Title loans offer fast access to cash by using your vehicle's title as collateral, with quick approval but often higher interest rates and shorter repayment terms. Vehicle equity lines provide a revolving credit option based on your car's equity, typically featuring lower interest rates and more flexible repayment plans but requiring more time for approval. Choosing between the two depends on your need for speed versus long-term cost and repayment flexibility.

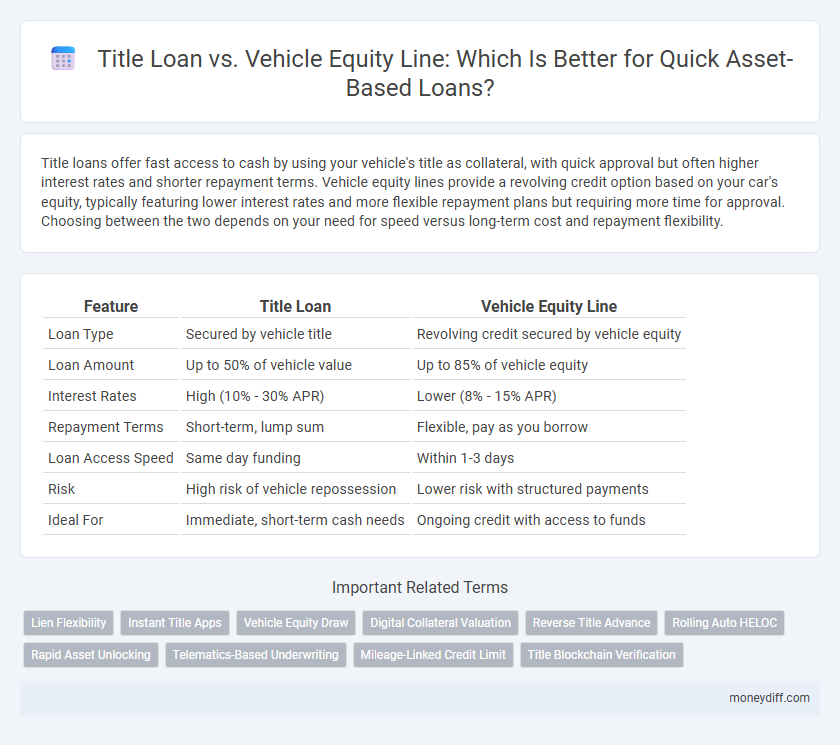

Table of Comparison

| Feature | Title Loan | Vehicle Equity Line |

|---|---|---|

| Loan Type | Secured by vehicle title | Revolving credit secured by vehicle equity |

| Loan Amount | Up to 50% of vehicle value | Up to 85% of vehicle equity |

| Interest Rates | High (10% - 30% APR) | Lower (8% - 15% APR) |

| Repayment Terms | Short-term, lump sum | Flexible, pay as you borrow |

| Loan Access Speed | Same day funding | Within 1-3 days |

| Risk | High risk of vehicle repossession | Lower risk with structured payments |

| Ideal For | Immediate, short-term cash needs | Ongoing credit with access to funds |

Understanding Title Loans: A Quick Overview

Title loans provide fast cash by using your vehicle's title as collateral, often with higher interest rates and shorter repayment terms than traditional loans. Vehicle equity lines leverage the available equity in your car, offering flexible borrowing limits and lower interest rates based on vehicle value and credit score. Understanding the risks and costs of title loans versus vehicle equity lines helps borrowers choose the best quick asset-based loan option.

What is a Vehicle Equity Line?

A Vehicle Equity Line is a revolving credit line secured by the equity in your vehicle, allowing you to borrow funds as needed up to a predetermined limit. Unlike a title loan that provides a lump sum payment, a Vehicle Equity Line offers flexibility with withdrawals and repayments similar to a credit card. This type of loan typically features lower interest rates and longer repayment terms, making it a cost-effective option for leveraging your vehicle's value.

Key Differences Between Title Loans and Vehicle Equity Lines

Title loans provide a lump sum based on the vehicle's current value and require repayment within a short term, often with higher interest rates and risks of repossession. Vehicle equity lines offer revolving credit using the vehicle's equity, allowing flexible borrowing and repayments over time with generally lower interest rates. Unlike title loans, vehicle equity lines typically retain the borrower's ownership and have more consumer protections.

Eligibility Criteria for Asset-Based Loans

Title loans require the borrower to own the vehicle outright with a clear title, ensuring the lender has immediate collateral, while vehicle equity lines typically demand both ownership and a minimum credit score to qualify. Eligibility for title loans often hinges on meeting age requirements and providing proof of income, whereas vehicle equity lines assess the borrower's creditworthiness and vehicle equity percentage. Lenders may also require valid identification and active registration for both loan types, but vehicle equity lines emphasize the equity available in the vehicle beyond existing liens.

Application Process: Title Loan vs. Vehicle Equity Line

Title loans require a straightforward application process involving proof of vehicle ownership and identification, with funds often available within 24 hours. Vehicle equity lines involve a more detailed evaluation of the vehicle's current value and the borrower's creditworthiness, typically requiring longer approval times. Both options use the vehicle as collateral, but title loans offer quicker access to cash due to simpler documentation and faster processing.

