Installment loans provide a structured repayment plan with fixed monthly payments over a set term, offering predictable budgeting and long-term credit building. Buy Now, Pay Later (BNPL) options allow consumers to split purchases into smaller, interest-free payments over a short period but may lack the same credit benefits and can lead to higher costs if payments are missed. Choosing between the two depends on financing needs, repayment flexibility, and credit impact preferences.

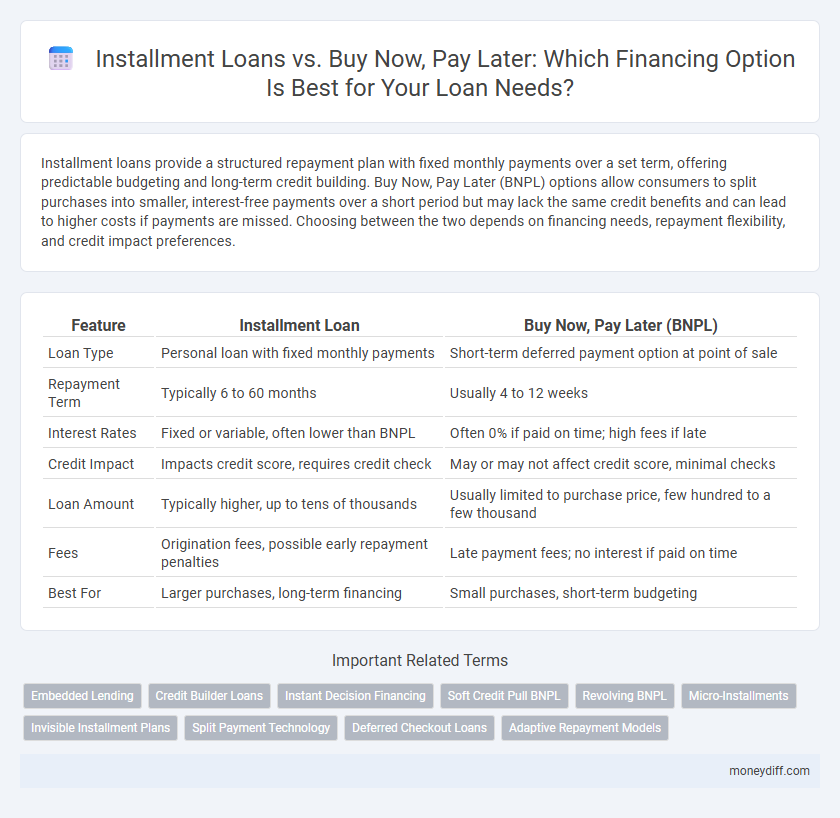

Table of Comparison

| Feature | Installment Loan | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Loan Type | Personal loan with fixed monthly payments | Short-term deferred payment option at point of sale |

| Repayment Term | Typically 6 to 60 months | Usually 4 to 12 weeks |

| Interest Rates | Fixed or variable, often lower than BNPL | Often 0% if paid on time; high fees if late |

| Credit Impact | Impacts credit score, requires credit check | May or may not affect credit score, minimal checks |

| Loan Amount | Typically higher, up to tens of thousands | Usually limited to purchase price, few hundred to a few thousand |

| Fees | Origination fees, possible early repayment penalties | Late payment fees; no interest if paid on time |

| Best For | Larger purchases, long-term financing | Small purchases, short-term budgeting |

Understanding Installment Loans: Key Features

Installment loans provide borrowers with a fixed loan amount repaid over a set period through consistent monthly payments, offering predictability and structured repayment. Interest rates on installment loans are typically fixed, allowing borrowers to clearly understand the total cost of borrowing from the outset. Unlike Buy Now, Pay Later options that often split payments into short-term, interest-free installments, installment loans are designed for longer terms and generally better suited for larger, planned purchases or debt consolidation.

