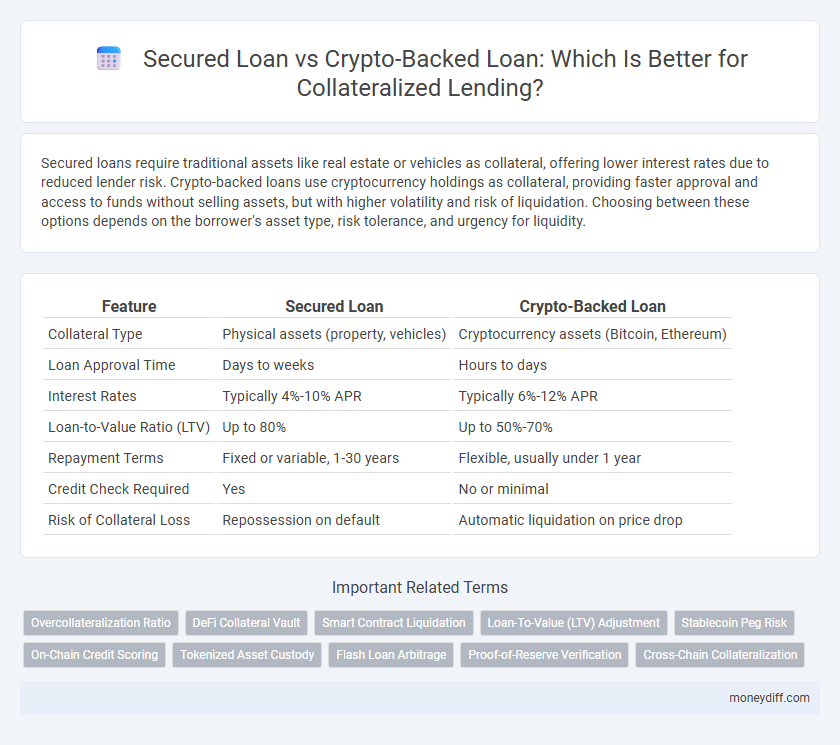

Secured loans require traditional assets like real estate or vehicles as collateral, offering lower interest rates due to reduced lender risk. Crypto-backed loans use cryptocurrency holdings as collateral, providing faster approval and access to funds without selling assets, but with higher volatility and risk of liquidation. Choosing between these options depends on the borrower's asset type, risk tolerance, and urgency for liquidity.

Table of Comparison

| Feature | Secured Loan | Crypto-Backed Loan |

|---|---|---|

| Collateral Type | Physical assets (property, vehicles) | Cryptocurrency assets (Bitcoin, Ethereum) |

| Loan Approval Time | Days to weeks | Hours to days |

| Interest Rates | Typically 4%-10% APR | Typically 6%-12% APR |

| Loan-to-Value Ratio (LTV) | Up to 80% | Up to 50%-70% |

| Repayment Terms | Fixed or variable, 1-30 years | Flexible, usually under 1 year |

| Credit Check Required | Yes | No or minimal |

| Risk of Collateral Loss | Repossession on default | Automatic liquidation on price drop |

Understanding Collateralized Lending: Secured Loans vs Crypto-Backed Loans

Secured loans require tangible assets like real estate or vehicles as collateral, providing lenders with lower risk and typically lower interest rates. Crypto-backed loans use digital assets such as Bitcoin or Ethereum as collateral, offering faster approval and increased liquidity but are subject to market volatility and regulatory uncertainties. Understanding the differences in collateral type, risk assessment, and loan terms is essential for borrowers choosing between traditional secured loans and crypto-backed lending options.

Key Differences Between Traditional Secured Loans and Crypto-Backed Loans

Traditional secured loans require collateral such as real estate or vehicles, offering established credit terms and regulatory oversight, whereas crypto-backed loans use digital assets like Bitcoin or Ethereum as collateral, providing faster approval and greater liquidity. Interest rates on secured loans tend to be lower due to the tangible value of assets, while crypto-backed loans may experience higher volatility and risk, impacting loan-to-value (LTV) ratios. Unlike conventional loans, crypto-backed lending platforms operate on blockchain technology, ensuring transparent and decentralized loan management.

