Small business loans offer fixed repayment schedules and often require collateral, making them suitable for established businesses with steady cash flow. Revenue-based financing provides flexible repayments tied directly to business revenue, ideal for companies with fluctuating income seeking growth capital without traditional loan constraints. Choosing between these options depends on cash flow stability, repayment preference, and long-term financial goals.

Table of Comparison

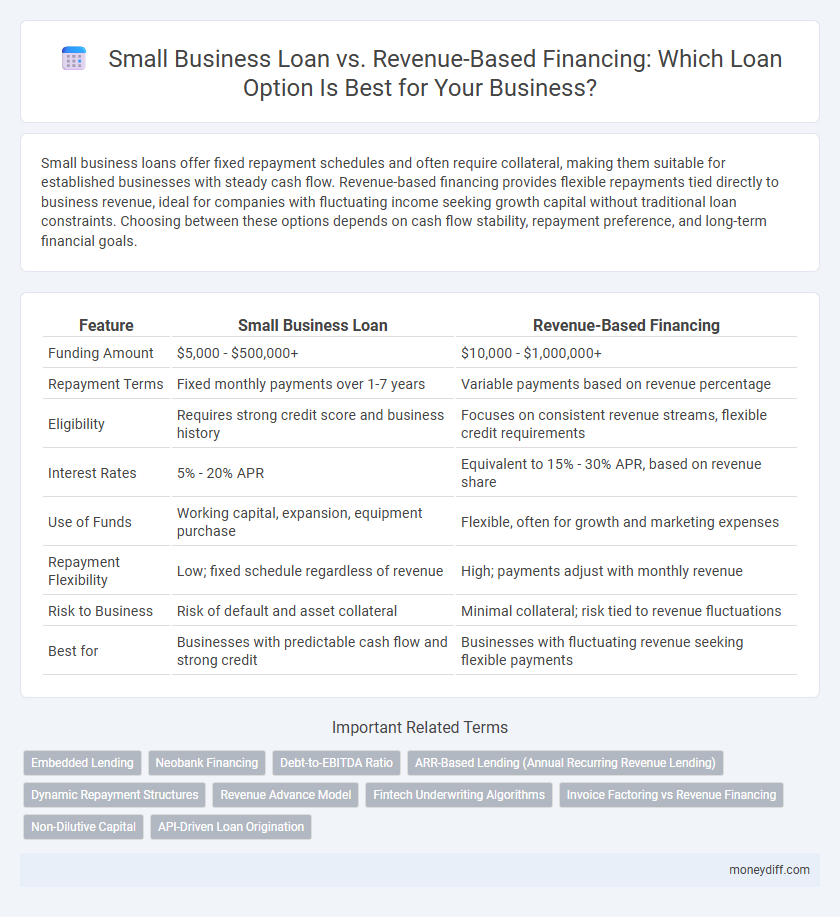

| Feature | Small Business Loan | Revenue-Based Financing |

|---|---|---|

| Funding Amount | $5,000 - $500,000+ | $10,000 - $1,000,000+ |

| Repayment Terms | Fixed monthly payments over 1-7 years | Variable payments based on revenue percentage |

| Eligibility | Requires strong credit score and business history | Focuses on consistent revenue streams, flexible credit requirements |

| Interest Rates | 5% - 20% APR | Equivalent to 15% - 30% APR, based on revenue share |

| Use of Funds | Working capital, expansion, equipment purchase | Flexible, often for growth and marketing expenses |

| Repayment Flexibility | Low; fixed schedule regardless of revenue | High; payments adjust with monthly revenue |

| Risk to Business | Risk of default and asset collateral | Minimal collateral; risk tied to revenue fluctuations |

| Best for | Businesses with predictable cash flow and strong credit | Businesses with fluctuating revenue seeking flexible payments |

Understanding Small Business Loans

Small business loans offer fixed amounts with set repayment schedules, ideal for entrepreneurs seeking predictable financing for growth, expansion, or equipment purchase. Revenue-based financing provides flexible repayments tied to monthly revenue percentages, allowing businesses with fluctuating income to manage cash flow more effectively. Understanding these options helps businesses align funding strategies with financial stability and growth potential.

What Is Revenue-Based Financing?

Revenue-based financing (RBF) is a type of funding where repayments are made as a fixed percentage of the borrower's ongoing gross revenues, offering flexible payment schedules aligned with cash flow. Unlike traditional small business loans that require fixed monthly payments regardless of income fluctuations, RBF adjusts payment amounts based on the business's performance, reducing the risk of default during slow periods. This model is especially beneficial for businesses with high gross margins and predictable revenue streams seeking capital without diluting equity.

Key Differences Between Small Business Loans and Revenue-Based Financing

Small Business Loans require fixed monthly payments with a set interest rate and term, while Revenue-Based Financing involves variable payments tied to a percentage of monthly revenue. Small Business Loans typically demand strong credit scores and collateral, whereas Revenue-Based Financing prioritizes consistent revenue streams over creditworthiness. The repayment structure in small business loans often leads to predictable cash flow obligations, contrasting with the flexible, revenue-aligned payments of revenue-based financing.

Eligibility Criteria for Small Business Loans vs Revenue-Based Financing

Small business loans typically require a strong credit score, detailed financial statements, and a demonstrated ability to repay, often favoring established businesses with consistent revenue. Revenue-based financing eligibility focuses on monthly or annual sales figures, with less emphasis on credit scores but requires a predictable revenue stream to determine repayment amounts as a percentage of income. Lenders for small business loans often demand collateral, whereas revenue-based financing primarily depends on business performance metrics for approval.

