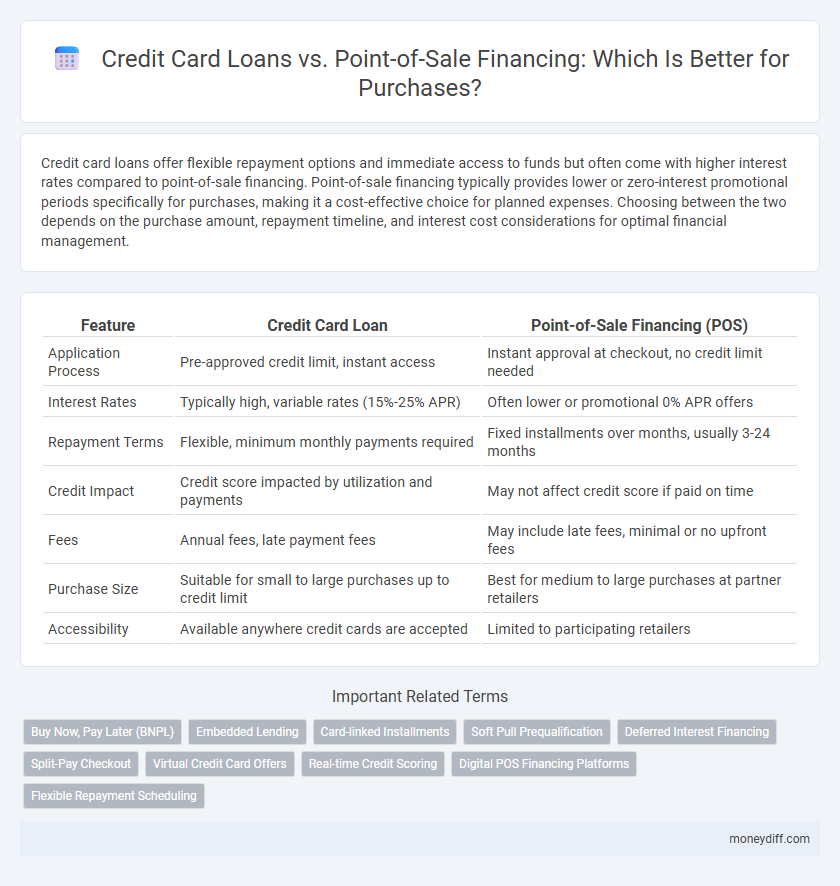

Credit card loans offer flexible repayment options and immediate access to funds but often come with higher interest rates compared to point-of-sale financing. Point-of-sale financing typically provides lower or zero-interest promotional periods specifically for purchases, making it a cost-effective choice for planned expenses. Choosing between the two depends on the purchase amount, repayment timeline, and interest cost considerations for optimal financial management.

Table of Comparison

| Feature | Credit Card Loan | Point-of-Sale Financing (POS) |

|---|---|---|

| Application Process | Pre-approved credit limit, instant access | Instant approval at checkout, no credit limit needed |

| Interest Rates | Typically high, variable rates (15%-25% APR) | Often lower or promotional 0% APR offers |

| Repayment Terms | Flexible, minimum monthly payments required | Fixed installments over months, usually 3-24 months |

| Credit Impact | Credit score impacted by utilization and payments | May not affect credit score if paid on time |

| Fees | Annual fees, late payment fees | May include late fees, minimal or no upfront fees |

| Purchase Size | Suitable for small to large purchases up to credit limit | Best for medium to large purchases at partner retailers |

| Accessibility | Available anywhere credit cards are accepted | Limited to participating retailers |

Understanding Credit Card Loans and Point-of-Sale Financing

Credit card loans allow consumers to borrow funds up to their credit limit with flexible repayment options and often higher interest rates. Point-of-sale financing enables immediate, installment-based payments directly at the purchase location, typically offering lower interest rates and promotional terms. Understanding the differences in interest rates, repayment schedules, and eligibility criteria helps consumers choose the most cost-effective financing method for their purchases.

Key Differences Between Credit Card Loans and POS Financing

Credit card loans offer revolving credit with flexible repayment options and higher interest rates, while point-of-sale (POS) financing provides installment-based payments directly tied to specific purchases, often featuring promotional zero or low-interest periods. Credit cards allow broader use across multiple merchants and purchase types, whereas POS financing is limited to particular retailers or transactions. The credit approval process for credit cards typically involves comprehensive credit checks, whereas POS financing approvals are often quicker and based on minimal credit assessment.

Interest Rates: Comparing Credit Card Loans and POS Financing

Credit card loans generally have higher interest rates, averaging between 15% and 25% APR, compared to point-of-sale (POS) financing options, which can offer promotional rates as low as 0% for an introductory period. POS financing often targets specific retailers and may include deferred interest if the balance is not paid within the promotional timeframe. Borrowers should carefully evaluate the effective interest rates and repayment terms of both credit card loans and POS financing to minimize overall borrowing costs.

Eligibility Requirements for Each Financing Option

Credit card loans typically require a good credit score, stable income, and a history of on-time payments to qualify, with issuers assessing individual creditworthiness through credit reports and income verification. Point-of-sale financing often has more lenient eligibility criteria, focusing on immediate approval based on minimal credit checks, and sometimes accommodating customers with lower credit scores or limited credit history. Understanding the specific requirements of each option helps consumers choose the financing method best aligned with their credit profile and purchase needs.

