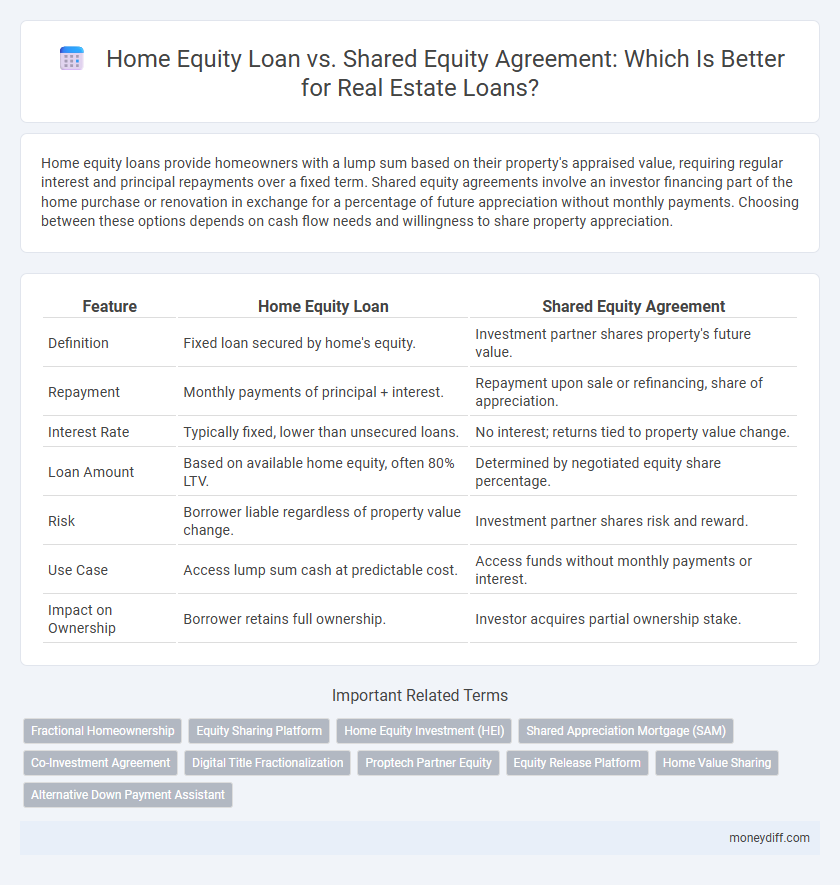

Home equity loans provide homeowners with a lump sum based on their property's appraised value, requiring regular interest and principal repayments over a fixed term. Shared equity agreements involve an investor financing part of the home purchase or renovation in exchange for a percentage of future appreciation without monthly payments. Choosing between these options depends on cash flow needs and willingness to share property appreciation.

Table of Comparison

| Feature | Home Equity Loan | Shared Equity Agreement |

|---|---|---|

| Definition | Fixed loan secured by home's equity. | Investment partner shares property's future value. |

| Repayment | Monthly payments of principal + interest. | Repayment upon sale or refinancing, share of appreciation. |

| Interest Rate | Typically fixed, lower than unsecured loans. | No interest; returns tied to property value change. |

| Loan Amount | Based on available home equity, often 80% LTV. | Determined by negotiated equity share percentage. |

| Risk | Borrower liable regardless of property value change. | Investment partner shares risk and reward. |

| Use Case | Access lump sum cash at predictable cost. | Access funds without monthly payments or interest. |

| Impact on Ownership | Borrower retains full ownership. | Investor acquires partial ownership stake. |

Understanding Home Equity Loans: Key Features and Benefits

Home equity loans provide homeowners with a fixed amount of money borrowed against the value of their home, typically offering lower interest rates compared to unsecured loans. These loans have predictable monthly payments and a defined repayment term, making them suitable for financing large expenses or consolidating debt. Borrowers retain full ownership of their property, unlike shared equity agreements where investors hold a percentage stake in the home's future value.

