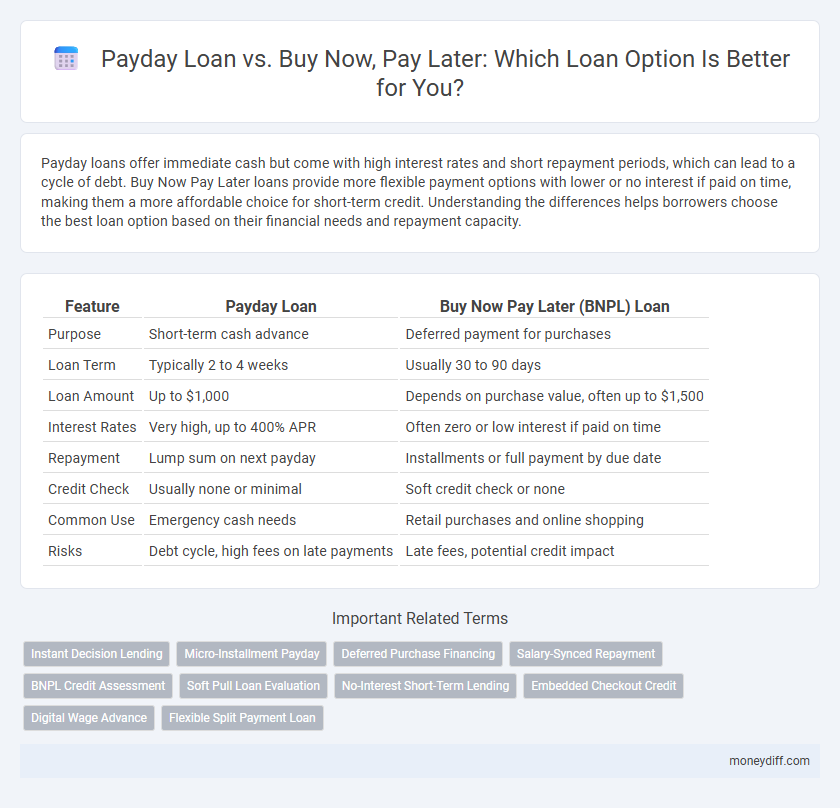

Payday loans offer immediate cash but come with high interest rates and short repayment periods, which can lead to a cycle of debt. Buy Now Pay Later loans provide more flexible payment options with lower or no interest if paid on time, making them a more affordable choice for short-term credit. Understanding the differences helps borrowers choose the best loan option based on their financial needs and repayment capacity.

Table of Comparison

| Feature | Payday Loan | Buy Now Pay Later (BNPL) Loan |

|---|---|---|

| Purpose | Short-term cash advance | Deferred payment for purchases |

| Loan Term | Typically 2 to 4 weeks | Usually 30 to 90 days |

| Loan Amount | Up to $1,000 | Depends on purchase value, often up to $1,500 |

| Interest Rates | Very high, up to 400% APR | Often zero or low interest if paid on time |

| Repayment | Lump sum on next payday | Installments or full payment by due date |

| Credit Check | Usually none or minimal | Soft credit check or none |

| Common Use | Emergency cash needs | Retail purchases and online shopping |

| Risks | Debt cycle, high fees on late payments | Late fees, potential credit impact |

Introduction to Payday Loans and Buy Now Pay Later Loans

Payday loans are short-term, high-interest loans intended to cover immediate cash needs until the next paycheck, often with fees that significantly increase the repayment amount. Buy Now Pay Later (BNPL) loans allow consumers to split purchases into interest-free installments over weeks or months, promoting manageable repayments without upfront costs. Both financial products cater to urgent spending but differ in cost structure, repayment flexibility, and typical usage scenarios.

How Payday Loans Work: Features and Process

Payday loans provide short-term cash advances designed to cover urgent expenses until the next paycheck, typically involving high interest rates and a fixed repayment date within two to four weeks. Borrowers must provide proof of income, identification, and a checking account, with funds often disbursed quickly, sometimes within 24 hours. The loan process includes applying online or in person, lender approval based on credit and income verification, and automatic repayment through post-dated checks or electronic withdrawal.

Understanding Buy Now Pay Later Loans

Buy Now Pay Later (BNPL) loans offer consumers short-term financing that splits the cost of purchases into manageable installments, making it easier to budget without immediate full payment. Unlike payday loans, BNPL options typically feature lower interest rates and transparent repayment schedules, reducing the risk of debt cycles commonly associated with high-interest payday borrowing. Understanding BNPL loans helps borrowers leverage flexible credit for everyday expenses while maintaining financial control and avoiding excessive fees.

Eligibility Criteria: Payday Loan vs Buy Now Pay Later

Payday loans typically require proof of steady income, a valid ID, and a checking account, catering primarily to individuals with urgent cash needs despite having lower credit scores. Buy Now Pay Later (BNPL) loans often necessitate a soft credit check, a debit or credit card, and a minimum age requirement, targeting consumers seeking flexible payment options for retail purchases. Eligibility for payday loans is more lenient but comes with higher interest rates, while BNPL schemes emphasize creditworthiness and spending behavior to ensure repayment within interest-free periods.

Interest Rates and Fees Comparison

Payday loans often carry extremely high interest rates, sometimes exceeding 400% APR, along with substantial fees that can lead to spiraling debt if not repaid quickly. Buy Now Pay Later (BNPL) loans typically feature lower or zero interest rates when payments are made on time, but may incur late fees or penalties that vary by provider. Comparing both options, BNPL loans generally offer a more affordable alternative with transparent fee structures, while payday loans pose higher financial risks due to their costly interest and fees.

