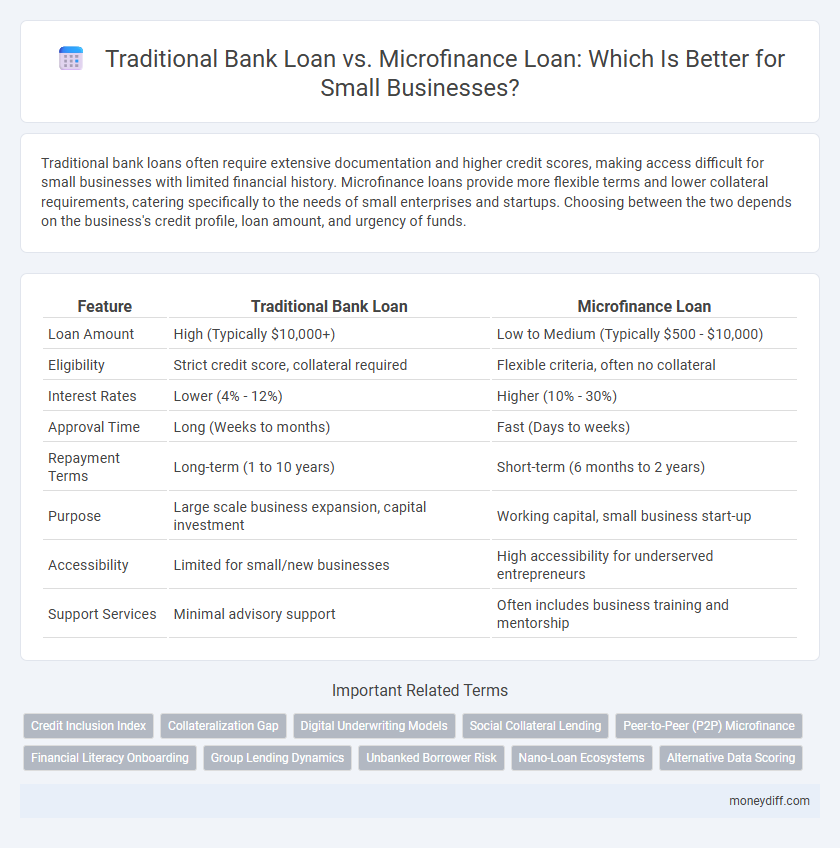

Traditional bank loans often require extensive documentation and higher credit scores, making access difficult for small businesses with limited financial history. Microfinance loans provide more flexible terms and lower collateral requirements, catering specifically to the needs of small enterprises and startups. Choosing between the two depends on the business's credit profile, loan amount, and urgency of funds.

Table of Comparison

| Feature | Traditional Bank Loan | Microfinance Loan |

|---|---|---|

| Loan Amount | High (Typically $10,000+) | Low to Medium (Typically $500 - $10,000) |

| Eligibility | Strict credit score, collateral required | Flexible criteria, often no collateral |

| Interest Rates | Lower (4% - 12%) | Higher (10% - 30%) |

| Approval Time | Long (Weeks to months) | Fast (Days to weeks) |

| Repayment Terms | Long-term (1 to 10 years) | Short-term (6 months to 2 years) |

| Purpose | Large scale business expansion, capital investment | Working capital, small business start-up |

| Accessibility | Limited for small/new businesses | High accessibility for underserved entrepreneurs |

| Support Services | Minimal advisory support | Often includes business training and mentorship |

Introduction to Business Loan Options

Traditional bank loans for small businesses typically require extensive credit history and collateral, offering larger loan amounts with lower interest rates. Microfinance loans cater to entrepreneurs with limited credit access, providing smaller, flexible financing options often accompanied by tailored support services. Understanding these distinctions helps business owners select financing that aligns with their credit profile and capital needs.

Understanding Traditional Bank Loans

Traditional bank loans typically require extensive credit history, collateral, and a rigorous application process, making them less accessible to many small businesses. These loans offer lower interest rates and larger sums but involve strict eligibility criteria and longer approval times. Understanding these factors helps small business owners determine if a traditional bank loan aligns with their financing needs and repayment capabilities.

What Are Microfinance Loans?

Microfinance loans provide small businesses with accessible funding options often unavailable through traditional bank loans due to less stringent credit requirements and smaller loan sizes. These loans focus on empowering entrepreneurs in underserved communities by offering flexible repayment terms and lower interest rates tailored to micro-enterprises. By enabling capital access for businesses lacking collateral or extensive credit history, microfinance loans support economic growth and financial inclusion on a local scale.

Eligibility Criteria: Traditional vs. Microfinance Loans

Traditional bank loans typically require strong credit history, collateral, and extensive documentation, making them less accessible for small businesses with limited financial records. In contrast, microfinance loans offer more flexible eligibility criteria, prioritizing business potential and character over credit scores, thereby supporting entrepreneurs with minimal collateral. Small businesses often find microfinance institutions more accommodating due to simplified application processes and lower barriers to entry.

Application Process Comparison

Traditional bank loans for small businesses involve a lengthy application process requiring extensive documentation, credit checks, and collateral verification. Microfinance loans offer a more streamlined and accessible application, often with minimal paperwork and quicker approval tailored for entrepreneurs with limited credit history. Small businesses benefit from microfinance institutions' emphasis on community-based lending and flexible criteria compared to rigid traditional bank policies.

Interest Rates and Repayment Terms

Traditional bank loans typically offer lower interest rates, ranging from 5% to 10%, but impose strict repayment terms and require extensive documentation. Microfinance loans have higher interest rates, often between 15% and 30%, but provide flexible repayment schedules tailored to small business cash flows. Small businesses benefit from microfinance loans through easier access and adaptable terms despite the higher cost compared to traditional bank loans.