What is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) allows consumers to split purchases into manageable installments, typically without interest if paid on time, making it a flexible alternative to traditional installment loans. Unlike standard installment loans that often involve longer repayment terms and interest rates, BNPL programs are integrated at checkout and offer transparent payment schedules. This financing option has surged in popularity for online shopping due to its convenience and minimal credit impact when payments are made promptly.

Eligibility and Approval Process: Installment Loan vs BNPL

Installment loans typically require a detailed credit check, steady income verification, and a longer approval timeline, making them more suitable for borrowers with established credit histories. Buy Now, Pay Later (BNPL) options often feature minimal eligibility requirements, fast approval processes, and limited credit impact, targeting consumers seeking quick, short-term financing. Lenders offering installment loans prioritize borrower creditworthiness and financial stability, whereas BNPL providers focus on transaction value and purchase behavior.

Interest Rates and Fees Comparison

Installment loans typically feature fixed interest rates and structured monthly payments, offering predictable costs over the loan term, while Buy Now, Pay Later (BNPL) services often provide interest-free periods but may impose high fees or steep interest rates if payments are missed or extended. The total cost of BNPL can surpass that of installment loans due to late fees or deferred interest charges, making installment loans generally more cost-effective for longer repayment periods. Consumers should compare the Annual Percentage Rates (APR) and potential fees for each option to determine the most economical choice based on their financial situation.

Repayment Terms: Flexibility and Structure

Installment loans offer structured repayment terms with fixed monthly payments over a set period, providing predictability and helping borrowers budget effectively. Buy Now, Pay Later (BNPL) plans usually feature shorter repayment windows with flexible schedules, often interest-free if paid on time, but can lead to higher costs if payments are missed. The key difference lies in installment loans' long-term stability versus BNPL's short-term convenience and potential financial risk.

Impact on Credit Score: Installment Loan vs BNPL

Installment loans typically have a more significant impact on credit scores because they involve fixed monthly payments reported to credit bureaus, helping build a positive credit history when paid on time. Buy Now, Pay Later (BNPL) services often do not report installment payments to credit bureaus unless the account becomes delinquent, which means timely payments may not boost credit scores, but missed payments can negatively affect credit. Consumers aiming to improve their credit should prefer installment loans over BNPL for consistent credit reporting and score enhancement.

Pros and Cons of Installment Loans

Installment loans offer fixed repayment schedules with consistent monthly payments, making budgeting easier and providing predictable financial planning. They typically have lower interest rates compared to Buy Now, Pay Later (BNPL) options, reducing overall borrowing costs and minimizing the risk of debt accumulation. However, installment loans often require credit checks and longer approval processes, and missing payments can negatively impact credit scores and incur late fees.

Advantages and Drawbacks of Buy Now, Pay Later

Buy Now, Pay Later (BNPL) offers the advantage of interest-free installments, making it accessible for consumers seeking short-term financing without upfront costs. However, BNPL can lead to higher overall expenses if payments are missed or extended, often resulting in late fees and potential credit score impacts. Unlike traditional installment loans, BNPL lacks flexibility in loan amounts and terms, limiting its suitability for larger or long-term financial needs.

Which Option is Better for Borrowers?

Installment loans offer fixed monthly payments and a clear repayment timeline, making them ideal for borrowers seeking predictable budgeting and long-term financial planning. Buy Now, Pay Later (BNPL) solutions provide short-term, interest-free installments but may lead to higher debt if payments are missed or extended. Borrowers prioritizing credit score improvement and structured repayment often find installment loans a better option compared to BNPL's flexible yet potentially costly model.

Tips for Responsible Borrowing and Money Management

Prioritize budgeting carefully before choosing between installment loans and Buy Now, Pay Later options to avoid overextending credit limits. Understand the interest rates, fees, and repayment terms associated with each loan type to ensure timely payments and minimize debt accumulation. Use payment reminders and track spending to maintain a healthy credit score and foster sustainable financial habits.

