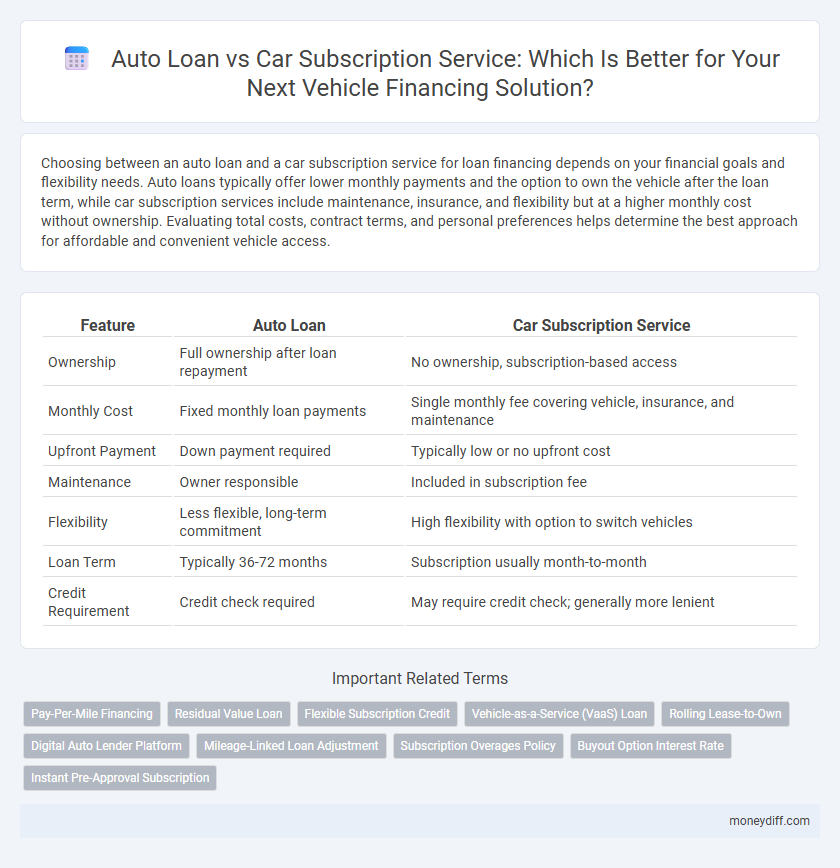

Choosing between an auto loan and a car subscription service for loan financing depends on your financial goals and flexibility needs. Auto loans typically offer lower monthly payments and the option to own the vehicle after the loan term, while car subscription services include maintenance, insurance, and flexibility but at a higher monthly cost without ownership. Evaluating total costs, contract terms, and personal preferences helps determine the best approach for affordable and convenient vehicle access.

Table of Comparison

| Feature | Auto Loan | Car Subscription Service |

|---|---|---|

| Ownership | Full ownership after loan repayment | No ownership, subscription-based access |

| Monthly Cost | Fixed monthly loan payments | Single monthly fee covering vehicle, insurance, and maintenance |

| Upfront Payment | Down payment required | Typically low or no upfront cost |

| Maintenance | Owner responsible | Included in subscription fee |

| Flexibility | Less flexible, long-term commitment | High flexibility with option to switch vehicles |

| Loan Term | Typically 36-72 months | Subscription usually month-to-month |

| Credit Requirement | Credit check required | May require credit check; generally more lenient |

Understanding Auto Loans: Key Features and Benefits

Auto loans provide borrowers with a structured repayment plan and the ability to own a vehicle outright after the loan term, usually ranging from 36 to 72 months with fixed interest rates. They often require a down payment and have varying approval criteria based on credit score, debt-to-income ratio, and lender policies, enabling long-term financial planning for car ownership. Benefits include building credit history, potential tax deductions on interest for business use, and freedom to customize or sell the vehicle once the loan is paid off.

Car Subscription Services Explained: A Modern Alternative

Car subscription services offer a flexible alternative to traditional auto loans by bundling insurance, maintenance, and registration fees into one monthly payment, eliminating the need for long-term financial commitments. Subscribers can switch vehicles frequently without the hassle of selling or trading in a car, providing greater convenience and cost predictability. This modern approach appeals to consumers seeking short-term access to various models without the debt burdens associated with auto loan financing.

Cost Comparison: Auto Loans vs Car Subscriptions

Auto loans typically involve fixed monthly payments over a set term with interest rates influenced by credit scores, resulting in long-term cost efficiency for ownership. Car subscription services often include insurance, maintenance, and registration in a single monthly fee, but typically cost more per month than traditional auto loans. Consumers should consider total cost of ownership, mileage limits, and flexibility when comparing these financing options.

Flexibility and Commitment: Which Option Suits You?

Auto loans provide structured payment plans with fixed terms, offering long-term ownership and financial predictability. Car subscription services deliver flexibility through short-term commitments and the ability to switch vehicles frequently without ownership burdens. Choosing between an auto loan and a subscription depends on preferences for commitment duration and adaptability to changing driving needs.

Ownership vs Usage: Analyzing Value Propositions

Auto loans provide full ownership of the vehicle, allowing drivers to build equity and customize their cars without restrictions. Car subscription services focus on usage, offering flexibility with bundled maintenance, insurance, and vehicle swaps for a fixed monthly fee. Choosing between these options depends on whether long-term ownership value or short-term convenience and variety is prioritized.

