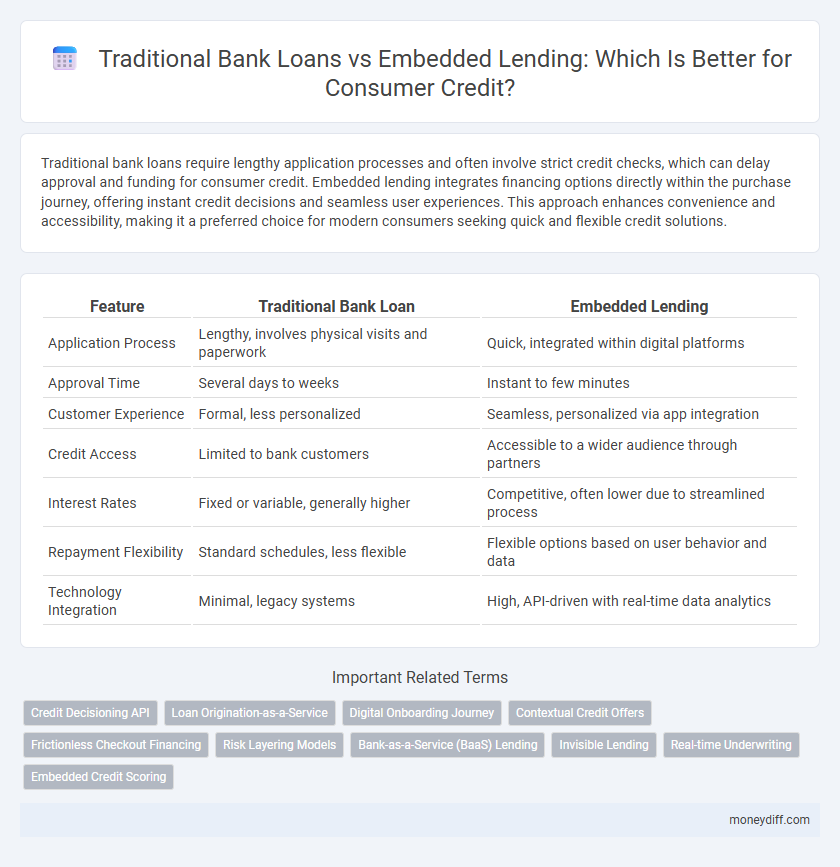

Traditional bank loans require lengthy application processes and often involve strict credit checks, which can delay approval and funding for consumer credit. Embedded lending integrates financing options directly within the purchase journey, offering instant credit decisions and seamless user experiences. This approach enhances convenience and accessibility, making it a preferred choice for modern consumers seeking quick and flexible credit solutions.

Table of Comparison

| Feature | Traditional Bank Loan | Embedded Lending |

|---|---|---|

| Application Process | Lengthy, involves physical visits and paperwork | Quick, integrated within digital platforms |

| Approval Time | Several days to weeks | Instant to few minutes |

| Customer Experience | Formal, less personalized | Seamless, personalized via app integration |

| Credit Access | Limited to bank customers | Accessible to a wider audience through partners |

| Interest Rates | Fixed or variable, generally higher | Competitive, often lower due to streamlined process |

| Repayment Flexibility | Standard schedules, less flexible | Flexible options based on user behavior and data |

| Technology Integration | Minimal, legacy systems | High, API-driven with real-time data analytics |

Understanding Traditional Bank Loans: An Overview

Traditional bank loans for consumer credit involve a formal application process, credit checks, and fixed interest rates determined by the bank's underwriting standards. These loans typically require collateral or a strong credit history, resulting in longer approval times and more stringent repayment terms. In contrast, embedded lending integrates credit offers directly within digital platforms, providing faster, more accessible financing without extensive paperwork or traditional barriers.

What Is Embedded Lending in Consumer Credit?

Embedded lending in consumer credit integrates loan offerings directly within non-financial platforms like e-commerce or payment apps, enabling consumers to access credit seamlessly at the point of transaction. Unlike traditional bank loans that require separate applications and approvals, embedded lending uses real-time data and instant underwriting to provide instant credit decisions and disbursements. This approach enhances the consumer experience by reducing friction, increasing loan accessibility, and enabling personalized credit products tailored to user behavior.

Key Differences Between Traditional and Embedded Lending

Traditional bank loans require borrowers to undergo extensive credit checks and lengthy approval processes, often involving physical branch visits. Embedded lending integrates credit options directly within digital platforms or e-commerce sites, offering instant approval and seamless user experience without redirecting customers to external lenders. This modern approach leverages real-time data and API-based systems, enabling faster, more personalized consumer credit solutions compared to conventional banking procedures.

Application Process: Bank Loans vs Embedded Lending

Traditional bank loans typically involve a lengthy and complex application process requiring extensive documentation, credit checks, and multiple approval stages, often taking several days to weeks for disbursement. Embedded lending streamlines consumer credit by integrating loan offerings directly within digital platforms, enabling real-time credit decisions and instantaneous approval through automated underwriting models. The seamless application process in embedded lending significantly enhances user experience by eliminating the need for separate loan applications and reducing friction.

Speed and Convenience: Which Wins for Consumers?

Embedded lending outpaces traditional bank loans in speed by integrating credit options directly within digital platforms, eliminating lengthy application processes. Consumers benefit from instant approvals and seamless transactions without visiting physical branches, enhancing overall convenience. Traditional loans often involve cumbersome paperwork and longer waiting periods, making embedded lending the preferred choice for quick access to consumer credit.