Eligibility Requirements for Secured and Crypto-Backed Loans

Secured loans typically require borrowers to have substantial credit history and tangible assets like real estate or vehicles as collateral, with stringent eligibility criteria based on credit scores and income verification. Crypto-backed loans allow users to leverage digital assets such as Bitcoin or Ethereum, offering more flexible eligibility with less emphasis on credit checks but requiring the deposit of volatile cryptocurrency as collateral. Lenders evaluate loan-to-value ratios (LTV) differently, often approving higher LTVs for secured loans compared to crypto-backed loans due to the fluctuating value of crypto assets.

Types of Collateral: Physical Assets vs Digital Assets

Secured loans typically use physical assets like real estate, vehicles, or equipment as collateral, offering tangible value and lower risk for lenders. Crypto-backed loans leverage digital assets such as Bitcoin, Ethereum, or other cryptocurrencies, providing faster access to funds but with higher volatility and risk. The choice between physical and digital collateral depends on asset liquidity, market stability, and borrower preference.

Interest Rates and Loan Terms Comparison

Secured loans backed by traditional assets like real estate typically offer lower interest rates ranging from 3% to 8%, with flexible loan terms spanning 5 to 30 years, providing stability and predictable repayment schedules. In contrast, crypto-backed loans often feature higher interest rates between 8% and 15% due to market volatility, with shorter loan terms generally from 3 to 12 months to mitigate collateral risk. Borrowers choosing between these options should weigh the cost efficiency and longer terms of secured loans against the faster access and higher risk associated with crypto-backed lending.

Risks and Security Factors in Secured and Crypto-Backed Lending

Secured loans rely on traditional assets like real estate or vehicles as collateral, offering lower risk due to their stable market value and established legal protections in case of default. Crypto-backed loans pose higher volatility risks since cryptocurrencies can experience rapid price fluctuations, potentially triggering margin calls or liquidation events. Security factors in crypto-backed lending are complicated by regulatory uncertainties and the reliance on digital wallets, increasing exposure to hacking or custodial failures compared to conventional secured loans.

Application Process: Traditional Banking vs Crypto Platforms

The application process for secured loans through traditional banking typically requires extensive credit checks, income verification, and lengthy approval times, making it more rigid and time-consuming. In contrast, crypto-backed loan platforms leverage blockchain technology to offer faster collateral valuation and instant loan approval with minimal credit scrutiny. This streamlined process on crypto platforms enhances accessibility and reduces bureaucratic hurdles compared to conventional bank loan applications.

Credit Checks: Impact on Secured and Crypto-Backed Loans

Secured loans typically require thorough credit checks to assess borrower risk, influencing interest rates and loan approval chances. Crypto-backed loans often bypass traditional credit evaluations, relying instead on the collateral value of digital assets to mitigate lender risk. This distinction makes crypto-backed loans more accessible to individuals with lower credit scores, while secured loans may offer more competitive terms for those with strong credit histories.

Liquidation and Default: What Happens to Your Collateral?

In secured loans, liquidation involves the lender seizing physical assets like property or vehicles when the borrower defaults, ensuring tangible collateral covers the outstanding debt. Crypto-backed loans use volatile digital assets as collateral, where sudden market drops can trigger automatic liquidation to protect lenders from losses. Default consequences in crypto loans typically result in immediate asset liquidation due to blockchain-enforced smart contracts, whereas traditional secured loans often allow negotiated repayment plans prior to foreclosure.

Choosing the Right Loan Type for Your Financial Needs

Secured loans use traditional assets like property or vehicles as collateral, providing lenders with tangible security and often resulting in lower interest rates. Crypto-backed loans leverage digital assets such as Bitcoin or Ethereum, offering quick access to funds without selling cryptocurrency but with higher volatility risk. Evaluating your financial stability, risk tolerance, and liquidity needs helps determine whether a secured loan or crypto-backed loan best aligns with your borrowing objectives.

