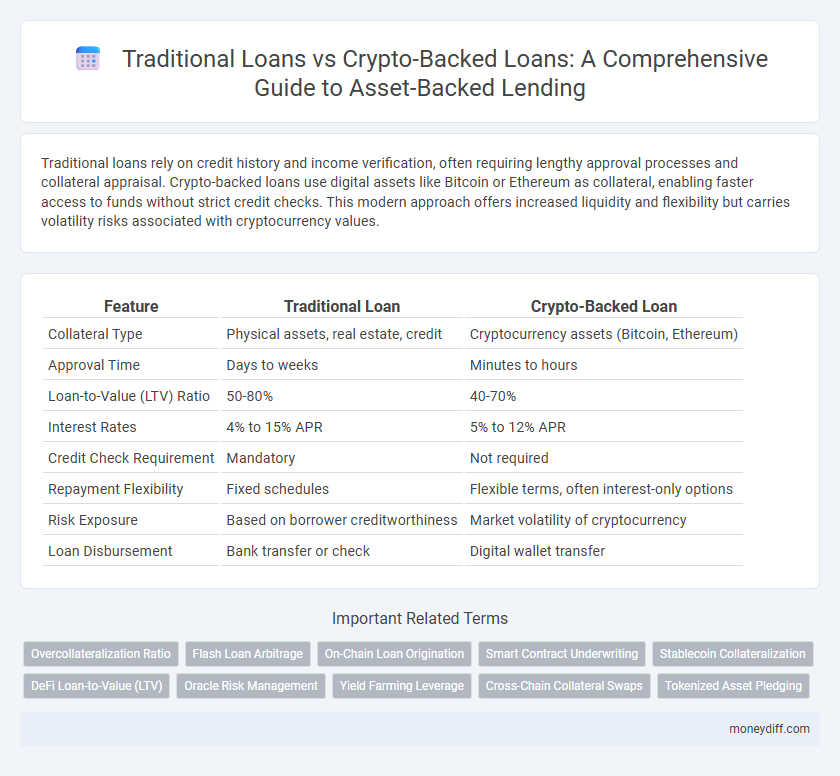

Traditional loans rely on credit history and income verification, often requiring lengthy approval processes and collateral appraisal. Crypto-backed loans use digital assets like Bitcoin or Ethereum as collateral, enabling faster access to funds without strict credit checks. This modern approach offers increased liquidity and flexibility but carries volatility risks associated with cryptocurrency values.

Table of Comparison

| Feature | Traditional Loan | Crypto-Backed Loan |

|---|---|---|

| Collateral Type | Physical assets, real estate, credit | Cryptocurrency assets (Bitcoin, Ethereum) |

| Approval Time | Days to weeks | Minutes to hours |

| Loan-to-Value (LTV) Ratio | 50-80% | 40-70% |

| Interest Rates | 4% to 15% APR | 5% to 12% APR |

| Credit Check Requirement | Mandatory | Not required |

| Repayment Flexibility | Fixed schedules | Flexible terms, often interest-only options |

| Risk Exposure | Based on borrower creditworthiness | Market volatility of cryptocurrency |

| Loan Disbursement | Bank transfer or check | Digital wallet transfer |

Understanding Traditional Loans in Asset-Backed Lending

Traditional loans in asset-backed lending involve borrowing funds secured by tangible assets such as real estate, vehicles, or inventory, providing lenders with collateral to minimize risk. Interest rates and repayment terms are typically fixed based on creditworthiness and asset valuation, ensuring predictable financial obligations for borrowers. This conventional approach relies heavily on physical assets and thorough credit assessments, distinguishing it from emerging crypto-backed lending options.

What Are Crypto-Backed Loans?

