Bridge loans provide short-term funding by leveraging future revenue or assets, offering immediate cash flow solutions but often require repayment with interest within a fixed period. Revenue-based financing allows businesses to raise capital by pledging a percentage of future revenue, aligning repayment with actual income fluctuations and reducing fixed repayment pressure. Choosing between the two depends on the company's cash flow stability, repayment flexibility needs, and cost considerations.

Table of Comparison

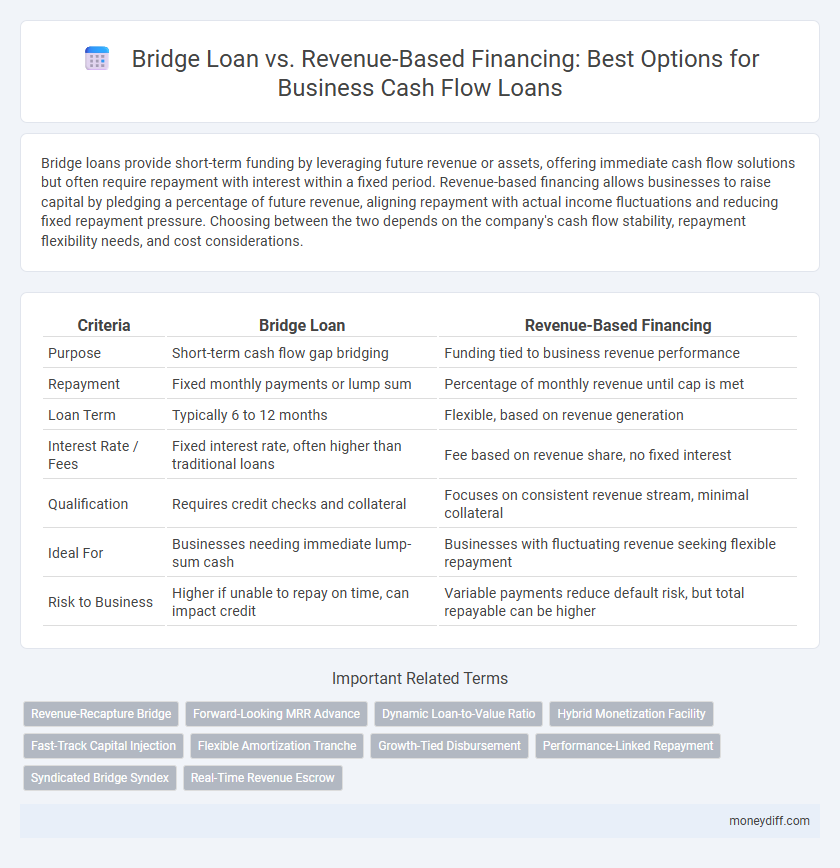

| Criteria | Bridge Loan | Revenue-Based Financing |

|---|---|---|

| Purpose | Short-term cash flow gap bridging | Funding tied to business revenue performance |

| Repayment | Fixed monthly payments or lump sum | Percentage of monthly revenue until cap is met |

| Loan Term | Typically 6 to 12 months | Flexible, based on revenue generation |

| Interest Rate / Fees | Fixed interest rate, often higher than traditional loans | Fee based on revenue share, no fixed interest |

| Qualification | Requires credit checks and collateral | Focuses on consistent revenue stream, minimal collateral |

| Ideal For | Businesses needing immediate lump-sum cash | Businesses with fluctuating revenue seeking flexible repayment |

| Risk to Business | Higher if unable to repay on time, can impact credit | Variable payments reduce default risk, but total repayable can be higher |

Introduction to Bridge Loans and Revenue-Based Financing

Bridge loans provide short-term cash flow solutions by offering quick funding secured against business assets, typically used to bridge gaps during financial transitions. Revenue-based financing offers flexible repayment tied directly to a percentage of the business's monthly revenue, aligning repayment schedules with cash flow fluctuations. Both options serve different business needs: bridge loans for immediate liquidity and revenue-based financing for growth without fixed loan payments.

