owned structures but often require membership eligibility and have stricter credit criteria. Community Development Loans focus on supporting underserved areas with easier qualification and community impact incentives but may carry higher rates and limited loan amounts. Choosing between them depends on credit profile, loan purpose, and community involvement goals.

Choosing the Right Loan for Your Financial Needs

Choosing the right loan depends on your financial goals and eligibility criteria, with Credit Union Loans often offering lower interest rates and personalized service due to their member-focused structure. Community Development Loans target underserved areas, providing favorable terms and support for projects that promote local economic growth and social impact. Assessing factors like loan purpose, credit requirements, and repayment flexibility helps determine whether a Credit Union Loan or a Community Development Loan best aligns with your financial needs.

Related Important Terms

Social Impact Lending

Credit Union Loans prioritize member-focused lending with favorable rates and community reinvestment, fostering financial inclusion and local economic stability. Community Development Loans specifically target underserved areas, funding projects that enhance affordable housing, small businesses, and social services to generate measurable social impact.

Cooperative Member Dividend Rates

Credit Union loans often offer lower interest rates and higher cooperative member dividend rates compared to Community Development loans, benefiting members through profit sharing and reduced borrowing costs. Community Development loans prioritize funding impact-driven projects but typically have less favorable dividend rates for individual cooperative members.

CDFI Certification (Community Development Financial Institution)

Credit Union Loans often offer lower interest rates and flexible terms due to member ownership, while Community Development Loans, particularly those issued by CDFI-certified institutions, focus on providing financial services to underserved communities and promoting economic development. CDFI certification ensures that these loans support local revitalization efforts and improve access to capital for small businesses and low-income borrowers.

Relationship-Based Underwriting

Credit Union Loans prioritize relationship-based underwriting by evaluating members' overall financial behaviors and trustworthiness within the community, often resulting in more personalized loan terms and lower interest rates. Community Development Loans also emphasize social impact and local economic improvement, using relationship-based criteria to support underserved populations but may include additional requirements linked to community benefits.

Credit Union Shared Branching

Credit Union loans offer members competitive interest rates and personalized service through shared branching networks, enabling access to funds across multiple locations nationwide. Community Development Loans prioritize funding projects that stimulate local economic growth, often providing flexible terms but with more stringent eligibility criteria focused on community impact.

Targeted Lending Pools

Credit Union Loans primarily target local members, offering personalized lending options with potentially lower interest rates due to member ownership and nonprofit status. Community Development Loans focus on underserved or economically disadvantaged areas, channeling funds into projects that promote affordable housing, small businesses, and community revitalization.

Loan Participation Program

Credit Union loans typically offer lower interest rates and personalized service due to their member-owned structure, while Community Development Loans target underserved areas with flexible terms aimed at economic growth. Loan Participation Programs enable financial institutions to share risks and pool resources, enhancing capital availability and increasing loan accessibility for projects benefiting community development.

Community Reinvestment Act (CRA) Lending

Community Development Loans prioritize financing projects that directly support low- to moderate-income communities, aligning closely with the Community Reinvestment Act (CRA) by promoting economic revitalization and affordable housing. Credit Union Loans often offer competitive rates and personalized service but may lack the specific CRA-focused impact required for targeted community development initiatives.

Financial Inclusion Metrics

Credit Union Loans typically offer lower interest rates and more flexible repayment terms, enhancing financial inclusion by serving underserved populations with limited access to traditional banking. Community Development Loans prioritize funding projects that stimulate economic growth in low-income areas, measuring success through metrics like increased credit access, job creation, and local business development.

Mission-Driven Loan Caps

Credit union loans typically have strict mission-driven loan caps aligned with member-focused financial inclusion and community support, ensuring funds are allocated to responsible, low-risk borrowers. Community development loans, often backed by government or nonprofit organizations, impose higher loan caps to stimulate economic growth in underserved areas, prioritizing impactful projects with broader social benefits.

Credit Union Loan vs Community Development Loan for loan. Infographic

moneydiff.com

moneydiff.com