Unsecured loans do not require collateral, making them accessible but often resulting in higher interest rates due to increased lender risk. Social impact loans prioritize funding projects with positive community outcomes, offering potentially lower rates and flexible terms to support social causes. Choosing between the two depends on financial needs and commitment to driving social change through responsible borrowing.

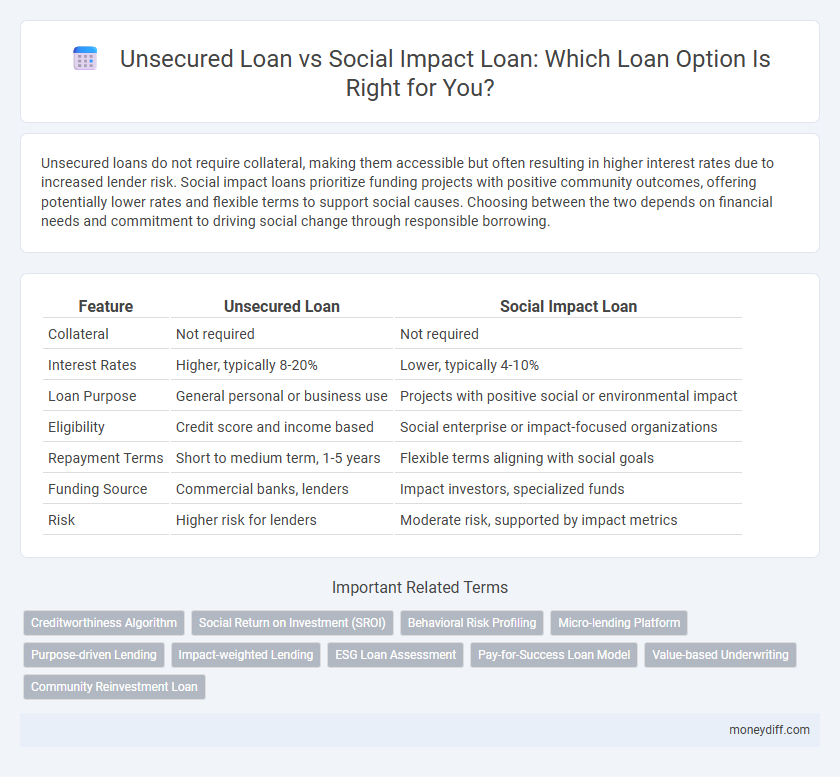

Table of Comparison

| Feature | Unsecured Loan | Social Impact Loan |

|---|---|---|

| Collateral | Not required | Not required |

| Interest Rates | Higher, typically 8-20% | Lower, typically 4-10% |

| Loan Purpose | General personal or business use | Projects with positive social or environmental impact |

| Eligibility | Credit score and income based | Social enterprise or impact-focused organizations |

| Repayment Terms | Short to medium term, 1-5 years | Flexible terms aligning with social goals |

| Funding Source | Commercial banks, lenders | Impact investors, specialized funds |

| Risk | Higher risk for lenders | Moderate risk, supported by impact metrics |

Understanding Unsecured Loans: Key Features and Benefits

Unsecured loans do not require collateral, making them accessible to borrowers without assets to pledge. These loans typically feature fixed interest rates and flexible repayment terms, supporting personal and business financial needs. The absence of collateral increases risk for lenders, often resulting in higher interest rates compared to secured or social impact loans.

What is a Social Impact Loan? Purpose and Principles

A Social Impact Loan is a type of financing designed to support projects that generate measurable social or environmental benefits alongside financial returns. Its purpose is to fund initiatives that address critical societal challenges such as education, healthcare, or sustainability, promoting positive community outcomes. These loans operate on principles of transparency, impact measurement, and often include concessional terms to encourage investment in socially beneficial ventures.

Eligibility Criteria: Unsecured Loans vs Social Impact Loans

Unsecured loans typically require borrowers to have a good credit score, stable income, and no collateral, making approval dependent on individual financial health and creditworthiness. Social impact loans prioritize eligibility based on the borrower's commitment to social or environmental projects, often requiring documentation of impact goals and alignment with lender-specific social objectives. While unsecured loans focus on financial risk assessment, social impact loans emphasize the borrower's contribution to community or environmental benefits.

Interest Rates: Comparing Costs and Borrower Impact

Unsecured loans typically have higher interest rates due to the increased risk for lenders, making them more expensive over the loan term. Social impact loans often offer lower or subsidized interest rates as they aim to support projects with positive community benefits, reducing overall borrower costs. Choosing a social impact loan can provide financial relief while promoting social good, contrasting with the generally higher-cost structure of unsecured loans.

Repayment Terms: Flexibility in Unsecured vs Social Impact Loans

Unsecured loans typically offer fixed repayment terms with less flexibility, making consistent monthly payments a requirement regardless of the borrower's financial situation. In contrast, social impact loans provide more adaptable repayment schedules tailored to the borrower's income fluctuations, aiming to support social initiatives while minimizing financial strain. This flexibility in social impact loans often includes income-based repayment options and grace periods that are not commonly available in traditional unsecured loans.

Risk Assessment: Lender Perspective on Both Loan Types

Unsecured loans pose higher default risk to lenders due to lack of collateral, leading to stricter credit evaluations and higher interest rates. Social impact loans, while also unsecured, incorporate qualitative risk assessments based on the borrower's social mission and potential community benefits. Lenders in social impact financing balance financial risk with social return, often leveraging impact metrics alongside traditional credit scores for comprehensive risk evaluation.

