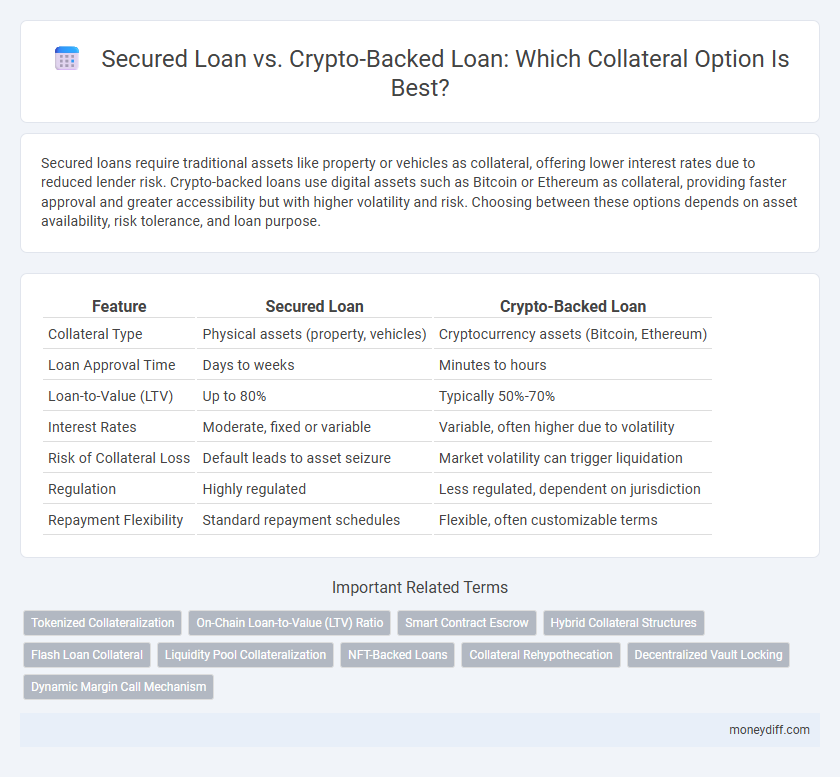

Secured loans require traditional assets like property or vehicles as collateral, offering lower interest rates due to reduced lender risk. Crypto-backed loans use digital assets such as Bitcoin or Ethereum as collateral, providing faster approval and greater accessibility but with higher volatility and risk. Choosing between these options depends on asset availability, risk tolerance, and loan purpose.

Table of Comparison

| Feature | Secured Loan | Crypto-Backed Loan |

|---|---|---|

| Collateral Type | Physical assets (property, vehicles) | Cryptocurrency assets (Bitcoin, Ethereum) |

| Loan Approval Time | Days to weeks | Minutes to hours |

| Loan-to-Value (LTV) | Up to 80% | Typically 50%-70% |

| Interest Rates | Moderate, fixed or variable | Variable, often higher due to volatility |

| Risk of Collateral Loss | Default leads to asset seizure | Market volatility can trigger liquidation |

| Regulation | Highly regulated | Less regulated, dependent on jurisdiction |

| Repayment Flexibility | Standard repayment schedules | Flexible, often customizable terms |

Understanding Secured Loans: Traditional Collateral Explained

Secured loans require borrowers to pledge traditional collateral, such as real estate, vehicles, or savings accounts, to reduce lender risk and obtain favorable interest rates. This collateral provides a tangible asset that lenders can seize if the borrower defaults, ensuring loan recovery and increasing approval chances. Understanding the nature of traditional collateral is crucial for evaluating loan security, repayment terms, and potential financial consequences in secured lending.

What Are Crypto-Backed Loans?

Crypto-backed loans allow borrowers to use their cryptocurrency holdings, such as Bitcoin or Ethereum, as collateral to access liquidity without selling their assets. These loans typically offer lower interest rates and faster approval compared to traditional secured loans, which require tangible assets like property or vehicles as collateral. The volatile nature of cryptocurrencies introduces unique risks, including potential margin calls if the collateral value drops significantly.