Repayment Terms: Flexibility and Structure

Credit card loans typically offer revolving credit with flexible repayment options and variable interest rates based on outstanding balances. Point-of-sale financing often involves fixed installment plans with set repayment periods and predetermined interest rates or fees. Borrowers seeking convenience and predictable payments may prefer point-of-sale financing, while those valuing repayment flexibility might opt for credit card loans.

Fees and Hidden Costs to Watch Out For

Credit card loans often involve high-interest rates and fees such as annual fees, late payment penalties, and cash advance charges that can quickly accumulate. Point-of-sale financing may offer lower interest rates or promotional zero-interest periods but frequently includes hidden costs like deferred interest or restocking fees if payments are missed or the purchase is returned. Careful review of the loan terms and fee schedules is essential to avoid unexpectedly high expenses in both financing options.

Impact on Credit Score: Credit Card Loans vs POS Financing

Credit card loans typically impact credit scores through utilization rates and payment history, where high balances can lower scores due to increased credit utilization ratios. Point-of-sale (POS) financing often reports as installment loans, which may positively affect credit mix and reduce utilization, potentially boosting credit scores if payments are timely. Late payments on either loan type negatively impact credit scores, but POS financing's structured repayment schedule may provide clearer opportunities to maintain consistent on-time payments.

Best Situations for Using Credit Card Loans

Credit card loans are ideal for consumers needing quick access to funds for smaller purchases or emergencies where repayment flexibility is crucial. These loans offer competitive interest rates if paid within the grace period and often include rewards programs, making them beneficial for frequent shoppers. Using credit card loans is best when purchases are planned, and users can avoid long-term debt by leveraging promotional rates and rewards.

When to Choose Point-of-Sale Financing Instead

Point-of-sale financing is ideal for consumers seeking immediate purchase approval with lower interest rates compared to credit card loans, especially for large or planned expenses. This option often offers promotional terms such as zero or low-interest periods, making it suitable when aiming to avoid high credit card interest and fees. Choosing point-of-sale financing can improve cash flow management by spreading payments over time without significantly increasing overall borrowing costs.

Tips for Responsible Use: Maximizing Benefits and Minimizing Debt

Use credit card loans wisely by paying off balances in full each month to avoid high interest rates and late fees. For point-of-sale financing, carefully review terms to ensure promotional offers do not lead to unexpected costs or extended debt. Prioritize budgeting and timely payments to maximize benefits while minimizing the risk of accumulating unmanageable debt.

Related Important Terms

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services offer point-of-sale financing that enables consumers to split purchases into interest-free installments, providing a convenient alternative to traditional credit card loans which often carry higher interest rates and potential impact on credit scores. BNPL solutions are increasingly favored for their transparent repayment terms and minimal credit checks, making them accessible for a wider range of shoppers seeking flexible payment options.

Embedded Lending

Embedded lending integrates point-of-sale financing directly within the purchase experience, offering tailored loan options that streamline approval and payments compared to traditional credit card loans. This approach reduces friction at checkout, enhances customer convenience, and often provides lower interest rates by leveraging real-time transaction data.

Card-linked Installments

Card-linked installments leverage credit card accounts to enable flexible repayment plans directly tied to point-of-sale purchases, offering seamless integration without the need for separate loan processing. Compared to traditional credit card loans, this financing method provides enhanced convenience and tailored installment options that improve cash flow management for consumers during purchase transactions.

Soft Pull Prequalification

Soft pull prequalification for credit card loans allows borrowers to check loan options without affecting their credit score, providing a low-risk way to assess eligibility. Point-of-sale financing often performs a soft pull initially to offer tailored payment plans, making it a convenient alternative for immediate purchase financing with minimal credit impact.

Deferred Interest Financing

Credit card loans often feature deferred interest financing, where interest accumulates during the promotional period but is waived if the balance is paid in full before the term ends, making timely payments crucial. Point-of-sale financing typically offers fixed-term, interest-free or low-interest periods with strict payment schedules, reducing the risk of unexpected interest charges compared to credit card deferred interest plans.

Split-Pay Checkout

Split-pay checkout offers a clear advantage over credit card loans and point-of-sale financing by enabling consumers to divide purchases into manageable installments without incurring high interest rates or complex loan terms. This payment method enhances affordability and transparency at checkout, improving consumer financial control and satisfaction.

Virtual Credit Card Offers

Virtual credit card offers provide secure, temporary card numbers that help manage credit card loans with reduced fraud risk during purchases, unlike traditional point-of-sale financing which directly links financing to merchants. These virtual cards enhance consumer control over spending limits and repayment terms, making them a flexible option for financing purchases without impacting existing credit card limits.

Real-time Credit Scoring

Credit card loans provide instant approval based on real-time credit scoring algorithms that analyze current credit utilization and payment history, enabling quick access to funds for purchases. Point-of-sale financing leverages real-time credit assessments at the moment of purchase, often using alternative data sources to deliver personalized loan offers with flexible repayment terms.

Digital POS Financing Platforms

Digital POS financing platforms offer seamless, real-time credit approvals and flexible repayment options directly at checkout, enhancing consumer purchase power beyond traditional credit card loans. These platforms leverage advanced algorithms and integration with merchant systems to provide personalized financing solutions, often resulting in higher conversion rates and improved customer satisfaction.

Flexible Repayment Scheduling

Credit card loans offer flexible repayment scheduling with minimum monthly payments and the option to pay off balances over time, whereas point-of-sale financing typically provides fixed installment plans with set payment dates tied directly to the purchase. Comparing both, credit card loans allow more control over payment timing and amounts, while point-of-sale financing ensures predictable payments structured around purchase terms.

Credit card loan vs Point-of-sale financing for purchases. Infographic

moneydiff.com

moneydiff.com