Auto loans typically offer flexible financing options for a wide range of vehicles, while green vehicle loans provide specialized incentives and lower interest rates to promote eco-friendly cars. Borrowers interested in sustainability often benefit from green vehicle loans due to potential tax credits and reduced environmental impact. Choosing between these loans depends on individual priorities like cost savings, environmental benefits, and eligibility criteria.

Table of Comparison

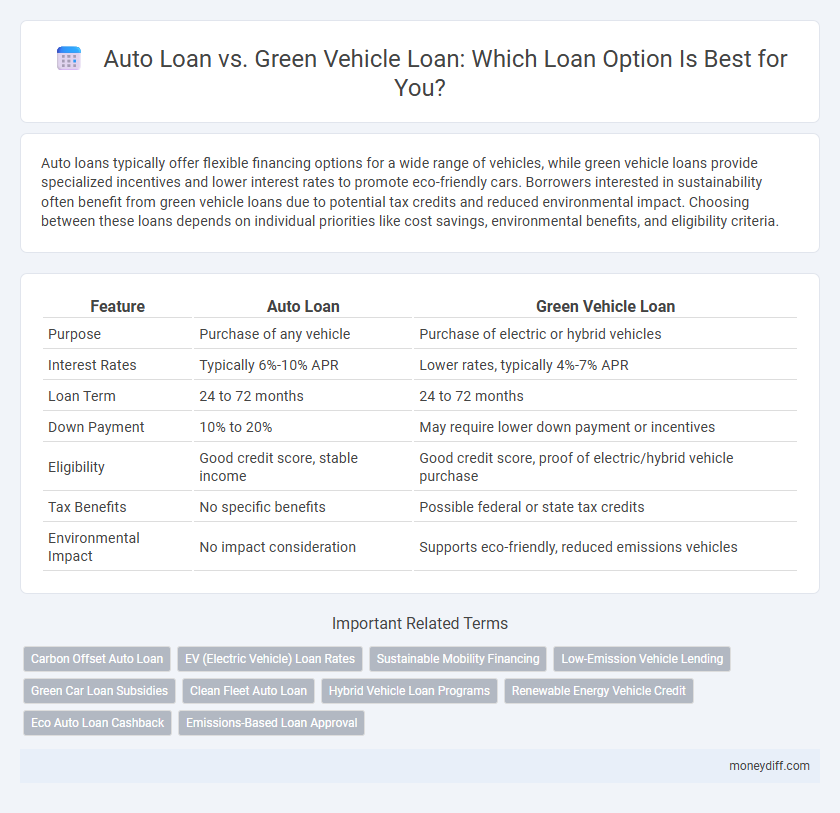

| Feature | Auto Loan | Green Vehicle Loan |

|---|---|---|

| Purpose | Purchase of any vehicle | Purchase of electric or hybrid vehicles |

| Interest Rates | Typically 6%-10% APR | Lower rates, typically 4%-7% APR |

| Loan Term | 24 to 72 months | 24 to 72 months |

| Down Payment | 10% to 20% | May require lower down payment or incentives |

| Eligibility | Good credit score, stable income | Good credit score, proof of electric/hybrid vehicle purchase |

| Tax Benefits | No specific benefits | Possible federal or state tax credits |

| Environmental Impact | No impact consideration | Supports eco-friendly, reduced emissions vehicles |

Understanding Auto Loans and Green Vehicle Loans

Auto loans typically offer financing for a wide range of vehicles including cars, trucks, and SUVs, with terms based on the vehicle's value, borrower's credit score, and loan duration. Green vehicle loans specifically target eco-friendly cars such as electric or hybrid models, often providing lower interest rates or incentives to promote sustainable transportation. Understanding the differences in eligibility, interest rates, and repayment terms can help borrowers choose the most cost-effective and environmentally beneficial financing option.

