Personal loans offer fixed amounts with structured repayment terms, making them suitable for planned short-term borrowing. Salary advances provide quick access to funds deducted directly from your next paycheck, ideal for urgent, smaller expenses. Choosing between the two depends on the repayment flexibility and borrowing amount needed.

Table of Comparison

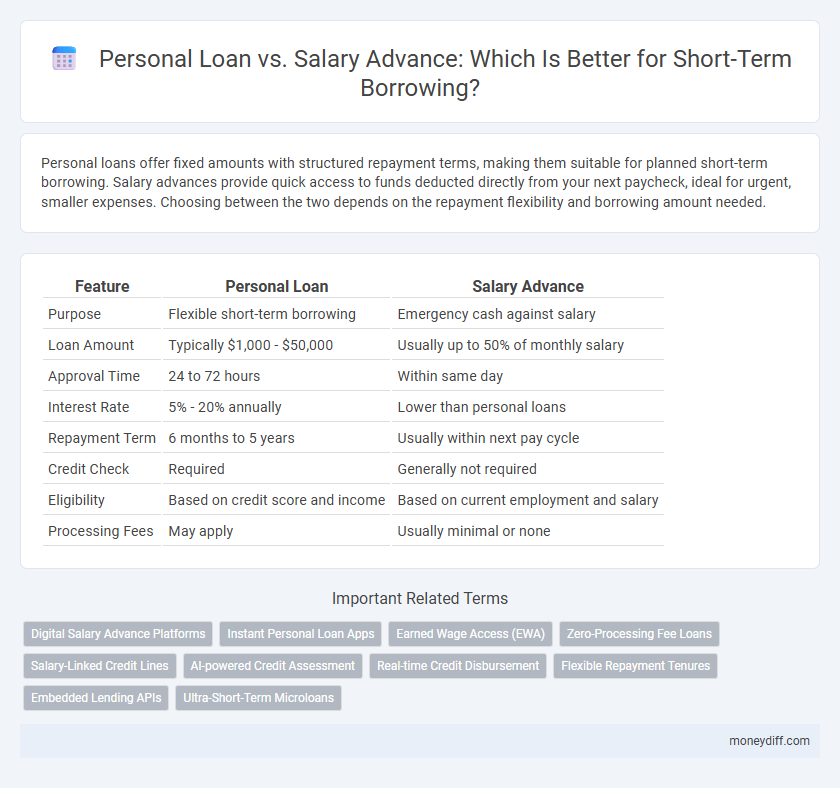

| Feature | Personal Loan | Salary Advance |

|---|---|---|

| Purpose | Flexible short-term borrowing | Emergency cash against salary |

| Loan Amount | Typically $1,000 - $50,000 | Usually up to 50% of monthly salary |

| Approval Time | 24 to 72 hours | Within same day |

| Interest Rate | 5% - 20% annually | Lower than personal loans |

| Repayment Term | 6 months to 5 years | Usually within next pay cycle |

| Credit Check | Required | Generally not required |

| Eligibility | Based on credit score and income | Based on current employment and salary |

| Processing Fees | May apply | Usually minimal or none |

Understanding Short-Term Borrowing: Personal Loan vs Salary Advance

Personal loans offer fixed amounts with set repayment schedules and typically higher interest rates, making them suitable for planned short-term expenses. Salary advances provide quick access to funds deducted directly from the next paycheck, often with lower or no interest but limited to a portion of the upcoming salary. Comparing loan terms, fees, and approval speed is crucial to determine the best option for immediate financial needs.

Key Differences Between Personal Loans and Salary Advances

Personal loans offer fixed amounts with set repayment terms, often requiring credit checks and approval processes, making them suitable for planned short-term borrowing. Salary advances provide immediate access to funds deducted directly from upcoming paychecks, typically without interest but with lower borrowing limits. Key differences include approval speed, repayment structure, and impact on credit score, influencing borrower choice based on urgency and financial stability.

Eligibility Criteria: Which Option Suits You Best?

Personal loans typically require a good credit score, stable income proof, and sometimes collateral, making them suitable for borrowers with established credit histories. Salary advances are generally accessible only to employees of specific companies with a regular payroll system, offering quick access without formal credit checks. Evaluating your credit profile and employment status helps determine whether a personal loan or salary advance is the best fit for your short-term borrowing needs.

Application Process: Personal Loan vs Salary Advance

The application process for a Personal Loan typically involves submitting detailed financial documents, undergoing credit checks, and waiting for approval from a financial institution, which can take several days to weeks. In contrast, a Salary Advance usually requires minimal paperwork, is approved quickly by an employer or payroll service, and funds are often disbursed within 24 hours. This streamlined procedure makes Salary Advances a faster option for short-term borrowing compared to Personal Loans, which involve more rigorous evaluation.

Interest Rates and Fees Comparison

Personal loans typically feature fixed interest rates ranging from 6% to 36% APR, with origination fees between 1% and 5%, making them suitable for planned short-term borrowing. Salary advances often carry lower fees or no interest but may include administrative charges or impact future paychecks, affecting cash flow. Comparing effective interest rates and total costs reveals personal loans offer predictable repayment, while salary advances provide quick access with potentially hidden fees.

