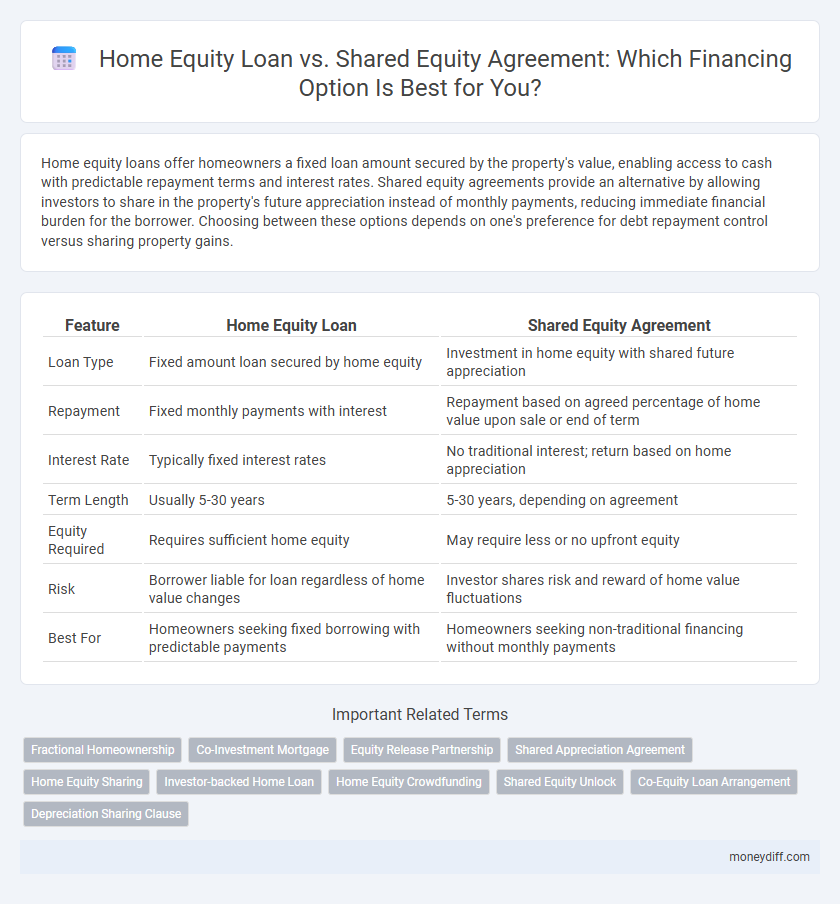

Home equity loans offer homeowners a fixed loan amount secured by the property's value, enabling access to cash with predictable repayment terms and interest rates. Shared equity agreements provide an alternative by allowing investors to share in the property's future appreciation instead of monthly payments, reducing immediate financial burden for the borrower. Choosing between these options depends on one's preference for debt repayment control versus sharing property gains.

Table of Comparison

| Feature | Home Equity Loan | Shared Equity Agreement |

|---|---|---|

| Loan Type | Fixed amount loan secured by home equity | Investment in home equity with shared future appreciation |

| Repayment | Fixed monthly payments with interest | Repayment based on agreed percentage of home value upon sale or end of term |

| Interest Rate | Typically fixed interest rates | No traditional interest; return based on home appreciation |

| Term Length | Usually 5-30 years | 5-30 years, depending on agreement |

| Equity Required | Requires sufficient home equity | May require less or no upfront equity |

| Risk | Borrower liable for loan regardless of home value changes | Investor shares risk and reward of home value fluctuations |

| Best For | Homeowners seeking fixed borrowing with predictable payments | Homeowners seeking non-traditional financing without monthly payments |

Understanding Home Equity Loans: An Overview

Home equity loans allow homeowners to borrow against the accumulated value of their property, offering a fixed interest rate and predictable monthly payments. These loans provide a lump sum amount based on the difference between the home's current market value and the outstanding mortgage balance. Understanding the terms, interest rates, and repayment schedules is crucial when comparing home equity loans to shared equity agreements, which involve selling a portion of property ownership to an investor in exchange for upfront cash.

