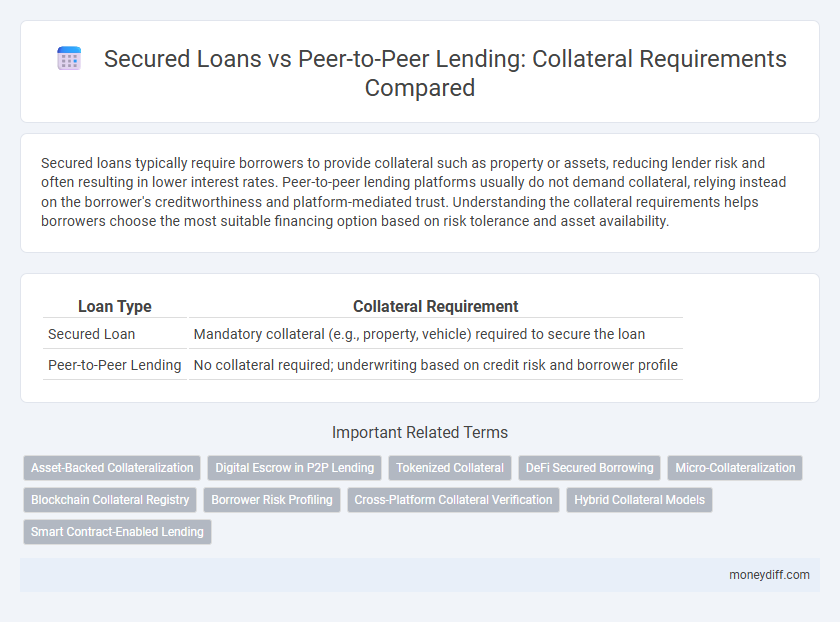

Secured loans typically require borrowers to provide collateral such as property or assets, reducing lender risk and often resulting in lower interest rates. Peer-to-peer lending platforms usually do not demand collateral, relying instead on the borrower's creditworthiness and platform-mediated trust. Understanding the collateral requirements helps borrowers choose the most suitable financing option based on risk tolerance and asset availability.

Table of Comparison

| Loan Type | Collateral Requirement |

|---|---|

| Secured Loan | Mandatory collateral (e.g., property, vehicle) required to secure the loan |

| Peer-to-Peer Lending | No collateral required; underwriting based on credit risk and borrower profile |

Understanding Secured Loans: Key Collateral Requirements

Secured loans require borrowers to provide collateral such as real estate, vehicles, or financial assets, which significantly reduces the lender's risk and often results in lower interest rates and higher borrowing limits. The collateral serves as a security for the loan, enabling lenders to recover the loan amount in case of default, making it a critical component for loan approval. In contrast, peer-to-peer lending platforms typically do not require collateral, relying more on borrower creditworthiness and platform-managed risk assessment.

Peer-to-Peer Lending: How Collateral Works

Peer-to-peer lending typically does not require traditional collateral, relying instead on borrower creditworthiness and platform risk assessments to secure funds. Collateral in peer-to-peer lending may include alternative assets or personal guarantees, but these are less common compared to secured loans. This model reduces barriers for borrowers without valuable assets while increasing risk for lenders, often balanced by higher interest rates and diversified lending pools.

Comparing Collateral in Secured Loans vs P2P Lending

Secured loans require tangible collateral such as property, vehicles, or savings accounts, providing lenders with a guarantee that mitigates risk and often results in lower interest rates. Peer-to-peer (P2P) lending platforms typically do not demand physical collateral, instead relying on borrower creditworthiness, resulting in higher interest rates to compensate for increased lender risk. Comparing collateral requirements highlights that secured loans offer more security for lenders, while P2P lending provides greater accessibility for borrowers with limited assets.

Types of Assets Used as Collateral in Secured Loans

Secured loans commonly require tangible assets such as real estate, vehicles, or equipment as collateral, providing lenders with assurance against default. These assets hold intrinsic value, which can be liquidated to recover the loan amount if necessary. In contrast, peer-to-peer lending typically does not involve collateral, relying instead on borrower creditworthiness and platform risk assessment.

Are Collateral-Free Options Possible with P2P Lending?

Peer-to-peer (P2P) lending platforms often provide collateral-free loan options, making them accessible to borrowers without assets to pledge. Unlike secured loans that require tangible collateral such as property or vehicles, P2P loans rely on creditworthiness and borrower profiles for approval. This collateral-free nature of P2P lending reduces upfront barriers, though interest rates may reflect higher risk for lenders.

Risk Implications of Collateral for Borrowers

Secured loans require borrowers to provide collateral, which reduces lender risk but increases borrower risk of asset loss if repayment fails. Peer-to-peer lending typically does not require collateral, exposing lenders to higher default risk but offering borrowers less personal asset risk. Borrowers considering secured loans must weigh the potential loss of collateral against the generally lower interest rates compared to unsecured peer-to-peer lending options.

What Lenders Look for in Collateral: Traditional vs P2P

Lenders in secured loans typically require tangible collateral such as real estate, vehicles, or savings accounts to mitigate risk and ensure loan recovery in case of default. Peer-to-peer lending platforms often have more flexible collateral requirements or may rely on personal creditworthiness and borrower profiles rather than physical assets. Traditional lenders prioritize asset value and liquidity, while P2P lenders focus on borrower reputation and alternative data to assess collateral adequacy.

