Bank loans provide structured repayment plans and typically require credit checks, offering a reliable option for borrowers who value security and established regulatory oversight. Decentralized finance (DeFi) loans eliminate intermediaries by enabling peer-to-peer lending on blockchain platforms, allowing for faster approval and potentially lower interest rates but with higher risks due to market volatility. Choosing between bank loans and DeFi loans depends on the borrower's preference for traditional security or the innovative flexibility of decentralized systems.

Table of Comparison

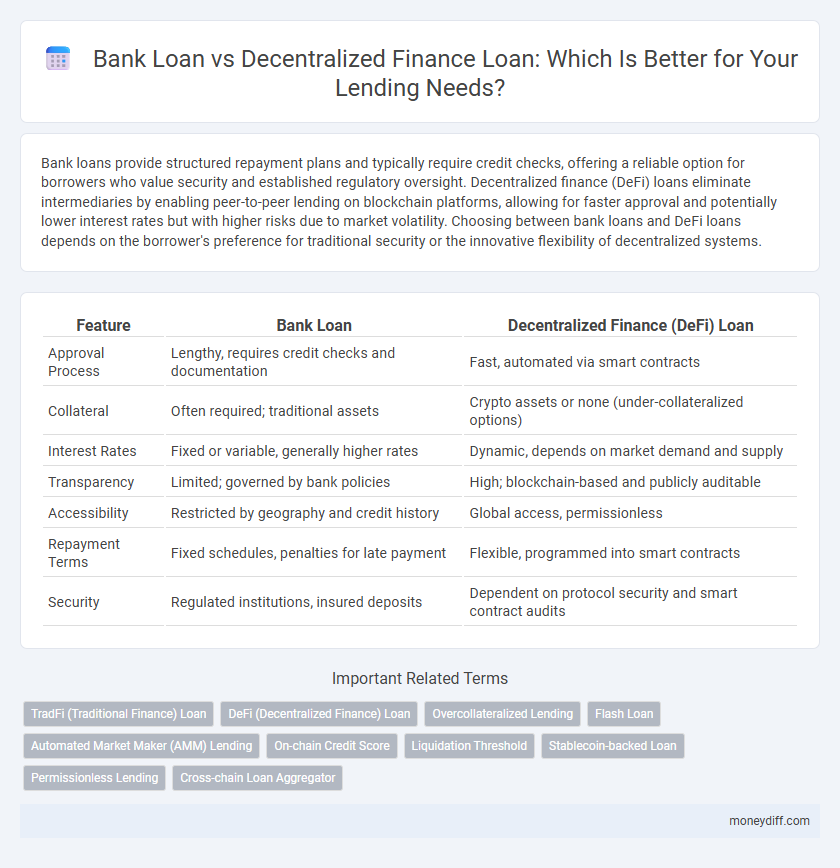

| Feature | Bank Loan | Decentralized Finance (DeFi) Loan |

|---|---|---|

| Approval Process | Lengthy, requires credit checks and documentation | Fast, automated via smart contracts |

| Collateral | Often required; traditional assets | Crypto assets or none (under-collateralized options) |

| Interest Rates | Fixed or variable, generally higher rates | Dynamic, depends on market demand and supply |

| Transparency | Limited; governed by bank policies | High; blockchain-based and publicly auditable |

| Accessibility | Restricted by geography and credit history | Global access, permissionless |

| Repayment Terms | Fixed schedules, penalties for late payment | Flexible, programmed into smart contracts |

| Security | Regulated institutions, insured deposits | Dependent on protocol security and smart contract audits |

Introduction to Bank Loans and DeFi Loans

Bank loans involve traditional financial institutions providing borrowers with fixed or variable interest rates, often requiring credit checks and collateral to secure the loan, ensuring regulatory oversight and consumer protection. Decentralized Finance (DeFi) loans operate through blockchain technology, enabling peer-to-peer lending without intermediaries, utilizing smart contracts for automatic execution and collateralization via cryptocurrency assets. DeFi loans offer greater accessibility and transparency but carry higher volatility risks compared to conventional bank loans regulated by central authorities.

