Home equity loans offer lower interest rates and longer repayment terms by leveraging your property's value, making them ideal for larger expenses or debt consolidation. Salary-advance loans provide quick access to funds with minimal approval requirements but typically come with higher interest rates and shorter repayment periods. Choosing between the two depends on your need for speed versus cost-effectiveness in financing.

Table of Comparison

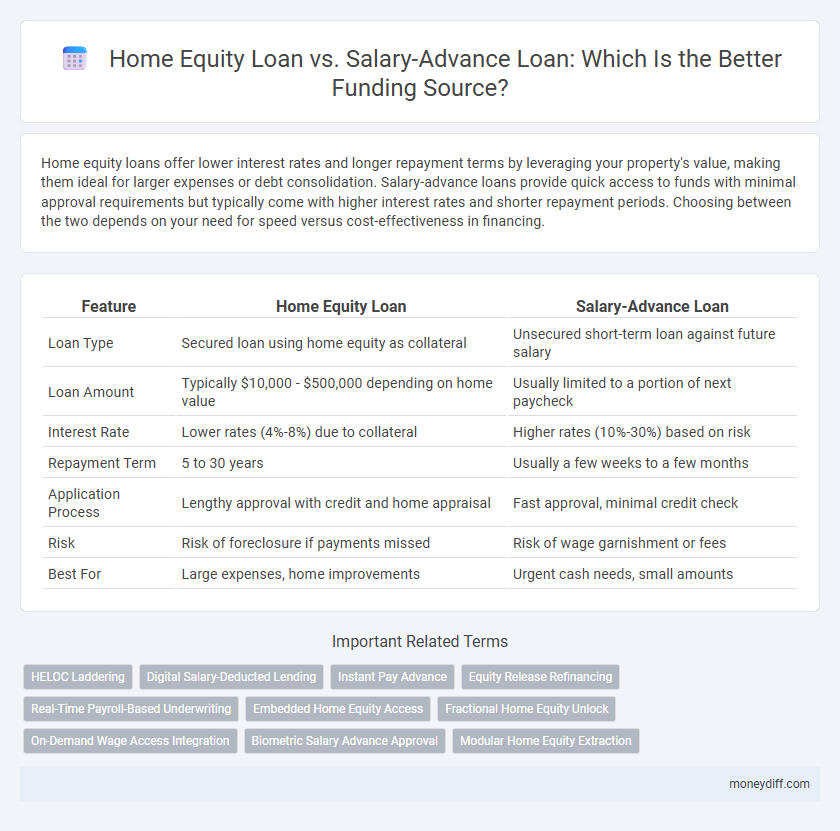

| Feature | Home Equity Loan | Salary-Advance Loan |

|---|---|---|

| Loan Type | Secured loan using home equity as collateral | Unsecured short-term loan against future salary |

| Loan Amount | Typically $10,000 - $500,000 depending on home value | Usually limited to a portion of next paycheck |

| Interest Rate | Lower rates (4%-8%) due to collateral | Higher rates (10%-30%) based on risk |

| Repayment Term | 5 to 30 years | Usually a few weeks to a few months |

| Application Process | Lengthy approval with credit and home appraisal | Fast approval, minimal credit check |

| Risk | Risk of foreclosure if payments missed | Risk of wage garnishment or fees |

| Best For | Large expenses, home improvements | Urgent cash needs, small amounts |

Understanding Home Equity Loans

Home equity loans allow homeowners to borrow against the accumulated value of their property, typically offering lower interest rates and longer repayment terms compared to salary-advance loans. These loans leverage real estate as collateral, reducing risk for lenders while providing substantial funds for large expenses like home renovations or debt consolidation. Understanding the loan-to-value ratio, interest rates, and repayment schedules is essential to evaluate home equity loans as a cost-effective funding source.

