Mortgage loans provide traditional financing through banks or lenders, offering structured repayment terms and competitive interest rates. Crowdfunded mortgages pool small investments from multiple individuals, allowing borrowers to access funds without relying on conventional banks, often with more flexible qualification criteria. Choosing between the two depends on factors like funding speed, cost, and borrower eligibility.

Table of Comparison

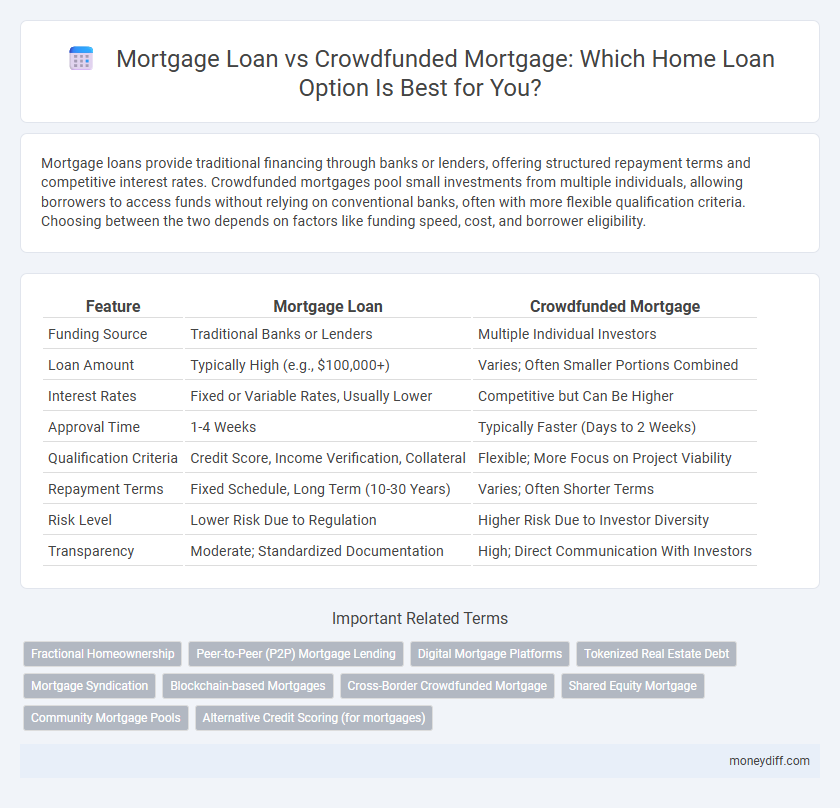

| Feature | Mortgage Loan | Crowdfunded Mortgage |

|---|---|---|

| Funding Source | Traditional Banks or Lenders | Multiple Individual Investors |

| Loan Amount | Typically High (e.g., $100,000+) | Varies; Often Smaller Portions Combined |

| Interest Rates | Fixed or Variable Rates, Usually Lower | Competitive but Can Be Higher |

| Approval Time | 1-4 Weeks | Typically Faster (Days to 2 Weeks) |

| Qualification Criteria | Credit Score, Income Verification, Collateral | Flexible; More Focus on Project Viability |

| Repayment Terms | Fixed Schedule, Long Term (10-30 Years) | Varies; Often Shorter Terms |

| Risk Level | Lower Risk Due to Regulation | Higher Risk Due to Investor Diversity |

| Transparency | Moderate; Standardized Documentation | High; Direct Communication With Investors |

Understanding Mortgage Loans: Traditional Financing Explained

Mortgage loans involve borrowing funds from banks or financial institutions to purchase property, typically requiring a down payment and fixed or variable interest rates over a set term. Crowdfunded mortgages pool resources from multiple investors via online platforms, offering an alternative funding source with potentially lower barriers to entry but varying interest rates and risk levels. Understanding these options helps borrowers evaluate costs, repayment terms, and lender requirements to select the most suitable financing for property acquisition.

What is a Crowdfunded Mortgage?

