Business loans offer established companies predictable financing with fixed interest rates and structured repayment schedules, making them ideal for long-term capital investments. Crowdlending provides startups and small businesses access to flexible funding from multiple individual investors, often with faster approval and less stringent credit requirements. Choosing between these options depends on the company's credit profile, funding timeline, and willingness to engage with a broad investor base.

Table of Comparison

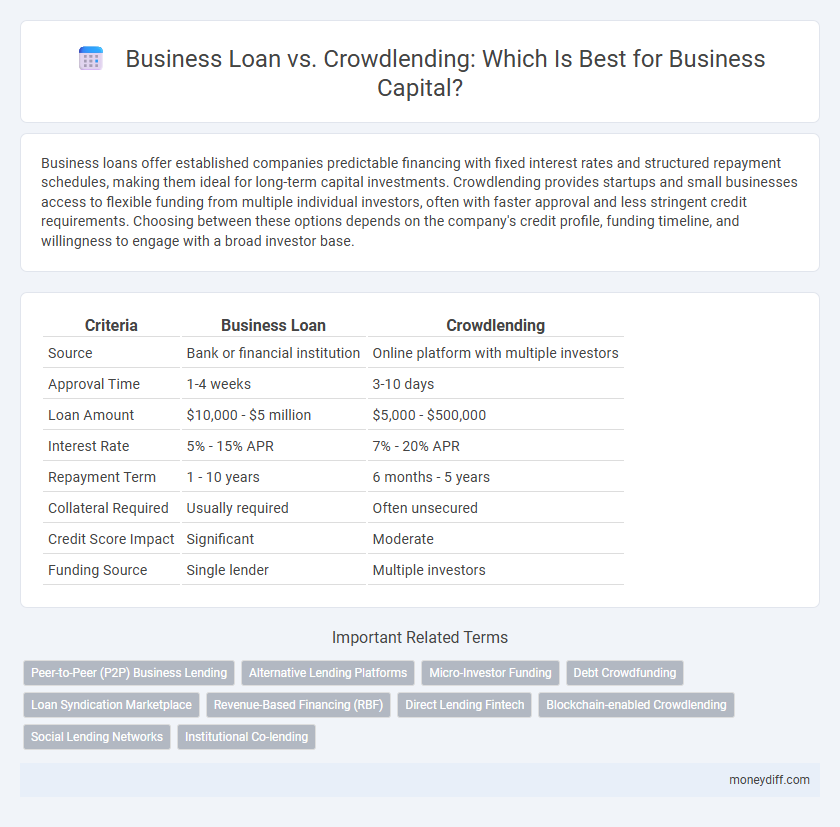

| Criteria | Business Loan | Crowdlending |

|---|---|---|

| Source | Bank or financial institution | Online platform with multiple investors |

| Approval Time | 1-4 weeks | 3-10 days |

| Loan Amount | $10,000 - $5 million | $5,000 - $500,000 |

| Interest Rate | 5% - 15% APR | 7% - 20% APR |

| Repayment Term | 1 - 10 years | 6 months - 5 years |

| Collateral Required | Usually required | Often unsecured |

| Credit Score Impact | Significant | Moderate |

| Funding Source | Single lender | Multiple investors |

Understanding Business Loans: Traditional Funding Explained

Business loans provide established businesses with fixed capital from banks or financial institutions, offering predictable repayment schedules and interest rates based on creditworthiness and business performance. Crowdlending leverages online platforms to connect multiple individual investors with businesses seeking funds, allowing for more flexible terms but often at higher interest rates and varied risk levels. Understanding the trade-offs between traditional business loans and crowdlending helps entrepreneurs choose funding that aligns with their capital needs, repayment ability, and growth plans.

What is Crowdlending? Modern Finance for Businesses

Crowdlending is a modern financing method where businesses raise capital by borrowing directly from a group of individual investors through online platforms, bypassing traditional banks. This alternative funding model offers flexible terms, quicker access to funds, and the ability to engage a community of supporters, making it ideal for startups and small businesses. Unlike conventional business loans, crowdlending emphasizes transparency and collaboration, providing a streamlined path to securing growth capital.

Key Differences Between Business Loans and Crowdlending

Business loans typically involve borrowing a fixed amount from banks or financial institutions with set interest rates and repayment schedules, making them a more traditional financing method for established businesses. Crowdlending, on the other hand, allows businesses to raise capital directly from multiple individual investors through online platforms, often offering more flexible terms but potentially higher overall costs. Key differences include the source of funds, approval timelines, risk distribution, and regulatory frameworks governing each financing option.

Eligibility Criteria: Which Option Fits Your Business?

Business loans typically require a strong credit score, proven financial statements, and sometimes collateral, making them suitable for established businesses with stable revenue. Crowdlending eligibility often focuses on the business idea's appeal, the entrepreneur's credibility, and social proof, making it more accessible to startups and small enterprises lacking traditional credit history. Choosing between the two depends on your business size, credit profile, and capital needs, with loans favoring financial stability and crowdlending rewarding innovation and community support.

Interest Rates and Repayment Terms Compared

Business loans typically offer fixed interest rates ranging from 5% to 12%, with repayment terms spanning 1 to 7 years, providing predictable monthly payments and structured timelines. Crowdlending platforms often feature variable interest rates depending on the risk profile, averaging between 8% and 15%, with more flexible and shorter repayment periods, usually from 6 months to 3 years. Evaluating these differences, businesses seeking stability might prefer traditional loans, whereas those valuing flexibility in repayment and quicker access to capital may benefit from crowdlending options.

