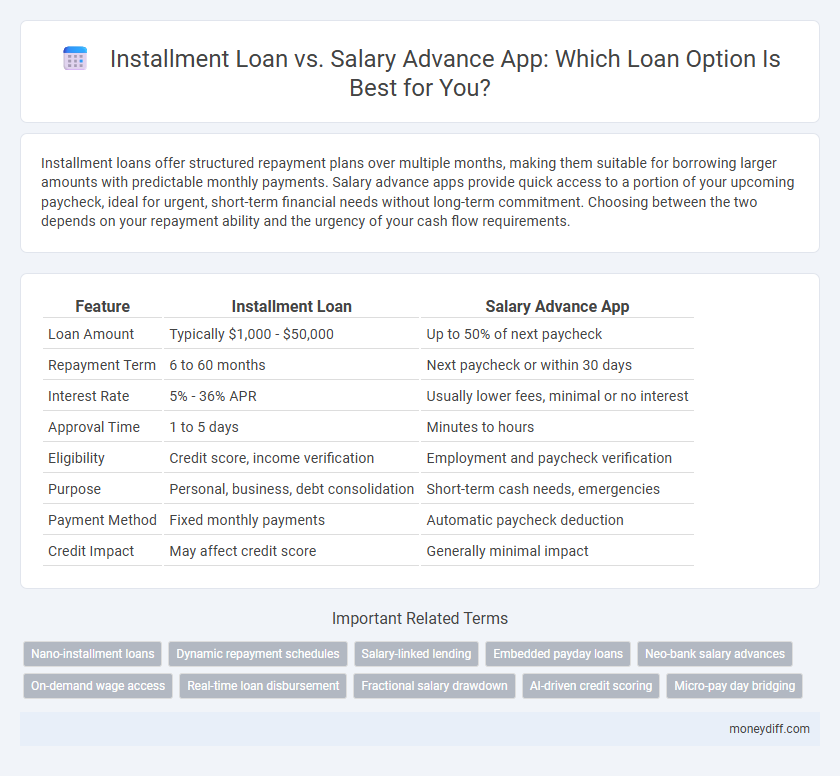

Installment loans offer structured repayment plans over multiple months, making them suitable for borrowing larger amounts with predictable monthly payments. Salary advance apps provide quick access to a portion of your upcoming paycheck, ideal for urgent, short-term financial needs without long-term commitment. Choosing between the two depends on your repayment ability and the urgency of your cash flow requirements.

Table of Comparison

| Feature | Installment Loan | Salary Advance App |

|---|---|---|

| Loan Amount | Typically $1,000 - $50,000 | Up to 50% of next paycheck |

| Repayment Term | 6 to 60 months | Next paycheck or within 30 days |

| Interest Rate | 5% - 36% APR | Usually lower fees, minimal or no interest |

| Approval Time | 1 to 5 days | Minutes to hours |

| Eligibility | Credit score, income verification | Employment and paycheck verification |

| Purpose | Personal, business, debt consolidation | Short-term cash needs, emergencies |

| Payment Method | Fixed monthly payments | Automatic paycheck deduction |

| Credit Impact | May affect credit score | Generally minimal impact |

Understanding Installment Loans: Key Features

Installment loans provide borrowers with a fixed loan amount repaid through equal monthly payments over a set term, typically ranging from 6 months to several years. Key features include predictable payment schedules, lower interest rates compared to payday loans, and loan amounts that can vary from a few hundred to tens of thousands of dollars depending on creditworthiness. Unlike salary advance apps, installment loans offer structured repayment plans designed to improve financial discipline and build credit history.

What Is a Salary Advance App Loan?

A salary advance app loan provides employees with early access to a portion of their earned wages before the official payday, offering a flexible alternative to traditional installment loans. Unlike installment loans that require fixed monthly payments over a set term, salary advances are typically repaid on the next paycheck cycle with minimal fees. This type of loan helps manage short-term cash flow needs without the long-term financial commitment associated with installment loans.

Eligibility Criteria: Installment Loans vs Salary Advance Apps

Installment loans typically require a good credit score, stable income, and employment verification to meet eligibility criteria, making them suitable for borrowers with established financial histories. Salary advance apps often have more lenient requirements, focusing mainly on proof of employment and regular paycheck deposits, which allows quick access to smaller loan amounts with minimal credit checks. Understanding these differences helps borrowers choose the appropriate option based on their credit profile and urgency of funds.

Application Process Comparison

Installment loans typically require detailed application forms, credit checks, and income verification, which can extend approval times to several days. Salary advance apps offer a faster, streamlined application process leveraging employer data and real-time payroll integration for near-instant approvals. The simplicity of salary advance apps reduces documentation requirements compared to traditional installment loan applications.

Interest Rates and Fees: Which Option is Cheaper?

Installment loans typically have fixed interest rates and structured monthly payments, making it easier to manage over time, while salary advance apps often charge higher fees and variable interest rates for short-term borrowing. Salary advance apps may include convenience fees or service charges that increase the overall cost compared to lower, amortized interest on installment loans. Choosing an installment loan usually results in lower total repayment costs due to predictable interest and minimal fees, whereas salary advance apps can be more expensive due to higher fees and accelerated repayment schedules.

