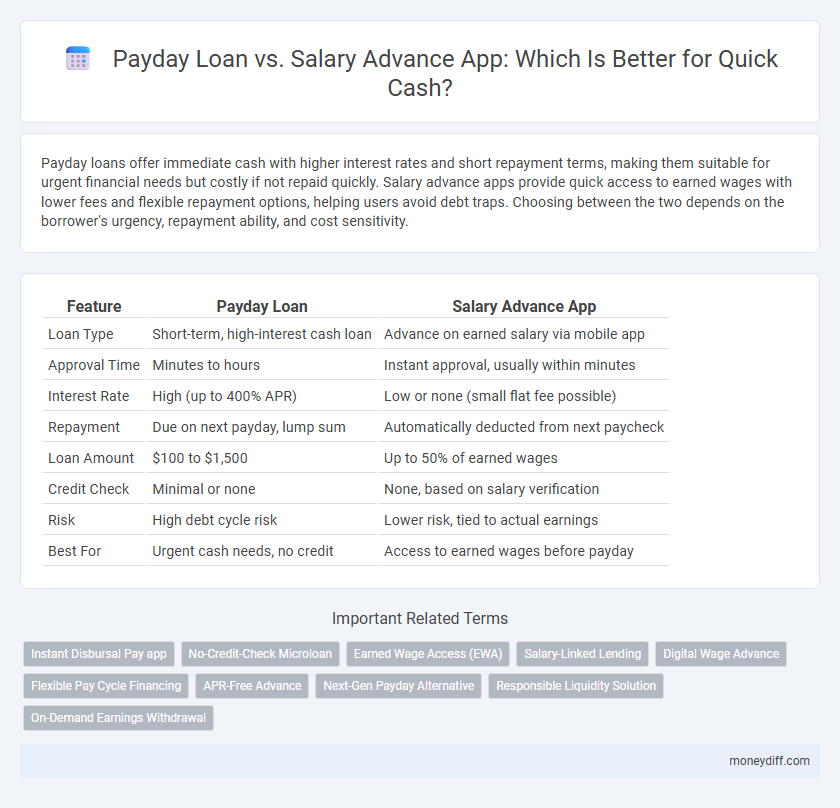

Payday loans offer immediate cash with higher interest rates and short repayment terms, making them suitable for urgent financial needs but costly if not repaid quickly. Salary advance apps provide quick access to earned wages with lower fees and flexible repayment options, helping users avoid debt traps. Choosing between the two depends on the borrower's urgency, repayment ability, and cost sensitivity.

Table of Comparison

| Feature | Payday Loan | Salary Advance App |

|---|---|---|

| Loan Type | Short-term, high-interest cash loan | Advance on earned salary via mobile app |

| Approval Time | Minutes to hours | Instant approval, usually within minutes |

| Interest Rate | High (up to 400% APR) | Low or none (small flat fee possible) |

| Repayment | Due on next payday, lump sum | Automatically deducted from next paycheck |

| Loan Amount | $100 to $1,500 | Up to 50% of earned wages |

| Credit Check | Minimal or none | None, based on salary verification |

| Risk | High debt cycle risk | Lower risk, tied to actual earnings |

| Best For | Urgent cash needs, no credit | Access to earned wages before payday |

Payday Loans vs Salary Advance Apps: Key Differences

Payday loans offer immediate cash with high interest rates and short repayment terms, often leading to costly debt cycles. Salary advance apps provide access to earned wages before payday, typically with lower fees and repayment tied to the employee's next paycheck. Choosing between the two depends on cash flow needs, cost considerations, and repayment flexibility, with salary advance apps generally offering a more affordable alternative.

Interest Rates and Fees: A Comparative Analysis

Payday loans typically carry higher interest rates and fees, often exceeding 300% APR, which significantly increases the repayment amount compared to salary advance apps. Salary advance apps usually offer lower or no interest, charging minimal flat fees or subscription-based costs, making them a more affordable option for quick cash. Understanding these cost differences helps borrowers choose the most cost-effective short-term funding solution.

Eligibility Criteria: Who Qualifies for Each Option?

Payday loans typically require borrowers to be at least 18 years old, have a steady income, and provide valid identification, making them accessible to individuals with less-than-perfect credit. Salary advance apps often require users to be employed at a participating company and have a direct deposit set up, restricting eligibility to verified employees. The eligibility differences highlight payday loans' broader accessibility versus salary advances' reliance on employer partnerships and payroll systems.

Loan Amounts and Repayment Terms

Payday loans typically offer smaller loan amounts, often ranging from $100 to $1,000, with repayment due on the borrower's next payday, usually within two to four weeks. Salary advance apps provide more flexible loan amounts based on the borrower's income, sometimes extending up to several hundred dollars or more, with repayment terms aligned to the borrower's upcoming paycheck date. Both options prioritize quick access to cash but differ in the structure and flexibility of repayment schedules.

Speed of Cash Disbursement: Which is Faster?

Payday loans typically offer cash disbursement within minutes to a few hours after approval, leveraging online platforms for rapid processing. Salary advance apps often provide instant access to earned wages, sometimes within the same day, by integrating directly with employers' payroll systems. Comparing both, salary advance apps generally deliver faster cash availability due to their seamless connection to salary data and reduced verification steps.

