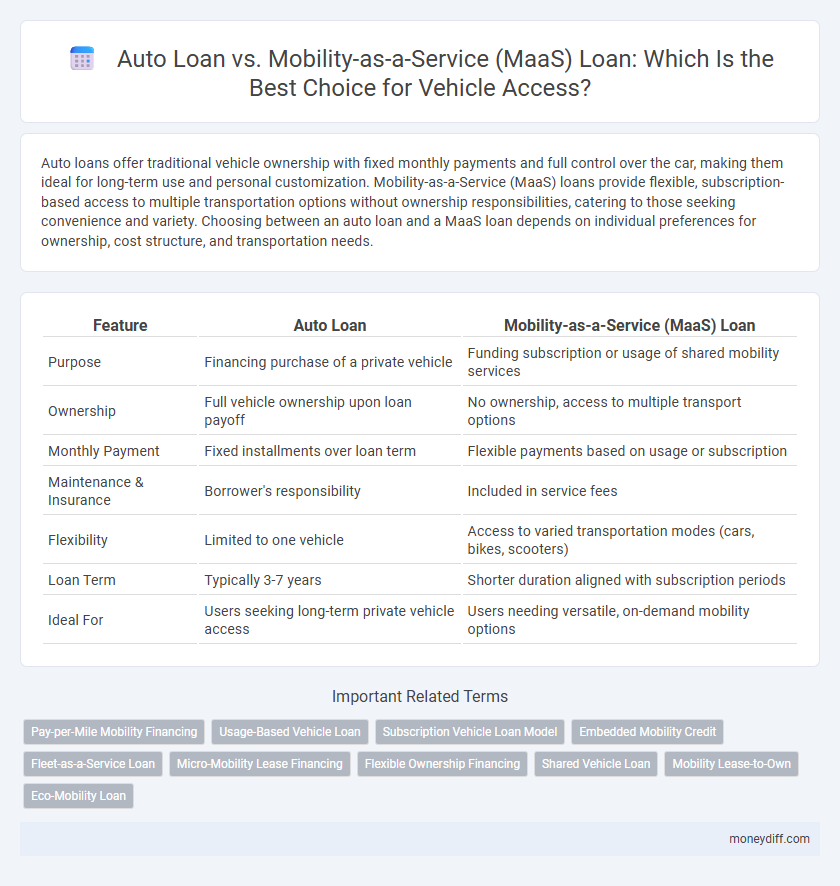

Auto loans offer traditional vehicle ownership with fixed monthly payments and full control over the car, making them ideal for long-term use and personal customization. Mobility-as-a-Service (MaaS) loans provide flexible, subscription-based access to multiple transportation options without ownership responsibilities, catering to those seeking convenience and variety. Choosing between an auto loan and a MaaS loan depends on individual preferences for ownership, cost structure, and transportation needs.

Table of Comparison

| Feature | Auto Loan | Mobility-as-a-Service (MaaS) Loan |

|---|---|---|

| Purpose | Financing purchase of a private vehicle | Funding subscription or usage of shared mobility services |

| Ownership | Full vehicle ownership upon loan payoff | No ownership, access to multiple transport options |

| Monthly Payment | Fixed installments over loan term | Flexible payments based on usage or subscription |

| Maintenance & Insurance | Borrower's responsibility | Included in service fees |

| Flexibility | Limited to one vehicle | Access to varied transportation modes (cars, bikes, scooters) |

| Loan Term | Typically 3-7 years | Shorter duration aligned with subscription periods |

| Ideal For | Users seeking long-term private vehicle access | Users needing versatile, on-demand mobility options |

Understanding Auto Loans: Traditional Vehicle Financing Explained

Auto loans provide consumers with funds to purchase a specific vehicle, typically requiring monthly payments over a fixed term with interest based on creditworthiness. Traditional auto financing involves ownership transfer, enabling long-term equity and asset depreciation benefits but includes maintenance and insurance costs borne by the borrower. This contrasts with Mobility-as-a-Service (MaaS) loans, which fund access to flexible transportation options without ownership, emphasizing convenience over investment in a physical asset.