Eligibility Requirements: Traditional Banks vs Embedded Platforms

Traditional banks require stringent eligibility criteria for consumer credit, including high credit scores, extensive documentation, and stable income verification, which can limit access for many borrowers. Embedded lending platforms leverage alternative data sources and streamlined verification processes, enabling faster approvals and broader eligibility for a diverse range of consumers. This flexibility in embedded lending often results in increased financial inclusion compared to traditional bank loans.

Interest Rates and Fees: How Do They Compare?

Traditional bank loans typically feature higher interest rates and more fees due to extensive underwriting processes and regulatory compliance costs. Embedded lending platforms leverage technology to reduce operational expenses, offering lower interest rates and fewer fees, enhancing affordability for consumers. This cost efficiency is a key differentiator, making embedded lending an attractive alternative for consumer credit.

User Experience and Accessibility in Lending Options

Traditional bank loans often require extensive paperwork, credit checks, and in-person visits, leading to longer approval times and limited accessibility for many consumers. Embedded lending integrates credit options directly within digital platforms, offering seamless, instant access to loans with minimal friction, enhancing user experience significantly. Consumers benefit from this streamlined process through faster decision-making and greater convenience, expanding credit accessibility beyond conventional banking constraints.

Risk and Security Considerations for Borrowers

Traditional bank loans often involve extensive credit checks and collateral requirements, providing robust security measures but increasing approval time and borrower risk due to potential credit damage. Embedded lending integrates credit offers within digital platforms, utilizing real-time data and AI-driven risk assessments to streamline approvals while maintaining secure transaction protocols to protect borrower information. Borrowers benefit from enhanced data privacy controls and dynamic risk evaluation models in embedded lending, reducing exposure to fraud and financial stress compared to conventional banking methods.

Future Trends: The Evolution of Consumer Credit Solutions

Traditional bank loans are increasingly challenged by embedded lending solutions that integrate credit offerings directly into consumer platforms such as e-commerce and digital wallets. Future trends in consumer credit emphasize seamless, real-time access to credit with personalized terms enabled by AI-driven underwriting and data analytics. This evolution promotes greater financial inclusion and convenience, reshaping how consumers access credit beyond conventional banking infrastructures.

Related Important Terms

Credit Decisioning API

Credit decisioning APIs in traditional bank loans rely on extensive manual underwriting processes and legacy credit scoring models, often resulting in slower approval times and limited flexibility. Embedded lending leverages real-time data integration through advanced credit decisioning APIs, enabling instant credit assessments and personalized lending offers within digital platforms.

Loan Origination-as-a-Service

Traditional bank loans rely on lengthy, manual loan origination processes that often delay consumer credit approval, whereas Embedded Lending leverages Loan Origination-as-a-Service (LOaaS) platforms to streamline and automate credit decisions within third-party ecosystems. LOaaS enhances customer experience by integrating real-time credit evaluations and instant disbursal, reducing operational costs and accelerating time-to-fund compared to conventional bank lending.

Digital Onboarding Journey

Traditional bank loans often involve lengthy digital onboarding processes with manual document uploads and multiple verification steps, causing delays in consumer credit access. Embedded lending streamlines the digital onboarding journey by integrating credit offers directly within consumer apps, enabling instant approval and frictionless user experience.

Contextual Credit Offers

Traditional bank loans rely on fixed application processes and credit assessments, often delaying approval times and reducing consumer engagement. Embedded lending integrates contextual credit offers directly within the consumer's digital journey, enhancing convenience by delivering personalized loan options based on real-time data and user behavior.

Frictionless Checkout Financing

Traditional bank loans often involve extensive paperwork, lengthy approval times, and stringent credit checks, creating friction during the consumer checkout process. Embedded lending streamlines financing by integrating credit offers directly within the checkout flow, enabling instant approval and seamless, frictionless consumer credit access.

Risk Layering Models

Traditional bank loans rely heavily on risk layering models that assess creditworthiness by combining multiple risk factors such as credit scores, income verification, and debt-to-income ratios, often resulting in stringent approval processes. Embedded lending integrates real-time data from digital platforms, enabling dynamic risk evaluation and personalized credit offers, which reduces default risk through continuous monitoring and adaptive underwriting.

Bank-as-a-Service (BaaS) Lending

Traditional bank loans typically involve lengthy approval processes and require direct interaction with bank branches, whereas Embedded Lending via Bank-as-a-Service (BaaS) platforms integrates consumer credit seamlessly into non-banking apps, offering instant financing options. BaaS Lending enables real-time credit assessments and streamlined loan disbursements, enhancing customer convenience and expanding access to credit beyond conventional banking channels.

Invisible Lending

Traditional bank loans require extensive paperwork, credit checks, and lengthy approval processes, often creating friction for consumers seeking quick access to credit. Invisible lending integrated within digital platforms offers seamless, real-time credit approvals embedded in everyday transactions, enhancing user experience and increasing loan accessibility.

Real-time Underwriting

Traditional bank loans rely on manual, time-intensive underwriting processes that often delay consumer credit approvals by several days, limiting real-time decision-making capabilities. Embedded lending leverages API-driven real-time underwriting technology, enabling instant credit assessments and approvals within digital platforms, thereby enhancing customer experience and operational efficiency.

Embedded Credit Scoring

Embedded credit scoring leverages real-time data from digital platforms, enabling instant and personalized loan approvals, contrasting sharply with the slower, manual underwriting processes of traditional bank loans. This integration enhances accuracy in risk assessment and expands access to consumer credit by utilizing alternative data points beyond conventional credit reports.

Traditional Bank Loan vs Embedded Lending for consumer credit. Infographic

moneydiff.com

moneydiff.com