Repayment Terms: Flexibility and Duration

Personal loans typically offer more flexible repayment terms with durations ranging from 12 to 60 months, allowing borrowers to select schedules that fit their financial situations. Salary advances usually require repayment on the next paycheck or within a very short period, often making them less flexible but faster to settle. Evaluating repayment duration and flexibility is crucial when choosing between personal loans and salary advances for short-term borrowing needs.

Impact on Your Credit Score

Personal loans typically require a credit check, which can temporarily lower your credit score, but timely repayments help improve it over time. Salary advances usually do not affect your credit score since they are employer-managed and do not appear on credit reports. Choosing a personal loan for short-term borrowing can build credit history, whereas salary advances primarily offer quick access to funds without impacting credit.

Pros and Cons of Personal Loans

Personal loans offer flexible repayment terms and typically higher borrowing limits compared to salary advances, making them suitable for larger short-term expenses. However, personal loans often require a credit check, may have higher interest rates, and longer approval times, which can be less convenient than salary advances deducted directly from a paycheck. The lack of immediate access and potential fees can outweigh the benefits for urgent or small financial needs.

Pros and Cons of Salary Advances

Salary advances offer quick access to funds without the need for credit checks, making them ideal for urgent short-term borrowing. However, their repayment is often tied directly to the next paycheck, which can strain monthly budgets and limit cash flow flexibility. Limited borrowing amounts and potential fees reduce their appeal compared to personal loans with structured repayment plans.

Choosing the Right Short-Term Borrowing Option

Personal loans typically offer fixed interest rates and repayment terms, making them suitable for borrowers seeking predictable monthly payments and longer repayment periods. Salary advances provide quick access to funds by allowing employees to borrow against their upcoming paycheck, often with lower fees but shorter repayment windows. Evaluating factors such as interest rates, repayment flexibility, and approval speed is crucial in choosing the right short-term borrowing option.

Related Important Terms

Digital Salary Advance Platforms

Digital salary advance platforms offer employees quick access to earned wages without the need for credit checks, making them a convenient alternative to traditional personal loans for short-term borrowing. Compared to personal loans, these platforms typically feature lower fees and faster approval times, catering specifically to immediate liquidity needs directly tied to paycheck cycles.

Instant Personal Loan Apps

Instant personal loan apps offer quick approval and disbursal, making them ideal for short-term borrowing compared to salary advances that depend on employer approval and payroll cycles. These apps provide flexible repayment options and access to funds without the need for collateral, enhancing convenience and financial agility.

Earned Wage Access (EWA)

Personal loans typically offer fixed amounts and repayment terms with interest rates based on credit scores, while Salary Advance through Earned Wage Access (EWA) allows employees to access a portion of their earned wages before payday without conventional interest charges. EWA serves as a flexible, cost-effective alternative for short-term borrowing by providing immediate liquidity, helping to avoid high-interest debt and improve financial wellness.

Zero-Processing Fee Loans

Personal loans with zero-processing fees offer a cost-effective short-term borrowing solution compared to salary advances, which often include hidden fees and salary deductions. Borrowers benefit from transparent terms and lower overall expenses by choosing zero-processing fee personal loans for immediate financial needs.

Salary-Linked Credit Lines

Salary-linked credit lines offer a more flexible short-term borrowing option compared to personal loans, with repayment directly deducted from the borrower's paycheck, reducing default risk. Unlike personal loans that often require lengthy approval and fixed interest rates, salary advances provide quicker access to funds with lower or no interest, tailored for immediate cash flow needs.

AI-powered Credit Assessment

AI-powered credit assessment enhances the approval process for personal loans by analyzing comprehensive financial data, offering better risk evaluation compared to traditional salary advances. This technology enables lenders to provide more accurate interest rates and flexible repayment terms tailored to individual credit profiles, improving short-term borrowing options.

Real-time Credit Disbursement

Personal loans offer structured repayment terms with potentially higher credit limits, but salary advances provide faster real-time credit disbursement directly from your employer, making them ideal for immediate cash needs. Real-time approval and instant fund transfer distinguish salary advances by reducing waiting periods compared to traditional personal loan processing times.

Flexible Repayment Tenures

Personal loans offer flexible repayment tenures ranging from 12 to 60 months, allowing borrowers to choose a schedule that fits their financial situation, whereas salary advances typically require repayment by the next paycheck, limiting flexibility. This extended tenure in personal loans helps reduce monthly installment amounts, making them more manageable for short-term borrowing needs compared to the stricter, shorter repayment terms of salary advances.

Embedded Lending APIs

Embedded lending APIs streamline short-term borrowing by enabling seamless access to personal loans and salary advances directly within digital platforms, reducing approval times and enhancing user experience. These APIs leverage real-time salary verification and credit data to tailor loan offers, making salary advances more accessible while providing flexible repayment options compared to traditional personal loans.

Ultra-Short-Term Microloans

Ultra-short-term microloans typically offer faster access to funds than personal loans, with lower borrowing amounts and shorter repayment periods ideal for immediate cash flow needs. Salary advances deduct repayments directly from upcoming paychecks, reducing approval time but often come with limits tied to the borrower's income cycle and employer policies.

Personal Loan vs Salary Advance for short-term borrowing. Infographic

moneydiff.com

moneydiff.com