What Is a Mobility-as-a-Service Loan?

A Mobility-as-a-Service (MaaS) loan is a financial product designed to cover expenses related to integrated transportation services, including ride-sharing, vehicle rentals, and public transit subscriptions. Unlike traditional auto loans that finance vehicle ownership, MaaS loans provide flexible access to multiple mobility options without the burden of long-term vehicle maintenance costs. This loan supports users seeking convenient, cost-effective alternatives for urban transportation by bundling various mobility services into a single payment plan.

Key Differences Between Auto Loans and MaaS Loans

Auto loans typically provide direct ownership financing for personal vehicles, with borrowers responsible for repayments, interest rates, and vehicle maintenance costs. Mobility-as-a-Service (MaaS) loans focus on funding subscription-based or pay-per-use access to shared transportation options, emphasizing flexibility and reduced long-term financial commitment. Key differences lie in ownership transfer, repayment structures, and the scope of vehicle access with auto loans targeting individual ownership and MaaS loans promoting shared mobility solutions.

Cost Comparison: Auto Loan vs. MaaS Loan

Auto loans typically involve higher upfront costs, including down payments and interest rates, resulting in long-term financial commitments for vehicle ownership. Mobility-as-a-Service (MaaS) loans offer flexible payment structures and often lower total costs by bundling access with maintenance, insurance, and usage fees into a single monthly payment. Consumers benefit from MaaS loans' cost efficiency, especially in urban areas with fluctuating transportation needs and reduced reliance on car ownership.

Flexibility and Commitment: Ownership vs. Subscription

Auto loans require a long-term financial commitment with vehicle ownership, offering full control but limited flexibility in upgrading or changing vehicles. Mobility-as-a-Service loans provide a subscription-based model, enabling flexible access to various vehicles without ownership responsibilities or depreciation concerns. This subscription approach suits users seeking adaptability and short-term use, while auto loans benefit those prioritizing asset ownership and eventual payoff.

Eligibility and Approval Criteria for Both Loan Types

Auto loan eligibility typically requires a good credit score, stable income, and proof of vehicle ownership or purchase agreement, with approval dependent on debt-to-income ratio and credit history. Mobility-as-a-Service (MaaS) loans often assess eligibility based on flexible credit requirements, subscription history, and usage patterns rather than traditional paperwork, facilitating quicker and more accessible approval processes. Both loan types prioritize financial stability, but MaaS loans emphasize user behavior and service utilization, offering an alternative for those with limited credit profiles.

Impact on Personal Budget and Cash Flow

Auto loans typically require higher monthly payments and larger down payments, significantly impacting personal budgets by reducing disposable income and tightening cash flow. Mobility-as-a-Service (MaaS) loans, often structured as subscription or pay-as-you-go plans, offer more flexible payment options that help maintain steady cash flow and minimize upfront costs. Choosing MaaS loans can reduce financial strain by aligning vehicle access costs with actual usage, enhancing budget adaptability.

Long-Term Value: Depreciation and Residuals

Auto loans typically involve purchasing a vehicle, where depreciation significantly impacts long-term value and affects the residual amount owed at loan maturity. Mobility-as-a-Service (MaaS) loans provide access without ownership, minimizing concerns about vehicle depreciation and residual value fluctuations. This financing approach favors users prioritizing flexibility and lower financial risk associated with vehicle obsolescence.

Insurance, Maintenance, and Additional Costs

Auto loans typically require borrowers to cover insurance premiums, routine maintenance, and unexpected repair costs, which can significantly increase overall vehicle expenses. Mobility-as-a-Service (MaaS) loans often include bundled costs such as insurance and maintenance within the subscription fee, reducing out-of-pocket expenses and financial risk for users. While auto loans offer ownership and potential asset value, MaaS loans provide flexible access with predictable costs, minimizing additional financial burdens related to vehicle upkeep.