Documentation Needed for Collateral in Each Loan Type

Secured loans require comprehensive documentation that proves ownership and value of collateral, such as property deeds, vehicle titles, or financial asset statements, to mitigate lender risk. Peer-to-peer lending typically does not involve collateral, thus minimizing documentation to basic borrower identity verification and creditworthiness assessments. The collateral documentation process in secured loans ensures a legal claim on assets, contrasting with the streamlined, unsecured nature of peer-to-peer lending platforms.

Impact of Collateral on Interest Rates and Loan Approval

Secured loans require collateral such as property or assets, which reduces the lender's risk and typically results in lower interest rates and higher approval chances for borrowers. Peer-to-peer lending usually does not require collateral, leading to higher interest rates to compensate for increased lender risk and stricter credit evaluation. The presence or absence of collateral significantly impacts both the cost of borrowing and the likelihood of loan approval in each lending model.

Evaluating Which Loan Suits Your Collateral Options

Secured loans require borrowers to provide collateral such as property or vehicles, reducing lender risk and often resulting in lower interest rates. Peer-to-peer lending typically does not require collateral, relying on creditworthiness and platform guidelines, which may lead to higher interest rates but easier access for those without assets. Evaluating your assets and risk tolerance helps determine whether a traditional secured loan or unsecured peer-to-peer loan better matches your collateral options and borrowing needs.

Related Important Terms

Asset-Backed Collateralization

Secured loans require tangible asset-backed collateral, such as property or vehicles, which reduces lender risk and typically results in lower interest rates. Peer-to-peer lending platforms often operate without traditional collateral, relying instead on borrower creditworthiness and platform risk assessment models.

Digital Escrow in P2P Lending

Secured loans typically require tangible collateral such as property or vehicles to mitigate lender risk, whereas peer-to-peer (P2P) lending leverages digital escrow services to securely manage funds and reduce default risks without traditional collateral. Digital escrow platforms in P2P lending ensure transparent transaction verification and fund disbursement, enhancing borrower and lender trust by holding payments in a secure third-party account until agreed-upon conditions are met.

Tokenized Collateral

Secured loans require tangible collateral such as property or vehicles to guarantee repayment, while peer-to-peer lending platforms increasingly utilize tokenized collateral, allowing digital assets like NFTs or tokens to serve as security. Tokenized collateral enhances liquidity and accessibility by enabling fractional ownership and blockchain-based verification, reducing traditional barriers in secured lending.

DeFi Secured Borrowing

DeFi secured borrowing typically requires digital assets as collateral, ensuring loan security through smart contracts on blockchain platforms, contrasting with peer-to-peer lending where collateral requirements vary widely and often lack automated enforcement. Secured loans in DeFi provide transparent, real-time collateral valuation and liquidation processes, enhancing trust and reducing counterparty risk compared to traditional peer-to-peer lending models.

Micro-Collateralization

Secured loans typically require substantial collateral such as real estate or vehicles, while peer-to-peer lending platforms increasingly utilize micro-collateralization, allowing borrowers to offer smaller, more accessible assets as security. This shift in micro-collateralization enhances loan accessibility for individuals with limited asset portfolios, reducing barriers to credit.

Blockchain Collateral Registry

Secured loans typically require physical collateral such as property or vehicles, while peer-to-peer lending increasingly leverages blockchain collateral registries to securely record and validate digital assets as collateral, enhancing transparency and reducing fraud. Blockchain collateral registries provide immutable records that streamline collateral verification and enable decentralized lending platforms to operate with increased trust and efficiency.

Borrower Risk Profiling

Secured loans require borrowers to provide collateral, significantly reducing lender risk and often resulting in lower interest rates due to tangible asset backing. Peer-to-peer lending typically assesses borrower risk through credit scores and financial behavior without collateral, leading to higher interest rates to compensate for increased lender risk exposure.

Cross-Platform Collateral Verification

Secured loans typically require traditional collateral such as property or vehicles, verified through established financial institutions using integrated collateral databases, enabling cross-platform consistency. Peer-to-peer lending platforms are increasingly adopting blockchain-based cross-platform collateral verification systems, allowing real-time, transparent asset validation across different financial networks without centralized intermediaries.

Hybrid Collateral Models

Hybrid collateral models in secured loans combine traditional asset-backed security with alternative collateral forms often seen in peer-to-peer lending, reducing risk while enhancing borrower access. This approach leverages the strength of tangible collateral alongside innovative valuation of social or digital assets to satisfy diverse lender requirements.

Smart Contract-Enabled Lending

Smart contract-enabled lending in secured loans automates collateral management, ensuring transparent and tamper-proof asset verification, while peer-to-peer lending platforms rely on coded agreements to reduce intermediaries but often face challenges in collateral enforcement. The integration of blockchain technology enhances security and efficiency in secured loans by locking collateral via smart contracts, contrasting with peer-to-peer lending's variable collateral requirements and decentralized trust mechanisms.

Secured Loan vs Peer-to-Peer Lending for collateral requirements. Infographic

moneydiff.com

moneydiff.com