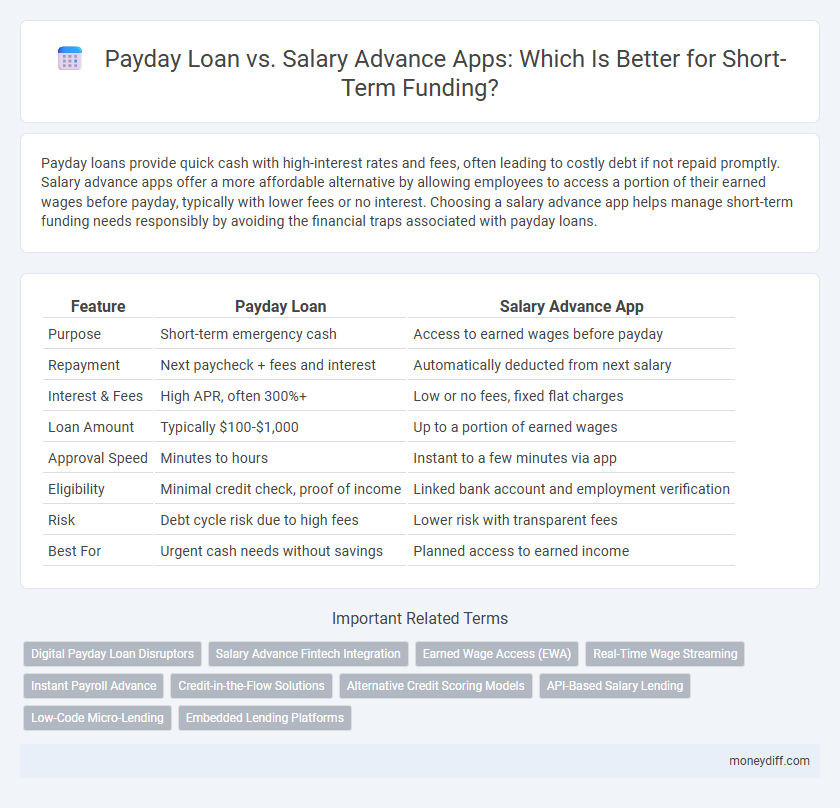

Payday loans provide quick cash with high-interest rates and fees, often leading to costly debt if not repaid promptly. Salary advance apps offer a more affordable alternative by allowing employees to access a portion of their earned wages before payday, typically with lower fees or no interest. Choosing a salary advance app helps manage short-term funding needs responsibly by avoiding the financial traps associated with payday loans.

Table of Comparison

| Feature | Payday Loan | Salary Advance App |

|---|---|---|

| Purpose | Short-term emergency cash | Access to earned wages before payday |

| Repayment | Next paycheck + fees and interest | Automatically deducted from next salary |

| Interest & Fees | High APR, often 300%+ | Low or no fees, fixed flat charges |

| Loan Amount | Typically $100-$1,000 | Up to a portion of earned wages |

| Approval Speed | Minutes to hours | Instant to a few minutes via app |

| Eligibility | Minimal credit check, proof of income | Linked bank account and employment verification |

| Risk | Debt cycle risk due to high fees | Lower risk with transparent fees |

| Best For | Urgent cash needs without savings | Planned access to earned income |

Introduction: Navigating Short-Term Funding Options

Payday loans offer quick cash with high interest rates and fees, suited for urgent, short-term needs despite potential financial strain. Salary advance apps provide employees access to earned wages before payday, promoting flexibility and avoiding traditional loan pitfalls. Choosing between these options depends on factors like repayment terms, cost, and financial stability.

Payday Loans: How They Work and Who Uses Them

Payday loans are short-term, high-interest loans designed to provide quick cash until the borrower's next paycheck, typically ranging from $100 to $1,500. These loans are often used by individuals with limited access to traditional credit, including those with poor credit scores or urgent financial needs. The lending process involves minimal credit checks, fast approval, and repayment directly from the borrower's next salary, making them popular among low-income workers facing unexpected expenses.

Salary Advance Apps: Innovative Solutions for Cash Flow

Salary advance apps provide innovative short-term funding by allowing employees to access earned wages before payday, improving cash flow without traditional loan approval processes. These apps use real-time payroll data to offer instant advances with lower fees and transparent terms compared to payday loans. By integrating directly with employer payroll systems, salary advance apps reduce financial stress and avoid high-interest debt cycles common in payday lending.

Key Differences Between Payday Loans and Salary Advance Apps

Payday loans typically come with high interest rates and fees, requiring repayment by the next paycheck, while salary advance apps offer smaller, interest-free advances directly from earned wages with flexible repayment options. Payday loans often carry a risk of debt cycles due to their high cost and short repayment terms, whereas salary advance apps promote financial wellness by allowing users to access earned income early without additional debt. The approval process for payday loans usually depends on credit checks and income verification, while salary advance apps integrate with employers or payroll systems to streamline access to funds.

Interest Rates and Fees: A Side-by-Side Comparison

Payday loans typically carry higher interest rates often exceeding 400% APR, coupled with substantial fees that can escalate the overall repayment amount. Salary advance apps offer more competitive rates, frequently deducting a flat fee or low-interest charge tied directly to the borrowed amount and pay cycle. Comparing both options reveals salary advance apps as a cost-effective alternative for short-term funding, reducing the risk of debt spirals caused by excessive payday loan fees.

