Business loans provide a fixed amount with set repayment terms, offering predictable monthly payments that help businesses plan their cash flow effectively. Revenue-based financing adjusts repayments based on a percentage of the business's monthly revenue, allowing flexibility during fluctuating income periods and aligning payment obligations with actual earnings. Choosing between these options depends on a company's financial stability and growth projections, as traditional loans suit steady cash flow while revenue-based financing supports businesses expecting variable income.

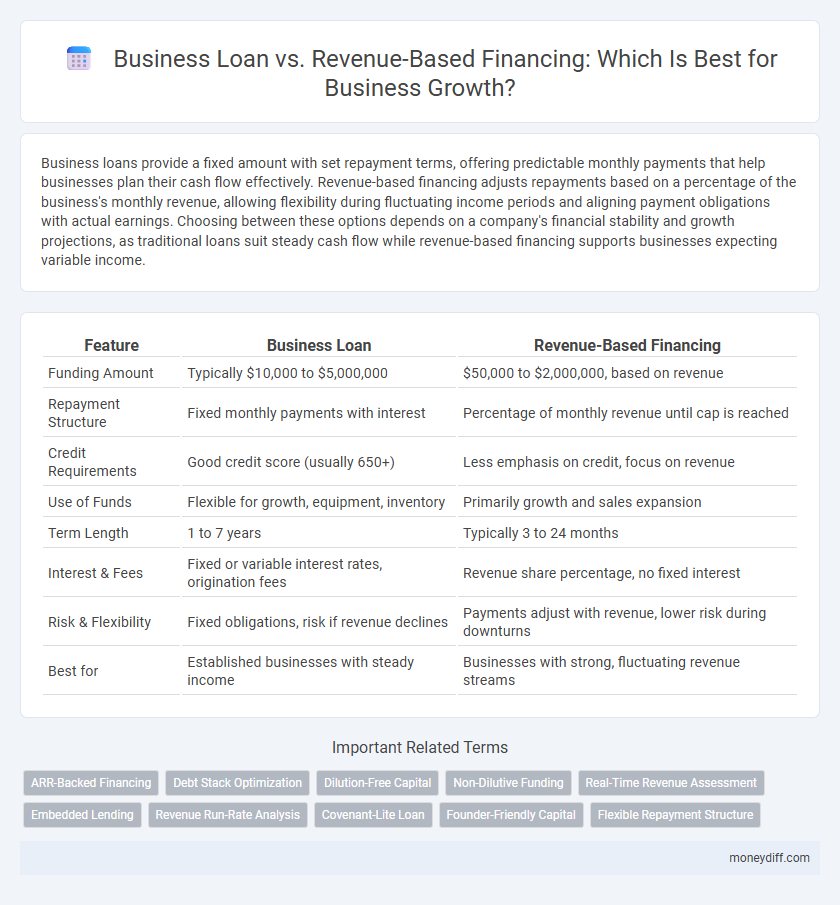

Table of Comparison

| Feature | Business Loan | Revenue-Based Financing |

|---|---|---|

| Funding Amount | Typically $10,000 to $5,000,000 | $50,000 to $2,000,000, based on revenue |

| Repayment Structure | Fixed monthly payments with interest | Percentage of monthly revenue until cap is reached |

| Credit Requirements | Good credit score (usually 650+) | Less emphasis on credit, focus on revenue |

| Use of Funds | Flexible for growth, equipment, inventory | Primarily growth and sales expansion |

| Term Length | 1 to 7 years | Typically 3 to 24 months |

| Interest & Fees | Fixed or variable interest rates, origination fees | Revenue share percentage, no fixed interest |

| Risk & Flexibility | Fixed obligations, risk if revenue declines | Payments adjust with revenue, lower risk during downturns |

| Best for | Established businesses with steady income | Businesses with strong, fluctuating revenue streams |

Understanding Business Loans: Traditional Funding Explained

Business loans typically provide a fixed amount of capital with set repayment terms and interest rates, making them ideal for businesses seeking predictable financing for expansion or equipment purchases. Traditional loans often require strong credit history, collateral, and detailed financial documentation, emphasizing stability and lower risk for lenders. Understanding the structured repayment schedules and qualification criteria helps businesses evaluate if traditional loans align with their cash flow and growth strategies.

What is Revenue-Based Financing?

Revenue-Based Financing (RBF) is a funding model where businesses receive capital in exchange for a fixed percentage of their monthly revenue until a predetermined amount is repaid. Unlike traditional business loans with fixed repayments and interest rates, RBF adjusts payments based on income fluctuations, providing flexibility during slower periods. This financing method suits businesses with recurring revenue streams seeking growth without diluting equity or risking collateral.

Key Differences Between Business Loans and Revenue-Based Financing

Business loans offer fixed repayment schedules and require collateral or strong credit scores, making them suitable for established businesses with predictable cash flow. Revenue-based financing provides flexible repayments tied to a percentage of monthly revenue, allowing businesses with fluctuating income to scale without immediate high debt obligations. Key differences include repayment structure, qualification criteria, and impact on cash flow, influencing which option best supports sustainable business growth.

Eligibility Requirements: Business Loan vs Revenue-Based Financing

Business loans typically require strong credit scores, collateral, and detailed financial documentation to qualify, making them more suited for established businesses with solid credit histories. Revenue-based financing eligibility centers on consistent monthly revenue, with flexible credit requirements and no collateral, appealing to startups or companies with fluctuating cash flows. Understanding these differences helps businesses select financing options aligned with their growth stage and financial stability.

Repayment Structures Compared

Business loans typically require fixed monthly repayments over a set term, providing predictable cash flow management for businesses. Revenue-Based Financing (RBF) adjusts repayment amounts based on a percentage of monthly revenue, offering flexibility during fluctuating sales periods. This variable repayment structure in RBF reduces financial strain during low revenue months, making it advantageous for businesses with seasonal or unpredictable income patterns.