Application Process: Small Business Loans vs Revenue-Based Financing

Small business loans typically require extensive documentation, including financial statements, credit history, and business plans, causing a longer and more rigorous application process. Revenue-based financing offers a streamlined application with fewer requirements by assessing monthly revenue trends, enabling faster approval and funding. Small business loans prioritize creditworthiness, while revenue-based financing focuses on consistent cash flow for determining eligibility.

Repayment Structures Compared

Small business loans typically require fixed monthly payments with predetermined interest rates and terms, ensuring consistent repayment schedules. Revenue-based financing adjusts repayment amounts according to the business's revenue, fluctuating with sales performance and aligning costs with cash flow. This flexible structure helps businesses manage repayments during slow periods, contrasting with the rigidity of traditional small business loan repayments.

Pros and Cons: Small Business Loans

Small business loans offer fixed interest rates and predictable repayment schedules, providing stability for entrepreneurs planning long-term growth. However, these loans often require strong credit scores, collateral, and extensive documentation, creating barriers for startups or businesses with fluctuating revenue. Unlike revenue-based financing, small business loans may impose higher financial risks during downturns due to fixed monthly payments regardless of sales performance.

Pros and Cons: Revenue-Based Financing

Revenue-Based Financing offers flexible repayment terms tied directly to a business's monthly revenue, reducing pressure during slower periods and aligning payments with cash flow. However, the cost can be higher over time compared to traditional small business loans, especially if revenue grows significantly, as repayments are a fixed percentage of sales. This option avoids equity dilution but may limit future borrowing capacity due to ongoing revenue-sharing obligations.

When to Choose Small Business Loans

Small business loans are ideal for entrepreneurs seeking larger capital amounts with fixed repayment schedules and lower interest rates, providing predictable cash flow management. These loans are best suited for businesses with strong credit histories and collateral that can support longer-term investments like equipment or expansion. Choosing small business loans is advantageous when consistent payments and clear terms are essential for strategic financial planning.

When Revenue-Based Financing Makes Sense

Revenue-based financing makes sense for small businesses with fluctuating monthly revenues that seek flexible repayment tied directly to income streams. Unlike traditional small business loans with fixed payments, revenue-based financing adjusts repayment amounts based on a percentage of monthly revenue, reducing pressure during slower periods. This option suits startups and seasonal businesses prioritizing cash flow management over long-term debt commitments.

Related Important Terms

Embedded Lending

Embedded lending integrates small business loans and revenue-based financing directly into the operational platforms that small businesses use, streamlining access to capital without disrupting cash flow. This model leverages data-driven credit assessment to offer flexible repayment terms tied to revenue fluctuations, optimizing funding solutions for growth and working capital needs.

Neobank Financing

Neobank financing offers small businesses tailored loan options such as Small Business Loans and Revenue-Based Financing, where traditional fixed repayments contrast with flexible repayments tied to revenue fluctuations. Small Business Loans provide predictable cash flow management with fixed interest rates, while Revenue-Based Financing aligns repayment with business performance, making it ideal for startups with variable income streams.

Debt-to-EBITDA Ratio

Small business loans typically require a debt-to-EBITDA ratio below 3.0 to qualify, indicating manageable leverage and risk for lenders, while revenue-based financing assesses repayment capacity more flexibly, focusing on a percentage of monthly revenue rather than strict debt metrics. This makes revenue-based financing an attractive option for businesses with fluctuating earnings or higher debt-to-EBITDA ratios that may not meet traditional loan qualifications.

ARR-Based Lending (Annual Recurring Revenue Lending)

Small business loans typically require fixed monthly payments and strict qualification criteria, whereas ARR-based lending offers flexible repayment tied directly to a company's annual recurring revenue, aligning lender risk with business performance. This revenue-based financing model supports businesses with predictable subscription income by adjusting loan repayment amounts in proportion to their ARR, enabling scalable growth without sacrificing equity.

Dynamic Repayment Structures

Small Business Loans typically offer fixed repayment schedules with set interest rates, providing predictable monthly payments that help businesses plan cash flow. Revenue-Based Financing adapts repayments to a percentage of the business's monthly revenue, allowing more flexibility and aligning payment amounts with actual income fluctuations.

Revenue Advance Model

Revenue-based financing offers flexible repayment tied directly to a small business's monthly revenue, avoiding fixed loan payments and reducing default risk compared to traditional small business loans with set repayment schedules and interest rates. This revenue advance model leverages predictable cash flow, enabling businesses to access capital without diluting equity or taking on significant debt burdens.

Fintech Underwriting Algorithms

Small business loans typically rely on traditional credit scores and financial statements, while revenue-based financing leverages fintech underwriting algorithms that analyze real-time sales data and cash flow patterns for faster, more flexible funding decisions. Fintech-driven models enable personalized risk assessment and dynamic repayment structures, enhancing access to capital for businesses with fluctuating revenues.

Invoice Factoring vs Revenue Financing

Small business loans typically offer fixed amounts with set repayment schedules, while revenue-based financing provides flexible repayments tied directly to a company's monthly revenue. Invoice factoring advances cash by selling outstanding invoices, enhancing immediate liquidity, whereas revenue financing draws capital based on ongoing revenue streams without asset collateral.

Non-Dilutive Capital

Small business loans provide fixed repayment terms with predictable interest rates, ensuring non-dilutive capital that preserves full ownership for entrepreneurs. Revenue-based financing offers flexible payments tied to actual revenue, maintaining equity but potentially leading to higher overall costs depending on business performance.

API-Driven Loan Origination

API-driven loan origination streamlines access to Small Business Loans by automating credit assessments and underwriting, reducing approval times compared to traditional methods. Revenue-Based Financing leverages real-time revenue data through APIs to tailor repayment schedules dynamically, offering more flexibility aligned with business cash flow.

Small Business Loan vs Revenue-Based Financing for loan. Infographic

moneydiff.com

moneydiff.com