A crowdfunded mortgage is a type of home loan funded by multiple individual investors rather than a traditional financial institution. This alternative financing method allows borrowers to raise capital from a pool of contributors who each invest a portion of the loan amount. Crowdfunded mortgages provide borrowers with access to diverse funding sources and can offer more flexible terms compared to conventional mortgage loans.

Key Differences Between Traditional and Crowdfunded Mortgages

Traditional mortgage loans involve borrowing a fixed amount from banks or financial institutions with set interest rates and repayment schedules, often requiring significant credit checks and collateral. Crowdfunded mortgages pool capital from multiple individual investors, offering flexible terms and potentially lower entry barriers but with varying risk and return profiles. Key differences include loan approval processes, funding sources, and regulatory oversight, impacting borrower accessibility and investment transparency.

Eligibility Criteria: Who Can Apply?

Mortgage loans typically require applicants to have a stable income, good credit score, and sufficient down payment, often necessitating proof of employment and financial stability. Crowdfunded mortgages attract a broader range of borrowers, including those with lower credit scores or unconventional income sources, as funding comes from multiple individual investors rather than a single financial institution. Eligibility for crowdfunded mortgages often emphasizes property value and potential investment returns, making it accessible to non-traditional applicants who may not qualify for standard mortgage loans.

Interest Rates: Mortgage Loan vs Crowdfunded Mortgage

Mortgage loans typically offer lower interest rates due to established banking regulations and risk assessment models, averaging between 3% to 5% annually. Crowdfunded mortgages often present higher interest rates, ranging from 5% to 8%, reflecting the increased risk for individual investors and less standardized underwriting processes. Borrowers should carefully compare interest rates and terms to determine the most cost-effective financing option for their property purchase.

Down Payment Requirements Compared

Mortgage loans typically require a down payment of 10-20% of the property's purchase price, which can be a significant upfront cost for borrowers. Crowdfunded mortgages often have lower down payment requirements, sometimes as low as 5%, because the risk is distributed among multiple investors. This reduced initial payment makes crowdfunded mortgage options more accessible to buyers with limited savings or first-time homebuyers.

Application Process: Step-by-Step Overview

The application process for a mortgage loan involves submitting financial documents, undergoing credit checks, and receiving approval from a traditional lender, typically requiring a detailed review and appraisal of the property. In contrast, a crowdfunded mortgage application often includes pitching the loan opportunity to multiple investors on a digital platform, followed by collective funding and approval steps that may be faster and more flexible. Both processes demand thorough verification of borrower credentials but vary significantly in funding sources and approval timelines.

Risks and Rewards: Evaluating Each Option

Mortgage loans typically offer structured repayment plans with predictable interest rates, providing borrowers with stability but requiring strong creditworthiness and collateral. Crowdfunded mortgages pool investments from multiple lenders, allowing for potentially lower entry barriers and diversified funding sources, yet they carry risks such as less regulatory oversight and possible delays in funding or repayment. Evaluating each option involves weighing the security and familiarity of traditional mortgage loans against the flexibility and novel challenges of crowdfunded mortgages to determine the best fit for individual financial goals and risk tolerance.

Flexibility and Repayment Terms

Mortgage loans typically offer fixed repayment schedules and set interest rates, providing predictability but limited flexibility in terms of payment adjustments. Crowdfunded mortgages often allow for more adaptable repayment terms, enabling borrowers to negotiate payment schedules with multiple investors, which can accommodate changing financial circumstances. Borrowers seeking customizable repayment options may benefit more from crowdfunded mortgages, while those preferring structured, traditional loan arrangements might favor conventional mortgage loans.

Which Mortgage Option is Best for You?

Mortgage loans typically offer structured repayment terms and fixed interest rates, making them ideal for borrowers seeking stability and predictability in home financing. Crowdfunded mortgages provide access to funds from multiple investors, potentially lowering entry barriers and offering more flexible approval criteria but may involve higher risk and variable terms. Evaluating your financial stability, risk tolerance, and long-term goals helps determine whether a traditional mortgage loan or a crowdfunded mortgage better aligns with your homeownership plans.