Impact on Cash Flow and Financial Planning

Business loans typically require fixed monthly repayments, which can strain cash flow during low-revenue periods, making financial planning more rigid. Revenue-based financing adjusts repayments based on a percentage of monthly revenue, providing flexible cash flow management and aligning payment obligations with business performance. This flexibility supports smoother financial planning but may result in higher total repayment if revenue grows significantly.

Flexibility and Scalability for Growing Businesses

Business loans provide fixed repayment schedules and higher funding amounts, ideal for businesses with steady cash flow looking for predictable financing. Revenue-based financing offers flexible repayments tied to monthly revenue, allowing scalability without the pressure of fixed payments during fluctuating income periods. Companies experiencing growth variability benefit from revenue-based models, while those with stable profits may prefer the certainty of traditional business loans.

Costs and Interest Rates: Which is More Affordable?

Business loans often feature fixed interest rates and predictable repayment schedules, making budgeting easier but can involve higher upfront costs and stringent credit requirements. Revenue-based financing offers flexible payments tied to a percentage of monthly revenue, which reduces pressure during low-income periods but may result in higher overall costs depending on business performance. Comparing these options, businesses with steady cash flow might find traditional loans more affordable, while startups seeking flexibility could benefit more from revenue-based financing despite variable total costs.

Pros and Cons: Business Loans vs Revenue-Based Financing

Business loans offer fixed repayment terms and often lower interest rates, providing predictable cash flow management but require strong credit and collateral, which can limit access. Revenue-based financing aligns repayments with business performance, enhancing flexibility during low revenues but may result in higher overall costs if the business grows rapidly. Choosing between these options depends on the company's risk tolerance, cash flow stability, and long-term growth projections.

Choosing the Best Option for Your Business Growth

Business loans provide fixed repayment schedules and predictable interest rates, ideal for businesses with steady cash flow and clear capital needs. Revenue-based financing offers flexible repayments tied to business revenue, benefiting companies with fluctuating income and seasonal sales cycles. Evaluating cash flow stability, growth projections, and repayment capacity will guide entrepreneurs in selecting the financing option that maximizes growth potential.

Related Important Terms

ARR-Backed Financing

ARR-backed financing offers scalable capital tied directly to annual recurring revenue, providing flexible repayment aligned with business performance. Business loans typically require fixed payments and collateral, making ARR-backed revenue-based financing a preferred option for growth companies prioritizing cash flow management and scalability.

Debt Stack Optimization

Business loans provide fixed repayment schedules and interest rates, allowing predictable cash flow management, while revenue-based financing offers flexible payments tied to business revenue, minimizing cash strain during slow periods. Optimizing the debt stack involves blending these options to balance cost of capital and repayment flexibility, enhancing overall financial agility for sustainable business growth.

Dilution-Free Capital

Business loans provide fixed repayment terms without equity dilution, ensuring full ownership retention but require consistent cash flow for debt servicing. Revenue-based financing offers flexible repayments tied to revenue, enabling growth without giving up equity or collateral, ideal for businesses seeking dilution-free capital with adaptable cash flow demands.

Non-Dilutive Funding

Business loans provide fixed repayment schedules and interest rates ideal for predictable cash flow, while revenue-based financing offers flexible repayments tied to actual sales, aligning costs with income without equity dilution. Both options preserve ownership, making them attractive non-dilutive funding sources for businesses aiming to scale without sacrificing control.

Real-Time Revenue Assessment

Business loans typically require fixed repayments and strict credit evaluations, while revenue-based financing offers flexible payments tied to real-time revenue fluctuations, enabling businesses to manage cash flow more effectively during growth phases. Real-time revenue assessment allows lenders to adjust repayment schedules based on actual sales performance, reducing financial strain and aligning funding costs with business success.

Embedded Lending

Business loans provide lump-sum capital with fixed repayment schedules, while revenue-based financing offers flexible repayments tied to a percentage of monthly revenue, reducing cash flow constraints for growing businesses. Embedded lending integrates these financing options directly within business platforms, streamlining access to capital and enabling faster business growth through seamless credit solutions.

Revenue Run-Rate Analysis

Business loans offer fixed repayment schedules and predictable cash flow management, making them suitable for companies with stable revenue and credit history. Revenue-based financing aligns repayments directly with a company's revenue run-rate, providing flexibility during fluctuating sales periods and supporting growth without fixed debt obligations.

Covenant-Lite Loan

Covenant-lite loans, which feature fewer restrictions and financial covenants, offer businesses greater operational flexibility compared to traditional business loans, making them attractive for growth-focused companies. Revenue-based financing provides an alternative repayment model tied to cash flow, but covenant-lite loans often deliver more predictable funding with less interference in business decisions, aiding scalable expansion.

Founder-Friendly Capital

Business loans offer fixed repayment schedules and predictable costs, making them suitable for businesses with steady cash flows, while revenue-based financing provides flexible payments tied to monthly revenue, aligning with fluctuating income but potentially higher costs over time. Founder-friendly capital emphasizes minimal equity dilution and control retention, positioning revenue-based financing as an attractive option for entrepreneurs seeking growth without sacrificing ownership.

Flexible Repayment Structure

Business loans offer fixed repayment schedules with predetermined interest rates, providing predictable cash flow management but less flexibility in fluctuating revenue periods. Revenue-based financing allows repayment tied directly to a percentage of monthly revenue, enabling businesses to adjust payments dynamically during slower months and better align growth with financial obligations.

Business Loan vs Revenue-Based Financing for business growth Infographic

moneydiff.com

moneydiff.com