How Loan Usage Differs: Personal, Business, and Social Outcomes

Unsecured loans primarily serve personal or business needs with flexible usage but lack specific social impact goals. Social impact loans target projects with measurable social or environmental benefits, often supporting non-profits or community initiatives. The key difference lies in loan usage; unsecured loans prioritize financial flexibility while social impact loans prioritize generating positive social outcomes.

Credit Score Requirements: Unsecured vs Social Impact Loan Approval

Unsecured loans typically require a higher credit score, often above 650, as lenders rely solely on creditworthiness without collateral. Social impact loans may have more flexible credit score requirements, focusing instead on the borrower's social contribution and project viability. Approval for social impact loans often considers qualitative factors beyond credit history, increasing accessibility for mission-driven individuals or organizations.

Advantages and Disadvantages: Which Loan Suits Your Needs?

Unsecured loans offer quick approval and no collateral requirement, making them accessible but often come with higher interest rates and stricter credit criteria. Social impact loans prioritize funding projects with positive community or environmental outcomes, typically providing lower interest rates and flexible terms but may require detailed impact reporting and eligibility based on social goals. Choosing between the two depends on your financial situation and the purpose of the loan--unsecured loans suit urgent personal or business needs, while social impact loans benefit those aligning with social or environmental missions.

Decision Guide: Choosing Between Unsecured and Social Impact Loans

Choosing between unsecured loans and social impact loans involves evaluating factors such as interest rates, purpose alignment, and eligibility criteria. Unsecured loans typically offer faster approval without collateral but may have higher interest rates, while social impact loans focus on funding projects with positive community benefits and often provide lower rates or flexible terms. Assessing financial needs alongside the social goals of your project ensures the most suitable loan option for sustainable borrowing.

Related Important Terms

Creditworthiness Algorithm

Unsecured loans rely heavily on traditional creditworthiness algorithms that assess credit scores, income, and debt-to-income ratios to determine eligibility and interest rates, often limiting access for borrowers with non-traditional financial backgrounds. Social impact loans utilize advanced creditworthiness algorithms incorporating alternative data such as social behavior, community engagement, and financial resilience indicators to evaluate borrower reliability, expanding credit access to underserved populations while promoting positive social outcomes.

Social Return on Investment (SROI)

Unsecured loans typically lack collateral and prioritize credit risk, whereas social impact loans emphasize measurable Social Return on Investment (SROI) by funding projects that generate positive social or environmental outcomes alongside financial returns. Evaluating SROI allows lenders and investors to quantify the broader societal benefits, guiding capital toward initiatives that create sustainable community impact beyond mere financial gain.

Behavioral Risk Profiling

Unsecured loans carry higher behavioral risk profiling due to the absence of collateral, leading lenders to rely heavily on credit scores and repayment history, whereas social impact loans integrate behavioral risk assessment with social metrics to align borrower incentives with positive community outcomes. This nuanced risk profiling in social impact loans aims to reduce default rates by fostering responsible borrowing through targeted social and behavioral data analysis.

Micro-lending Platform

Unsecured loans on micro-lending platforms offer borrowers fast access to funds without collateral, emphasizing creditworthiness and repayment capacity, whereas social impact loans prioritize funding projects with measurable social benefits, often integrating impact metrics into loan terms to support community development. Micro-lending platforms specializing in social impact loans leverage investor funds to drive sustainable change, balancing financial returns with social outcomes, unlike traditional unsecured loans focused solely on financial risk and return.

Purpose-driven Lending

Unsecured loans provide flexible borrowing options without collateral, primarily for personal or business use, while social impact loans specifically fund projects generating measurable social or environmental benefits. Purpose-driven lending prioritizes financing that aligns with social responsibility goals, making social impact loans ideal for investors and borrowers committed to positive change.

Impact-weighted Lending

Unsecured loans provide quick access to funds without collateral but typically carry higher interest rates due to increased lender risk, while social impact loans prioritize funding projects that generate measurable social or environmental benefits alongside financial returns. Impact-weighted lending evaluates these loans based on both financial performance and the positive societal outcomes, enabling investors to support initiatives that drive sustainable change.

ESG Loan Assessment

Unsecured loans typically do not require collateral and are assessed primarily on creditworthiness and income stability, whereas social impact loans emphasize Environmental, Social, and Governance (ESG) criteria, targeting projects that generate measurable social and environmental benefits alongside financial returns. ESG loan assessment involves evaluating borrowers' sustainability practices and impact metrics to ensure alignment with responsible investment goals within the loan portfolio.

Pay-for-Success Loan Model

Unsecured loans provide quick access to funds without collateral but typically carry higher interest rates due to increased risk for lenders. The Pay-for-Success loan model within Social Impact Loans ties repayment to measurable social outcomes, aligning investor returns with impactful community benefits.

Value-based Underwriting

Value-based underwriting for unsecured loans prioritizes creditworthiness through financial history and income stability, whereas social impact loans emphasize borrowers' social outcomes and community benefits, integrating environmental, social, and governance (ESG) criteria into risk assessment. This approach aligns loan approval with broader societal impact goals, expanding access for mission-driven projects while maintaining financial sustainability.

Community Reinvestment Loan

Unsecured loans offer flexible borrowing without collateral but often come with higher interest rates, whereas Social Impact Loans prioritize financing projects that benefit underserved communities, typically featuring favorable terms focused on measurable social outcomes. Community Reinvestment Loans, a subset of Social Impact Loans, specifically target investments in low-income neighborhoods, promoting economic development and financial inclusion while encouraging lenders to meet their community reinvestment obligations.

Unsecured Loan vs Social Impact Loan for loan. Infographic

moneydiff.com

moneydiff.com