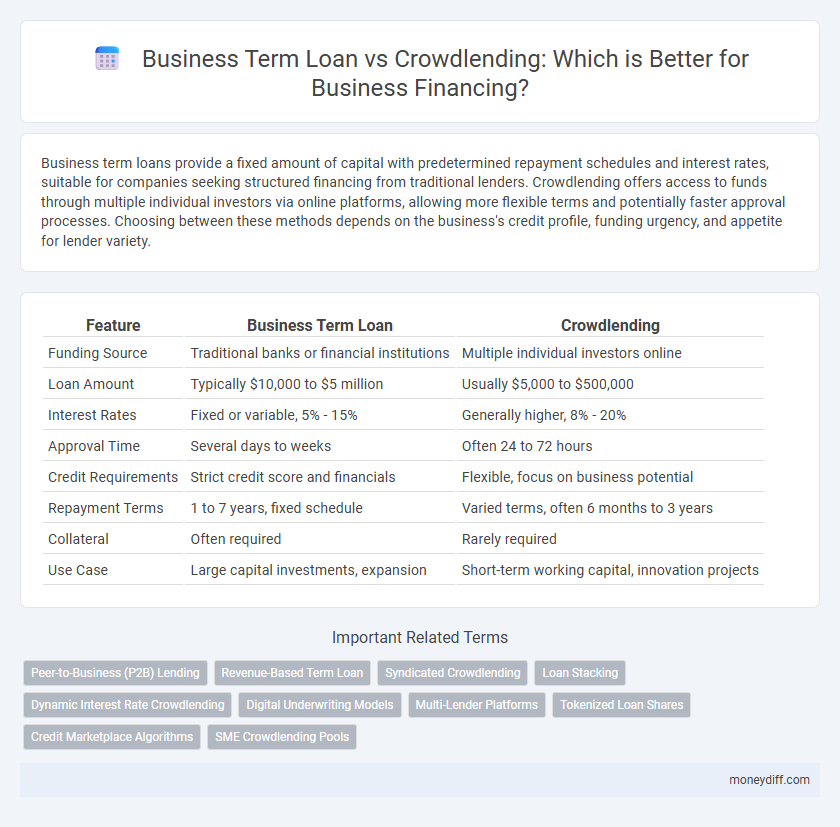

Business term loans provide a fixed amount of capital with predetermined repayment schedules and interest rates, suitable for companies seeking structured financing from traditional lenders. Crowdlending offers access to funds through multiple individual investors via online platforms, allowing more flexible terms and potentially faster approval processes. Choosing between these methods depends on the business's credit profile, funding urgency, and appetite for lender variety.

Table of Comparison

| Feature | Business Term Loan | Crowdlending |

|---|---|---|

| Funding Source | Traditional banks or financial institutions | Multiple individual investors online |

| Loan Amount | Typically $10,000 to $5 million | Usually $5,000 to $500,000 |

| Interest Rates | Fixed or variable, 5% - 15% | Generally higher, 8% - 20% |

| Approval Time | Several days to weeks | Often 24 to 72 hours |

| Credit Requirements | Strict credit score and financials | Flexible, focus on business potential |

| Repayment Terms | 1 to 7 years, fixed schedule | Varied terms, often 6 months to 3 years |

| Collateral | Often required | Rarely required |

| Use Case | Large capital investments, expansion | Short-term working capital, innovation projects |

Understanding Business Term Loans

Business term loans provide a fixed amount of capital with a structured repayment schedule and predefined interest rates, making them ideal for businesses seeking predictable financing for expansion or operational needs. Unlike crowdlending, which involves multiple individual lenders pooling funds often with flexible terms, business term loans typically come from traditional financial institutions offering more stability and regulatory protection. Understanding the fixed principal, interest obligations, and loan tenure of business term loans is crucial for optimizing cash flow management and long-term financial planning.

What is Crowdlending for Businesses?