Key Differences Between Auto and Green Vehicle Loans

Auto loans typically finance conventional gasoline or diesel vehicles with standard interest rates and loan terms, while green vehicle loans target electric, hybrid, or other eco-friendly cars, often offering lower interest rates and special incentives to promote sustainability. Green vehicle loans may include tax credits, rebates, or reduced processing fees that are not available with traditional auto loans. Loan eligibility criteria and repayment periods can also vary, with green vehicle loans frequently providing more flexible options to encourage environmentally responsible purchases.

Eligibility Criteria for Auto Loans vs Green Vehicle Loans

Auto loans typically require applicants to have a stable income, a good credit score, and proof of residency, with eligibility often influenced by the borrower's debt-to-income ratio and employment history. Green vehicle loans may have similar credit requirements but often include additional criteria such as the vehicle being certified as environmentally friendly, eligibility for government incentives, or adherence to specific energy efficiency standards. Some lenders also prioritize applicants with a history of sustainable practices or offer preferential rates to promote green vehicle adoption.

Interest Rates Comparison: Auto Loan vs Green Vehicle Loan

Auto loans typically have higher interest rates compared to green vehicle loans, which often benefit from government incentives and lower financing costs to promote eco-friendly transportation. The average interest rate for standard auto loans ranges from 4% to 7%, while green vehicle loans, such as those for electric or hybrid cars, can have rates as low as 2% to 4%. Borrowers seeking green vehicle loans may also access tax credits and rebates that further reduce the overall cost of financing.

Loan Terms and Repayment Flexibility

Auto loans typically offer fixed loan terms ranging from 24 to 72 months, with consistent monthly repayments and limited flexibility for early payoff without penalties. Green vehicle loans often come with extended repayment periods and may include incentives such as lower interest rates or deferred payments, promoting affordability for eco-friendly purchases. Both loan types require assessment of repayment capacity, but green vehicle loans tend to provide more adaptable terms to support sustainable investment.

Environmental Impact: Why Choose a Green Vehicle Loan?

Green Vehicle Loans promote the purchase of eco-friendly cars, significantly reducing carbon emissions compared to traditional auto loans for gasoline vehicles. These loans often come with lower interest rates and incentives, encouraging borrowers to opt for electric or hybrid models that support environmental sustainability. Choosing a Green Vehicle Loan contributes to lowering air pollution and dependence on fossil fuels, aligning with global efforts to combat climate change.

Incentives and Benefits for Green Vehicle Loans

Green vehicle loans offer unique incentives such as lower interest rates, tax credits, and rebates that are often unavailable with traditional auto loans. These benefits reduce the overall cost of financing electric or hybrid cars, making them more affordable and environmentally friendly. Many governments and financial institutions provide exclusive programs to encourage the adoption of green vehicles through preferential loan terms and cash incentives.

Down Payment and Financing Options

Auto loans typically require a down payment ranging from 10% to 20% of the vehicle's purchase price, while green vehicle loans often offer lower or zero down payment options to promote eco-friendly car purchases. Financing options for auto loans generally include fixed or variable interest rates over terms of 36 to 72 months, whereas green vehicle loans may provide extended repayment terms and additional incentives such as tax credits or reduced interest rates. Borrowers seeking green vehicle loans benefit from specialized financing programs aimed at reducing upfront costs and supporting sustainable transportation choices.

Total Cost of Ownership: Traditional vs Green Vehicles

Total cost of ownership for auto loans varies significantly between traditional gasoline vehicles and green vehicles like electric or hybrid models due to differences in fuel, maintenance, and depreciation costs. Green vehicle loans often come with higher interest rates or shorter terms but are offset by lower fuel expenses, tax incentives, and reduced maintenance costs over time. Evaluating total cost of ownership requires considering loan terms alongside operational savings and resale value depreciation typical of green vehicles.