Understanding How Bank Loans Work

Bank loans involve a traditional financial institution providing a borrower with a fixed amount of money, which must be repaid with interest over a predetermined period. The approval process typically requires credit checks, income verification, and collateral to mitigate the bank's risk. Interest rates and repayment terms are regulated and structured, offering predictability but often less flexibility compared to decentralized finance loans.

Exploring the Fundamentals of DeFi Loans

DeFi loans leverage blockchain technology to enable peer-to-peer lending without traditional intermediaries, offering increased transparency and lower fees compared to conventional bank loans. Unlike bank loans that require credit checks and lengthy approval processes, DeFi loans use smart contracts to automate transactions and collateral management, providing faster access to funds. The decentralized nature of DeFi also reduces reliance on centralized institutions, potentially increasing accessibility and financial inclusion worldwide.

Eligibility Criteria: Bank vs DeFi Loans

Bank loans typically require stringent eligibility criteria such as a strong credit score, proof of income, and collateral, making access difficult for borrowers with limited financial history. DeFi loans leverage blockchain technology and smart contracts, allowing borrowers to secure funds without traditional credit checks, often using cryptocurrency as collateral. This difference significantly broadens DeFi loan accessibility while increasing the risk profile for lenders compared to conventional banking standards.

Application Process Comparison: Traditional vs Decentralized

Traditional bank loans require extensive documentation, credit checks, and lengthy approval times, often taking weeks to finalize. Decentralized finance (DeFi) loans utilize blockchain technology, enabling users to apply and receive funds through smart contracts within minutes, bypassing intermediaries. The transparent and automated application process in DeFi eliminates the need for credit scores, making loans more accessible and efficient compared to conventional banking systems.

Interest Rates and Fees: Banks vs DeFi Platforms

Bank loans typically offer fixed or variable interest rates with additional fees such as processing charges and late payment penalties, often resulting in higher overall costs due to regulatory and operational expenses. DeFi loans generally feature lower interest rates and minimal fees, enabled by blockchain automation and peer-to-peer lending, reducing overhead and eliminating intermediaries. The transparency of DeFi platforms allows borrowers to compare rates instantly, while banks may have less flexible fee structures and slower approval processes.

Collateral Requirements: Traditional Banking vs DeFi Lending

Bank loans typically require substantial collateral such as real estate or fixed assets to secure the loan, ensuring low default risk for financial institutions. DeFi lending platforms use crypto-assets as collateral, allowing for faster, permissionless access but with higher volatility risk due to fluctuating token prices. Collateral liquidation processes in DeFi are automated through smart contracts, contrasting with traditional banks' manual and lengthy foreclosure procedures.

Speed and Accessibility of Loan Approvals

Bank loans often involve lengthy approval processes requiring extensive documentation and credit checks, leading to slower access to funds. Decentralized finance (DeFi) loans utilize blockchain technology to enable near-instant loan approvals through smart contracts, eliminating the need for traditional intermediaries. This enhances accessibility by providing loans to users globally without reliance on credit scores or bank branches.

Risks and Security: Bank Loans vs DeFi Loans

Bank loans typically offer stronger security through regulatory oversight, insured deposits, and established credit evaluation processes, reducing default risks for both lenders and borrowers. DeFi loans operate on blockchain technology with smart contracts, providing transparency and automation but exposing users to risks such as smart contract vulnerabilities, lack of legal recourse, and price volatility of collateral. Understanding these risk factors is crucial when choosing between traditional bank loans and decentralized finance lending options for safer and more secure borrowing.

Which Loan Option Suits Your Financial Goals?

Bank loans offer structured repayment plans and regulatory protection, making them suitable for borrowers seeking predictable terms and credit history improvement. Decentralized finance (DeFi) loans provide faster access to funds with fewer intermediaries and flexible collateral options, ideal for tech-savvy users prioritizing speed and transparency. Choosing between a bank loan and a DeFi loan depends on your financial goals, risk tolerance, and need for traditional oversight versus innovative lending solutions.

