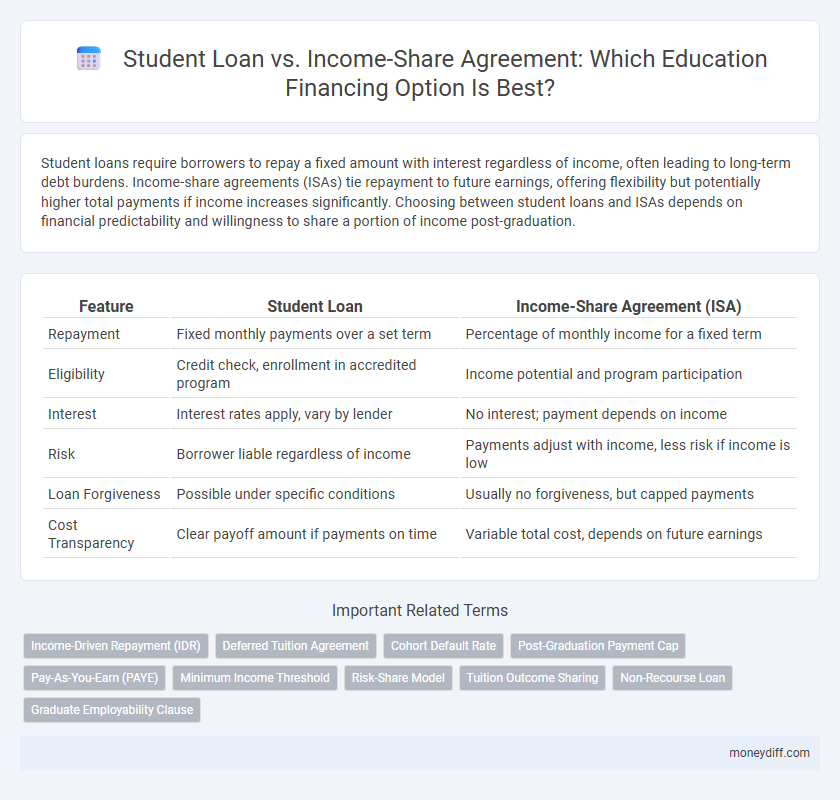

Student loans require borrowers to repay a fixed amount with interest regardless of income, often leading to long-term debt burdens. Income-share agreements (ISAs) tie repayment to future earnings, offering flexibility but potentially higher total payments if income increases significantly. Choosing between student loans and ISAs depends on financial predictability and willingness to share a portion of income post-graduation.

Table of Comparison

| Feature | Student Loan | Income-Share Agreement (ISA) |

|---|---|---|

| Repayment | Fixed monthly payments over a set term | Percentage of monthly income for a fixed term |

| Eligibility | Credit check, enrollment in accredited program | Income potential and program participation |

| Interest | Interest rates apply, vary by lender | No interest; payment depends on income |

| Risk | Borrower liable regardless of income | Payments adjust with income, less risk if income is low |

| Loan Forgiveness | Possible under specific conditions | Usually no forgiveness, but capped payments |

| Cost Transparency | Clear payoff amount if payments on time | Variable total cost, depends on future earnings |

Understanding Student Loans: An Overview

Student loans typically involve borrowing a fixed amount with set interest rates and repayment schedules, requiring students to repay regardless of future income. Income-share agreements (ISAs) differ by allowing students to repay a percentage of their future income over a predetermined period, aligning repayment with actual earnings. Understanding these fundamental differences helps students choose financing options that balance financial risk with potential earnings after graduation.

What Is an Income-Share Agreement (ISA)?

An Income-Share Agreement (ISA) is a financial contract where a student receives funding for education in exchange for agreeing to pay a fixed percentage of future income for a set period, rather than taking on traditional debt. Unlike student loans that accrue interest and require fixed monthly payments regardless of income, ISAs adjust payments based on earnings, reducing financial risk during lower income periods. ISAs often appeal to students in uncertain career paths by aligning repayment with actual job income, providing a flexible alternative to conventional student loans.

Key Differences Between Student Loans and ISAs

Student loans require fixed monthly repayments with interest over a specified term, impacting borrowers regardless of income level, while Income-Share Agreements (ISAs) tie repayment amounts to a fixed percentage of the borrower's future income for a set period. Unlike student loans that accumulate interest, ISAs adjust payments based on earnings, potentially reducing financial strain during periods of low income or unemployment. Additionally, student loans often have credit checks and strict qualification criteria, whereas ISAs may offer more accessible funding without traditional credit assessments.

Upfront Costs: Loan vs ISA

Student loans typically require upfront fees such as origination charges and sometimes immediate interest accrual, increasing initial financial burdens. Income-Share Agreements (ISAs) often eliminate upfront costs by deferring payments until graduates secure employment and earn above a certain income threshold. This shift reduces early financial strain but may result in higher total payments depending on future income levels.

Repayment Terms: Student Loan vs ISA

Student loans require fixed monthly payments over a set term with interest rates that increase total repayment, while income-share agreements (ISAs) mandate payments based on a percentage of the borrower's income for a defined period, potentially reducing financial strain during low-earning phases. Student loan repayment begins immediately or after a grace period, regardless of income level, whereas ISA repayments fluctuate with actual earnings, adjusting financial obligations accordingly. The key difference lies in repayment flexibility and risk distribution: student loans shift repayment risk to the borrower, but ISAs align payment amounts with income, offering more adaptable terms.

Effects on Long-Term Financial Health

Student loans create long-term debt that accrues interest, impacting credit scores and increasing financial burdens over time. Income-Share Agreements (ISAs) align repayment with future earnings, reducing the risk of default but potentially costing more if income rises significantly. Choosing between them depends on anticipated career income stability and willingness to manage debt-driven financial obligations.