Eligibility Requirements and Accessibility

Payday loans typically require proof of income, a valid ID, and a checking account, but often have stricter credit checks and higher fees compared to salary advance apps. Salary advance apps usually access your employer's payroll data directly, allowing easier eligibility with fewer credit checks and faster approval processes. Accessibility for salary advance apps is generally higher due to their integration with employer systems, while payday loans rely on external lenders, sometimes limiting availability based on location and credit history.

Application Process: Speed and Convenience

Payday loans typically offer a faster application process with minimal documentation, often providing funds within hours, which caters to urgent financial needs. Salary advance apps leverage direct employer data to streamline approval, enabling quick access to earned wages without extensive credit checks. Both options prioritize convenience, but salary advance apps generally feature user-friendly mobile interfaces that simplify repeated use.

Impact on Credit Score and Financial Health

Payday loans typically have higher interest rates and fees, which can lead to increased debt and negatively impact credit scores if repayment is delayed or missed. Salary advance apps often provide lower-cost alternatives with transparent repayment terms, reducing the risk of credit damage and supporting better financial health. Choosing salary advance apps can enhance short-term funding accessibility while maintaining creditworthiness.

Pros and Cons: Payday Loans vs Salary Advance Apps

Payday loans offer quick access to cash with minimal credit checks but often carry high interest rates and fees, leading to potential debt cycles. Salary advance apps provide employees with early access to earned wages, promoting financial flexibility and lower costs, but availability depends on employer participation and limits on advance amounts. Choosing between payday loans and salary advance apps requires balancing immediate funding needs against affordability and repayment terms.

Choosing the Right Short-Term Funding for Your Needs

Payday loans typically offer fast cash with high interest rates and fees, making them suitable for emergency expenses but costly for longer repayment periods. Salary advance apps provide access to earned wages before payday, often with lower or no fees, promoting affordability and better financial management. Assess your repayment ability, fees, and urgency to select the optimal short-term funding solution aligned with your financial situation.

Related Important Terms

Digital Payday Loan Disruptors

Digital payday loan disruptors leverage technology to offer faster, more transparent short-term funding compared to traditional payday loans, often providing salary advances directly through apps with lower fees and improved user experience. These salary advance apps use real-time payroll data to assess eligibility instantly, reducing reliance on high-interest rates and predatory lending practices common in conventional payday loans.

Salary Advance Fintech Integration

Salary advance apps leverage fintech integration to provide employees with instant access to earned wages, reducing reliance on costly payday loans that typically carry high interest rates and fees. This seamless digital solution enhances financial wellness by offering transparent, low-cost short-term funding directly through employer payroll systems.

Earned Wage Access (EWA)

Payday loans often carry high interest rates and fees, leading to significant debt cycles, whereas Earned Wage Access (EWA) through salary advance apps provides employees immediate access to earned wages without interest, promoting financial wellness. EWA solutions offer transparent, fee-free short-term funding by allowing workers to withdraw earned income before payday, reducing reliance on predatory lending practices.

Real-Time Wage Streaming

Payday loans often involve high interest rates and fixed repayment schedules, whereas salary advance apps leverage real-time wage streaming technology to allow employees to access earned wages instantly, reducing financial stress without accruing significant debt. Real-time wage streaming provides a flexible, transparent short-term funding solution by enabling seamless, on-demand access to pay based on actual hours worked.

Instant Payroll Advance

Instant payroll advance offers a seamless alternative to traditional payday loans by providing employees immediate access to earned wages through salary advance apps, minimizing high-interest fees and reducing reliance on predatory lending. This short-term funding solution enhances financial stability by enabling users to cover urgent expenses without waiting for the next paycheck, leveraging real-time payroll data for quick and secure disbursement.

Credit-in-the-Flow Solutions

Payday loans typically involve higher interest rates and fees, making salary advance apps a cost-effective credit-in-the-flow solution by offering employees access to earned wages without traditional credit checks. These apps integrate with payroll systems to provide instant, short-term funding, enhancing financial wellness and reducing reliance on predatory lending.

Alternative Credit Scoring Models

Payday loans and salary advance apps differ significantly in their approach to credit evaluation, with salary advance apps often utilizing alternative credit scoring models such as transaction history and employment data to assess borrower risk more accurately. These alternative models enhance accessibility for users with limited credit history while potentially reducing the high interest rates commonly associated with payday loans.

API-Based Salary Lending

API-based salary lending platforms offer seamless access to salary advances by directly integrating with employers' payroll systems, reducing approval times and enhancing security compared to traditional payday loans. These apps minimize high-interest rates and hidden fees common in payday loans by providing transparent, affordable short-term funding tied to verified income data.

Low-Code Micro-Lending

Low-code micro-lending platforms enhance accessibility and speed for short-term funding by simplifying the process of payday loans and salary advance apps with minimal coding requirements. These solutions enable financial institutions to rapidly deploy and scale payday loan and salary advance app services, reducing operational costs and improving user experience through automated underwriting and real-time disbursement.

Embedded Lending Platforms

Embedded lending platforms integrate payday loans and salary advance apps directly into employer or financial service interfaces, enabling seamless access to short-term funding. These platforms optimize user experience by offering personalized loan terms and faster approval processes, enhancing financial flexibility without traditional credit checks.

Payday Loan vs Salary Advance App for short-term funding. Infographic

moneydiff.com

moneydiff.com