Repayment Terms: Flexibility and Duration

Installment loans typically offer fixed repayment terms with set monthly payments over a longer duration, providing borrowers with predictable budgeting. Salary advance apps often allow shorter repayment periods aligned with the borrower's next paycheck, offering greater flexibility but requiring quicker repayment. Understanding the balance between flexibility and duration helps borrowers choose the loan type that best fits their financial situation.

Impact on Credit Score: Risks and Benefits

Installment loans typically have a more significant impact on credit scores because they involve longer repayment terms and regular monthly payments reported to credit bureaus, which can help build credit history if managed well. Salary advance apps, while offering quick access to funds with minimal credit checks, usually do not affect credit scores directly since they often do not report to credit bureaus, but failure to repay can lead to overdraft fees or account holds impacting financial health. Understanding these differences is crucial for managing credit risk and leveraging the benefits of each loan type for financial stability.

Accessibility and Speed of Funding

Installment loans generally require a more comprehensive application process, resulting in longer approval times compared to salary advance apps, which offer near-instant access to funds based on upcoming paychecks. Salary advance apps provide higher accessibility for users with limited credit history by leveraging employment verification rather than traditional credit checks. The speed of funding through salary advance apps often ranges from minutes to a few hours, whereas installment loans can take several days to process and disburse funds.

Pros and Cons: Installment Loans vs Salary Advance Apps

Installment loans provide fixed repayment schedules with predictable monthly payments, offering borrowers clarity and the ability to budget effectively; however, they may require thorough credit checks and longer approval times. Salary advance apps offer quick access to small amounts of cash based on earned wages, with minimal credit requirements and immediate availability, but often come with higher fees and shorter repayment periods. Comparing these options depends on the borrower's financial situation, need for speed, cost tolerance, and repayment flexibility.

Which Loan Option Is Best for Your Financial Needs?

Installment loans offer structured repayment schedules with fixed interest rates, making them suitable for larger expenses and long-term financial planning. Salary advance apps provide quick access to a portion of your upcoming paycheck, ideal for urgent cash needs with minimal fees but limited borrowing amounts. Evaluating your repayment capacity, loan amount needed, and urgency of funds will help determine the best option for your financial needs.

Related Important Terms

Nano-installment loans

Nano-installment loans offered through salary advance apps provide borrowers with flexible repayment terms by dividing loan amounts into small, manageable installments directly deducted from their salary, minimizing default risk. These apps typically feature quick approval processes, lower interest rates compared to traditional payday loans, and enhanced accessibility for users with limited credit history.

Dynamic repayment schedules

Installment loans offer dynamic repayment schedules tailored to borrower income fluctuations, enabling flexible monthly payments that reduce financial strain. Salary advance apps provide quicker access to funds with repayment often aligned to the next paycheck, but typically lack the extended, customizable repayment options found in installment loans.

Salary-linked lending

Salary-linked lending through a salary advance app offers borrowers quick access to funds by leveraging their verified income, ensuring repayment is automatically aligned with their next paycheck, reducing default risk. In contrast, installment loans typically involve fixed repayments over a longer term, requiring credit checks and often higher interest rates, making salary advance apps more flexible for short-term financial needs.

Embedded payday loans

Embedded payday loans within salary advance apps offer users instant access to small, short-term funds directly linked to their upcoming paycheck, providing convenience and faster approval compared to traditional installment loans that require longer repayment schedules and credit assessments. These embedded solutions seamlessly integrate into payroll systems, reducing friction and enhancing financial wellness by preventing overdrafts and high-interest borrowing cycles.

Neo-bank salary advances

Neo-bank salary advance apps provide instant access to a portion of earned wages without traditional credit checks, making them ideal for short-term financial needs. Installment loans typically involve fixed monthly payments over a set term with higher interest rates, whereas salary advances from neo-banks offer lower cost, flexible repayment aligned with pay cycles.

On-demand wage access

Installment loans offer structured repayment schedules with fixed monthly payments, while salary advance apps provide on-demand wage access, allowing employees to withdraw earned wages before payday. This immediate liquidity feature of salary advance apps helps manage cash flow without incurring high-interest debt associated with traditional installment loans.

Real-time loan disbursement

Installment loans typically involve structured repayment schedules with fixed amounts over time, while salary advance apps offer quick, real-time loan disbursement by leveraging employees' upcoming paychecks as collateral. Real-time loan disbursement in salary advance apps enhances liquidity by providing immediate access to funds without the waiting period associated with traditional installment loan processing.

Fractional salary drawdown

Installment loans offer structured repayment schedules with fixed amounts over a set period, while salary advance apps provide immediate access to a fraction of earned wages before payday, enabling fractional salary drawdown. Fractional salary drawdown allows users to access earned income incrementally, reducing reliance on high-interest installment loans and improving cash flow management.

AI-driven credit scoring

AI-driven credit scoring in installment loans uses predictive analytics to evaluate borrower creditworthiness more accurately, enabling personalized repayment terms and improved risk management. Salary advance apps leverage real-time income and spending data with AI algorithms to provide instant funds, offering faster access and minimizing default risks compared to traditional credit assessments.

Micro-pay day bridging

Installment loans offer structured repayments over extended periods, providing predictable cash flow management, while salary advance apps deliver micro-pay day bridging by granting immediate, smaller funds directly against upcoming paychecks. Micro-pay day bridging through salary advance apps addresses urgent financial needs without long-term debt, enhancing short-term liquidity compared to traditional installment loans.

Installment Loan vs Salary Advance App for Loan Infographic

moneydiff.com

moneydiff.com