Interest Rates and Fees Comparison

Title loans typically have higher interest rates, often ranging from 25% to 300% APR, coupled with substantial fees that can significantly increase the overall cost. Vehicle equity lines of credit generally offer lower interest rates, commonly between 5% and 15% APR, with fees that tend to be more transparent and manageable. Choosing a vehicle equity line can reduce borrowing costs and provide more flexible repayment options compared to the often costly and rigid structure of title loans.

Repayment Terms and Flexibility

Title loans typically offer shorter repayment terms of 15 to 30 days with a fixed payment amount, often resulting in higher monthly costs and less flexibility. Vehicle equity lines of credit provide longer repayment periods, usually spanning several months to years, allowing borrowers to make variable payments based on their financial situation. The flexibility in vehicle equity lines can help manage cash flow more effectively compared to the rigid, lump-sum repayment requirements of title loans.

Risks and Consequences of Default

Title loans often carry higher interest rates and shorter repayment terms, increasing the risk of vehicle repossession upon default. Vehicle equity lines generally offer lower interest rates but require consistent payments to prevent credit score damage and potential foreclosure on the vehicle. Both loan types can lead to significant financial consequences, including loss of transportation and increased debt due to fees and penalties.

Which Option is Right for You?

Title loans offer fast access to cash by using your vehicle's title as collateral, often with higher interest rates and shorter repayment terms. Vehicle equity lines of credit provide a revolving credit option based on your vehicle's equity, usually featuring lower interest rates and more flexible repayment plans. Choosing the right option depends on your financial urgency, ability to meet payment schedules, and tolerance for risk related to interest rates and potential vehicle repossession.

Tips for Choosing Safe Asset-Based Loans

When choosing safe asset-based loans such as title loans or vehicle equity lines, prioritize lenders with transparent terms, including clear interest rates and repayment schedules to avoid hidden fees. Evaluate the loan-to-value ratio carefully, ensuring it aligns with your vehicle's market value to prevent excessive borrowing that risks repossession. Verify lender licensing and customer reviews to confirm legitimacy and protect against predatory lending practices in quick asset-based financing.

Related Important Terms

Lien Flexibility

Title loans typically place a lien directly on the vehicle's title, restricting the borrower from selling or transferring the asset until the loan is repaid, whereas vehicle equity lines offer more lien flexibility, allowing borrowers to access funds against their car's equity while retaining ownership and more control over the lien status. This flexibility often makes vehicle equity lines a preferable option for borrowers seeking quick, asset-based financing without losing full vehicle rights.

Instant Title Apps

Title loans provide immediate cash advances by using vehicle ownership as collateral, offering faster approval through Instant Title apps compared to traditional vehicle equity lines that rely on credit checks and longer processing times; Instant Title apps streamline asset-based loans by verifying ownership instantly, enabling quicker access to funds for borrowers needing urgent liquidity.

Vehicle Equity Draw

Vehicle Equity Draw provides a flexible, revolving line of credit secured by your vehicle's equity, allowing multiple withdrawals and repayments without reapplying. Unlike title loans that offer a lump sum with fixed terms, Vehicle Equity Draw optimizes cash flow management by leveraging vehicle equity as a dynamic financial resource for quick access to funds.

Digital Collateral Valuation

Digital collateral valuation enhances accuracy and speed in both title loans and vehicle equity lines by providing real-time asset assessments through advanced algorithms and data analytics. This technology minimizes risk and streamlines approval processes, making quick asset-based loans more efficient and reliable for lenders and borrowers alike.

Reverse Title Advance

Reverse Title Advance offers rapid access to funds by leveraging vehicle equity without the need to sell the car, contrasting with traditional title loans that require full title transfer. This vehicle equity line provides flexible repayment terms and often lower interest rates, making it a preferred choice for quick, asset-based financing.

Rolling Auto HELOC

Rolling Auto HELOCs offer flexible borrowing by leveraging vehicle equity with variable credit limits and interest rates, making them more adaptable than traditional title loans that provide fixed, lump-sum amounts secured solely by vehicle titles. Unlike title loans, which often carry higher interest and risk of repossession, a Rolling Auto HELOC functions similarly to a home equity line of credit, allowing borrowers to draw funds repeatedly against their vehicle's equity while repaying the balance over time.

Rapid Asset Unlocking

Title loans provide immediate cash by leveraging full vehicle ownership, ensuring rapid asset unlocking but often carry higher interest rates and shorter terms. Vehicle equity lines offer flexible borrowing against accumulated equity, enabling quick access to funds while allowing continued vehicle use.

Telematics-Based Underwriting

Telematics-based underwriting enhances title loans by using real-time vehicle data to assess risk and personalize loan terms, offering faster approval compared to traditional vehicle equity lines that rely on static vehicle valuations. This data-driven approach improves accuracy in credit risk evaluation and enables more flexible lending for quick asset-based loans.

Mileage-Linked Credit Limit

Title loans typically offer quick access to cash by using a vehicle's title as collateral, but the credit limit is often fixed regardless of mileage. Vehicle equity lines, however, provide a mileage-linked credit limit that adjusts based on the vehicle's usage, allowing borrowers to access more funds as their mileage decreases, reflecting real-time asset value.

Title Blockchain Verification

Title loans and vehicle equity lines both leverage asset-based financing but title blockchain verification enhances security and transparency by providing an immutable digital record of vehicle ownership, reducing fraud risks. This technology enables faster approval processes and increased trust between lenders and borrowers by verifying title authenticity in real-time on a decentralized ledger.

Title loan vs Vehicle equity line for quick asset-based loans. Infographic

moneydiff.com

moneydiff.com