Home loans offer traditional security with fixed terms and in-person support, while digital mortgages provide faster approval and streamlined online processes for property financing. Digital mortgages leverage technology to reduce paperwork and improve convenience, making them ideal for tech-savvy borrowers seeking efficiency. Choosing between the two depends on the borrower's preference for personalized service or speed and simplicity in securing funds.

Table of Comparison

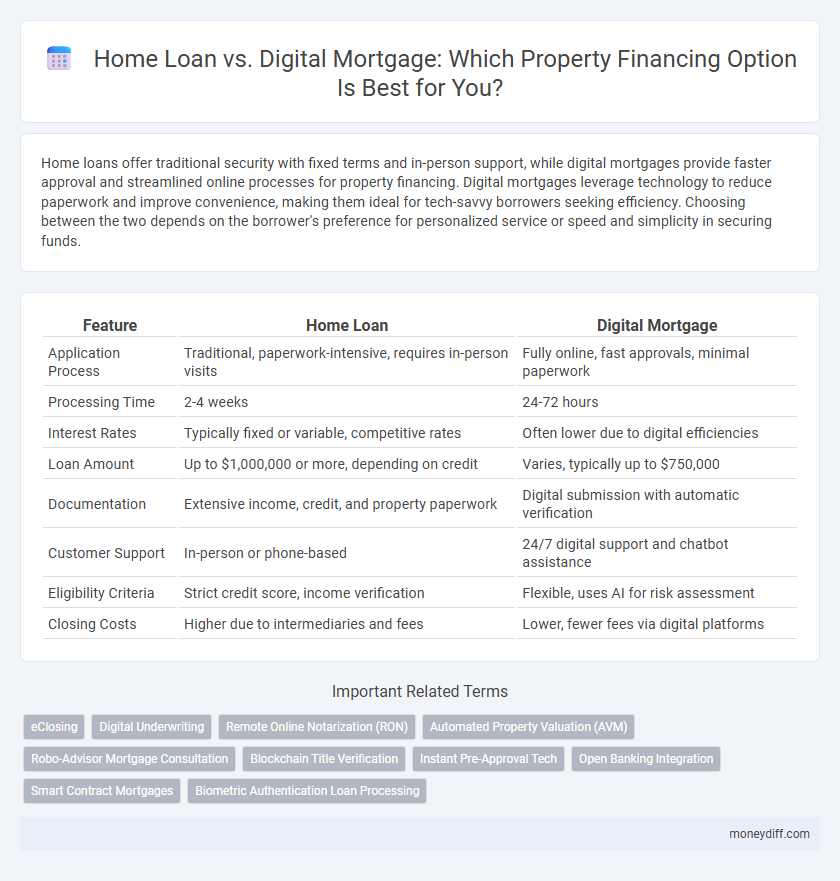

| Feature | Home Loan | Digital Mortgage |

|---|---|---|

| Application Process | Traditional, paperwork-intensive, requires in-person visits | Fully online, fast approvals, minimal paperwork |

| Processing Time | 2-4 weeks | 24-72 hours |

| Interest Rates | Typically fixed or variable, competitive rates | Often lower due to digital efficiencies |

| Loan Amount | Up to $1,000,000 or more, depending on credit | Varies, typically up to $750,000 |

| Documentation | Extensive income, credit, and property paperwork | Digital submission with automatic verification |

| Customer Support | In-person or phone-based | 24/7 digital support and chatbot assistance |

| Eligibility Criteria | Strict credit score, income verification | Flexible, uses AI for risk assessment |

| Closing Costs | Higher due to intermediaries and fees | Lower, fewer fees via digital platforms |

Understanding Home Loans: Traditional Property Financing

Home loans involve borrowing money from banks or financial institutions with fixed or adjustable interest rates to purchase property. Traditional property financing requires extensive documentation, in-person visits, and longer approval processes compared to digital mortgages. Understanding the terms, interest rates, repayment schedules, and eligibility criteria is essential for making informed decisions in home financing.

What Is a Digital Mortgage? Key Features and Benefits

A digital mortgage streamlines property financing by leveraging online platforms to manage the entire loan process from application to closing with minimal paperwork and faster approvals. Key features include automated document verification, electronic signatures, and real-time status tracking, enhancing transparency and convenience for borrowers. This approach reduces processing times and lowers costs compared to traditional home loans, making property financing more accessible and efficient.

Home Loan vs Digital Mortgage: Core Differences

Home loans typically involve traditional bank processes with in-person documentation and longer approval times, whereas digital mortgages leverage online platforms for faster, automated approvals and paperless transactions. Digital mortgages offer enhanced convenience with integrated technology solutions like electronic signatures and real-time status tracking, contrasting with the manual, document-heavy approach of conventional home loans. Interest rates and terms may be similar, but digital mortgages provide greater transparency and streamlined user experience due to advanced data analytics and digital underwriting methods.

Application Process: In-Person vs Online Experience

Home loans often require in-person meetings, involving physical document submissions and face-to-face consultations that can extend processing times. Digital mortgages streamline the application through online platforms, enabling rapid document uploads, real-time status tracking, and remote communication with loan officers. This online experience reduces processing delays, enhances convenience, and increases accessibility for property financing applicants.

Speed and Efficiency: Who Wins the Race?

Digital mortgages significantly outpace traditional home loans in speed and efficiency, often completing approvals in days versus weeks. Automated verification processes and electronic documentation reduce manual errors and streamline underwriting. Borrowers benefit from instant pre-approvals and faster closings, making digital mortgages the clear frontrunner in property financing speed.