Related Important Terms

Embedded Lending

Embedded lending integrates installment loans directly within a purchase platform, offering consumers seamless financing options that often feature fixed repayment schedules and longer terms compared to Buy Now, Pay Later (BNPL) plans. This integration enhances user experience by enabling immediate loan approval and tailored credit assessments, positioning installment loans as a more sustainable credit solution within embedded finance ecosystems.

Credit Builder Loans

Installment loans provide fixed monthly payments over a set term, helping borrowers build credit history through consistent repayment, while Buy Now, Pay Later plans typically involve short-term, interest-free installments that may not report to credit bureaus, offering limited credit-building benefits. Credit builder loans specifically focus on improving credit scores by reporting timely payments to credit agencies, making them a more reliable option for enhancing credit compared to most Buy Now, Pay Later services.

Instant Decision Financing

Installment loans offer structured repayment schedules with fixed interest rates, providing clarity and long-term budgeting control, while Buy Now, Pay Later (BNPL) solutions emphasize instant decision financing, enabling quick approvals and flexible, short-term payments often without interest. Instant decision financing in BNPL leverages real-time credit assessments to streamline access to credit, making it a practical choice for consumers seeking immediate purchasing power without lengthy application processes.

Soft Credit Pull BNPL

Installment loans typically involve hard credit pulls that can impact credit scores, whereas Buy Now, Pay Later (BNPL) options often utilize soft credit pulls, allowing consumers to access financing without affecting their credit report. The soft credit inquiry in BNPL services enables faster approval and greater accessibility for shoppers with limited credit history or lower credit scores.

Revolving BNPL

Revolving Buy Now, Pay Later (BNPL) programs offer flexible repayment options with a revolving credit line, unlike traditional installment loans that require fixed monthly payments over a set term. Revolving BNPL allows consumers to make multiple purchases and manage repayments with variable amounts, often incorporating dynamic credit limits and interest charges based on usage, providing more adaptable short-term financing solutions.

Micro-Installments

Micro-installments in installment loans offer flexible repayment options with smaller, frequent payments over time, reducing borrower financial strain compared to traditional loans. Buy Now, Pay Later solutions typically provide short-term, interest-free financing but may incur higher fees and stricter repayment windows, making micro-installments a more manageable choice for long-term budget planning.

Invisible Installment Plans

Invisible installment plans in loan options blend seamlessly into the purchase process, allowing borrowers to spread payments without explicit loan disclosures, unlike traditional buy now, pay later schemes which clearly present payment terms upfront. These hidden installment arrangements improve user experience by integrating repayments into regular billing cycles, often reducing perceived debt burdens and promoting sustained credit usage.

Split Payment Technology

Installment Loans provide structured repayment schedules with fixed monthly payments over a set term, offering predictable financial management, while Buy Now, Pay Later (BNPL) services leverage split payment technology to divide purchases into interest-free installments, enhancing short-term affordability. Split payment technology enables seamless transaction processing and real-time credit assessment, improving consumer flexibility and merchant conversion rates without traditional loan underwriting.

Deferred Checkout Loans

Installment loans offer structured monthly payments with fixed interest rates, providing clear repayment timelines ideal for larger purchases, whereas Buy Now, Pay Later deferred checkout loans enable consumers to delay payments without immediate interest, enhancing short-term affordability for smaller transactions. Deferred checkout loans often feature zero or low interest if paid within the promotional period, contrasting with installment loans that consistently accrue interest over the loan term.

Adaptive Repayment Models

Installment loans offer fixed or variable adaptive repayment models with predictable monthly payments over a set term, allowing borrowers to manage budgets effectively while building credit history. Buy Now, Pay Later programs provide flexible, often interest-free repayment schedules tailored to shorter durations, appealing to consumers seeking immediate purchasing power without long-term debt commitments.

Installment Loan vs Buy Now, Pay Later for loan. Infographic

moneydiff.com

moneydiff.com