Crowdlending for businesses is a form of financing where multiple individual investors collectively lend money to a business through an online platform, bypassing traditional banks. This method offers faster access to funds with potentially more flexible terms compared to conventional business term loans, which involve borrowing a fixed amount from a bank or financial institution with set repayment schedules. Crowdlending platforms also enable businesses to reach a wider pool of investors, often resulting in competitive interest rates and diversified funding sources.

Key Differences: Business Term Loan vs Crowdlending

Business term loans provide a fixed amount of capital with set repayment schedules and interest rates, often requiring collateral and credit checks. Crowdlending allows businesses to raise funds from multiple individual lenders online, offering flexible terms and typically faster access to capital without traditional bank requirements. While business term loans offer predictability and established legal frameworks, crowdlending emphasizes community-backed funding and diversified lender risk.

Eligibility Criteria for Business Term Loan and Crowdlending

Business term loans typically require a strong credit score, proof of consistent revenue, and a solid business plan to qualify, emphasizing financial stability and ability to repay. Crowdlending platforms often have more flexible eligibility criteria, focusing on the business idea's appeal and community support rather than stringent credit requirements. Both financing options demand documentation like financial statements, but business term loans usually require collateral, whereas crowdlending relies on investor confidence.

Application Process: Traditional Loans vs Crowdlending Platforms

Business term loans typically require extensive documentation, credit checks, and approval processes handled by banks or financial institutions, often resulting in longer waiting periods. Crowdlending platforms streamline application by enabling businesses to present their proposals online, attracting multiple investors with faster review and funding times. The digital nature of crowdlending reduces paperwork and speeds up access to capital compared to traditional loan applications.

Interest Rates and Repayment Terms Compared

Business term loans typically offer fixed interest rates ranging from 5% to 15%, with repayment terms spanning three to seven years, providing predictable monthly payments. Crowdlending interest rates can vary widely, often between 8% and 20%, depending on the platform and borrower's credit profile, with more flexible repayment schedules that may include monthly or quarterly installments. Businesses must weigh the stability of term loans against the potential cost and flexibility of crowdlending when choosing financing options.

Funding Speed: Which Option Delivers Faster?

Business term loans typically provide faster access to funds, often disbursed within a few days to weeks after application, due to streamlined approval processes with traditional financial institutions. Crowdlending platforms may take longer, usually several weeks, as they require campaign duration and investor commitments before funds can be released. For urgent financing needs, business term loans generally deliver quicker funding compared to the more time-intensive nature of crowdlending.

Risks and Benefits for Business Owners

Business term loans offer predictable repayment schedules and fixed interest rates, providing stability and easier financial planning for business owners, but they often require collateral and stringent credit checks, increasing risk if obligations aren't met. Crowdlending enables access to diverse investors and flexible funding amounts without collateral, reducing dependency on traditional banks but entails higher interest rates and less regulatory protection, which may expose businesses to fluctuating borrowing costs. Choosing between the two depends on a business owner's risk tolerance, creditworthiness, and growth strategy.

Impact on Business Credit and Reputation

Business term loans typically provide a structured repayment plan that positively impacts business credit by demonstrating consistent payment history and borrowing capacity. Crowdlending may offer more flexible funding options but can pose risks to business reputation if repayments are delayed or if the funding platform has lower regulatory oversight. Maintaining timely repayments on either financing method is critical to enhancing credit scores and preserving strong business credibility.

Choosing the Right Financing: Business Loan or Crowdlending?

Business term loans provide structured repayment schedules and predictable interest rates, making them ideal for businesses seeking stable financing with clear obligations. Crowdlending offers flexible funding from multiple investors, often with faster approval and less stringent credit requirements, appealing to startups or small businesses needing quick capital. Businesses should evaluate cash flow stability, creditworthiness, and growth potential to determine whether traditional term loans or crowdlending platforms align better with their financial goals.