Crypto-backed loans use cryptocurrency assets like Bitcoin or Ethereum as collateral, allowing borrowers to access liquidity without selling their holdings. These loans offer faster approval processes and often lower interest rates compared to traditional loans due to the digital asset's transparency and blockchain verification. Unlike traditional loans secured by physical assets, crypto-backed loans leverage decentralized finance protocols, enhancing flexibility and accessibility for borrowers.

Key Differences Between Traditional and Crypto-Backed Loans

Traditional loans rely on credit scores and income verification, with assets like real estate or vehicles serving as collateral, while crypto-backed loans use digital currencies such as Bitcoin or Ethereum as collateral. Interest rates on crypto-backed loans tend to be more competitive due to lower risk of default, as lenders can liquidate the underlying crypto assets quickly. Unlike traditional loans, crypto-backed loans offer faster approval times and increased accessibility for borrowers without established credit histories.

Collateral Requirements in Traditional vs Crypto-Backed Loans

Traditional loans typically require physical assets such as real estate, vehicles, or valuable personal property as collateral, which often involves lengthy appraisal and verification processes. Crypto-backed loans use digital assets like Bitcoin or Ethereum as collateral, enabling faster approval times and more flexible access to funds due to blockchain transparency. The volatility of cryptocurrency collateral necessitates higher loan-to-value (LTV) ratios and more frequent margin calls compared to traditional asset-backed lending.

Interest Rates Comparison: Traditional vs Crypto-Backed Lending

Traditional loans typically feature fixed or variable interest rates averaging 6-12%, influenced by credit scores and collateral valuation. Crypto-backed loans offer lower interest rates, often ranging from 4-8%, due to the digital asset's volatility and decentralized lending platforms. The comparative cost-effectiveness of crypto-backed lending depends on market fluctuations and the borrower's appetite for risk.

Speed and Accessibility of Loan Approval

Traditional loans typically involve a lengthy approval process requiring extensive credit checks and documentation, often delaying access to funds by weeks. Crypto-backed loans provide rapid approval and disbursement, leveraging blockchain technology and collateralized digital assets to enable near-instant access to capital. The accessibility of crypto-backed loans is enhanced by fewer credit restrictions, making them available to a broader range of borrowers compared to traditional loan products.

Credit History and Borrower Eligibility

Traditional loans rely heavily on detailed credit history and credit scores to assess borrower eligibility, often requiring strong financial documentation and a long credit record. Crypto-backed loans prioritize digital asset collateral over credit history, enabling borrowers with limited or no credit data to access funding by leveraging their cryptocurrency holdings. This shift allows for more inclusive borrowing opportunities, particularly for individuals without established credit profiles.

Risks Associated with Traditional and Crypto-Backed Loans

Traditional loans often involve stringent credit checks and collateral assessments but carry risks such as lengthy approval processes, potential foreclosure on physical assets, and exposure to fluctuating interest rates. Crypto-backed loans provide quicker access to funds using digital assets as collateral but face risks including high market volatility, potential liquidation during price drops, and regulatory uncertainties. Both loan types require careful risk management to avoid asset loss and financial instability.

Security and Regulatory Aspects in Asset-Backed Lending

Traditional loans in asset-backed lending rely on regulatory frameworks such as the Truth in Lending Act and require thorough credit checks and collateral documentation, providing well-established legal protections and lender security. Crypto-backed loans use blockchain technology for collateralization, offering transparency and reduced counterparty risk but face regulatory uncertainty and evolving compliance standards across jurisdictions. Security in traditional loans hinges on tangible assets and regulatory oversight, while crypto-backed lending emphasizes digital asset custody solutions and smart contract execution to mitigate default risk.

Choosing the Right Loan Type for Asset-Backed Borrowing

Choosing the right loan type for asset-backed borrowing depends on factors like collateral flexibility, approval speed, and volatility tolerance. Traditional loans offer fixed interest rates and stable repayment terms but require stringent credit checks and longer approval times. Crypto-backed loans leverage digital assets as collateral, providing faster access to funds and lower credit barriers, though they carry higher risk due to price volatility.