Related Important Terms

Overcollateralization Ratio

Secured loans typically require an overcollateralization ratio of 150% or higher to mitigate lender risk, whereas crypto-backed loans often demand a higher ratio, frequently exceeding 200%, due to cryptocurrency price volatility. This augmented overcollateralization ratio in crypto-backed loans protects lenders from rapid asset devaluation and liquidation risks inherent in digital assets.

DeFi Collateral Vault

Secured loans traditionally require tangible assets such as property or vehicles as collateral, whereas crypto-backed loans utilize digital assets stored in a DeFi collateral vault, enabling decentralized and permissionless lending. DeFi collateral vaults enhance transparency and liquidity by automating asset management through smart contracts while reducing counterparty risk in collateralized lending.

Smart Contract Liquidation

Smart contract liquidation in crypto-backed loans automates collateral seizure and sale when loan-to-value ratios fall below set thresholds, reducing lender risk and enhancing transaction transparency. In contrast, secured loans rely on traditional collateral management with slower, manual liquidation processes, often increasing recovery time and operational costs.

Loan-To-Value (LTV) Adjustment

Secured loans typically offer Loan-To-Value (LTV) ratios ranging from 70% to 90%, allowing borrowers to leverage traditional assets like real estate as collateral with relatively stable LTV adjustments based on asset appraisal. Crypto-backed loans often feature lower and more volatile LTV ratios, commonly between 40% and 60%, due to the high price fluctuations of digital assets, necessitating frequent LTV recalibrations to mitigate lender risk.

Stablecoin Peg Risk

Secured loans typically rely on traditional assets like real estate or vehicles as collateral, minimizing volatility and stablecoin peg risk, whereas crypto-backed loans use digital assets including stablecoins that may face peg devaluation risks impacting loan value stability. Borrowers must assess the potential instability of stablecoin pegs in crypto-backed loans compared to the relatively stable collateral valuation of conventional secured loans.

On-Chain Credit Scoring

Secured loans traditionally rely on physical assets like property or vehicles as collateral, while crypto-backed loans use digital assets stored on blockchain networks to enable faster, borderless lending with transparent asset valuation. On-chain credit scoring leverages blockchain data, such as transaction history and asset liquidity, to assess borrower risk more accurately and automate loan approval processes without conventional credit reports.

Tokenized Asset Custody

Secured loans leverage physical or traditional assets like real estate or vehicles as collateral, while crypto-backed loans utilize tokenized digital assets stored through specialized custody solutions that ensure enhanced security and transparent ownership. Tokenized asset custody for crypto-backed loans employs blockchain technology to facilitate seamless transfer, verification, and liquidation of collateral, reducing counterparty risk and increasing loan accessibility.

Flash Loan Arbitrage

Secured loans typically require tangible assets like real estate or vehicles as collateral, offering low-interest rates backed by stable valuations, while crypto-backed loans leverage volatile digital assets such as Bitcoin or Ethereum, enabling faster approval and greater liquidity for Flash Loan Arbitrage strategies. Flash Loan Arbitrage exploits instantaneous, uncollateralized borrowing within decentralized finance (DeFi) platforms, where crypto-backed loans provide access to quick capital without traditional credit checks, enhancing arbitrage opportunities across multiple blockchain exchanges.

Proof-of-Reserve Verification

Secured loans typically involve tangible assets such as real estate or vehicles as collateral, whereas crypto-backed loans use digital assets verified through Proof-of-Reserve mechanisms to ensure transparency and liquidity. Proof-of-Reserve verification enhances trust in crypto-backed lending by providing real-time audits of asset holdings, reducing counterparty risk for both lenders and borrowers.

Cross-Chain Collateralization

Cross-chain collateralization enables borrowers to leverage assets from multiple blockchain networks to secure both secured loans and crypto-backed loans, increasing flexibility and capital efficiency. This technology reduces dependency on a single chain's liquidity and minimizes liquidation risks by diversifying collateral across interoperable protocols.

Secured Loan vs Crypto-Backed Loan for collateralized lending. Infographic

moneydiff.com

moneydiff.com