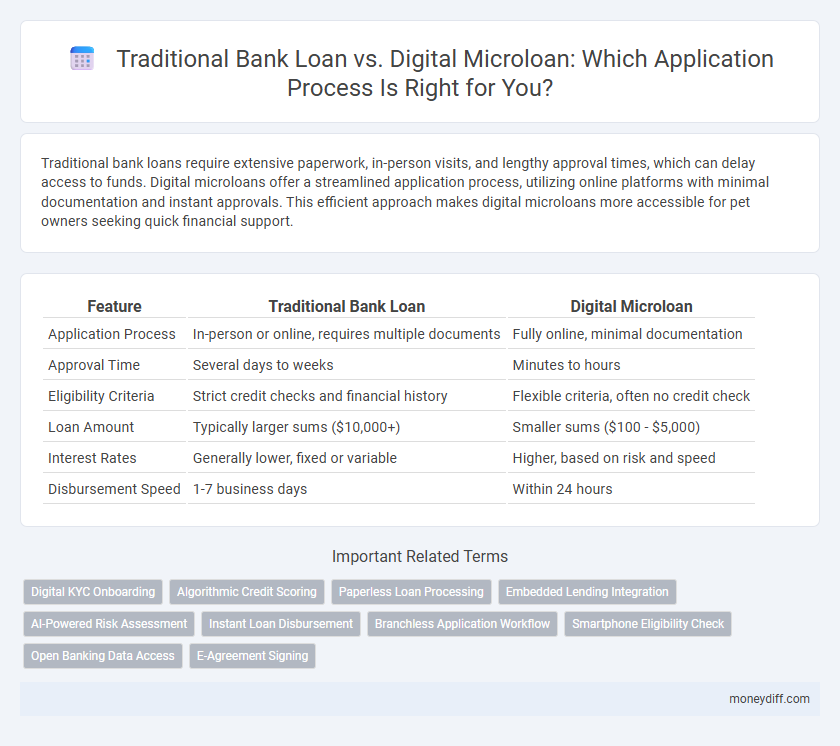

Traditional bank loans require extensive paperwork, in-person visits, and lengthy approval times, which can delay access to funds. Digital microloans offer a streamlined application process, utilizing online platforms with minimal documentation and instant approvals. This efficient approach makes digital microloans more accessible for pet owners seeking quick financial support.

Table of Comparison

| Feature | Traditional Bank Loan | Digital Microloan |

|---|---|---|

| Application Process | In-person or online, requires multiple documents | Fully online, minimal documentation |

| Approval Time | Several days to weeks | Minutes to hours |

| Eligibility Criteria | Strict credit checks and financial history | Flexible criteria, often no credit check |

| Loan Amount | Typically larger sums ($10,000+) | Smaller sums ($100 - $5,000) |

| Interest Rates | Generally lower, fixed or variable | Higher, based on risk and speed |

| Disbursement Speed | 1-7 business days | Within 24 hours |

Overview: Traditional Bank Loans vs Digital Microloans

Traditional bank loans require extensive documentation, in-person visits, and longer approval times, often taking weeks to process. Digital microloans leverage automated online platforms with minimal paperwork and fast approval, sometimes within minutes to hours. This streamlined application process caters to borrowers needing quick access to smaller loan amounts without the bureaucratic hurdles of traditional banking.

Eligibility Criteria Comparison

Traditional bank loans often require extensive eligibility criteria, including a high credit score, stable income proof, and collateral, which can limit accessibility for many applicants. Digital microloans typically feature more flexible eligibility requirements, using alternative data points such as mobile phone usage and social media activity to assess creditworthiness. This streamlined process enables faster approvals and broader access, particularly benefiting individuals with limited credit histories or formal documentation.

Documentation Requirements: Paperwork vs Paperless

Traditional bank loans require extensive documentation including physical forms, proof of income, and collateral papers, creating a lengthy and often cumbersome application process. Digital microloans leverage paperless systems with minimal documentation, often utilizing automated data verification and digital identity checks to expedite approval. This contrast in paperwork requirements significantly impacts the speed and convenience of loan processing for applicants.

Application Submission Methods

Traditional bank loan applications require in-person visits to branches, involving physical paperwork and longer processing times. Digital microloan platforms enable applicants to submit applications online via mobile apps or websites, ensuring faster, more convenient, and paperless submission. This shift to digital methods reduces waiting periods and lowers barriers for accessing credit, especially for underserved populations.

Speed of Approval and Disbursement

Digital microloans offer significantly faster approval and disbursement times, often within minutes to a few hours, due to automated algorithms and streamlined online applications. Traditional bank loans typically require several days to weeks for approval, involving thorough credit checks and extensive paperwork. The expedited process of digital microloans enhances accessibility for borrowers needing immediate funds.

Credit Assessment Techniques

Traditional bank loans rely on comprehensive credit assessments including detailed financial statements, credit scores, and in-person interviews, often leading to longer approval times. Digital microloans utilize automated algorithms, real-time data analytics, and alternative credit scoring methods such as social media activity and transactional data to expedite the credit evaluation process. This technology-driven approach reduces the application time from weeks to minutes, increasing accessibility for borrowers with limited credit history.