Loan Amounts and Accessibility

Traditional bank loans typically offer higher loan amounts, often exceeding $50,000, but require extensive documentation and strong credit history, limiting accessibility for many small businesses. Microfinance loans provide smaller amounts, usually ranging from $500 to $10,000, with simplified application processes designed to improve accessibility for startups and entrepreneurs lacking collateral. Small businesses with limited credit profiles benefit from microfinance institutions that prioritize community development and flexible repayment terms.

Advantages of Traditional Bank Loans

Traditional bank loans offer lower interest rates and higher loan amounts compared to microfinance loans, making them ideal for small businesses with significant capital needs. These loans provide longer repayment terms and access to a wide range of financial products, enhancing cash flow management and business growth. Established credit history and collateral requirements in traditional banking also build business creditworthiness for future financing opportunities.

Benefits of Microfinance Loans for Small Businesses

Microfinance loans offer small businesses greater accessibility with lower collateral requirements compared to traditional bank loans, enabling entrepreneurs to secure funds despite limited credit history. These loans often feature flexible repayment terms and faster approval processes, supporting cash flow management and business growth. Microfinance institutions also provide tailored financial education and networking opportunities, enhancing borrowers' capacity to succeed and sustain operations.

Choosing the Right Loan for Your Small Business

Traditional bank loans typically offer lower interest rates and larger loan amounts but require extensive credit history and collateral, making them less accessible for many small businesses. Microfinance loans provide easier access, faster approval, and flexible terms tailored for startups or businesses with limited credit, but often come with higher interest rates and smaller principal amounts. Evaluating your business's credit profile, capital needs, and repayment capacity is crucial to choosing between traditional bank loans and microfinance options to ensure sustainable growth.

Related Important Terms

Credit Inclusion Index

Traditional bank loans often present stringent eligibility criteria and limited accessibility for small businesses, resulting in lower scores on the Credit Inclusion Index. Microfinance loans, designed to target underserved entrepreneurs with flexible terms and minimal collateral requirements, significantly enhance credit inclusion by expanding financial access and improving the Credit Inclusion Index in emerging markets.

Collateralization Gap

Traditional bank loans often require substantial collateral that many small businesses lack, creating a significant collateralization gap that limits access to financing. Microfinance loans typically offer lower collateral requirements or alternative guarantees, helping bridge this gap and enabling small businesses to secure necessary funding for growth.

Digital Underwriting Models

Digital underwriting models in traditional bank loans leverage extensive credit histories and financial data to assess small business loan applications, often resulting in longer processing times and stricter approval criteria; in contrast, microfinance loans utilize alternative data and AI-driven algorithms to offer faster, more inclusive access to capital for underserved small businesses with limited credit records. These innovative digital tools enable microfinance institutions to reduce risk and expand financial inclusion by tailoring loan offers based on real-time business performance and social data.

Social Collateral Lending

Traditional bank loans for small businesses often require stringent credit history and tangible collateral, limiting access for entrepreneurs without established assets. Microfinance loans leverage social collateral lending, using group guarantees and community trust to reduce default risk and increase loan accessibility for underserved small business owners.

Peer-to-Peer (P2P) Microfinance

Peer-to-peer (P2P) microfinance loans offer small businesses faster access to funds with lower interest rates and easier eligibility criteria compared to traditional bank loans, which often require extensive collateral and lengthy approval processes. P2P platforms connect individual lenders directly with borrowers, enhancing financial inclusion and providing flexible repayment options tailored to the cash flow of small enterprises.

Financial Literacy Onboarding

Traditional bank loans for small businesses often require rigorous financial literacy onboarding, including detailed credit history analysis and comprehensive financial statements, while microfinance loans typically provide tailored financial education aimed at improving budgeting and cash flow management to support borrower success and loan repayment. Effective onboarding in both loan types enhances financial decision-making and increases the likelihood of sustainable business growth.

Group Lending Dynamics

Traditional bank loans typically require individual collateral and credit history, making access challenging for small businesses, whereas microfinance loans often utilize group lending dynamics, where collective responsibility and peer monitoring reduce default risk and improve repayment rates. This group-based approach fosters social capital and trust, enabling entrepreneurs without formal credit backgrounds to secure funding more effectively.

Unbanked Borrower Risk

Traditional bank loans often require extensive credit histories and collateral, making access difficult for unbanked borrowers who lack formal financial records. Microfinance loans target unbanked small business owners by offering flexible terms and personalized risk assessments, reducing barriers and improving loan accessibility despite limited credit profiles.

Nano-Loan Ecosystems

Traditional bank loans often involve extensive credit checks and collateral requirements that can exclude small businesses, whereas microfinance loans provide accessible, unsecured funding tailored for low-income entrepreneurs. Nano-loan ecosystems enhance this by integrating digital platforms and community-based lending, enabling ultra-small, short-term loans that foster financial inclusion and agile capital flows for micro-enterprises.

Alternative Data Scoring

Traditional bank loans often rely on credit scores and formal financial statements, limiting access for small businesses with insufficient credit history, whereas microfinance loans utilize alternative data scoring methods such as transaction history, social media activity, and mobile phone usage to assess creditworthiness. Alternative data scoring enhances loan approval rates for underserved small businesses by providing a more comprehensive financial profile beyond conventional metrics.

Traditional Bank Loan vs Microfinance Loan for small businesses. Infographic

moneydiff.com

moneydiff.com