Flexibility and Risk for Borrowers

Student loans typically offer fixed repayment schedules with set interest rates, which can limit flexibility but provide predictable monthly payments. Income-Share Agreements (ISAs) adjust repayment amounts based on the borrower's income, offering greater flexibility and reduced risk during periods of low earnings. Borrowers choosing ISAs may avoid debt accumulation, but face potential higher overall costs if their income increases significantly.

Impact on Academic and Career Choices

Student loans often pressure borrowers to select high-paying careers to repay fixed debt, potentially limiting academic freedom and career exploration. Income-Share Agreements (ISAs) tie repayment to income, which can encourage students to pursue paths aligned with their interests without the burden of insurmountable debt. Research shows that ISAs may promote diverse academic choices and reduce financial stress, influencing career selection more positively than traditional student loans.

Pros and Cons of Student Loans

Student loans offer fixed repayment schedules and the ability to borrow significant amounts upfront, making them suitable for covering comprehensive educational expenses. However, they often come with high-interest rates and repayment obligations regardless of income, potentially leading to financial strain for graduates with lower earnings. Unlike income-share agreements, student loans lack flexibility tied to post-graduation income, increasing the risk of default and long-term debt burden.

Pros and Cons of Income-Share Agreements

Income-share agreements (ISAs) offer flexible repayment tied to future income, reducing the risk of unmanageable debt for students pursuing higher education. Unlike traditional student loans with fixed interest and monthly payments, ISAs eliminate interest accumulation and adjust payments based on the borrower's earnings, but they may result in higher overall costs if the graduate's income significantly increases. Potential drawbacks include limited availability, varying contract terms, and the risk of extended payment periods that can impact long-term financial planning.

Related Important Terms

Income-Driven Repayment (IDR)

Income-Driven Repayment (IDR) plans for student loans adjust monthly payments based on income and family size, offering greater flexibility and reducing financial stress compared to fixed-rate obligations typical of Income-Share Agreements (ISAs). Unlike ISAs that require a fixed percentage of future income regardless of loan balance, IDR plans provide forgiveness after 20-25 years, aligning repayment with the borrower's ability to pay.

Deferred Tuition Agreement

A Deferred Tuition Agreement (DTA) allows students to postpone tuition payments until after graduation, linking repayment to future income instead of upfront loans. Unlike traditional student loans, DTAs function as Income-Share Agreements (ISAs), minimizing debt risk by adjusting payments based on earnings, which can provide financial flexibility during early career stages.

Cohort Default Rate

Student loans typically show higher cohort default rates compared to income-share agreements (ISAs), which tie repayment to a percentage of future income rather than fixed monthly payments. This structure in ISAs reduces borrower default risk by aligning repayment obligations with actual earnings, thereby potentially lowering overall cohort default rates.

Post-Graduation Payment Cap

Student loans typically require fixed monthly payments with interest accruing over time, often leading to high total repayment amounts, whereas income-share agreements (ISAs) cap post-graduation payments based on a percentage of a graduate's income for a set period, protecting borrowers from overwhelming debt. The payment cap in ISAs ensures graduates pay only a fraction of their earnings, making repayment more manageable compared to the potentially unlimited burden of traditional student loan debt.

Pay-As-You-Earn (PAYE)

Student loans under Pay-As-You-Earn (PAYE) offer fixed monthly payments based on income, reducing financial strain for graduates with lower earnings compared to Income-Share Agreements (ISAs), which require a percentage of future income but may lack payment caps or loan forgiveness options. PAYE loans provide protection through loan forgiveness after 20 years and eligibility criteria that align repayment obligations with the borrower's discretionary income, making them a safer long-term financing choice for education.

Minimum Income Threshold

Student loans require fixed repayments regardless of income, while income-share agreements (ISAs) include a minimum income threshold below which no payments are due, protecting borrowers with low earnings. This minimum income threshold in ISAs varies by provider but typically ranges from $20,000 to $30,000 annually, ensuring affordability and reducing default risk for borrowers with fluctuating or low post-graduation income.

Risk-Share Model

Student loans require fixed monthly repayments regardless of income, increasing financial risk for borrowers during low-earning periods, whereas income-share agreements (ISAs) use a risk-share model that adjusts payments based on actual income, reducing default risk and providing flexible repayment terms tied to borrower earnings. This model aligns lender and borrower incentives by sharing financial risks and benefits according to the borrower's post-graduation income trajectory.

Tuition Outcome Sharing

Tuition Outcome Sharing models in Income-Share Agreements (ISAs) require students to pay a fixed percentage of their future income for a set period, aligning repayment with post-graduation earnings and reducing financial risk compared to traditional student loans with fixed interest and fixed schedules. ISAs emphasize outcome-based repayment, while student loans often entail debt accumulation regardless of career success or income trajectory.

Non-Recourse Loan

A student loan is typically a non-recourse loan that requires fixed repayments regardless of future income, while an income-share agreement (ISA) functions as a non-recourse loan where repayment depends on a percentage of the borrower's post-graduation income. Unlike traditional student loans, ISAs reduce financial risk by eliminating fixed monthly payments and providing income-contingent obligations.

Graduate Employability Clause

Graduate employability clauses in income-share agreements (ISAs) link repayment amounts to post-graduation income, reducing financial risk for students compared to fixed-rate student loans, which require standard payments regardless of employment status. These clauses incentivize educational institutions to support student career outcomes, aligning loan repayment with actual earnings and enhancing graduate financial stability.

Student Loan vs Income-Share Agreement for loan. Infographic

moneydiff.com

moneydiff.com