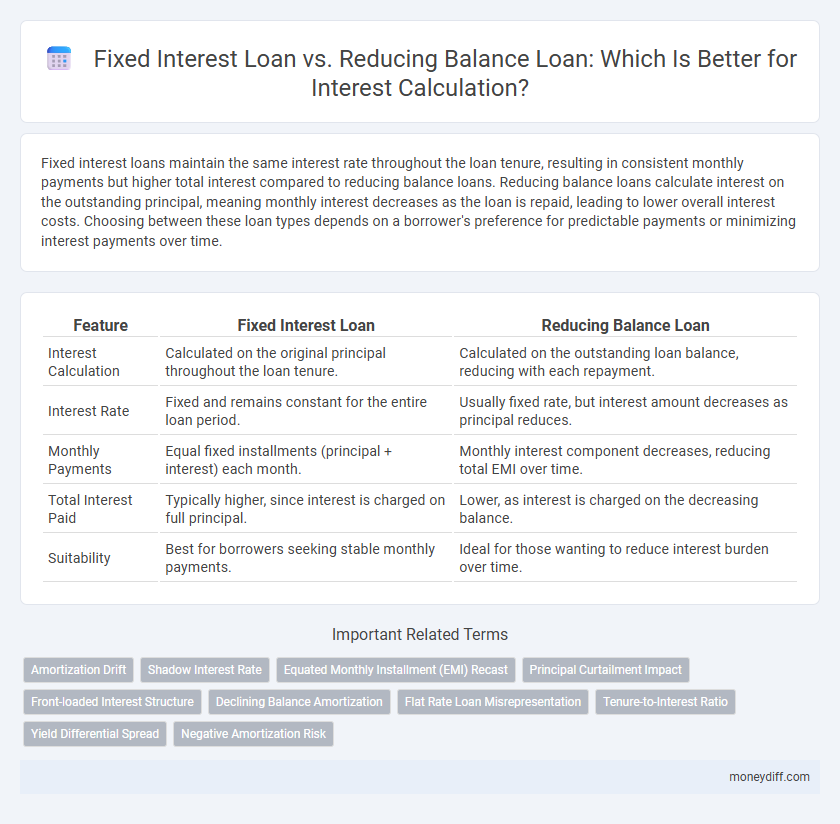

Fixed interest loans maintain the same interest rate throughout the loan tenure, resulting in consistent monthly payments but higher total interest compared to reducing balance loans. Reducing balance loans calculate interest on the outstanding principal, meaning monthly interest decreases as the loan is repaid, leading to lower overall interest costs. Choosing between these loan types depends on a borrower's preference for predictable payments or minimizing interest payments over time.

Table of Comparison

| Feature | Fixed Interest Loan | Reducing Balance Loan |

|---|---|---|

| Interest Calculation | Calculated on the original principal throughout the loan tenure. | Calculated on the outstanding loan balance, reducing with each repayment. |

| Interest Rate | Fixed and remains constant for the entire loan period. | Usually fixed rate, but interest amount decreases as principal reduces. |

| Monthly Payments | Equal fixed installments (principal + interest) each month. | Monthly interest component decreases, reducing total EMI over time. |

| Total Interest Paid | Typically higher, since interest is charged on full principal. | Lower, as interest is charged on the decreasing balance. |

| Suitability | Best for borrowers seeking stable monthly payments. | Ideal for those wanting to reduce interest burden over time. |

Understanding Fixed Interest Loans

Fixed interest loans maintain a constant interest rate throughout the loan tenure, ensuring predictable monthly payments and stable budgeting for borrowers. Interest is calculated on the original principal amount, which means the interest component remains the same even as the outstanding loan balance decreases. This method contrasts with reducing balance loans, where interest is charged on the outstanding principal, resulting in decreasing interest payments over time.

Exploring Reducing Balance Loans

Reducing balance loans calculate interest on the outstanding principal, decreasing as repayments are made, resulting in lower total interest compared to fixed interest loans where interest is charged on the original principal throughout the loan tenure. This method benefits borrowers by reducing interest costs over time, especially for long-term loans with regular installments. Financial institutions often prefer reducing balance loans for their transparent amortization schedules and alignment with actual loan balances.

Key Differences Between Fixed and Reducing Balance Loans

Fixed interest loans charge interest on the entire principal amount throughout the loan tenure, resulting in consistent monthly payments and predictable financial planning. Reducing balance loans calculate interest on the outstanding principal, which decreases with each repayment, leading to lower interest charges over time and potentially faster loan repayment. Key differences include the method of interest calculation, total interest paid, and payment flexibility, making fixed interest loans suitable for budgeting stability and reducing balance loans advantageous for cost savings.

How Fixed Interest Loan Calculations Work

Fixed interest loan calculations involve charging interest on the entire principal amount throughout the loan tenure, resulting in consistent monthly payments. The interest is computed using a fixed rate applied to the original principal, making repayment amounts predictable and stable. This method contrasts with reducing balance loans, where interest decreases as the principal is repaid over time.

Interest Computation in Reducing Balance Loans

Reducing balance loans calculate interest on the outstanding principal, resulting in decreasing interest payments over time as the loan is repaid. This method contrasts with fixed interest loans, where interest is computed on the initial principal amount throughout the loan tenure. The reducing balance approach leads to lower total interest costs and faster principal reduction, making it a cost-effective option for borrowers.

Pros and Cons of Fixed Interest Loans

Fixed interest loans provide predictable monthly payments, simplifying budgeting by maintaining a constant interest rate throughout the loan term. However, they often result in higher overall interest costs compared to reducing balance loans, where interest is calculated on the decreasing principal amount. Borrowers may benefit from fixed interest loans when market rates are stable or expected to rise, but could miss out on savings if rates decline.

