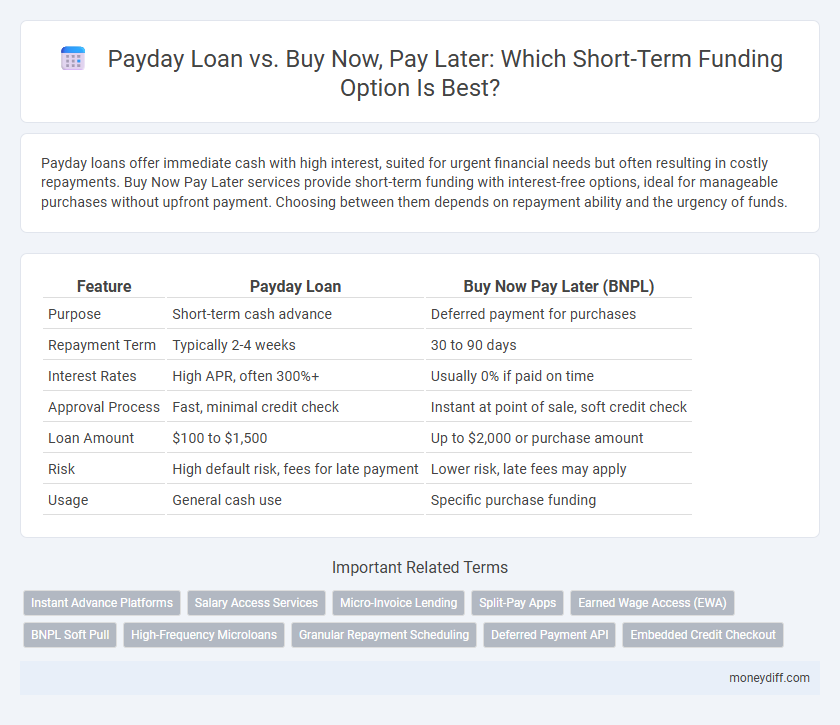

Payday loans offer immediate cash with high interest, suited for urgent financial needs but often resulting in costly repayments. Buy Now Pay Later services provide short-term funding with interest-free options, ideal for manageable purchases without upfront payment. Choosing between them depends on repayment ability and the urgency of funds.

Table of Comparison

| Feature | Payday Loan | Buy Now Pay Later (BNPL) |

|---|---|---|

| Purpose | Short-term cash advance | Deferred payment for purchases |

| Repayment Term | Typically 2-4 weeks | 30 to 90 days |

| Interest Rates | High APR, often 300%+ | Usually 0% if paid on time |

| Approval Process | Fast, minimal credit check | Instant at point of sale, soft credit check |

| Loan Amount | $100 to $1,500 | Up to $2,000 or purchase amount |

| Risk | High default risk, fees for late payment | Lower risk, late fees may apply |

| Usage | General cash use | Specific purchase funding |

Understanding Payday Loans and Buy Now Pay Later

Payday loans offer quick cash with high interest rates and fees, typically requiring full repayment by the next paycheck, making them a costly short-term funding option. Buy Now Pay Later (BNPL) services split purchases into interest-free installments over weeks or months, providing flexible repayment without immediate financial strain. Understanding the fees, repayment terms, and credit impact is essential for choosing between payday loans and BNPL for short-term financial needs.

How Payday Loans Work: Pros and Cons

Payday loans provide quick, short-term cash by allowing borrowers to access funds that must be repaid with high interest on their next paycheck, often within two weeks. These loans offer fast approval and easy access without strict credit checks but carry risks such as exorbitant fees, high annual percentage rates (APRs) often exceeding 400%, and the potential for debt cycles due to short repayment terms. Borrowers must weigh the convenience of payday loans against the financial strain from their costly repayment structures compared to alternatives like Buy Now Pay Later options.

What Is Buy Now Pay Later? Benefits and Drawbacks

Buy Now Pay Later (BNPL) is a short-term financing option allowing consumers to purchase items immediately and pay in installments over time, often interest-free if payments are timely. Benefits include budget management without incurring high-interest rates typical of payday loans and increased purchasing power at checkout. Drawbacks involve potential overspending, late fees, and impact on credit scores if payments are missed, contrasting with payday loans' high fees and immediate repayment demands.

Eligibility Criteria: Payday Loans vs BNPL

Payday loans typically require proof of income, an active checking account, and a minimum age of 18, making eligibility accessible but sometimes restrictive due to credit checks or income verification. Buy Now Pay Later (BNPL) options often have more lenient criteria, focusing on purchase verification and basic identity checks rather than credit scores, allowing broader access for consumers with varying credit profiles. Both methods prioritize quick approval, but payday loans involve stricter income requirements whereas BNPL emphasizes seamless integration with retailer platforms and minimal upfront documentation.

Interest Rates and Fees: A Comparative Analysis

Payday loans often carry high interest rates, typically ranging from 300% to 500% APR, coupled with fees that can quickly escalate the total repayment cost. Buy Now Pay Later (BNPL) services generally offer lower or zero interest fees if payments are made on time, making them a more affordable short-term funding option. However, late payments on BNPL plans can incur fees and affect credit scores, whereas payday loans impose immediate steep costs and potential debt cycles.

Impact on Credit Score: Payday Loans vs BNPL

Payday loans often negatively impact credit scores due to high interest rates and frequent late payments, which lenders report to credit bureaus. Buy Now Pay Later (BNPL) services typically have a minimal immediate effect on credit scores as many do not perform hard credit checks or report timely payments. However, missed BNPL payments can lead to debt collection, ultimately harming credit ratings.

