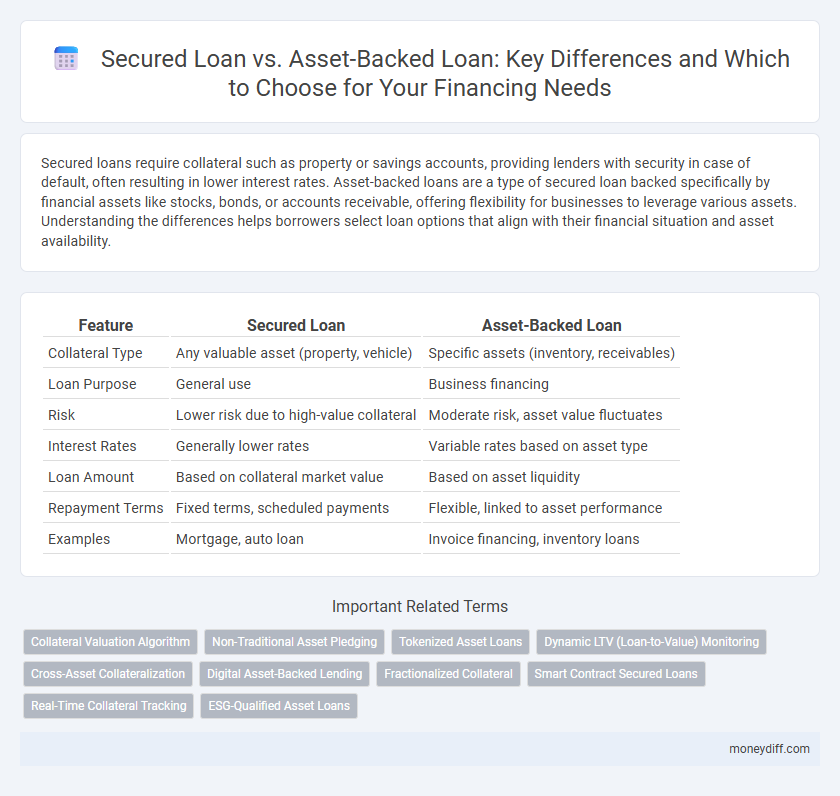

Secured loans require collateral such as property or savings accounts, providing lenders with security in case of default, often resulting in lower interest rates. Asset-backed loans are a type of secured loan backed specifically by financial assets like stocks, bonds, or accounts receivable, offering flexibility for businesses to leverage various assets. Understanding the differences helps borrowers select loan options that align with their financial situation and asset availability.

Table of Comparison

| Feature | Secured Loan | Asset-Backed Loan |

|---|---|---|

| Collateral Type | Any valuable asset (property, vehicle) | Specific assets (inventory, receivables) |

| Loan Purpose | General use | Business financing |

| Risk | Lower risk due to high-value collateral | Moderate risk, asset value fluctuates |

| Interest Rates | Generally lower rates | Variable rates based on asset type |

| Loan Amount | Based on collateral market value | Based on asset liquidity |

| Repayment Terms | Fixed terms, scheduled payments | Flexible, linked to asset performance |

| Examples | Mortgage, auto loan | Invoice financing, inventory loans |

Understanding Secured Loans: Definition and Key Features

Secured loans require collateral, such as property or valuable assets, to guarantee repayment, reducing lender risk and often resulting in lower interest rates. Key features include fixed or variable interest rates, defined repayment terms, and the potential for asset repossession upon default. Understanding these aspects helps borrowers evaluate the trade-offs between secured loans and asset-backed loans, which use specific assets as security but may vary in scope and risk.

What Are Asset-Backed Loans? Overview and Essentials

Asset-backed loans are a type of secured loan where the borrower pledges specific assets, such as inventory, accounts receivable, or equipment, as collateral to obtain financing. These loans are essential for businesses needing capital tied directly to tangible or financial assets, reducing lender risk through asset liquidation in case of default. Unlike general secured loans that may use broader collateral, asset-backed loans specifically link repayment to the value and liquidation potential of distinct asset pools.

Secured Loan vs Asset-Backed Loan: Core Differences

Secured loans require collateral directly tied to the loan agreement, such as a home or vehicle, ensuring lower interest rates due to reduced lender risk. Asset-backed loans use specific assets like accounts receivable or inventory as collateral, often utilized by businesses to leverage operational assets for funding. The core difference lies in the collateral type and loan purpose, with secured loans often aimed at personal financing and asset-backed loans focused on corporate financial strategies.

Types of Assets Used as Collateral in Loans

Secured loans typically use tangible assets like real estate, vehicles, or equipment as collateral, providing lenders with a clear claim on physical property in case of default. Asset-backed loans extend collateral options to include financial assets such as accounts receivable, inventory, or securities, allowing businesses to leverage liquid or semi-liquid assets to secure funding. The choice of collateral affects loan terms, interest rates, and approval processes based on the asset's liquidity and market value.

Eligibility Criteria: Secured Loans vs Asset-Backed Loans

Secured loans require borrowers to pledge specific collateral, such as real estate or vehicles, to qualify, ensuring lender security. Asset-backed loans accept a broader range of financial assets like accounts receivable or inventory as collateral, catering to businesses with tangible operational assets. Eligibility for secured loans often hinges on collateral value and borrower creditworthiness, while asset-backed loan approval depends on the quality and liquidity of the pledged financial assets.