What is a Shared Equity Agreement?

A Shared Equity Agreement is a financing arrangement where an investor provides funds to a homeowner in exchange for a percentage of the property's future appreciation or depreciation. Unlike a traditional Home Equity Loan that requires monthly repayments with fixed interest, Shared Equity Agreements involve no monthly payments but share the risk and rewards of the property's value changes. This option is ideal for homeowners seeking lump-sum funds without increasing monthly debt obligations, often used for home improvements or debt consolidation.

Key Differences Between Home Equity Loans and Shared Equity Agreements

Home equity loans provide a lump sum borrowed against the borrower's home value, requiring fixed monthly repayments with interest, while shared equity agreements involve a third party investing in a percentage of the home's future appreciation without monthly payments. Unlike home equity loans, shared equity agreements do not increase debt but share potential profits or losses when the property is sold. Borrowers retain ownership with home equity loans but must split appreciation gains with investors under shared equity agreements.

Eligibility Criteria: Home Equity Loan vs Shared Equity

Home equity loans typically require a borrower to have substantial home ownership with significant equity, a strong credit score usually above 620, and stable income to qualify. Shared equity agreements often have more flexible eligibility criteria, welcoming homeowners with limited equity or lower credit scores, as the investor takes on part of the risk. The loan-to-value ratio (LTV) limits for home equity loans are generally around 80-85%, whereas shared equity agreements focus more on the property's future value appreciation potential than immediate equity or credit scores.

Costs and Fees: Comparing Both Loan Options

Home equity loans typically involve fixed interest rates and upfront costs such as appraisal, origination, and closing fees, while shared equity agreements often charge no monthly payments but include a percentage of the home's future appreciation as a cost. Home equity loans have predictable costs and fees, making budgeting easier, whereas shared equity agreements can result in higher total repayment if property values increase significantly. Understanding these cost structures is essential for borrowers to choose the most financially advantageous loan option based on their long-term plans.

Impact on Homeownership and Property Rights

Home Equity Loans provide borrowers full ownership and control over their property while leveraging home value for cash, with fixed repayment terms and interest rates impacting monthly payments. Shared Equity Agreements involve a third-party investor owning a percentage of the property, reducing loan payments but sharing future home appreciation or depreciation, which affects long-term equity and ownership rights. The choice influences property rights distinctly: Home Equity Loans maintain sole ownership, whereas Shared Equity Agreements create shared ownership and profit-sharing obligations.

Repayment Terms: Home Equity Loans vs Shared Equity Agreements

Home equity loans require fixed monthly repayments over a predetermined term, typically ranging from 5 to 30 years, with interest rates either fixed or variable. Shared equity agreements involve repayment based on a percentage of the home's future value at sale or refinance, with no monthly payments required during the agreement term. This structure means borrowers repay more or less depending on market appreciation or depreciation, contrasting the predictable repayment schedule of home equity loans.

Risks and Benefits of Home Equity Loans

Home equity loans offer fixed interest rates and predictable monthly payments, making them ideal for homeowners seeking financial stability. However, they carry the risk of foreclosure if borrowers default, as the home serves as collateral. Benefits include potential tax-deductible interest and access to substantial funds, but risks involve reduced home equity and increased debt load.

Pros and Cons of Shared Equity Agreements

Shared equity agreements offer the advantage of access to funds without immediate monthly repayments or interest accumulation, making them ideal for homeowners needing liquidity without increasing debt. However, the cons include potential sharing of significant home appreciation with the investor and limited control over property decisions, which can impact long-term financial outcomes. Unlike traditional home equity loans, shared equity agreements may reduce future profit from home sales, requiring careful evaluation of the equity percentage offered.

Which Loan Option Fits Your Financial Goals?

Home equity loans provide a fixed interest rate and predictable monthly payments, ideal for homeowners seeking stable financing with full ownership retention. Shared equity agreements offer flexible repayment terms tied to property value, suited for those willing to share future home appreciation in exchange for reduced upfront costs. Evaluating your long-term financial goals and risk tolerance helps determine if a traditional home equity loan's certainty or a shared equity agreement's partnership aligns better with your needs.