Repayment Terms and Flexibility

Payday loans typically require full repayment by the next paycheck, often within two to four weeks, creating tight repayment terms with high fees and limited flexibility. Buy Now Pay Later (BNPL) services offer installment plans spread over several weeks or months, allowing borrowers more manageable payments and increased flexibility without immediate full repayment. BNPL options generally provide transparent schedules and lower interest costs, making them a more adaptable choice for short-term funding compared to payday loans.

Risks and Pitfalls of Payday Loans

Payday loans often come with exorbitant interest rates and fees that can trap borrowers in a cycle of debt due to their short repayment periods and high rollover charges. Unlike Buy Now Pay Later options, payday loans lack transparency and regulatory protections, increasing the risk of financial strain and default. Borrowers face significant pitfalls including sudden debt accumulation and damage to credit scores if payments are missed or delayed.

BNPL Risks: What Borrowers Should Know

Buy Now Pay Later (BNPL) offers short-term funding with deferred payments but carries risks such as high-interest rates, late fees, and potential impacts on credit scores. Borrowers may face increased debt burdens if multiple BNPL purchases accumulate without timely repayment. Understanding BNPL terms, repayment schedules, and lender policies helps mitigate financial risks compared to payday loans, which typically have higher fees and faster debt cycles.

Which Option Is Better for Short-Term Funding?

Payday loans offer immediate cash with high interest rates and fees, making them costly short-term funding options compared to Buy Now Pay Later (BNPL) services, which provide interest-free installments if payments are made on time. BNPL programs typically have clearer repayment schedules and lower risks of debt accumulation, appealing to consumers seeking manageable short-term financing. Evaluating personal financial discipline and urgency of funds helps determine that BNPL is generally better for planned purchases, while payday loans may be necessary for unexpected expenses despite their financial drawbacks.

Related Important Terms

Instant Advance Platforms

Instant advance platforms offer payday loans that provide immediate cash for urgent expenses, typically with higher interest rates and shorter repayment terms compared to Buy Now Pay Later options. Buy Now Pay Later services enable consumers to split purchases into interest-free installments, promoting budget-friendly short-term funding without the hefty fees associated with payday loans.

Salary Access Services

Payday loans provide immediate cash advances based on upcoming salary but often come with high interest and fees, making them costly for short-term funding. Salary Access Services integrated into Buy Now Pay Later plans offer flexible repayment aligned with pay cycles, reducing debt risk while improving financial control for users.

Micro-Invoice Lending

Micro-invoice lending offers a flexible short-term funding option by allowing borrowers to secure advances against outstanding invoices, contrasting with payday loans that provide quick cash based on income but often involve high fees and interest rates. Buy Now Pay Later (BNPL) services facilitate consumer purchases with deferred payments, whereas micro-invoice lending targets small businesses seeking to improve cash flow without escalating debt burdens.

Split-Pay Apps

Split-pay apps for short-term funding offer a flexible alternative to payday loans by allowing users to divide purchases into manageable installments without high-interest fees, enhancing financial control and reducing immediate debt pressure. Unlike payday loans with typically high APRs exceeding 300%, buy now pay later services integrated in split-pay apps provide transparent payment schedules and often waive interest for timely payments, making them a more affordable option.

Earned Wage Access (EWA)

Payday loans often come with high interest rates and fees, making them an expensive short-term funding option compared to Buy Now Pay Later (BNPL) plans that offer interest-free installments. Earned Wage Access (EWA) provides immediate access to earned but unpaid wages, presenting a lower-cost alternative to both payday loans and BNPL by reducing reliance on debt for urgent cash needs.

BNPL Soft Pull

Buy Now Pay Later (BNPL) services often use a soft pull credit check, providing faster access to short-term funding without impacting credit scores, unlike payday loans which may involve harder credit inquiries and higher interest rates. BNPL options offer flexible repayment plans and transparency, making them a more consumer-friendly alternative for managing immediate expenses.

High-Frequency Microloans

Payday loans offer quick access to high-frequency microloans with immediate cash disbursement, typically attracting high-interest rates and fees that can escalate repayment costs. Buy Now Pay Later services provide short-term funding through installment payments at lower or zero interest, making them a cost-effective alternative for managing micro-purchases without immediate financial strain.

Granular Repayment Scheduling

Payday loans typically require full repayment on the borrower's next payday, offering limited flexibility, while Buy Now Pay Later (BNPL) services provide granular repayment scheduling through installment plans spread over weeks or months. BNPL's tiered payment structures align better with short-term cash flow management, minimizing the risk of default compared to the lump-sum repayment demanded by payday loans.

Deferred Payment API

Payday loans provide immediate cash with high interest and fees, posing risks of debt cycles, while Buy Now Pay Later (BNPL) offers deferred payments through APIs that integrate seamlessly with merchants, enabling short-term credit without upfront interest. Deferred Payment APIs enhance BNPL services by automating payment schedules and offering transparent terms, making them a more flexible and user-friendly alternative to traditional payday loans for short-term funding needs.

Embedded Credit Checkout

Embedded credit checkout in Buy Now Pay Later (BNPL) services offers seamless approval and immediate purchase without traditional credit checks, making it a preferred short-term funding option over payday loans, which often carry higher interest rates and fees. BNPL integrates directly at the point of sale, providing transparent installment options that reduce the risk of debt accumulation compared to the predatory terms frequently associated with payday loans.

Payday Loan vs Buy Now Pay Later for short-term funding. Infographic

moneydiff.com

moneydiff.com