Choosing the Right Loan for Your Needs

Evaluating auto loans versus green vehicle loans involves comparing interest rates, loan terms, and eligibility criteria tailored to your vehicle type and financial situation. Green vehicle loans often offer lower interest rates and special incentives for electric or hybrid cars, making them cost-effective for eco-friendly buyers. Selecting the right loan requires analyzing your budget, vehicle preference, and long-term savings potential linked to energy-efficient transportation.

Related Important Terms

Carbon Offset Auto Loan

Carbon Offset Auto Loans integrate traditional auto financing with environmental benefits, enabling borrowers to purchase vehicles while funding projects that reduce carbon emissions. Green Vehicle Loans typically offer lower interest rates or incentives for electric or hybrid cars, emphasizing sustainability and eco-friendly transportation solutions.

EV (Electric Vehicle) Loan Rates

Electric Vehicle (EV) loan rates for green vehicle loans often feature lower interest rates compared to traditional auto loans, incentivizing eco-friendly purchases. Many lenders provide specialized green vehicle loan programs with more favorable terms, such as tax incentives and rebates, reducing overall financing costs for electric cars.

Sustainable Mobility Financing

Auto loans typically finance conventional vehicles with standard interest rates and repayment terms, whereas green vehicle loans offer lower rates or incentives to promote the purchase of electric or hybrid vehicles. Sustainable mobility financing emphasizes green vehicle loans, reducing carbon emissions and supporting eco-friendly transportation through government subsidies and favorable loan conditions.

Low-Emission Vehicle Lending

Low-emission vehicle lending through green vehicle loans offers lower interest rates and tax incentives compared to traditional auto loans, encouraging the purchase of environmentally friendly cars such as hybrids and electric vehicles. These specialized loans often include benefits like reduced down payments and flexible repayment terms, making sustainable vehicle ownership more accessible.

Green Car Loan Subsidies

Green vehicle loans often come with government subsidies and tax incentives that reduce the overall cost of borrowing compared to traditional auto loans, making them more financially attractive for eco-conscious buyers. These subsidies can include lower interest rates, cashback offers, or grants specifically designed to promote the purchase of electric or hybrid vehicles.

Clean Fleet Auto Loan

Clean Fleet Auto Loan offers competitive interest rates and flexible terms specifically designed for financing eco-friendly vehicles, making it a smarter choice compared to traditional auto loans that typically have higher rates and less focus on environmental benefits. This loan supports the purchase of hybrid, electric, and alternative fuel vehicles, promoting sustainability while providing financial incentives such as lower fees and potential tax benefits.

Hybrid Vehicle Loan Programs

Hybrid vehicle loan programs offer competitive interest rates and flexible terms specifically designed to promote eco-friendly transportation. Compared to traditional auto loans, these green vehicle loans often include incentives such as lower down payments, tax credits, and reduced financing costs to support the purchase of hybrid cars.

Renewable Energy Vehicle Credit

An auto loan typically offers standard financing options for conventional vehicles, whereas a green vehicle loan includes specialized incentives such as the Renewable Energy Vehicle Credit, which reduces the overall cost by providing tax credits for purchasing electric or hybrid cars. Leveraging the Renewable Energy Vehicle Credit through a green vehicle loan significantly lowers monthly payments and promotes sustainable transportation investments.

Eco Auto Loan Cashback

Eco Auto Loan Cashback offers significant savings on green vehicle loans by providing cash incentives for purchasing electric or hybrid cars, making it more cost-effective compared to traditional auto loans. These loans typically feature lower interest rates and special rebates aimed at promoting environmentally friendly transportation options.

Emissions-Based Loan Approval

Auto loans typically assess creditworthiness based on income and credit score, while green vehicle loans prioritize emissions data, offering lower interest rates for low-emission or electric vehicles. Emissions-based loan approval incentivizes environmentally friendly car purchases by integrating carbon footprint reduction metrics into the lending criteria.

Auto Loan vs Green Vehicle Loan for loan. Infographic

moneydiff.com

moneydiff.com