Refinancing replaces your existing mortgage with a new loan, often changing the interest rate or loan term to improve monthly payments or reduce overall debt. Mortgage recast involves paying a lump sum toward the principal, lowering monthly payments without altering the original loan's interest rate or term. Choosing between refinancing and mortgage recast depends on your financial goals, credit score, and current interest rates to achieve optimal debt adjustment.

Table of Comparison

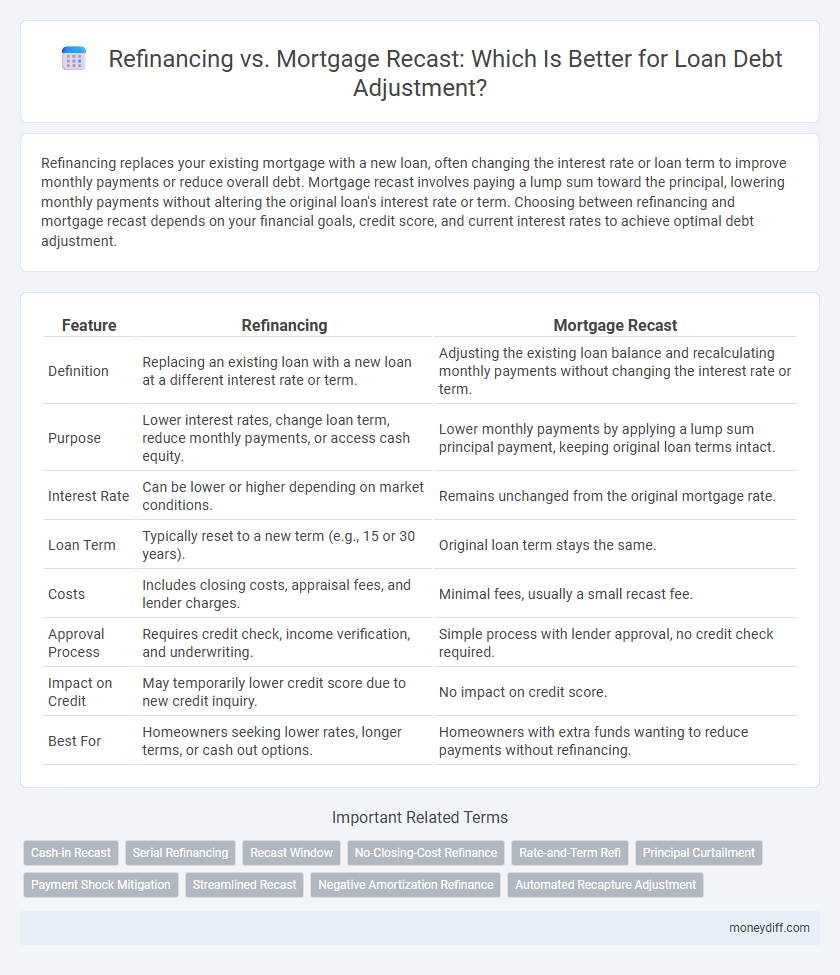

| Feature | Refinancing | Mortgage Recast |

|---|---|---|

| Definition | Replacing an existing loan with a new loan at a different interest rate or term. | Adjusting the existing loan balance and recalculating monthly payments without changing the interest rate or term. |

| Purpose | Lower interest rates, change loan term, reduce monthly payments, or access cash equity. | Lower monthly payments by applying a lump sum principal payment, keeping original loan terms intact. |

| Interest Rate | Can be lower or higher depending on market conditions. | Remains unchanged from the original mortgage rate. |

| Loan Term | Typically reset to a new term (e.g., 15 or 30 years). | Original loan term stays the same. |

| Costs | Includes closing costs, appraisal fees, and lender charges. | Minimal fees, usually a small recast fee. |

| Approval Process | Requires credit check, income verification, and underwriting. | Simple process with lender approval, no credit check required. |

| Impact on Credit | May temporarily lower credit score due to new credit inquiry. | No impact on credit score. |

| Best For | Homeowners seeking lower rates, longer terms, or cash out options. | Homeowners with extra funds wanting to reduce payments without refinancing. |

Understanding Refinancing and Mortgage Recast

Refinancing replaces an existing mortgage with a new loan, often to secure a lower interest rate or change loan terms, potentially extending the repayment period and adjusting monthly payments. Mortgage recast involves paying a lump sum to reduce the principal balance, followed by recalculating monthly payments without changing the loan's interest rate or term, resulting in lower monthly payments. Understanding these options helps borrowers optimize debt adjustment strategies by weighing cost savings, fees, and long-term financial goals.