Application Process: Speed, Ease, and Documentation

Business loans typically involve a rigorous application process requiring extensive documentation, including financial statements and credit history, which can slow approval times. Crowdlending platforms streamline funding requests by enabling businesses to submit concise proposals online, often resulting in faster approvals with minimal paperwork. The ease of access and reduced documentation make crowdlending a quicker option for small businesses seeking capital compared to traditional bank loans.

Risk Assessment: Security and Guarantees

Business loans typically require collateral and thorough credit assessments to mitigate lender risk, ensuring security through tangible guarantees such as property or equipment. Crowdlending platforms rely on diversified investor funding with varying risk exposures, often involving less stringent collateral but higher interest rates to compensate for increased risk. Both methods demand careful evaluation of financial stability and repayment capacity, but business loans offer more structured guarantees compared to the flexible, community-based security models in crowdlending.

Funding Amounts: Limits and Flexibility

Business loans typically offer higher funding amounts, often ranging from $50,000 to several million dollars, providing substantial capital for large-scale projects. Crowdlending platforms usually have lower limits, commonly between $10,000 and $500,000, but offer greater flexibility in repayment terms and funding sources. The choice between these options depends on the capital requirements and desired funding structure for the business.

Impact on Business Credit and Ownership

Business loans typically require collateral and impact business credit scores directly, influencing future borrowing capacity, while ownership remains unchanged. Crowdlending involves multiple individual investors funding the business through loans, which can diversify credit risk without affecting business equity or ownership structure. Both options affect credit differently, with loans having a more traditional credit impact and crowdlending offering flexible repayment terms without ownership dilution.

Choosing the Right Financing: Which Suits Your Business Goals?

Business loans offer structured repayment plans and established credit-building benefits, suitable for companies seeking long-term stability and predictable expenses. Crowdlending provides access to a diverse pool of investors, often with more flexible terms, making it ideal for startups or businesses with unique value propositions aiming for rapid growth. Evaluating factors such as interest rates, funding speed, collateral requirements, and business stage helps determine whether traditional loans or crowdlending aligns better with specific business objectives.

Related Important Terms

Peer-to-Peer (P2P) Business Lending

Peer-to-peer (P2P) business lending offers an alternative to traditional business loans by connecting entrepreneurs directly with individual investors through online platforms, often resulting in faster funding and more flexible terms. Crowdlending leverages social capital and a diverse pool of lenders, providing businesses with accessible capital without the stringent criteria typically imposed by banks, while maintaining competitive interest rates.

Alternative Lending Platforms

Alternative lending platforms like crowdlending provide businesses with faster access to capital compared to traditional business loans, often featuring flexible terms and lower eligibility requirements. Crowdlending leverages a network of individual investors allowing companies to raise funds without relying solely on conventional bank approvals.

Micro-Investor Funding

Micro-investor funding through crowdlending offers businesses direct access to a diverse pool of small-scale investors, often resulting in more flexible repayment terms compared to traditional business loans from banks, which tend to have stringent qualification criteria and fixed interest rates. Crowdlending platforms leverage technology to match entrepreneurs with micro-investors, facilitating quicker capital acquisition while distributing risk among multiple lenders, thereby enhancing financial inclusion for startups and SMEs.

Debt Crowdfunding

Debt crowdfunding, a form of business loan, enables companies to raise capital by borrowing from multiple individual investors through online platforms, often offering more flexible terms compared to traditional bank loans. This method provides access to diverse funding sources while maintaining control over business operations and avoiding equity dilution.

Loan Syndication Marketplace

Business Loan syndication marketplace offers a streamlined platform connecting multiple lenders to finance larger business capital needs, providing diversified risk and enhanced funding capacity compared to traditional single-source loans. Crowdlending for business capital relies on numerous smaller investors through online platforms, often resulting in higher interest rates and limited funding volume, making loan syndication marketplaces a more scalable and efficient option for substantial business financing.

Revenue-Based Financing (RBF)

Revenue-Based Financing (RBF) offers businesses flexible repayment terms tied to a fixed percentage of monthly revenue, unlike traditional business loans that require fixed payments regardless of cash flow. Crowdlending platforms facilitating RBF enable entrepreneurs to access capital without diluting equity, providing an alternative to conventional debt with repayment amounts adjusting to actual business performance.

Direct Lending Fintech

Direct lending fintech platforms streamline access to business capital by connecting entrepreneurs with investors, offering faster approval and flexible terms compared to traditional bank loans. Crowdlending enables multiple investors to fund a business through an online platform, while business loans through fintech maintain direct lender-borrower relationships, optimizing credit assessment through advanced algorithms.

Blockchain-enabled Crowdlending

Business loans typically involve traditional banks providing fixed capital with set interest rates and credit requirements, while blockchain-enabled crowdlending leverages decentralized networks to connect businesses directly with multiple investors, offering greater transparency, lower fees, and faster access to funds. This innovative model reduces reliance on intermediaries by utilizing smart contracts on blockchain platforms, enhancing security and streamlining the lending process for entrepreneurs seeking flexible capital solutions.

Social Lending Networks

Business loans typically involve traditional financial institutions offering fixed amounts with structured repayment terms, while crowdlending leverages social lending networks to connect multiple individual investors directly with businesses seeking capital. Social lending networks facilitate a decentralized funding approach, often enabling faster access to funds and potentially lower interest rates through peer-to-peer lending platforms.

Institutional Co-lending

Institutional co-lending combines traditional business loans and crowdlending by partnering banks with alternative lenders to provide diversified capital sources, reducing risk and enhancing funding availability for business growth. This hybrid model leverages institutional credit evaluation alongside community-driven investment, offering competitive interest rates and flexible terms for businesses seeking capital.

Business Loan vs Crowdlending for business capital. Infographic

moneydiff.com

moneydiff.com