Exploring Salary-Advance Loans

Salary-advance loans offer quick access to funds by leveraging your upcoming paycheck, making them a convenient alternative to home equity loans that require property as collateral. These loans typically have fewer qualification requirements and faster approval processes compared to home equity loans, which involve credit checks and property appraisals. However, salary-advance loans usually come with higher interest rates and lower borrowing limits, making them suitable for short-term financial needs rather than large expenses.

Key Differences Between Home Equity and Salary-Advance Loans

Home equity loans use the borrower's property as collateral, enabling access to larger sums with lower interest rates, while salary-advance loans are unsecured, short-term funds typically limited to a portion of the borrower's upcoming paycheck. Home equity loans involve longer repayment terms and potential tax benefits, whereas salary-advance loans have higher interest rates and shorter repayment periods, often due by the next payday. The risk of foreclosure is inherent in home equity loans if payments are missed, contrasting with salary-advance loans where default primarily affects credit scores or results in employer deductions.

Eligibility Requirements for Each Loan Type

Home equity loans typically require the borrower to have substantial homeownership with significant equity, often at least 15-20%, and a strong credit score above 620, along with proof of steady income and low debt-to-income ratio. Salary-advance loans generally demand proof of regular employment with a stable paycheck, a minimum income threshold often set by the lender, and less stringent credit requirements, focusing more on immediate repayment ability. Understanding these eligibility differences helps borrowers select the most suitable funding source based on their financial standing and asset ownership.

Interest Rates: Home Equity vs Salary-Advance

Home equity loans generally offer lower interest rates compared to salary-advance loans due to secured collateral on property value, reducing lender risk. Salary-advance loans, often classified as unsecured short-term credit, carry higher interest rates that reflect increased default risk and immediacy of funds. Borrowers should weigh the cost-effectiveness of long-term home equity financing against the convenience and higher expense of salary-advance options.

Repayment Terms Comparison

Home equity loans typically offer longer repayment terms, often ranging from 5 to 30 years, with fixed interest rates that provide predictable monthly payments. Salary-advance loans usually require repayment within a few weeks to months, featuring higher interest rates and quicker payback schedules tied directly to the borrower's next paycheck. The extended tenure of home equity loans generally results in lower monthly payments, whereas salary-advance loans impose higher costs over a short period, emphasizing immediate cash flow needs rather than long-term financial planning.

Impact on Credit Score and Financial Health

Home equity loans typically have a lower impact on credit scores due to their secured nature, as they use the borrower's property as collateral, promoting responsible repayment behavior that can enhance credit history. In contrast, salary-advance loans, often unsecured and short-term, may result in higher interest rates and potential late fees, which can quickly damage credit scores and destabilize financial health if repayments are delayed. Evaluating the long-term financial implications, home equity loans generally support better credit management and financial stability compared to salary-advance loans.

Risks and Benefits of Home Equity Loans

Home equity loans offer lower interest rates and longer repayment terms compared to salary-advance loans, making them cost-effective for substantial funding needs. However, they carry the risk of foreclosure if borrowers default, as the home serves as collateral. In contrast, salary-advance loans provide quick access to cash without risking property but often come with higher interest rates and shorter repayment periods.

Pros and Cons of Salary-Advance Loans

Salary-advance loans offer quick access to funds with minimal credit checks, making them ideal for urgent financial needs, but they often carry high interest rates and fees that can increase overall repayment costs. Unlike home equity loans that use property as collateral, salary-advance loans are unsecured, which reduces risk for borrowers but can lead to higher approval costs and shorter repayment terms. Borrowers must weigh the convenience of immediate cash flow against potential financial strain from expensive and recurring salary-advance lending.

Choosing the Right Loan: Factors to Consider

Home Equity Loans offer lower interest rates and longer repayment terms by leveraging property value, making them ideal for substantial funding needs and long-term financial planning. Salary-Advance Loans provide quick access to funds with minimal eligibility requirements but typically involve higher interest rates and shorter repayment periods, suitable for urgent, small-scale expenses. Key factors to consider include loan amount, interest rates, repayment flexibility, credit score impact, and the borrower's ability to use home equity as collateral.

