Home loans typically offer standard interest rates and flexible repayment terms for purchasing residential properties, while green home loans provide lower interest rates and incentives for energy-efficient or environmentally friendly homes. Choosing a green home loan supports sustainable living by encouraging the use of eco-friendly materials and renewable energy systems, often resulting in long-term savings on utility costs. Evaluating both options based on interest rates, eligibility criteria, and environmental benefits can help buyers make an informed decision for property investment.

Table of Comparison

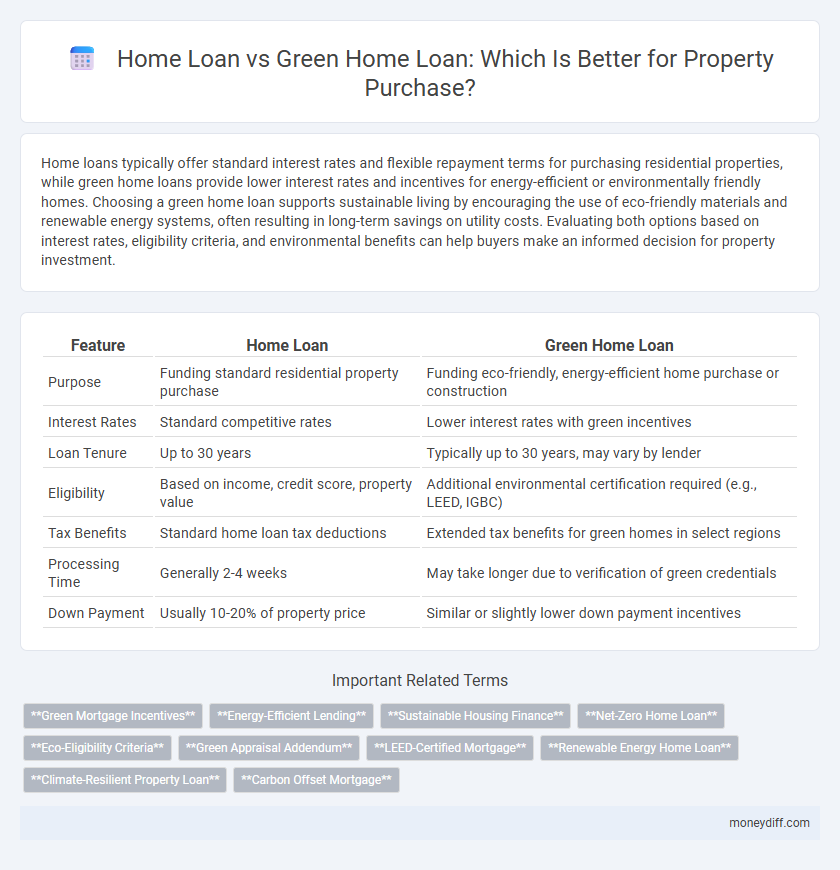

| Feature | Home Loan | Green Home Loan |

|---|---|---|

| Purpose | Funding standard residential property purchase | Funding eco-friendly, energy-efficient home purchase or construction |

| Interest Rates | Standard competitive rates | Lower interest rates with green incentives |

| Loan Tenure | Up to 30 years | Typically up to 30 years, may vary by lender |

| Eligibility | Based on income, credit score, property value | Additional environmental certification required (e.g., LEED, IGBC) |

| Tax Benefits | Standard home loan tax deductions | Extended tax benefits for green homes in select regions |

| Processing Time | Generally 2-4 weeks | May take longer due to verification of green credentials |

| Down Payment | Usually 10-20% of property price | Similar or slightly lower down payment incentives |

Understanding Home Loans: Basics and Benefits

Home loans provide traditional financing options for purchasing residential properties with fixed or variable interest rates tailored to borrower credit profiles. Green home loans offer similar financing but include incentives such as lower interest rates and tax benefits for energy-efficient, environmentally friendly homes. Borrowers benefit from lower monthly payments and long-term savings due to reduced utility costs and government subsidies linked to green property features.

What is a Green Home Loan?

A Green Home Loan is a specialized mortgage designed to finance energy-efficient and environmentally friendly homes, offering borrowers lower interest rates and tax benefits compared to traditional home loans. These loans specifically target properties built with sustainable materials, renewable energy sources, and water-saving fixtures, promoting reduced carbon footprints and long-term savings on utility bills. Financial institutions often require property certification from recognized green building councils to qualify for this loan, ensuring the home's compliance with eco-friendly standards.

Key Differences Between Home Loan and Green Home Loan

Home Loans typically offer standard interest rates and flexible tenure options for purchasing residential properties, while Green Home Loans provide lower interest rates and incentives for eco-friendly, energy-efficient homes. Green Home Loans often require certification of green features such as solar panels or efficient insulation, supporting sustainable living and reducing carbon footprints. Borrowers choosing Green Home Loans benefit from cost savings on both finance and long-term utility expenses compared to conventional Home Loans.

Eligibility Criteria for Home Loan vs Green Home Loan

Home loans typically require a stable income proof, good credit score, and property documentation, while green home loans additionally mandate proof of energy-efficient features or eco-friendly certifications for the property. Eligibility criteria for green home loans often include lower loan-to-value ratios and stricter appraisal of the home's environmental impact. Lenders may offer preferential interest rates and flexible repayment options on green home loans, emphasizing sustainability alongside financial credibility.

Interest Rates Comparison: Home Loan vs Green Home Loan

Home loans typically offer interest rates ranging from 7% to 9%, while green home loans present lower rates, generally between 6% to 8%, encouraging environmentally-friendly property investments. Financial institutions incentivize green home loans by providing up to 1% interest rate reduction compared to standard home loans, thus reducing the overall cost of borrowing. Borrowers benefit from lower EMIs and increased long-term savings when opting for green home loans due to these competitive interest rate advantages.