Related Important Terms

TradFi (Traditional Finance) Loan

Traditional finance loans, issued by banks, rely on credit history, collateral, and regulatory compliance, offering structured interest rates and longer repayment terms. These loans benefit from established legal protections and personalized customer service but often involve slower approval processes and stricter eligibility criteria compared to decentralized finance loan options.

DeFi (Decentralized Finance) Loan

DeFi loans leverage blockchain technology to enable peer-to-peer lending without traditional intermediaries, reducing approval times and enhancing transparency through smart contracts. Unlike bank loans, DeFi loans offer greater accessibility and flexibility, often requiring lower collateral and providing decentralized governance for borrowers worldwide.

Overcollateralized Lending

Overcollateralized lending in bank loans typically requires borrowers to provide collateral exceeding the loan value to mitigate credit risk, ensuring traditional financial institutions maintain asset security and regulatory compliance. Decentralized finance (DeFi) loans also use overcollateralization, leveraging blockchain technology for transparent, peer-to-peer lending without intermediaries, but often involve volatile crypto assets as collateral, increasing risk exposure.

Flash Loan

Flash loans in decentralized finance offer instant, collateral-free borrowing executed within a single blockchain transaction, contrasting with traditional bank loans that require credit checks, collateral, and lengthy approval processes. The speed and accessibility of DeFi flash loans enable arbitrage and rapid trading opportunities, while bank loans provide structured repayment plans and regulatory oversight for long-term financing needs.

Automated Market Maker (AMM) Lending

Bank loans rely on centralized credit assessment and fixed interest rates, while decentralized finance (DeFi) loans using Automated Market Maker (AMM) lending harness liquidity pools and algorithm-driven pricing to offer dynamic interest rates and instant loan approval without intermediaries. AMM lending platforms enable peer-to-peer borrowing with enhanced transparency, reduced costs, and access to global liquidity, revolutionizing traditional lending models.

On-chain Credit Score

On-chain credit scores utilize blockchain data to provide transparent and immutable credit assessments, enabling decentralized finance loans to offer instant, permissionless lending without traditional bank intermediaries. Bank loans rely on centralized credit reports and extensive manual verification, resulting in slower approval processes and limited transparency compared to the efficiency of DeFi's on-chain credit evaluation.

Liquidation Threshold

Bank loans typically enforce a fixed liquidation threshold determined by the lender's risk assessment, often leading to stricter collateral requirements and potential asset seizure upon default. Decentralized finance (DeFi) loans use automated smart contracts with dynamic liquidation thresholds based on real-time market data and collateral volatility, enabling more transparent and flexible risk management.

Stablecoin-backed Loan

Stablecoin-backed loans in decentralized finance (DeFi) offer increased transparency, lower interest rates, and faster approval compared to traditional bank loans, which often involve extensive credit checks and slower processing times. DeFi loans leverage blockchain technology to provide collateralized lending without intermediaries, enhancing accessibility while reducing regulatory barriers inherent in banking systems.

Permissionless Lending

Bank loans require extensive credit checks and regulatory approval, limiting accessibility especially for borrowers with lower credit scores. Permissionless lending in decentralized finance (DeFi) platforms enables borrowers to access loans instantly without intermediaries, using smart contracts to secure funds based on collateral on a blockchain.

Cross-chain Loan Aggregator

Cross-chain loan aggregators enable users to access a wider range of loan offerings by bridging liquidity across multiple blockchains, providing more competitive rates and flexible terms than traditional bank loans. Unlike bank loans, which require extensive credit checks and centralized approval processes, decentralized finance loans leverage smart contracts for instant, transparent, and permissionless lending options across various crypto assets.

Bank Loan vs Decentralized Finance Loan for Loan Infographic

moneydiff.com

moneydiff.com