Related Important Terms

Fractional Homeownership

Mortgage loans provide individuals with full ownership and fixed repayment terms, while crowdfunded mortgages enable fractional homeownership by allowing multiple investors to pool funds and share property ownership proportions. Fractional homeownership through crowdfunded mortgages offers greater accessibility and diversified investment opportunities without the need for traditional full mortgage approval processes.

Peer-to-Peer (P2P) Mortgage Lending

Peer-to-peer (P2P) mortgage lending leverages digital platforms to connect borrowers directly with individual lenders, offering potentially lower interest rates and faster approval compared to traditional mortgage loans from banks. Crowdfunded mortgages pool funds from multiple investors, distributing risk and increasing accessibility for borrowers who might not qualify for conventional loans.

Digital Mortgage Platforms

Digital mortgage platforms streamline both mortgage loan and crowdfunded mortgage processes by offering automated credit assessments, real-time property valuations, and seamless document management, enhancing user experience and approval speed. Crowdfunded mortgages leverage these platforms to pool investments from multiple backers, providing alternative financing options with transparent tracking, whereas traditional mortgage loans focus on direct lender-to-borrower transactions with standardized underwriting procedures.

Tokenized Real Estate Debt

Tokenized real estate debt in crowdfunded mortgages enables fractional ownership and liquidity by digitizing mortgage loans on blockchain platforms, contrasting with traditional mortgage loans that involve singular, large lenders and limited transferability. This innovative approach increases access to real estate investment by lowering entry barriers and enhancing transparency in loan servicing and repayments.

Mortgage Syndication

Mortgage syndication involves pooling funds from multiple investors to finance large mortgage loans, offering diversified risk and access to higher-value properties compared to crowdfunded mortgages, which typically gather smaller amounts from a broader base of individual investors. This structured approach in mortgage syndication provides more stability and professional management, making it a preferred option for institutional investors seeking substantial returns in mortgage lending.

Blockchain-based Mortgages

Blockchain-based mortgage loans offer enhanced transparency, security, and faster processing by leveraging decentralized ledgers for property title management and loan agreements. Crowdfunded mortgages on blockchain platforms democratize real estate investment, enabling multiple investors to pool funds while reducing reliance on traditional financial institutions and increasing liquidity in the mortgage market.

Cross-Border Crowdfunded Mortgage

Cross-border crowdfunded mortgage loans leverage international investor pools to provide diverse funding sources and competitive interest rates compared to traditional mortgage loans, which rely predominantly on local banks. This innovative financing method offers increased accessibility and flexibility for borrowers seeking property investments across borders while mitigating currency and regulatory risks through platform-driven due diligence and compliance measures.

Shared Equity Mortgage

Shared equity mortgages combine traditional mortgage financing with crowd investment, allowing multiple investors to share ownership equity and reduce borrower monthly payments. Unlike conventional mortgage loans, crowdfunded shared equity mortgages offer increased access to financing through diversified investor pools while sharing property appreciation or depreciation risks.

Community Mortgage Pools

Mortgage loans typically involve traditional lenders providing funds directly to borrowers, while crowdfunded mortgages leverage community mortgage pools, allowing multiple investors to collectively finance a property. Community mortgage pools diversify risk among participants and increase access to funding for borrowers, often resulting in more flexible terms and localized investment opportunities.

Alternative Credit Scoring (for mortgages)

Alternative credit scoring for mortgage loans leverages non-traditional data such as utility payments, rental history, and social behaviors to assess borrower reliability beyond conventional credit reports. Crowdfunded mortgages often integrate innovative alternative credit scoring models to broaden access for underserved borrowers, enabling more inclusive lending compared to traditional mortgage loans reliant on standard credit scores.

Mortgage Loan vs Crowdfunded Mortgage for Loan Infographic

moneydiff.com

moneydiff.com