Related Important Terms

Overcollateralization Ratio

Traditional loans typically require an overcollateralization ratio of 100% or higher, meaning borrowers must pledge assets valued at or above the loan amount to mitigate lender risk. Crypto-backed loans often demand a higher overcollateralization ratio ranging from 125% to 150% due to the volatility of digital assets, ensuring sufficient collateral value covers potential market fluctuations.

Flash Loan Arbitrage

Traditional loans require credit checks and collateral with lengthy approval processes, limiting rapid capital deployment needed for effective flash loan arbitrage. Crypto-backed loans utilize blockchain assets as collateral, enabling instant liquidity and seamless execution of arbitrage strategies within decentralized finance (DeFi) platforms.

On-Chain Loan Origination

Traditional loans rely on centralized banks for asset-backed lending, requiring extensive credit checks and lengthy approval processes, while crypto-backed loans use on-chain loan origination to enable transparent, instant, and decentralized lending secured by digital assets. This innovation leverages blockchain technology to provide seamless collateral management, real-time verification, and automated smart contract execution, reducing intermediaries and enhancing access to credit.

Smart Contract Underwriting

Smart contract underwriting in crypto-backed loans automates asset verification and risk assessment using blockchain technology, reducing the need for manual intervention and increasing transparency. Traditional loans rely on manual underwriting processes, often resulting in longer approval times and increased operational costs compared to the efficiency of smart contracts in securing collateral and enforcing loan terms.

Stablecoin Collateralization

Traditional loans rely on physical assets or credit history for collateral, often resulting in lengthy approval times and less flexible terms. Crypto-backed loans, particularly those using stablecoin collateralization, enable faster access to funds, reduce volatility risk, and enhance liquidity by leveraging blockchain technology.

DeFi Loan-to-Value (LTV)

Traditional loans typically offer Loan-to-Value (LTV) ratios ranging from 50% to 80% based on credit history and physical collateral appraisal, whereas crypto-backed loans in DeFi markets often provide higher LTVs up to 70% with faster approval and transparent smart contract enforcement. DeFi's LTV ratios adjust dynamically with real-time asset valuations and liquidation mechanisms, enhancing flexibility but introducing volatility risks absent in conventional asset-backed lending.

Oracle Risk Management

Traditional loans rely heavily on credit scores and manual risk assessments, often leading to slower approval processes and limited transparency. In contrast, crypto-backed loans utilize Oracle Risk Management systems to provide real-time, automated asset valuation and mitigate volatility risks, enhancing security and efficiency in asset-backed lending.

Yield Farming Leverage

Traditional loans for asset-backed lending offer fixed interest rates and strict credit evaluations, limiting flexibility in yield farming leverage; crypto-backed loans enable users to leverage digital assets as collateral, providing faster access to capital and enhanced exposure to yield farming opportunities while mitigating liquidation risks through smart contract automation. Yield farming leverage via crypto-backed loans increases potential returns by unlocking capital from illiquid assets, though borrowers face volatility and platform-specific risks absent in conventional lending models.

Cross-Chain Collateral Swaps

Traditional loans rely on fiat currency and centralized financial institutions for asset-backed lending, limiting flexibility and cross-border collateral options. Crypto-backed loans enable cross-chain collateral swaps, allowing borrowers to leverage digital assets from multiple blockchain networks, increasing liquidity and optimizing loan terms through decentralized finance protocols.

Tokenized Asset Pledging

Traditional loans rely on physical collateral such as real estate or vehicles, whereas crypto-backed loans utilize tokenized assets, enabling seamless digital asset pledging that accelerates loan approval and reduces counterparty risk. Tokenized asset pledging enhances transparency and liquidity, allowing borrowers to leverage a broader range of digital assets as collateral within decentralized finance platforms.

Traditional Loan vs Crypto-Backed Loan for asset-backed lending Infographic

moneydiff.com

moneydiff.com