Key Differences Between Bridge Loans and Revenue-Based Financing

Bridge loans provide short-term capital secured against collateral to rapidly cover immediate cash flow gaps, typically repaid through refinancing or sale. Revenue-based financing offers flexible funding where repayments are a fixed percentage of monthly revenue, aligning with business performance without requiring assets as collateral. Key differences include repayment structure, risk allocation, and eligibility criteria, with bridge loans favoring asset-rich businesses and revenue-based financing suited for steady revenue streams without heavy collateral demands.

How Bridge Loans Work for Business Cash Flow

Bridge loans provide short-term capital to businesses facing immediate cash flow gaps, often used to cover expenses while waiting for long-term financing or incoming revenue. These loans typically have higher interest rates and shorter repayment periods, making them ideal for urgent funding needs but requiring careful cash flow management to avoid strain. By securing bridge loans, businesses can maintain operations and seize growth opportunities without waiting for delayed revenue streams.

Understanding Revenue-Based Financing for Business Growth

Revenue-based financing (RBF) provides businesses with capital in exchange for a percentage of future revenue, offering flexible repayment that adjusts with cash flow fluctuations. Unlike bridge loans, which require fixed repayments and may strain short-term liquidity, RBF aligns payment schedules with actual business performance. This financing model supports sustainable business growth by reducing repayment pressure during slower periods and scaling with revenue increases.

Interest Rates and Repayment Terms: Bridge Loan vs Revenue-Based Financing

Bridge loans typically feature higher interest rates, often ranging from 8% to 12%, with fixed repayment terms usually spanning 6 to 12 months. Revenue-based financing adjusts repayments according to a fixed percentage of monthly revenue, offering flexibility but often resulting in variable effective interest costs based on business performance. Businesses prioritizing predictable payments might prefer bridge loans, while those valuing payment adaptability aligned with cash flow fluctuations may benefit more from revenue-based financing.

Eligibility Requirements for Each Financing Option

Bridge loans typically require strong credit history, collateral, and a clear exit strategy for repayment, making them suitable for businesses with immediate funding needs and tangible assets. Revenue-based financing eligibility depends on consistent revenue streams and a proven growth trajectory, prioritizing businesses with fluctuating cash flow but strong sales potential. Both options demand financial transparency, but bridge loans lean on asset-backed security while revenue-based financing emphasizes predictable income patterns.

Pros and Cons of Bridge Loans for Businesses

Bridge loans offer businesses quick access to capital, providing essential short-term cash flow to cover urgent expenses or bridge funding gaps between larger financing rounds. Their high-interest rates and short repayment periods can strain business finances, making them less ideal for companies without a clear, imminent revenue inflow. Despite these drawbacks, bridge loans remain effective for businesses needing immediate liquidity to capitalize on time-sensitive opportunities or maintain operations during transitional phases.

Pros and Cons of Revenue-Based Financing

Revenue-based financing offers flexible repayment terms tied to a company's monthly revenue, reducing pressure during low-sales periods but potentially resulting in higher overall costs if revenues grow rapidly. Unlike bridge loans, it avoids fixed payment schedules and equity dilution but may limit cash flow predictability due to variable payments. Businesses with fluctuating income benefit from its adaptable structure, while those needing quick, lump-sum capital might find traditional bridge loans more suitable.

When to Choose a Bridge Loan Over Revenue-Based Financing

Choose a bridge loan over revenue-based financing when immediate, short-term capital is essential to cover urgent expenses or seize time-sensitive opportunities, as bridge loans provide quick access to funds without tying repayments to business revenue fluctuations. Bridge loans are ideal for businesses expecting imminent funding or revenue inflows to repay the loan quickly, minimizing interest costs. Revenue-based financing suits stable, growing companies with predictable cash flow but may strain businesses needing rapid financial support during transitional periods.

Which Financing Option is Best for Your Business Cash Flow Needs?