Key Differences Between Refinancing and Recasting

Refinancing involves replacing an existing loan with a new mortgage, typically to secure a lower interest rate or change the loan term, which can reset the amortization schedule and may incur closing costs. Mortgage recasting allows borrowers to reduce monthly payments by making a lump-sum payment toward the principal without altering the interest rate or loan term, resulting in lower monthly obligations without extensive fees. The key difference lies in refinancing restructuring the entire loan, whereas recasting modifies the payment schedule based on a reduced principal balance without a new loan application.

Pros and Cons of Mortgage Refinancing

Mortgage refinancing offers lower interest rates and potentially reduced monthly payments, enhancing long-term savings for borrowers. However, refinancing often entails closing costs, application fees, and may extend the loan term, increasing overall interest paid. Unlike mortgage recasting, refinancing requires credit approval and can reset the amortization schedule, which may not suit borrowers seeking quick debt adjustment without substantial fees.

Pros and Cons of Mortgage Recasting

Mortgage recasting allows borrowers to reduce monthly payments by applying a lump sum toward the principal without refinancing, often resulting in lower fees and less paperwork. The main advantages include maintaining the existing interest rate and avoiding higher closing costs typically associated with refinancing. However, mortgage recasting offers limited flexibility as not all lenders provide this option, and it doesn't shorten the loan term or change interest rates like refinancing can.

Cost Implications: Fees, Closing Costs, and Savings

Refinancing a mortgage involves higher upfront costs, including application fees, appraisal fees, and closing costs, which can range from 2% to 5% of the loan amount, while mortgage recasts generally require only a small fee, often under $500, making them more cost-effective in the short term. Refinancing can offer long-term savings by securing a lower interest rate or a shorter loan term, but recasting allows borrowers to reduce monthly payments without changing the interest rate or loan terms, yielding modest monthly savings without extensive closing costs. Evaluating cost implications depends on the borrower's financial goals, the size of the principal payment, current interest rates, and how long they plan to remain in the home.

Impact on Interest Rates and Loan Terms

Refinancing a loan often results in a new interest rate and loan term, potentially lowering monthly payments but possibly extending the repayment period or incurring closing costs. Mortgage recasting adjusts the loan balance by making a lump-sum payment, reducing monthly payments while keeping the original interest rate and loan term intact. Borrowers seeking lower interest rates and altered loan durations typically benefit more from refinancing, whereas recasting suits those aiming to reduce payments without changing loan conditions.

Eligibility Requirements for Refinancing vs Recasting

Refinancing eligibility requires a strong credit score, sufficient home equity, and proof of stable income to qualify for new loan terms with potentially lower interest rates or altered loan duration. Mortgage recast, on the other hand, demands an existing loan in good standing with a significant principal payment made, typically $5,000 or more, allowing borrowers to reduce monthly payments without changing the original interest rate or loan term. Understanding these requirements helps homeowners decide between refinancing for long-term savings and recasting for immediate payment reduction.

When to Choose Refinancing Over Recasting

Refinancing is preferable when seeking to lower your interest rate significantly, extend the loan term for reduced monthly payments, or tap into home equity for additional funds. It suits homeowners who want to change loan types, such as switching from an adjustable-rate mortgage to a fixed-rate mortgage, or who have improved credit scores to qualify for better terms. Recasting works best for borrowers with large lump-sum payments aiming to reduce monthly payments without altering the original loan terms or incurring closing costs.

Tax Implications and Financial Considerations

Refinancing a mortgage involves obtaining a new loan with different terms, which can lead to potential tax deductions on mortgage interest but may also incur closing costs and extend the loan duration, impacting overall financial planning. Mortgage recast adjusts the existing loan balance and monthly payments without changing the interest rate or loan term, preserving the original tax benefits while minimizing fees and avoiding a new credit check. Evaluating the tax implications and long-term financial effects of both options is essential for effective debt adjustment and optimizing mortgage-related expenses.