Eligibility and Approval Criteria Compared

Home loans typically require a stable income, good credit score, and detailed documentation such as income proof, property valuation, and identity verification, making eligibility stricter. Digital mortgages streamline approval with automated credit checks and electronic document submission, often offering faster decisions but still demand minimum credit standards and income verification. Comparing eligibility, traditional home loans rely more on manual underwriting, while digital mortgages leverage technology to enhance transparency and reduce processing time.

Documentation: Paperwork vs Digital Convenience

Home loans typically require extensive paperwork, including physical copies of income proof, credit reports, and property documents, which can prolong the approval process. Digital mortgages streamline documentation by enabling applicants to upload and verify necessary files electronically, significantly reducing processing times. This shift towards digital convenience enhances user experience while maintaining compliance and security in property financing.

Costs and Fees: Analyzing the Financial Impact

Home loans typically involve higher upfront costs such as appraisal fees, origination fees, and closing costs, which can range from 2% to 5% of the loan amount, whereas digital mortgages often reduce these expenses through streamlined application processes and automated underwriting. Digital mortgage platforms may lower costs by minimizing paperwork and eliminating certain fees, potentially saving borrowers thousands of dollars throughout the loan term. Evaluating interest rates, hidden charges, and platform fees is essential to determine the true financial impact of each financing option on overall affordability.

Security and Data Protection: Traditional vs Digital Mortgages

Traditional home loans often involve in-person verification and securely stored physical documents, offering robust data protection through established banking protocols and reduced exposure to cyber threats. Digital mortgages leverage encryption, multi-factor authentication, and advanced cybersecurity measures to protect sensitive borrower information, but they face heightened risks from cyberattacks and data breaches due to their online nature. Evaluating security and data protection requires balancing the physical security controls of traditional loans with the sophisticated digital safeguards essential in digital mortgage platforms.

Choosing the Best Option: Factors to Consider for Property Buyers

Property buyers must evaluate interest rates, loan processing speed, and overall convenience when choosing between a home loan and a digital mortgage. Home loans typically offer lower interest rates and personalized service, while digital mortgages provide faster approvals and streamlined online application processes. Assessing credit score requirements, documentation demands, and customer support quality helps in selecting the financing solution that best fits individual financial situations and timelines.

Related Important Terms

eClosing

eClosing streamlines the home loan process by enabling borrowers to complete document signing and notarization electronically, significantly reducing the time and paperwork involved compared to traditional mortgage methods. Digital mortgage platforms integrate eClosing features to enhance security, improve transparency, and accelerate property financing from application to loan funding.

Digital Underwriting

Digital underwriting in home loans streamlines property financing by leveraging advanced algorithms and real-time data analytics to assess creditworthiness faster and with greater accuracy than traditional underwriting methods. This technology reduces approval times, minimizes manual errors, and enhances borrower experience by enabling automated risk analysis and instant decision-making.

Remote Online Notarization (RON)

Remote Online Notarization (RON) significantly enhances digital mortgage processes by allowing borrowers to securely complete and notarize home loan documents online, eliminating the need for in-person visits. This advancement streamlines property financing, reduces processing time, and increases accessibility compared to traditional home loan procedures.

Automated Property Valuation (AVM)

Automated Property Valuation (AVM) enhances digital mortgage processes by providing instant, data-driven home appraisals, reducing the need for manual assessment and accelerating loan approvals. Traditional home loans often rely on slower, in-person valuations which can delay financing, whereas AVM integration in digital mortgages streamlines property valuation with real-time market data and predictive analytics.

Robo-Advisor Mortgage Consultation

Robo-advisor mortgage consultation offers a streamlined alternative to traditional home loans by providing algorithm-driven advice, personalized loan options, and faster approval processes for property financing. Digital mortgages leverage AI technology to analyze credit profiles and market data, optimizing interest rates and repayment terms while reducing human error and paperwork delays.

Blockchain Title Verification

Blockchain title verification enhances digital mortgage security by providing immutable, transparent property records, significantly reducing title fraud risks compared to traditional home loans. This technology streamlines the financing process, enabling faster approvals and increased trust for borrowers and lenders alike.

Instant Pre-Approval Tech

Instant pre-approval technology in digital mortgages accelerates property financing by providing immediate credit decisions using AI-driven algorithms, contrasting with traditional home loans that often require manual processing and longer wait times. This technology enhances borrower convenience and streamlines the approval process, enabling faster property purchases and improved financial planning.

Open Banking Integration

Digital mortgages leverage open banking integration to streamline property financing by enabling instant account verification, reducing paperwork, and accelerating loan approval processes. Home loans, while traditionally reliant on manual documentation, are increasingly adopting open banking APIs to enhance transparency and provide personalized interest rates based on real-time financial data.

Smart Contract Mortgages

Smart contract mortgages streamline home loan processes by automating contract execution and reducing paperwork through blockchain technology, enhancing transparency and security in property financing. Unlike traditional home loans, digital mortgages using smart contracts enable faster approvals, lower costs, and real-time updates on loan status, transforming the mortgage experience for borrowers and lenders.

Biometric Authentication Loan Processing

Biometric authentication streamlines loan processing by enhancing security and reducing fraud risks in both home loans and digital mortgages, enabling faster verification of borrower identity through fingerprint or facial recognition technology. Digital mortgages leverage biometric authentication more extensively, accelerating approvals and improving user experience compared to traditional home loan processes reliant on manual identity checks.

Home Loan vs Digital Mortgage for property financing. Infographic

moneydiff.com

moneydiff.com