Key Differences Between Secured and Crypto-Backed Loans

Secured loans require traditional assets like real estate or vehicles as collateral, providing lenders with tangible security, while crypto-backed loans use digital assets such as Bitcoin or Ethereum. The volatility of cryptocurrency impacts the loan-to-value ratio and risk assessment more significantly compared to stable, physical collateral. Interest rates and approval processes differ, with crypto-backed loans often offering faster approvals but higher interest due to market fluctuations.

Types of Collateral Accepted: Real Assets vs Digital Assets

Secured loans typically require real assets such as property, vehicles, or savings accounts as collateral, providing tangible value that lenders can repossess in case of default. Crypto-backed loans accept digital assets like Bitcoin, Ethereum, or other cryptocurrencies, leveraging blockchain technology for verification and offering faster access to funds without the need for traditional credit checks. The choice between real and digital asset collateral impacts risk assessment, loan approval speed, and asset liquidity.

Risk Factors: Asset Volatility and Security

Secured loans typically rely on stable, physical assets such as real estate or vehicles, which present lower volatility and more predictable value retention, reducing the risk of collateral depreciation. Crypto-backed loans involve highly volatile digital assets, exposing lenders and borrowers to rapid fluctuations in collateral value, which can trigger margin calls or liquidations. Assessing the security of collateral in crypto loans requires vigilant monitoring of market conditions and implementing automated risk management mechanisms to mitigate asset volatility risks.

Loan Approval Speed and Process Comparison

Secured loans typically have a faster approval process due to established credit evaluation methods and widely accepted collateral like real estate or vehicles. Crypto-backed loans involve blockchain verification and fluctuating asset valuation, often resulting in longer approval times and additional procedural steps. Comparing both, traditional secured loans offer streamlined processing, while crypto-backed loans require specialized underwriting and dynamic collateral assessment.

Interest Rates: Traditional Banks vs Crypto Lenders

Interest rates for secured loans from traditional banks typically range between 4% and 8%, reflecting lower risk due to established collateral such as property or vehicles. Crypto-backed loans often feature higher interest rates, ranging from 8% to 15%, driven by the volatility of digital assets used as collateral. Banks prioritize credit scores and asset stability, while crypto lenders factor in market fluctuations and liquidation risks when setting rates.

Accessibility and Eligibility Requirements

Secured loans typically require traditional collateral such as real estate or vehicles, making them accessible primarily to borrowers with valuable physical assets and a strong credit history. Crypto-backed loans offer increased accessibility by allowing digital assets like Bitcoin or Ethereum as collateral, appealing to borrowers holding cryptocurrencies but may have stricter eligibility criteria based on the volatility and value of the crypto collateral. Eligibility for secured loans often involves detailed credit checks and income verification, whereas crypto-backed loans focus more on the valuation and liquidity of the digital assets provided.

Impact on Credit Score and Privacy

Secured loans typically require collateral such as property or vehicles, which can impact your credit score through regular repayments reported to credit bureaus, while offering limited privacy as lender records reflect the transaction. Crypto-backed loans use digital assets as collateral, generally causing no direct impact on credit scores since they often bypass traditional credit checks, enhancing privacy by reducing third-party data sharing. Borrowers choosing crypto-backed loans benefit from maintaining greater confidentiality, but must also consider the volatility of cryptocurrency as collateral.

Which Collateral Option Is Right for You?

Secured loans use traditional assets like real estate or vehicles as collateral, offering lower interest rates and stable terms for borrowers with valuable physical assets. Crypto-backed loans leverage digital currencies such as Bitcoin or Ethereum, providing faster approval and flexible repayment but with higher volatility risks due to market fluctuations. Choosing between secured loans and crypto-backed loans depends on your risk tolerance, asset availability, and need for liquidity in leveraging collateral.