What is a Shared Equity Agreement? Definition and Overview

A Shared Equity Agreement is a financial arrangement where an investor provides capital for a home purchase in exchange for a percentage of the property's future appreciation. Unlike a traditional Home Equity Loan, it does not require monthly repayments or interest but involves sharing profits when the property is sold or refinanced. This agreement allows homeowners to access equity without increasing debt, making it an alternative to conventional loans in real estate financing.

Eligibility Requirements: Home Equity Loan vs Shared Equity Agreement

Home equity loans typically require a strong credit score, sufficient home equity of at least 15-20%, and a stable income to qualify, ensuring borrowers can repay the loan. Shared equity agreements often have more flexible eligibility criteria, focusing on property value and the borrower's financial situation rather than credit score. Lenders for home equity loans prioritize creditworthiness, while shared equity providers assess long-term property value appreciation and ownership stakeholder alignment.

Costs and Fees: Comparing Financial Implications

Home equity loans typically involve fixed interest rates and regular monthly payments, often including origination fees and closing costs that can significantly impact the total expense. Shared equity agreements usually require lower upfront costs but involve sharing a percentage of the property's appreciation or sale price, which can result in higher long-term financial obligations. Evaluating the total cost of ownership, including interest, fees, and potential equity sharing, is crucial for choosing between these financing options.

Repayment Structures and Flexibility

Home equity loans require fixed monthly payments with predetermined interest rates, offering predictable repayment schedules but limited flexibility. Shared equity agreements involve repaying a percentage of the property's future value upon sale or refinancing, allowing for more adaptable terms tied to market conditions. This structure reduces immediate financial burden but can result in variable overall repayment amounts depending on property appreciation.

Effect on Homeownership and Equity Rights

Home equity loans provide borrowers with a lump sum secured against their property, allowing full retention of homeownership and equity growth, while monthly repayments reduce overall equity over time. Shared equity agreements involve investors providing funds in exchange for a percentage of future home appreciation, resulting in partial ownership and shared equity rights, which can diminish individual control but reduce debt obligations. Understanding these differences is crucial for homeowners evaluating the impact on long-term property value and equity control.

Risks and Potential Drawbacks

Home equity loans carry the risk of foreclosure if repayments are missed, as the property serves as collateral, potentially leading to loss of homeownership. Shared equity agreements may limit future financial flexibility because the investor shares in property appreciation or depreciation, which can reduce the homeowner's profit upon sale. Both options pose risks related to market fluctuations, but shared equity exposes homeowners to unpredictable costs tied to real estate value changes.

Impact on Long-Term Wealth and Home Appreciation

Home equity loans provide a fixed borrowing amount secured against property value, enabling homeowners to access funds while retaining full appreciation benefits, thus supporting long-term wealth growth through property value increases. Shared equity agreements involve a third party investing in the home in exchange for a percentage of future appreciation, reducing immediate financial burdens but sharing long-term gains, which can limit the owner's wealth accumulation from rising property values. Choosing between these options depends on balancing upfront access to capital against the potential dilution of future home appreciation returns.

Suitability: Which Option Fits Your Financial Situation?

Home equity loans suit homeowners with steady income and the ability to repay fixed monthly payments, offering predictable costs and full ownership retention. Shared equity agreements fit those seeking to access home value without increasing debt, sharing future appreciation with investors but reducing control over the property. Evaluating cash flow, risk tolerance, and long-term financial goals helps determine whether a loan's structured repayment or an equity share's flexibility better aligns with your situation.

Making the Right Choice: Home Equity Loan or Shared Equity Agreement?

Choosing between a home equity loan and a shared equity agreement depends on financial goals and repayment preferences. Home equity loans offer fixed interest rates and predictable monthly payments, leveraging existing property value without sharing future appreciation. Shared equity agreements, often used for real estate investments, allow homeowners to access funds without monthly repayments but require sharing a percentage of the property's future value gain with the investor.