Related Important Terms

HELOC Laddering

Home Equity Loan offers lower interest rates and longer repayment terms compared to Salary-Advance Loans, making it a cost-effective choice for substantial home improvements or debt consolidation. Utilizing HELOC laddering allows borrowers to access multiple Home Equity Line of Credit (HELOC) segments over time, optimizing cash flow and interest management while maintaining borrowing flexibility.

Digital Salary-Deducted Lending

Home Equity Loans offer lower interest rates by leveraging property value, ideal for long-term financing, while Digital Salary-Deducted Loans provide faster approval and repayment through automatic salary deductions, minimizing default risk. Salary-advance loans accessed via digital platforms prioritize convenience and liquidity, enabling borrowers to manage short-term cash flow without collateral.

Instant Pay Advance

Home Equity Loans offer lower interest rates by leveraging property value but require collateral and longer approval times, while Salary-Advance Loans such as Instant Pay Advance deliver quick, unsecured access to funds directly from upcoming wages, ideal for urgent financial needs without credit checks. Instant Pay Advance stands out for its immediate disbursement and flexible repayment directly tied to the borrower's payroll cycle, minimizing risk and streamlining cash flow management.

Equity Release Refinancing

Home Equity Loans leverage the borrower's property value as collateral, often offering lower interest rates and larger loan amounts, making them suitable for long-term financing needs like home renovations or debt consolidation. Salary-Advance Loans provide quick access to funds based on upcoming wages but typically have higher interest rates and shorter repayment terms, making them less ideal for substantial equity release refinancing.

Real-Time Payroll-Based Underwriting

Home Equity Loans leverage the borrower's accumulated property value as collateral, often resulting in lower interest rates and larger loan amounts compared to Salary-Advance Loans, which rely on immediate income for short-term funding. Real-Time Payroll-Based Underwriting enhances Salary-Advance Loans by verifying income instantly through payroll data, improving credit decision accuracy and reducing default risk.

Embedded Home Equity Access

Home Equity Loans provide borrowers with embedded access to their property's built-up value, offering larger, long-term funding options with typically lower interest rates compared to Salary-Advance Loans, which are short-term, high-cost advances tied directly to payroll. The embedded home equity access enables leveraging accumulated real estate wealth securely, making it a preferable option for substantial expenses or debt consolidation.

Fractional Home Equity Unlock

Fractional Home Equity Unlock allows homeowners to access a portion of their property's value without full loan obligations, offering a flexible alternative to salary-advance loans that often have higher interest rates and shorter repayment terms. This option optimizes cash flow by leveraging home equity incrementally, reducing reliance on immediate salary deductions and mitigating financial strain compared to conventional salary-advance borrowing.

On-Demand Wage Access Integration

Home Equity Loans offer borrowers substantial funds by leveraging property value, providing lower interest rates and longer repayment terms, whereas Salary-Advance Loans deliver immediate cash access based on earned wages with faster approval but higher fees. On-Demand Wage Access Integration enables employees to access earned income instantly, reducing reliance on costly salary-advance loans while fostering financial stability and improved cash flow management.

Biometric Salary Advance Approval

Home Equity Loans offer lower interest rates by leveraging property value but require extensive credit checks and longer approval times, whereas Salary-Advance Loans provide quick access to funds with biometric salary advance approval, enabling secure and immediate verification through fingerprint or facial recognition technology. The biometric system reduces fraud risk and accelerates disbursement, making salary-advance loans an efficient option for urgent financial needs compared to traditional home equity financing.

Modular Home Equity Extraction

Modular home equity extraction provides a stable and cost-effective funding source by leveraging the accumulated value in a property, offering lower interest rates and longer repayment terms compared to salary-advance loans, which often come with higher fees and shorter payback periods. Home equity loans typically enable borrowers to access substantial funds for modular home improvements or purchases, while salary-advance loans serve as quick, small-scale financial solutions tied directly to future income.

Home Equity Loan vs Salary-Advance Loan for funding source. Infographic

moneydiff.com

moneydiff.com