User Experience in Application Process

The application process for traditional bank loans often involves lengthy paperwork, multiple in-person visits, and extended approval times, which can hinder user experience. In contrast, digital microloans offer streamlined online applications, instant eligibility checks, and rapid disbursal, significantly enhancing convenience and accessibility for users. Mobile-friendly platforms and automated verification in digital microloans reduce friction, making the borrowing experience faster and more user-centric.

Accessibility for Underserved Borrowers

Traditional bank loans often require extensive documentation, credit history, and in-person visits, creating barriers for underserved borrowers lacking banking access. Digital microloans utilize streamlined online applications, minimal paperwork, and alternative credit scoring, increasing accessibility for individuals in remote or low-income communities. Mobile platforms and instant approvals further enhance loan accessibility, reducing time and effort compared to conventional banking processes.

Security Measures in the Application Process

Traditional bank loans implement rigorous security measures including multi-factor authentication, encrypted data transmission, and in-person identity verification to ensure borrower authenticity and protect sensitive financial information. Digital microloan platforms utilize advanced AI-driven fraud detection, biometric authentication, and secure cloud storage to streamline application security while maintaining data privacy. Both methods prioritize safeguarding applicant information, but digital microloans offer faster, automated security protocols optimized for online environments.

Customer Support During Application

Traditional bank loan applications often involve extensive paperwork and require multiple in-person visits, which can delay customer support response times. Digital microloans offer streamlined, app-based applications with instant chat support and automated assistance, providing faster and more accessible customer service. The seamless digital interface allows borrowers to receive real-time guidance, improving the overall efficiency and satisfaction during the application process.

Related Important Terms

Digital KYC Onboarding

Digital microloans leverage advanced digital KYC onboarding processes that enable instant identity verification through biometric data and secure document uploads, significantly reducing application time compared to traditional bank loans, which typically require in-person visits and extensive paperwork. This streamlined digital onboarding enhances borrower experience by providing faster access to funds and minimizing fraud risks with automated compliance checks.

Algorithmic Credit Scoring

Traditional bank loans often require extensive paperwork and manual credit assessments, leading to longer approval times and potential bias in evaluation. Digital microloans leverage algorithmic credit scoring that uses real-time data and machine learning models, enabling faster, more accurate, and inclusive credit decisions for diverse borrower profiles.

Paperless Loan Processing

Digital microloans offer a fully paperless application process through mobile apps and online platforms, enabling instant submission and verification of documents, whereas traditional bank loans often require physical paperwork and in-person visits, leading to longer approval times. This streamlined digital approach reduces processing time from days to minutes, increasing accessibility and convenience for borrowers.

Embedded Lending Integration

Traditional bank loans often require extensive in-branch paperwork and lengthy approval times, whereas digital microloans leverage embedded lending integration to offer seamless, instant application processes directly within digital platforms. Embedded lending enables real-time credit assessments and automated approvals, significantly reducing friction and improving customer experience compared to conventional loans.

AI-Powered Risk Assessment

Traditional bank loans involve lengthy manual application processes with human-driven risk assessment, leading to slower approval times and higher operational costs. Digital microloans leverage AI-powered risk assessment algorithms that analyze alternative data sources instantly, enabling faster, more accurate credit decisions and streamlined application experiences.

Instant Loan Disbursement

Traditional bank loans often involve lengthy application procedures with extensive documentation and approval times, whereas digital microloans leverage automated algorithms for instant loan disbursement, enabling borrowers to receive funds within minutes. The streamlined digital application process reduces processing delays and enhances accessibility, particularly for small loan amounts requiring quick financial support.

Branchless Application Workflow

Traditional bank loans typically require in-person branch visits, extensive paperwork, and longer approval times, limiting convenience and speed for applicants. Digital microloans utilize a fully branchless application workflow through mobile apps or online platforms, enabling instant credit decisions and seamless document submission for faster loan disbursement.

Smartphone Eligibility Check

Traditional bank loans typically require extensive paperwork, in-person visits, and lengthy eligibility verification processes, whereas digital microloans offer instant smartphone eligibility checks through automated algorithms that analyze credit scores and income data in real-time. Smartphone-based eligibility checks enable faster approval times and greater accessibility for users with limited access to physical bank branches.

Open Banking Data Access

Traditional bank loans require extensive paperwork and manual verification, leading to longer approval times, whereas digital microloans leverage Open Banking data access to automatically retrieve and analyze financial information, enabling faster and more accurate credit assessments. Integration of Open Banking APIs facilitates real-time account data sharing, reducing application friction and enhancing user experience for digital microloan applicants.

E-Agreement Signing

Traditional bank loans often require physical presence for document signing, resulting in longer processing times, while digital microloans leverage e-agreement signing to enable instant, paperless approval and faster access to funds. E-agreement signing enhances security with digital authentication and reduces administrative overhead, making the application process more efficient for both lenders and borrowers.

Traditional Bank Loan vs Digital Microloan for application process. Infographic

moneydiff.com

moneydiff.com