Interest Rates and Fees: What to Expect

Secured loans typically offer lower interest rates compared to unsecured loans due to the collateral reducing lender risk. Asset-backed loans, a subset of secured loans, may have varying fees depending on the asset's type and liquidity, often including appraisal and maintenance costs. Borrowers should expect that both loan types require thorough evaluation of fees and interest structures to optimize financial benefits.

Application Process: Step-by-Step Guide

Secured loans require borrowers to pledge specific assets such as property or vehicles, with the application process involving asset valuation, credit assessment, and collateral documentation submission. Asset-backed loans involve securing the loan with financial assets like stocks or receivables, emphasizing verification of asset liquidity and ownership during application. Both processes demand thorough documentation, but asset-backed loan applications often require additional scrutiny of asset marketability and potential fluctuations in value.

Risks and Benefits of Secured and Asset-Backed Loans

Secured loans offer lower interest rates and higher borrowing limits due to collateral such as real estate or vehicles, reducing lender risk but exposing borrowers to asset forfeiture upon default. Asset-backed loans use financial assets like stocks or receivables as collateral, providing flexibility and quicker access to funds while carrying market value volatility risks that can affect loan stability. Both loan types improve credit access but require careful assessment of collateral value fluctuations and potential asset loss consequences.

When to Choose a Secured Loan Over an Asset-Backed Loan

Choose a secured loan over an asset-backed loan when you have valuable collateral, such as real estate or a vehicle, that you can pledge to secure the loan and potentially benefit from lower interest rates. Secured loans often offer larger borrowing limits and longer repayment terms, making them suitable for major expenses like home improvements or debt consolidation. This option is preferable if you want to leverage high-value assets and secure financing with favorable terms while minimizing lender risk.

Frequently Asked Questions: Secured vs Asset-Backed Loans

Secured loans require collateral, such as a home or vehicle, directly tied to the loan agreement, reducing lender risk and often resulting in lower interest rates. Asset-backed loans use financial assets like stocks, bonds, or receivables as collateral, offering flexibility to borrowers who may not have physical assets to pledge. Both loan types impact credit scores and approval times differently, making it crucial to understand the collateral type and loan terms before choosing between them.

Related Important Terms

Collateral Valuation Algorithm

Collateral valuation algorithms for secured loans primarily assess the borrower's pledged asset value, ensuring loan-to-value ratios remain within acceptable risk parameters. In asset-backed loans, these algorithms incorporate cash flow analysis from income-generating assets, enhancing precision in collateral value estimation and credit risk management.

Non-Traditional Asset Pledging

Secured loans typically require traditional collateral such as real estate or vehicles, while asset-backed loans allow borrowers to pledge non-traditional assets like inventory, accounts receivable, or equipment to secure funding. This flexibility in asset-backed loans provides businesses with alternative financing options, unlocking capital without liquidating core assets.

Tokenized Asset Loans

Tokenized asset loans leverage blockchain technology to convert physical and digital assets into tradable tokens, providing a flexible and transparent form of secured financing compared to traditional asset-backed loans that rely on tangible collateral like real estate or equipment. This innovative approach enhances liquidity and accessibility, enabling borrowers to unlock value from unique or illiquid assets while offering lenders increased security and simplified asset verification through smart contracts.

Dynamic LTV (Loan-to-Value) Monitoring

Dynamic LTV monitoring in secured loans involves continuous assessment of the collateral's value to maintain accurate loan-to-value ratios, ensuring risk mitigation and compliance throughout the loan term. Asset-backed loans utilize real-time LTV adjustments based on fluctuating asset valuations to optimize borrowing limits and protect lender interests against market volatility.

Cross-Asset Collateralization

Secured loans use specific collateral such as real estate or vehicles to guarantee repayment, while asset-backed loans leverage a pool of diverse assets including receivables or inventory to support the loan. Cross-asset collateralization enhances lending flexibility by allowing multiple asset types from different categories to be combined, reducing risk and potentially lowering interest rates.

Digital Asset-Backed Lending

Digital asset-backed loans leverage cryptocurrencies or tokenized assets as collateral, offering enhanced liquidity and faster approval compared to traditional secured loans that rely on physical assets like real estate or vehicles. This emerging lending model provides increased transparency and lower defaults by utilizing blockchain technology for asset verification and real-time valuation.

Fractionalized Collateral

Secured loans require borrowers to pledge specific collateral, such as property or vehicles, while asset-backed loans use financial assets like receivables or inventory as security. Fractionalized collateral enables dividing ownership of assets into tradable shares, increasing liquidity and flexibility in both secured and asset-backed lending structures.

Smart Contract Secured Loans

Smart contract secured loans leverage blockchain technology to automate key loan functions, offering enhanced security and transparency compared to traditional secured loans that rely on physical collateral verification. These loans reduce counterparty risk by locking assets digitally through smart contracts, whereas asset-backed loans depend on tangible or financial assets as collateral without integrated automation.

Real-Time Collateral Tracking

Secured loans require collateral such as real estate or vehicles, enabling real-time collateral tracking through advanced valuation systems that update asset worth dynamically. Asset-backed loans use financial assets like receivables or inventory as collateral, leveraging real-time tracking tools to monitor asset liquidity and risk for improved loan management.

ESG-Qualified Asset Loans

ESG-qualified asset loans are a subset of secured loans where the collateral consists of environmentally and socially responsible assets, enhancing sustainable finance initiatives and reducing lending risks through alignment with ESG criteria. Unlike general asset-backed loans, these loans prioritize assets that meet environmental, social, and governance standards, promoting responsible investment while securing borrower creditworthiness.

Secured Loan vs Asset-Backed Loan for loan. Infographic

moneydiff.com

moneydiff.com