Impact on Credit Score and Financial Health

Payday loans often carry high-interest rates and fees that can rapidly increase debt, leading to negative impacts on credit scores if repayments are missed, thereby harming overall financial health. In contrast, salary advance apps typically offer lower or no interest and connect repayments to upcoming paychecks, minimizing risk to credit scores and supporting better financial management. Choosing salary advance apps can provide a safer short-term cash solution without the detrimental credit score consequences associated with payday loans.

Pros and Cons: Payday Loans vs Salary Advance Apps

Payday loans offer fast access to cash with minimal credit checks but come with high interest rates and fees that can lead to debt cycles. Salary advance apps provide smaller, interest-free advances directly from earned wages, promoting responsible borrowing but may have limitations on advance amounts and require employer participation. Choosing between them depends on urgency, repayment ability, and cost tolerance for short-term financial needs.

Common Risks and Potential Pitfalls

Payday loans and salary advance apps both provide quick cash but carry significant risks, including high-interest rates and fees that can trap borrowers in a cycle of debt. Payday loans often have strict repayment terms that can lead to late fees and credit damage, while salary advance apps may impose limits on advance amounts and tie repayments directly to your next paycheck, risking overdrafts or insufficient funds. Understanding these pitfalls is crucial to avoid financial strain and worsening credit health.

User Experience: Application Process and Accessibility

Payday loans often require extensive documentation and credit checks, leading to longer approval times, while salary advance apps streamline the process by integrating with employers' payroll systems for instant cash access. Salary advance apps typically offer intuitive mobile interfaces with fewer eligibility barriers, improving accessibility for users without traditional credit history. The seamless application process and fast disbursement in salary advance apps enhance user experience compared to the more cumbersome payday loan procedures.

Choosing the Best Option for Emergency Cash Needs

Payday loans offer quick cash with high-interest rates and short repayment terms, making them suitable for immediate emergencies but costly if not repaid promptly. Salary advance apps provide employees access to earned wages before payday, often with lower fees and transparent terms, promoting financial flexibility without long-term debt. Carefully comparing fees, repayment terms, and eligibility can help individuals select the best option for managing urgent cash flow needs without jeopardizing financial stability.

Related Important Terms

Instant Disbursal Pay app

Instant Disbursal Pay app offers quick access to funds by providing payday loans and salary advances with instant approval and disbursal, catering to urgent cash needs. Unlike traditional payday loans, its user-friendly platform enables faster salary advance processing, ensuring immediate liquidity without extensive credit checks.

No-Credit-Check Microloan

Payday loans and salary advance apps both offer quick cash solutions, but no-credit-check microloans provided by salary advance apps often feature lower interest rates and easier approval processes without requiring a credit check. These microloans leverage automated salary data to deliver instant funds, making them a preferred choice for employees needing urgent financial support.

Earned Wage Access (EWA)

Earned Wage Access (EWA) apps provide quick cash by allowing employees to access a portion of their earned wages before payday, offering a more flexible and often less costly alternative to traditional payday loans. Unlike payday loans, EWA services typically avoid high interest rates and fees, promoting financial well-being by reducing reliance on high-cost short-term credit.

Salary-Linked Lending

Salary-linked lending through salary advance apps offers quick cash by directly deducting repayments from the borrower's paycheck, reducing the risk of high interest rates and fees commonly associated with payday loans. These apps provide a more affordable and transparent alternative for short-term borrowing by integrating with employers' payroll systems to ensure timely repayments.

Digital Wage Advance

Digital wage advance apps offer a faster and more cost-effective alternative to traditional payday loans by allowing employees to access a portion of their earned wages before payday without high interest rates. Unlike payday loans that often carry excessive fees and risk of debt cycles, salary advance apps prioritize financial wellness with transparent terms and instant digital disbursements.

Flexible Pay Cycle Financing

Payday loans often come with fixed repayment dates and high fees, whereas salary advance apps offer flexible pay cycle financing that aligns repayments with your paycheck schedule. This flexibility reduces financial strain by allowing borrowers to manage cash flow more effectively without incurring excessive interest or penalties.

APR-Free Advance

APR-Free Advance apps provide an interest-free alternative to payday loans by offering quick cash advances directly from upcoming salary deposits, eliminating high Annual Percentage Rates (APR) and hidden fees. These salary advance apps enable users to access funds instantly without falling into debt traps typically associated with payday loans.

Next-Gen Payday Alternative

Next-gen payday alternative apps offer faster, more transparent access to quick cash than traditional payday loans, with lower interest rates and flexible repayment terms tailored to salary schedules. These digital platforms leverage AI-driven credit assessments and seamless mobile integration, reducing the risk of debt cycles and promoting financial wellness for users seeking immediate funds.

Responsible Liquidity Solution

Payday loans offer immediate cash with high-interest rates and short repayment terms often leading to debt cycles, while salary advance apps provide responsible liquidity solutions by allowing employees to access earned wages early with minimal fees and fewer risks. Leveraging salary advance apps promotes financial stability through transparent payment schedules and avoids the predatory practices commonly associated with payday lending.

On-Demand Earnings Withdrawal

Payday loans often come with high interest rates and fees, making them a costly option for quick cash, whereas salary advance apps offer on-demand earnings withdrawal that allows employees to access a portion of their earned wages before payday with minimal or no interest. This instant access to earned income through salary advance apps provides a more affordable and flexible financial solution compared to traditional payday loans.

Payday loan vs Salary advance app for quick cash. Infographic

moneydiff.com

moneydiff.com