Credit Score Impact: Auto Loan vs Subscription Service

Auto loans directly impact credit scores through regular monthly payments that are reported to credit bureaus, helping to build or improve credit history. Car subscription services typically do not involve credit reporting since they function more like rental agreements, resulting in minimal or no effect on credit scores. Choosing an auto loan can enhance credit standing over time, while subscriptions offer flexibility without influencing credit creditworthiness.

Monthly Payments: Breaking Down the Financial Differences

Monthly payments for an auto loan typically involve fixed installments over a set loan term, allowing borrowers to build equity and eventually own the vehicle. Car subscription services charge a single monthly fee covering the vehicle, insurance, maintenance, and sometimes taxes, resulting in higher but more predictable payments without ownership. Comparing these options highlights the trade-off between lower monthly costs with long-term investment in auto loans and comprehensive, hassle-free payments through car subscriptions.

Maintenance and Insurance Considerations

Auto loans require borrowers to handle maintenance costs and insurance premiums independently, often leading to variable expenses based on the vehicle's age and condition. Car subscription services typically bundle maintenance and insurance within the monthly fee, providing predictable costs and hassle-free upkeep. This integrated approach can simplify budgeting for subscribers compared to the financial responsibilities associated with traditional auto loans.

Long-Term Financial Implications

Auto loans require fixed monthly payments over extended terms, leading to interest costs that increase the total vehicle price, impacting long-term financial commitments and credit scores. Car subscription services involve higher monthly fees without ownership benefits, potentially limiting asset accumulation and complicating long-term budgeting. Evaluating total cost of ownership and equity potential is essential for optimizing financial outcomes between these options.

Choosing the Right Option for Your Financial Goals

Auto loans offer structured repayment plans with fixed interest rates, making them suitable for buyers aiming to build equity and own the vehicle outright. Car subscription services provide flexible monthly fees covering insurance, maintenance, and depreciation, ideal for individuals seeking convenience without long-term commitment. Evaluating your budget, ownership preferences, and financial goals helps determine whether a traditional auto loan or a subscription service aligns best with your needs.

Related Important Terms

Pay-Per-Mile Financing

Pay-per-mile financing offers a flexible alternative to traditional auto loans by charging interest based on the actual miles driven, making it cost-effective for low-mileage drivers. Car subscription services often include this model to tailor payments to usage, contrasting with fixed monthly payments typical of conventional auto loans.

Residual Value Loan

Auto loans typically involve fixed monthly payments and ownership transfer upon full repayment, whereas car subscription services offer flexible usage without long-term commitment but often exclude residual value considerations. Residual value loans leverage the vehicle's projected worth at lease-end to lower monthly payments, making them ideal for consumers seeking ownership with reduced financial burden compared to traditional auto loans or subscription fees.

Flexible Subscription Credit

Auto loans provide fixed loan terms and interest rates, offering predictable monthly payments and eventual ownership, while car subscription services grant flexible subscription credit options that allow users to change vehicles frequently without long-term financial commitment. This flexibility in subscription credit supports varied budgeting preferences and reduces credit impact, contrasting with the rigid credit requirements and amortization schedules typical of traditional auto loans.

Vehicle-as-a-Service (VaaS) Loan

Vehicle-as-a-Service (VaaS) loans redefine auto financing by bundling vehicle use, maintenance, and insurance into a single monthly payment, offering greater flexibility compared to traditional auto loans. Unlike conventional auto loans that require upfront down payments and long-term commitments, VaaS loans enable consumers to access newer models with lower financial risk and seamless service integration.

Rolling Lease-to-Own

Rolling lease-to-own offers flexible monthly payments and the ability to switch vehicles frequently, unlike traditional auto loans that require fixed terms and often higher upfront costs. This model combines lease and ownership benefits, allowing customers to build equity over time while enjoying the convenience of a subscription-like service.

Digital Auto Lender Platform

Digital auto lender platforms streamline the loan application process for auto loans, offering competitive interest rates and flexible repayment terms tailored to individual credit profiles. Car subscription services provide a hassle-free alternative with inclusive maintenance and insurance, but typically involve higher monthly costs compared to traditional auto loan financing through digital lenders.

Mileage-Linked Loan Adjustment

Auto loans with mileage-linked loan adjustment customize monthly payments based on actual vehicle usage, offering flexibility for drivers with fluctuating mileage patterns. Car subscription services typically include mileage limits with fees for excess use, making auto loans more cost-effective for high-mileage drivers seeking personalized loan terms.

Subscription Overages Policy

Auto loan agreements typically include fixed monthly payments and specific terms for late fees but rarely address usage limits, whereas car subscription services enforce strict overage policies that charge extra fees based on mileage, duration, or additional use beyond the subscription terms. This subscription overages policy ensures predictable costs for subscribers while encouraging responsible vehicle use, contrasting with the traditional loan's emphasis on ownership and financing structure.

Buyout Option Interest Rate

Auto loan buyout options typically feature fixed interest rates ranging from 3% to 7%, offering predictable long-term costs for vehicle ownership. Car subscription services generally do not provide buyout options, limiting flexibility and potentially increasing overall expense compared to traditional auto loans with lower interest rates.

Instant Pre-Approval Subscription

Auto loans typically require credit checks and lengthy approval processes, whereas car subscription services offer instant pre-approval, allowing consumers to access vehicles quickly without traditional financing hurdles. Instant pre-approval in subscription models streamlines access by eliminating loan paperwork, making it a flexible alternative to standard auto loans.

Auto Loan vs Car Subscription Service for Loan Infographic

moneydiff.com

moneydiff.com