Bridge loans provide quick access to capital by offering short-term, secured funding ideal for businesses facing urgent cash flow gaps, while revenue-based financing offers flexible repayments tied directly to your company's income, minimizing the risk during slower revenue periods. Bridge loans typically suit businesses needing immediate cash infusions with an exit strategy, such as awaiting long-term funding, whereas revenue-based financing works best for companies with fluctuating revenue that prefer payment terms aligned with actual earnings without fixed installments. Selecting the best option depends on your business's cash flow stability, repayment capacity, and urgency of capital requirements.

Related Important Terms

Revenue-Recapture Bridge

Revenue-Recapture Bridge loans provide businesses with quick access to cash flow by allowing repayment through a percentage of future revenue, aligning payment obligations with actual earnings fluctuations. Compared to traditional revenue-based financing, this hybrid model offers more flexible repayment terms and faster capital infusion, making it ideal for companies experiencing variable income streams or seasonal sales cycles.

Forward-Looking MRR Advance

Forward-Looking MRR Advance in bridge loans provides immediate capital by leveraging projected monthly recurring revenue, enabling businesses to cover short-term cash flow gaps without diluting equity. Revenue-based financing, in contrast, ties repayments directly to actual revenue, offering flexible repayments but potentially limiting growth if cash inflows are inconsistent.

Dynamic Loan-to-Value Ratio

Dynamic loan-to-value (LTV) ratio in bridge loans allows flexible collateral valuation based on fluctuating asset prices, providing short-term liquidity for businesses needing immediate cash flow support. Revenue-based financing adjusts repayments according to a percentage of monthly revenue, minimizing risk without requiring fixed collateral or high LTV constraints.

Hybrid Monetization Facility

Bridge loans offer short-term funding to cover immediate cash flow gaps, while revenue-based financing provides flexible repayment tied to business income, minimizing fixed obligations. Hybrid Monetization Facilities combine these approaches, leveraging bridge loans for quick capital and revenue-based components for scalable repayment aligned with cash flow fluctuations.

Fast-Track Capital Injection

Bridge loans provide a fast-track capital injection by offering short-term funds secured against future assets, enabling businesses to quickly cover immediate cash flow gaps during transitional periods. Revenue-based financing delivers flexible repayments linked to actual revenue performance, allowing companies to inject working capital without fixed monthly obligations.

Flexible Amortization Tranche

Bridge loans offer flexible amortization tranches that allow businesses to tailor repayment schedules based on short-term funding needs, unlike revenue-based financing which ties repayments directly to a percentage of monthly revenue. This flexibility in bridge loans helps maintain cash flow stability during transitional periods without the constraints of fluctuating income impacting repayment amounts.

Growth-Tied Disbursement

Bridge loans provide immediate capital secured by short-term assets, allowing businesses to address urgent cash flow gaps, while revenue-based financing offers flexible repayment tied directly to a percentage of future revenue, aligning disbursement with actual business growth. This growth-tied disbursement model in revenue-based financing reduces repayment pressure during low revenue periods, contrasting with the fixed repayment schedule of bridge loans.

Performance-Linked Repayment

Bridge loans require fixed, short-term repayment schedules regardless of business performance, potentially straining cash flow during slow periods. Revenue-based financing offers performance-linked repayment, where businesses repay a percentage of their revenue, aligning cash outflows with actual earnings and enhancing financial flexibility.

Syndicated Bridge Syndex

Syndicated Bridge Syndex offers businesses immediate cash flow relief through a syndicated bridge loan, providing quick, short-term capital secured by collective lender participation, ideal for bridging financing gaps before long-term funding. Unlike revenue-based financing, which ties repayments to a percentage of future revenues, Syndicated Bridge Syndex ensures fixed repayment terms with predictable cash flow management, supporting businesses requiring urgent liquidity without diluting ownership.

Real-Time Revenue Escrow

Bridge loans provide short-term capital to cover immediate cash flow gaps, while revenue-based financing offers flexible repayments tied to real-time revenue escrow, ensuring payments adjust dynamically with business performance. Real-time revenue escrow enhances transparency and trust by locking repayment amounts directly from daily sales, reducing risk for both lenders and businesses.

Bridge Loan vs Revenue-Based Financing for business cash flow. Infographic

moneydiff.com

moneydiff.com