Repayment Terms: Flexibility and Duration

Payday loans typically have short repayment terms ranging from two to four weeks, requiring a lump-sum payment that can strain borrowers' finances. Buy Now Pay Later (BNPL) loans offer more flexible repayment options, allowing consumers to spread payments over several weeks or months with little to no interest, promoting easier budget management. The extended duration and installment-based structure of BNPL loans provide greater repayment flexibility compared to the rigid, high-cost terms of payday loans.

Impact on Credit Score: Which Option is Safer?

Payday loans typically have a more severe impact on credit scores due to high-interest rates and short repayment terms, often leading to missed payments and defaults. Buy Now Pay Later (BNPL) loans generally report fewer negative entries to credit bureaus and allow staggered payments, making them a safer option for maintaining a healthy credit score. Consumers seeking to protect their credit ratings should prioritize BNPL options and ensure timely payments to avoid detrimental effects.

Risks and Drawbacks of Payday Loans

Payday loans carry high-interest rates often exceeding 400% APR, creating a substantial risk of debt cycles for borrowers unable to repay quickly. These loans typically require full repayment by the borrower's next paycheck, leading to frequent renewals and escalating fees. Unlike Buy Now Pay Later loans that offer structured repayment plans, payday loans lack consumer protections, increasing the potential for financial hardship and credit damage.

Risks and Drawbacks of Buy Now Pay Later Loans

Buy Now Pay Later (BNPL) loans often carry risks such as high late fees, negative impacts on credit scores if payments are missed, and the temptation to overspend due to deferred payments. Unlike payday loans, BNPL loans may lack comprehensive regulation, increasing the potential for hidden terms and escalating debt. Consumers should carefully review BNPL agreements to avoid debt accumulation and financial strain.

Choosing the Right Loan: Key Considerations

Payday loans offer quick cash with high interest rates and short repayment terms, making them suitable for urgent small expenses but costly if not repaid promptly. Buy Now Pay Later (BNPL) loans provide interest-free installments over a few weeks or months, ideal for managing purchases without immediate full payment but may impact credit if missed. Evaluating factors like interest rates, repayment flexibility, fees, and credit impact helps borrowers choose the right loan based on financial needs and repayment ability.

Related Important Terms

Instant Decision Lending

Payday loans offer instant decision lending with quick access to small, short-term funds but often come with high-interest rates and fees. Buy Now Pay Later loans provide a flexible repayment plan for purchases without immediate interest, leveraging instant credit approval to streamline consumer spending.

Micro-Installment Payday

Micro-installment payday loans offer small, short-term borrowing options designed to be repaid in multiple small installments, contrasting with Buy Now Pay Later (BNPL) loans which typically allow deferred payments without interest if paid within a promotional period. While micro-installment payday loans often have higher interest rates and faster repayment schedules, BNPL services provide flexible credit for purchases with minimal upfront costs, making them suitable for managing immediate expenses without impacting credit scores significantly.

Deferred Purchase Financing

Payday loans offer immediate cash advances with high interest rates and short repayment terms, designed for urgent financial needs. Buy Now Pay Later loans provide deferred purchase financing that allows consumers to split payments over weeks or months without upfront interest, promoting manageable, interest-free repayment options for everyday purchases.

Salary-Synced Repayment

Payday loans require repayment aligned with the borrower's next paycheck, ensuring salary-synced repayment but often carry high interest rates and fees. Buy Now Pay Later loans offer flexible repayment plans spread over several weeks or months, syncing payments with salary deposits to ease budgeting without immediate full repayment.

BNPL Credit Assessment

BNPL credit assessment relies on real-time transaction data and minimal credit checks, enabling faster approval and reduced credit risk compared to payday loans, which typically involve high-interest rates and rigorous credit scrutiny. This streamlined evaluation process in BNPL loans supports responsible borrowing by aligning repayment terms with consumer spending behaviors and financial capacity.

Soft Pull Loan Evaluation

Payday loans typically involve hard credit pulls that can negatively impact credit scores, whereas Buy Now Pay Later (BNPL) loans often use soft pull loan evaluations, allowing consumers to access credit without a significant credit check or immediate score impact. Soft pull assessments in BNPL facilitate faster approval and reduce credit risk exposure compared to traditional payday loan underwriting methods.

No-Interest Short-Term Lending

Payday loans and Buy Now Pay Later (BNPL) services both offer short-term lending options, but payday loans typically involve high-interest rates and fees, while BNPL loans often provide no-interest periods for purchases when payments are made on time. No-interest short-term lending through BNPL platforms appeals to consumers by allowing delayed payments without additional costs, contrasting the high-cost borrowing structure common in payday loans.

Embedded Checkout Credit

Embedded checkout credit in payday loans offers immediate, short-term cash with high interest rates and fees, designed for urgent needs. Buy Now Pay Later (BNPL) loans integrate seamlessly into the checkout process, allowing consumers flexible, interest-free installment payments, enhancing affordability and purchase convenience.

Digital Wage Advance

Digital wage advance services provide immediate access to earned wages, distinguishing them from payday loans that often carry high interest rates and fees, and Buy Now Pay Later loans that split purchases into scheduled payments without upfront cash. Unlike payday loans with strict repayment periods, digital wage advances offer flexibility by linking repayments directly to upcoming paychecks, reducing financial stress and avoiding debt cycles common in traditional payday lending.

Flexible Split Payment Loan

Payday loans offer quick, short-term cash but often come with high-interest rates and fees, making them costly over time. Buy Now Pay Later loans provide flexible split payment options with transparent terms, allowing borrowers to manage expenses through scheduled installments without immediate full payment.

Payday Loan vs Buy Now Pay Later Loan for Loan Infographic

moneydiff.com

moneydiff.com