Related Important Terms

Tokenized Collateralization

Tokenized collateralization in crypto-backed loans leverages blockchain technology to convert digital assets into secure, tradable tokens, enhancing transparency and liquidity compared to traditional secured loans that rely on physical or fixed assets. This innovation reduces appraisal delays and allows fractional ownership, making loan collateral more versatile and accessible in decentralized finance (DeFi) platforms.

On-Chain Loan-to-Value (LTV) Ratio

Secured loans typically involve traditional assets like real estate or vehicles as collateral with established market valuations, enabling conservative Loan-to-Value (LTV) ratios often below 80%, reducing lender risk. Crypto-backed loans utilize volatile digital assets as collateral with dynamic On-Chain LTV ratios frequently ranging between 50%-70%, reflecting real-time blockchain data and increased risk due to price fluctuations.

Smart Contract Escrow

Smart Contract Escrow in crypto-backed loans automates collateral management by securely locking digital assets, reducing counterparty risks and ensuring transparent execution of loan terms. Traditional secured loans rely on physical assets as collateral, which require manual verification and custody, making smart contracts a more efficient and trustless alternative for collateral handling.

Hybrid Collateral Structures

Hybrid collateral structures combine traditional secured loans with crypto-backed assets, enhancing loan flexibility and risk management by diversifying collateral types. This approach optimizes borrowing capacity and mitigates volatility by leveraging both tangible assets and volatile cryptocurrencies as security.

Flash Loan Collateral

Flash loan collateral in secured loans typically involves traditional assets such as real estate or vehicles, ensuring stable and tangible security for lenders. In contrast, crypto-backed loans utilize digital assets like cryptocurrencies as collateral, offering faster, more flexible flash loan options but with higher volatility and risk exposure.

Liquidity Pool Collateralization

Secured loans typically rely on tangible assets like real estate or vehicles for collateral, offering stable but less flexible liquidity options. Crypto-backed loans utilize liquidity pool collateralization, enabling asset holders to leverage decentralized finance (DeFi) pools for faster access to funds while maintaining exposure to volatile cryptocurrency markets.

NFT-Backed Loans

NFT-backed loans represent a cutting-edge form of secured loan where non-fungible tokens serve as collateral, offering borrowers liquidity without relinquishing ownership of digital assets. Compared to traditional secured loans using physical collateral, NFT-backed loans provide faster approval and greater accessibility within decentralized finance ecosystems.

Collateral Rehypothecation

Secured loans traditionally use tangible assets like real estate or vehicles as collateral, where lenders often retain the right to rehypothecate these assets, increasing liquidity but also risk for borrowers. In contrast, crypto-backed loans involve digital assets as collateral, with platforms frequently enabling rehypothecation to amplify lending capacity, though this carries unique risks due to cryptocurrency volatility and regulatory uncertainty.

Decentralized Vault Locking

Secured loans typically rely on traditional assets like real estate or vehicles for collateral, whereas crypto-backed loans utilize decentralized vault locking mechanisms to secure digital assets on blockchain networks. Decentralized vault locking enhances transparency and security by enabling borrowers to store collateral on smart contracts, minimizing counterparty risk and enabling faster loan approvals without intermediaries.

Dynamic Margin Call Mechanism

Secured loans typically require traditional assets like real estate or vehicles as collateral, with a static margin call mechanism based on fixed loan-to-value ratios, whereas crypto-backed loans use volatile digital assets and implement dynamic margin call mechanisms that automatically adjust collateral requirements in real-time to mitigate risk during market fluctuations. This dynamic margin call system helps protect lenders by triggering additional collateral deposits or partial loan repayments when the value of crypto collateral drops below predefined thresholds, ensuring loan stability in highly volatile crypto markets.

Secured Loan vs Crypto-Backed Loan for collateral options. Infographic

moneydiff.com

moneydiff.com