Environmental Impact: Green Home Loan Advantages

Green Home Loans offer lower interest rates and tax benefits compared to conventional Home Loans, incentivizing eco-friendly property purchases. Properties financed through Green Home Loans typically incorporate energy-efficient designs, renewable energy installations, and sustainable building materials, significantly reducing the carbon footprint. This financing option supports environmental impact reduction by promoting sustainable housing developments that lower greenhouse gas emissions and decrease long-term utility costs.

Government Incentives and Subsidies for Green Home Loans

Green Home Loans offer unique government incentives and subsidies designed to promote environmentally friendly property purchases, including lower interest rates and tax rebates that traditional Home Loans typically do not provide. These benefits reduce the overall cost of financing energy-efficient homes, making them more attractive for buyers aiming to minimize their ecological footprint. Access to such subsidies significantly enhances the affordability and sustainability of green properties compared to standard home loan options.

Cost Savings Over Time: Green Home Loan vs Traditional Home Loan

Green Home Loans typically offer lower interest rates and government-backed incentives compared to traditional Home Loans, resulting in significant cost savings over the loan tenure. Energy-efficient properties financed through Green Home Loans reduce utility expenses, amplifying overall savings beyond just the loan interest. The combined effect of reduced borrowing costs and ongoing operational savings makes Green Home Loans a financially advantageous choice for environmentally conscious homebuyers.

Application Process: Home Loan vs Green Home Loan

The application process for a Home Loan typically involves standard documentation such as income proof, property details, and credit history, with a timeline of 7-14 days for approval. Green Home Loans require similar documents but add certification of energy-efficient features or eco-friendly construction compliance, which may extend processing time by an additional 3-5 days. Financial institutions often offer streamlined digital platforms for both loan types, but appraisal procedures for Green Home Loans emphasize sustainability criteria, influencing the approval schedule.

Which Loan is Right for Your Property Purchase?

Choosing between a Home Loan and a Green Home Loan depends on your property's environmental features and long-term savings goals. Green Home Loans offer lower interest rates and tax incentives for energy-efficient homes, making them ideal for eco-friendly property purchases. Traditional Home Loans may provide more flexible eligibility criteria and higher loan amounts for conventional properties without sustainability certifications.

Related Important Terms

Green Mortgage Incentives

Green home loans offer significant mortgage incentives such as lower interest rates, reduced processing fees, and tax benefits, encouraging environmentally-friendly property purchases. These financial benefits make green mortgages a cost-effective alternative to traditional home loans while promoting energy-efficient and sustainable housing.

Energy-Efficient Lending

Green home loans offer lower interest rates and tax benefits compared to traditional home loans, specifically incentivizing energy-efficient property purchases by funding eco-friendly upgrades like solar panels and insulation. Energy-efficient lending promotes reduced carbon footprints and long-term savings on utility bills, making green home loans a financially and environmentally smarter choice for property acquisition.

Sustainable Housing Finance

Sustainable housing finance offers green home loans that provide lower interest rates and tax benefits compared to traditional home loans, incentivizing energy-efficient property purchases. These eco-friendly loans support the adoption of renewable energy systems and sustainable construction materials, reducing environmental impact while promoting affordable housing finance solutions.

Net-Zero Home Loan

Net-Zero Home Loans offer lower interest rates and government incentives compared to traditional home loans, promoting energy-efficient property purchases that reduce carbon footprints and utility costs. Borrowers benefit from long-term savings and increased property value by investing in sustainable homes designed to produce as much energy as they consume.

Eco-Eligibility Criteria

Green home loans require properties to meet specific eco-eligibility criteria such as energy efficiency standards, use of sustainable building materials, and certification from recognized green building councils, which often leads to lower interest rates compared to traditional home loans. Traditional home loans generally do not require these environmental standards, making them accessible for a wider range of properties but typically without the eco-friendly incentives and benefits.

Green Appraisal Addendum

The Green Appraisal Addendum enhances a Green Home Loan by accurately assessing the energy efficiency and environmental benefits of the property, often resulting in favorable loan terms compared to a traditional Home Loan. This addendum helps lenders evaluate sustainable features such as solar panels, insulation, and HVAC systems, which can increase property value and lower risk.

LEED-Certified Mortgage

LEED-Certified Mortgage programs offer homebuyers reduced interest rates and eligibility for green incentives when purchasing energy-efficient properties, making them a compelling alternative to traditional home loans. These loans prioritize sustainable construction features and lower carbon footprints, potentially increasing property value and reducing long-term utility costs compared to conventional home financing options.

Renewable Energy Home Loan

Renewable energy home loans offer lower interest rates and government incentives compared to traditional home loans, encouraging buyers to invest in energy-efficient properties or install solar panels. These loans often include benefits such as longer repayment terms and subsidies, making sustainable homeownership more affordable and environmentally responsible.

Climate-Resilient Property Loan

Climate-resilient property loans, such as Green Home Loans, offer borrowers lower interest rates and incentives when purchasing energy-efficient or environmentally friendly homes compared to traditional home loans. These loans support sustainable property investments by financing climate-resilient features like solar panels, rainwater harvesting, and energy-efficient materials, reducing both carbon footprint and utility costs.

Carbon Offset Mortgage

A Green Home Loan, also known as a Carbon Offset Mortgage, offers lower interest rates and incentives for properties with energy-efficient features, reducing the borrower's carbon footprint while saving on utility costs. In contrast, a traditional Home Loan lacks these environmental benefits but may provide more flexible qualification criteria and broader property eligibility.

Home Loan vs Green Home Loan for property purchase. Infographic

moneydiff.com

moneydiff.com