Related Important Terms

Fractional Homeownership

Home equity loans provide borrowers with a lump sum based on their home's value, requiring fixed repayments and accruing interest, while shared equity agreements involve investors purchasing a fractional ownership in the property, sharing future appreciation without monthly payments. Fractional homeownership through shared equity agreements enables homeowners to access capital without traditional debt, aligning investor and owner interests in property value growth.

Equity Sharing Platform

Home Equity Loans provide homeowners with a lump sum based on their property's current equity, requiring fixed repayments and interest, while Shared Equity Agreements through an Equity Sharing Platform allow owners to access funds by sharing future property appreciation without monthly payments. Equity Sharing Platforms streamline this innovative financing, enabling investors and homeowners to collaborate on real estate equity, reducing upfront costs and aligning returns with market value changes.

Home Equity Investment (HEI)

Home Equity Investment (HEI) offers homeowners a unique alternative to traditional Home Equity Loans by providing funds in exchange for a share of future home appreciation without monthly repayments. Unlike Shared Equity Agreements, HEI allows for more flexible repayment terms tied directly to the property's value at the time of sale or refinance, minimizing immediate financial strain while leveraging home equity.

Shared Appreciation Mortgage (SAM)

A Shared Appreciation Mortgage (SAM) allows homeowners to borrow against their property by sharing future home appreciation with investors, avoiding traditional interest payments typical of home equity loans. This structure reduces monthly financial strain while offering lenders a stake in the property's increased value, contrasting the fixed repayment schedule and interest rates of standard home equity loans.

Co-Investment Agreement

A Home Equity Loan provides a fixed amount borrowed against the homeowner's equity, requiring regular repayments with interest, while a Co-Investment Agreement in a Shared Equity Agreement allows an investor to co-own a portion of the property, sharing both the risks and profits without traditional loan repayments. This arrangement aligns investor and homeowner interests, often facilitating access to real estate financing without increasing monthly debt obligations.

Digital Title Fractionalization

Home equity loans provide homeowners with fixed or variable-rate borrowing against their property's value, ensuring predictable repayment terms, while shared equity agreements offer an alternative by allowing investors to acquire fractional ownership through digital title fractionalization, enabling flexible capital access without monthly payments. Digital title fractionalization enhances transparency and liquidity in shared equity agreements, facilitating secure, blockchain-based transfer of property stakes and broadening investment opportunities in real estate markets.

Proptech Partner Equity

Home Equity Loan offers homeowners immediate cash based on their property's appraised value, requiring fixed monthly payments and full repayment over time, while Shared Equity Agreements, such as those enabled by Proptech Partner Equity, provide alternative financing by sharing future home appreciation with investors without monthly payments. Proptech Partner Equity leverages technology to streamline Shared Equity Agreements, aligning interests between homeowners and investors for flexible real estate financing solutions.

Equity Release Platform

Home equity loans provide a lump sum with fixed interest rates secured against the borrower's property, allowing homeowners immediate access to funds while retaining full ownership, whereas shared equity agreements on equity release platforms offer investors a stake in the property's future value in exchange for upfront cash without monthly repayments. Equity release platforms facilitate transparent comparisons between these options, highlighting differences in repayment structures, risk distribution, and long-term financial impact on real estate assets.

Home Value Sharing

Home Equity Loans provide borrowers with a lump sum based on the current appraised value of their property minus any outstanding mortgage balance, allowing them to utilize home equity without relinquishing ownership. Shared Equity Agreements involve exchanging a percentage of future home appreciation with an investor, enabling access to funds without monthly payments but requiring the homeowner to share the increase in home value upon sale or refinancing.

Alternative Down Payment Assistant

Home equity loans provide a fixed sum based on the homeowner's accumulated equity, allowing immediate access to cash for property investment or renovations, whereas shared equity agreements involve a third party investing in the home in exchange for a percentage of future appreciation, reducing the need for traditional down payments. Shared equity agreements serve as an alternative down payment assistant by minimizing upfront costs and sharing financial risks without increasing monthly debt obligations.

Home Equity Loan vs Shared Equity Agreement for real estate. Infographic

moneydiff.com

moneydiff.com