Making the Best Debt Adjustment Decision

Refinancing replaces an existing mortgage with a new loan, often offering lower interest rates and extended terms to reduce monthly payments, while a mortgage recast adjusts the original loan by applying a lump sum payment to the principal, lowering monthly payments without changing the interest rate or loan term. Choosing between refinancing and mortgage recasting depends on factors like current interest rates, loan terms, closing costs, and the borrower's financial goals. Making the best debt adjustment decision requires analyzing long-term savings, cash flow flexibility, and overall financial impact to ensure sustainable homeownership.

Related Important Terms

Cash-in Recast

Cash-in recasting reduces monthly mortgage payments by applying a lump sum directly to the loan principal without changing the interest rate or loan term, offering significant savings on interest over time. Refinancing replaces the existing loan with a new mortgage, often with different terms and interest rates, which can reduce payments but typically involves higher upfront costs and credit checks.

Serial Refinancing

Serial refinancing involves repeatedly replacing an existing loan with a new one to obtain better interest rates or terms, often increasing overall debt if not carefully managed. Mortgage recasting adjusts the principal balance by applying a lump-sum payment, lowering monthly payments without changing interest rates, making it a more cost-effective debt adjustment compared to serial refinancing.

Recast Window

The typical recast window for a mortgage allows borrowers to request a principal and payment adjustment after making a significant lump-sum payment, usually without the need for a full refinance or credit approval. Refinancing resets loan terms by replacing the original loan with a new one, often involving closing costs and credit checks, making recasting a cost-effective option for reducing monthly payments without extending the loan term.

No-Closing-Cost Refinance

No-closing-cost refinance enables borrowers to adjust debt by refinancing their mortgage without upfront fees, often resulting in lower monthly payments or a shorter loan term compared to a mortgage recast, which only changes the payment schedule without modifying interest rates or loan terms. This option benefits homeowners seeking to optimize cash flow or interest savings while avoiding initial out-of-pocket expenses.

Rate-and-Term Refi

Rate-and-term refinancing adjusts the interest rate or loan term to optimize monthly payments without increasing the principal balance, offering better debt management compared to mortgage recasting, which modifies payment amounts by recalculating amortization based on the existing principal after a lump-sum payment. Refinancing typically provides lower interest rates or shorter loan durations, resulting in significant long-term savings and improved cash flow.

Principal Curtailment

Refinancing replaces an existing mortgage with a new loan often to secure a lower interest rate or different terms, while a mortgage recast involves paying down a significant portion of the principal upfront to reduce monthly payments without changing the interest rate or loan term. Principal curtailment during a mortgage recast directly reduces the outstanding loan balance, leading to immediate payment reduction and potential interest savings without the closing costs associated with refinancing.

Payment Shock Mitigation

Refinancing restructures a loan by replacing the existing mortgage with a new one, often lowering interest rates and monthly payments to mitigate payment shock. Mortgage recasting adjusts the current loan balance and monthly payments by applying a lump-sum principal payment without changing the interest rate or loan terms, offering immediate payment relief with lower fees.

Streamlined Recast

Streamlined mortgage recast allows borrowers to reduce monthly payments by making a lump sum principal payment without refinancing, saving on closing costs and interest rates compared to traditional loan refinancing. This efficient debt adjustment option is ideal for homeowners seeking lower payments without altering loan terms or extending the mortgage duration.

Negative Amortization Refinance

A negative amortization refinance increases the loan balance by adding unpaid interest to the principal, often resulting in higher long-term debt despite lower initial payments. In contrast, a mortgage recast adjusts the payment schedule by recalculating monthly payments on the existing principal without increasing the loan amount, avoiding the risk of escalating debt through added interest.

Automated Recapture Adjustment

Automated recapture adjustment optimizes loan terms by recalculating the mortgage balance based on recent payments, offering a cost-effective alternative to refinancing with lower fees and reduced interest rates. Unlike refinancing, this approach avoids lengthy underwriting processes and credit checks, enabling quicker debt adjustment and improved cash flow management.

Refinancing vs Mortgage recast for debt adjustment. Infographic

moneydiff.com

moneydiff.com