Related Important Terms

Peer-to-Business (P2B) Lending

Business term loans provide lump-sum funding with fixed repayment schedules and interest rates, typically sourced from banks or financial institutions, while Peer-to-Business (P2B) lending, a subtype of crowdlending, connects businesses directly with individual investors through online platforms, offering flexible terms and often faster access to capital. P2B lending leverages digital marketplaces to reduce traditional banking barriers, enabling smaller firms to secure financing through diversified investor pools with potentially lower costs and increased transparency.

Revenue-Based Term Loan

Revenue-based term loans provide flexible repayment tied directly to business revenue, making them ideal for companies with fluctuating cash flow compared to fixed-schedule business term loans or equity-dependent crowdlending models. This financing approach minimizes dilution of ownership while ensuring payments adjust according to sales performance, offering a strategic advantage over traditional term loans and crowd-invested funding.

Syndicated Crowdlending

Syndicated crowdlending pools multiple investors to provide substantial capital for business financing, offering flexibility and diverse funding sources compared to traditional business term loans, which rely on a single financial institution and typically involve fixed interest rates and stricter collateral requirements. This alternative financing method allows businesses to access larger funds through a distributed risk model, often resulting in faster approval processes and more competitive terms.

Loan Stacking

Business term loans provide structured, bank-approved financing with fixed repayment schedules, reducing the risk of loan stacking compared to crowdlending, where multiple investors may fund overlapping loans, increasing default risk. Loan stacking in crowdlending often complicates cash flow management for businesses due to varied terms and simultaneous obligations across multiple platforms.

Dynamic Interest Rate Crowdlending

Dynamic interest rate crowdlending offers businesses flexible financing options by adjusting rates based on market conditions and borrower risk, enhancing cost predictability compared to fixed-rate business term loans. This adaptive pricing mechanism often leads to more competitive rates and improved access to capital for businesses seeking tailored loan structures beyond traditional term loan constraints.

Digital Underwriting Models

Digital underwriting models in business term loans leverage advanced algorithms and big data analytics to assess credit risk quickly and accurately, providing lenders with precise approval decisions. In contrast, crowdlending platforms use digital tools to aggregate multiple individual investors' assessments and diversify risk, offering businesses flexible financing options with potentially lower interest rates.

Multi-Lender Platforms

Business term loans offer structured repayment schedules and predictable interest rates, while crowdlending through multi-lender platforms enables businesses to access diverse sources of capital from numerous individual investors, often with faster approval times and flexible terms. Multi-lender platforms optimize risk distribution among lenders and increase funding potential, making them a strategic alternative to traditional bank loans for business financing.

Tokenized Loan Shares

Business term loans provide fixed interest rates and structured repayment schedules directly from financial institutions, while crowdlending leverages tokenized loan shares to enable fractional investments from multiple lenders through blockchain technology, enhancing liquidity and transparency. Tokenized loan shares offer seamless secondary market trading and real-time ownership tracking, making crowdlending a flexible alternative for businesses seeking diversified funding sources.

Credit Marketplace Algorithms

Business term loans typically rely on traditional credit scoring models within established lending institutions, whereas crowdlending platforms leverage advanced credit marketplace algorithms that analyze a broader set of real-time data points, including social behavior and alternative credit signals. These algorithms enhance risk assessment accuracy and enable more dynamic interest rate adjustments, facilitating faster and often more accessible financing options for small and medium enterprises.

SME Crowdlending Pools

SME Crowdlending Pools offer small and medium-sized enterprises access to diversified funding sources by aggregating multiple individual investors, often resulting in more flexible repayment terms and competitive interest rates compared to traditional Business Term Loans. Unlike Business Term Loans, which involve a single lender and fixed collateral requirements, Crowdlending Pools enable SMEs to leverage community-based funding, reducing reliance on bank credit and enhancing credit accessibility for growing businesses.

Business Term Loan vs Crowdlending for business financing. Infographic

moneydiff.com

moneydiff.com