Related Important Terms

Fractional Homeownership

Home equity loans provide borrowers with a lump sum based on the equity of their property, requiring fixed repayment schedules and interest, while shared equity agreements involve a third-party investor owning a fractional share of the home in exchange for a percentage of future appreciation or depreciation. Fractional homeownership through shared equity agreements reduces monthly financial burden and risk compared to traditional home equity loans, offering flexible capital access without increasing debt obligations.

Co-Investment Mortgage

A Home Equity Loan provides borrowers with a lump sum based on their property's equity, typically requiring full repayment with interest, while a Shared Equity Agreement offers a co-investment mortgage structure where the lender shares in the property's future appreciation instead of charging traditional interest. This co-investment mortgage aligns lender and borrower interests, enabling more flexible repayment tied to the home's value fluctuations.

Equity Release Partnership

Home Equity Loan offers a fixed amount based on the homeowner's accumulated equity, while a Shared Equity Agreement through Equity Release Partnership allows borrowing against future home value appreciation without monthly repayments. Equity Release Partnership specializes in shared equity agreements that provide flexible access to funds by sharing a portion of future home value changes instead of creating additional debt.

Shared Appreciation Agreement

Shared Appreciation Agreements allow homeowners to access funds without traditional monthly payments by sharing a portion of future home value appreciation with lenders. Unlike home equity loans, these agreements reduce immediate financial strain but require repayment based on the property's market performance at sale or maturity.

Home Equity Sharing

Home equity loans offer borrowers a fixed amount based on the existing equity in their property, requiring regular repayments with interest, while shared equity agreements allow investors to co-own a percentage of the home in exchange for funds, with repayment tied to the property's future value rather than fixed installments. Home equity sharing provides flexibility by eliminating monthly payments but involves sharing potential appreciation or depreciation, making it a strategic option for homeowners seeking capital without incurring additional debt.

Investor-backed Home Loan

Investor-backed home loans through shared equity agreements offer flexible repayment options based on property value appreciation, contrasting with traditional home equity loans that require fixed monthly payments and accrue interest. Shared equity agreements reduce borrower risk by linking repayment to market performance, making them attractive alternatives for homeowners seeking to leverage equity without increasing debt burden.

Home Equity Crowdfunding

Home equity crowdfunding enables homeowners to access funds through collective investments, offering an alternative to traditional home equity loans that involve fixed interest rates and repayment schedules; this shared equity agreement allows investors to earn returns based on property appreciation rather than interest payments. Unlike conventional loans, shared equity agreements align homeowner and investor interests by distributing equity gains, making home equity crowdfunding a flexible financing solution with potential for shared financial growth.

Shared Equity Unlock

Shared Equity Unlock allows homeowners to access funds by selling a percentage of their property's future appreciation, providing a flexible alternative to traditional home equity loans that require monthly repayments and interest. This arrangement can reduce financial strain by aligning loan repayment with property value changes rather than fixed payment schedules.

Co-Equity Loan Arrangement

A Home Equity Loan provides borrowers with a lump sum based on their home's value, requiring fixed monthly payments and accruing interest, while a Shared Equity Agreement involves a co-equity loan arrangement where an investor shares in the home's appreciation or depreciation without regular payments. Co-equity loan arrangements offer flexible financing by aligning lender returns with property market performance, reducing immediate borrower obligations compared to traditional home equity loans.

Depreciation Sharing Clause

A Home Equity Loan typically involves fixed repayment terms based on the borrowed amount and accrued interest, without any involvement in property value fluctuations or depreciation. In contrast, a Shared Equity Agreement includes a depreciation sharing clause where the lender or investor shares in the decrease or increase of the property's market value, impacting the final repayment amount.

Home Equity Loan vs Shared Equity Agreement for Loan Infographic

moneydiff.com

moneydiff.com