Choosing the Right Vehicle Financing Option for Your Needs

Choosing the right vehicle financing option depends on your usage patterns and financial goals; an auto loan provides ownership with fixed monthly payments, ideal for long-term use and asset building. Mobility-as-a-Service (MaaS) loans cater to flexible, short-term vehicle access, offering subscription-based payments that include maintenance and insurance, perfect for urban commuters or occasional drivers. Evaluating total cost, convenience, and mobility needs helps determine whether traditional financing or MaaS aligns best with your lifestyle and budget.

Related Important Terms

Pay-per-Mile Mobility Financing

Pay-per-mile mobility financing offers flexible vehicle access by charging borrowers based on actual usage, contrasting traditional auto loans that require fixed monthly payments regardless of miles driven. This model aligns costs directly with mobility patterns, promoting affordability and efficient budgeting for urban commuters and occasional drivers.

Usage-Based Vehicle Loan

Usage-based vehicle loans provide flexible financing tailored to actual vehicle usage, contrasting traditional auto loans that require fixed payments regardless of mileage or usage frequency. Mobility-as-a-Service (MaaS) loans emphasize pay-per-use models, reducing upfront costs and aligning loan repayment with real-time travel demand, optimizing affordability and accessibility for users.

Subscription Vehicle Loan Model

The Subscription Vehicle Loan Model offers flexible, all-inclusive payments covering maintenance, insurance, and access to multiple vehicle types, contrasting with traditional auto loans that typically incur fixed monthly payments for a single vehicle purchase. This model enhances affordability and convenience by integrating vehicle access with service subscriptions, meeting the evolving demands of consumers prioritizing mobility over ownership.

Embedded Mobility Credit

Embedded Mobility Credit integrates financing directly into Mobility-as-a-Service platforms, offering seamless access to vehicles without traditional auto loan requirements. This approach enhances flexibility and convenience compared to standard auto loans by bundling credit within subscription-based mobility services.

Fleet-as-a-Service Loan

Auto loans provide traditional financing for individual vehicle ownership, requiring full repayment with interest over a fixed term. Fleet-as-a-Service loans under the Mobility-as-a-Service model offer flexible financing options to access multiple vehicles within a fleet, optimizing cost efficiency and operational scalability for businesses.

Micro-Mobility Lease Financing

Auto loans provide traditional vehicle financing with fixed terms and ownership benefits, while Mobility-as-a-Service (MaaS) loans, particularly micro-mobility lease financing, offer flexible access to electric scooters and bikes without ownership, supporting urban mobility solutions. Micro-mobility lease financing reduces upfront costs and maintenance responsibilities, catering to users seeking short-term, eco-friendly transport options in congested city environments.

Flexible Ownership Financing

Auto loans provide traditional vehicle ownership with fixed monthly payments and long-term asset control, while Mobility-as-a-Service (MaaS) loans offer flexible financing tailored for subscription-based access to diverse transportation options without long-term commitment. Consumers seeking adaptable mobility solutions benefit from MaaS loans by combining financial flexibility with the convenience of pay-as-you-go access, contrasting with the rigidity of conventional auto loan structures.

Shared Vehicle Loan

A Shared Vehicle Loan under Mobility-as-a-Service financing offers flexible, cost-effective access to vehicles by enabling users to share rides or vehicles without full ownership, contrasting traditional Auto Loans that require full purchase and long-term repayment obligations. This innovative lending model supports urban mobility by reducing individual financial burden and encouraging environmentally friendly transportation choices.

Mobility Lease-to-Own

Mobility Lease-to-Own loans offer flexible payment plans and lower upfront costs compared to traditional auto loans, enabling users to access vehicles without long-term financial commitment. This model integrates vehicle use with evolving mobility services, providing an adaptive alternative to purchasing through conventional auto financing.

Eco-Mobility Loan

Eco-Mobility Loans offer tailored financing solutions for electric vehicles and shared mobility services, promoting sustainable transportation with lower interest rates and flexible repayment options compared to traditional auto loans. These loans support eco-friendly mobility by incentivizing the adoption of electric scooters, bikes, and car-sharing platforms, reducing carbon emissions and urban congestion.

Auto Loan vs Mobility-as-a-Service Loan for vehicle access. Infographic

moneydiff.com

moneydiff.com