Advantages and Disadvantages of Reducing Balance Loans

Reducing balance loans calculate interest on the outstanding principal, resulting in lower interest payments over time compared to fixed interest loans where interest is charged on the entire principal. The key advantage of reducing balance loans is cost-effectiveness, especially for borrowers who can make early repayments, which reduces the principal faster and minimizes interest. However, the complexity of interest calculations and variable monthly payments can be challenging for budgeting compared to the predictability of fixed interest loans.

Impact on Total Interest Paid Over Loan Tenure

A fixed interest loan calculates interest on the entire principal amount throughout the loan tenure, leading to higher total interest paid compared to a reducing balance loan where interest is charged on the outstanding principal, decreasing over time. Reducing balance loans result in lower overall interest costs due to the diminishing principal, making them more cost-effective for borrowers with longer loan tenures. Choosing between these loan types significantly influences the total interest expense and overall repayment amount.

Choosing the Right Loan Type for Your Needs

Fixed interest loans provide stable monthly payments by applying a constant interest rate over the loan term, ideal for borrowers seeking predictable budgeting. Reducing balance loans calculate interest on the outstanding principal balance, leading to lower interest costs over time as repayments progress, benefiting those who can manage variable payments. Assess financial stability, repayment capacity, and long-term savings potential to choose the right loan type that aligns with your financial goals.

Which Interest Calculation Method Saves More Money?

Fixed interest loans charge interest on the original principal throughout the loan tenure, resulting in higher overall interest payments compared to reducing balance loans. Reducing balance loans calculate interest on the outstanding principal after each repayment, which decreases over time, leading to lower total interest costs. Borrowers typically save more money with reducing balance loans due to declining interest charges as the loan principal is repaid.

Related Important Terms

Amortization Drift

Fixed interest loans maintain a constant interest rate throughout the tenure, resulting in uniform monthly payments with minimal amortization drift, whereas reducing balance loans recalculate interest on the diminishing principal, causing varying monthly installments and a higher risk of amortization drift. Understanding amortization drift is crucial for borrowers to anticipate payment fluctuations and manage repayment schedules effectively in reducing balance loan structures.

Shadow Interest Rate

Shadow interest rate reveals the true cost of a fixed interest loan by accounting for the effect of compounding over time, often making it appear higher than the nominal rate. In contrast, the reducing balance loan calculates interest on the declining principal, resulting in a lower shadow interest rate and overall interest expense.

Equated Monthly Installment (EMI) Recast

Fixed interest loans maintain a constant Equated Monthly Installment (EMI) throughout the tenure, simplifying repayment planning but potentially leading to higher overall interest costs. Reducing balance loans recalculate the EMI periodically based on the outstanding principal, allowing borrowers to benefit from decreasing interest charges as the loan is repaid faster.

Principal Curtailment Impact

Fixed interest loans maintain consistent interest charges based on the original principal throughout the loan tenure, minimizing the impact of principal curtailment on overall interest costs. In contrast, reducing balance loans calculate interest on the diminishing principal after each payment, significantly lowering total interest paid when principal curtailment occurs early in the loan period.

Front-loaded Interest Structure

Fixed interest loans feature a front-loaded interest structure where borrowers pay higher interest charges in the early repayment stages based on the initial principal, resulting in consistently higher monthly payments. In contrast, reducing balance loans calculate interest on the declining principal balance, leading to lower interest expenses over time and gradually decreasing monthly installments.

Declining Balance Amortization

Declining Balance Amortization in reducing balance loans calculates interest on the outstanding principal, resulting in decreasing interest payments over time compared to fixed interest loans that apply a constant interest rate on the initial principal. This method promotes faster principal repayment and lower total interest costs throughout the loan tenure.

Flat Rate Loan Misrepresentation

Flat rate loans often misrepresent the true cost of borrowing by calculating interest on the entire principal throughout the loan term, ignoring the decreasing balance, which can lead to higher actual interest payments compared to reducing balance loans where interest is computed on the outstanding principal. Borrowers may underestimate expenses with flat rate loans, causing financial strain, whereas reducing balance loans provide a more transparent and accurate reflection of interest costs as the principal diminishes over time.

Tenure-to-Interest Ratio

Fixed interest loans maintain a constant interest rate over the tenure, resulting in stable but potentially higher total interest payments, whereas reducing balance loans calculate interest on the outstanding principal, lowering interest cost proportionally as tenure increases. The tenure-to-interest ratio in reducing balance loans becomes more favorable over longer periods due to decreasing interest liability, offering greater cost efficiency compared to fixed interest loans.

Yield Differential Spread

Fixed interest loans maintain a constant interest rate throughout the tenure, resulting in a stable but often higher overall interest cost compared to reducing balance loans, where interest is calculated on the outstanding principal, decreasing over time and thus lowering the effective yield differential spread. The yield differential spread between these loan types highlights the cost efficiency of reducing balance loans by minimizing interest expenses as principal repayments progress.

Negative Amortization Risk

Fixed interest loans maintain a consistent interest amount throughout the loan tenure, reducing the risk of negative amortization where unpaid interest increases the loan principal. In contrast, reducing balance loans calculate interest on the outstanding principal, minimizing interest costs over time but potentially causing negative amortization if repayments are insufficient to cover accruing interest.

Fixed Interest Loan vs Reducing Balance Loan for interest calculation. Infographic

moneydiff.com

moneydiff.com