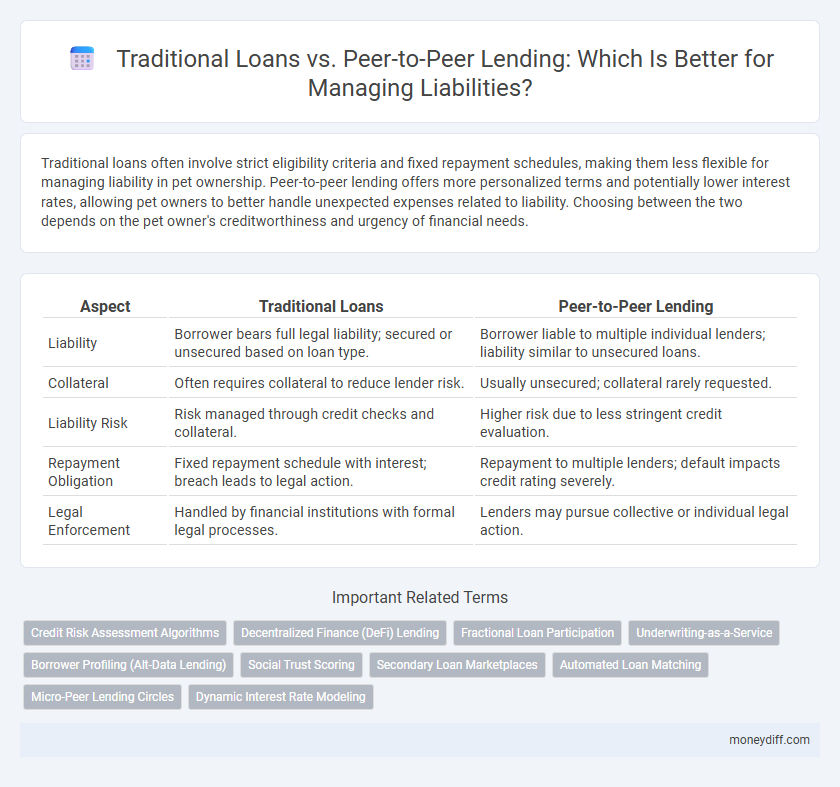

Traditional loans often involve strict eligibility criteria and fixed repayment schedules, making them less flexible for managing liability in pet ownership. Peer-to-peer lending offers more personalized terms and potentially lower interest rates, allowing pet owners to better handle unexpected expenses related to liability. Choosing between the two depends on the pet owner's creditworthiness and urgency of financial needs.

Table of Comparison

| Aspect | Traditional Loans | Peer-to-Peer Lending |

|---|---|---|

| Liability | Borrower bears full legal liability; secured or unsecured based on loan type. | Borrower liable to multiple individual lenders; liability similar to unsecured loans. |

| Collateral | Often requires collateral to reduce lender risk. | Usually unsecured; collateral rarely requested. |

| Liability Risk | Risk managed through credit checks and collateral. | Higher risk due to less stringent credit evaluation. |

| Repayment Obligation | Fixed repayment schedule with interest; breach leads to legal action. | Repayment to multiple lenders; default impacts credit rating severely. |

| Legal Enforcement | Handled by financial institutions with formal legal processes. | Lenders may pursue collective or individual legal action. |

Understanding Traditional Loans and Peer-to-Peer Lending

Traditional loans involve borrowing a fixed amount of money from banks or financial institutions, with liability resting on the borrower to repay principal and interest according to agreed terms. Peer-to-peer lending connects borrowers directly with individual investors through online platforms, distributing liability across multiple lenders rather than a single institution. Understanding the distinctions in liability structures helps borrowers assess risk, repayment flexibility, and potential legal obligations in each financing method.

Key Differences Between Traditional Loans and P2P Lending

Traditional loans typically involve financial institutions as intermediaries, resulting in stricter credit requirements and longer approval times, whereas peer-to-peer (P2P) lending connects borrowers directly with individual investors, offering more flexible terms and faster access to funds. In terms of liability, traditional loans often impose personal liability on borrowers, with collateral requirements, while P2P lending platforms may offer varying degrees of borrower protection but generally carry higher interest rates due to increased risk for investors. Risk assessment methods differ significantly; traditional lenders rely on extensive credit evaluations, whereas P2P platforms use alternative data analytics and social lending metrics to determine borrower creditworthiness.

Liability Implications in Traditional Loans

Traditional loans create fixed liability obligations for borrowers, requiring regular principal and interest payments over a set term, which directly impacts credit scores and debt-to-income ratios. Default on these loans can lead to legal actions, wage garnishments, and collateral repossession, significantly increasing financial risk. Lenders retain full control over loan terms, fees, and liability enforcement, making borrowers solely responsible for meeting payment schedules to avoid aggravated liabilities.

Liability Risks in Peer-to-Peer Lending

Peer-to-peer lending carries distinct liability risks compared to traditional loans, including increased exposure to borrower defaults due to lack of collateral and regulatory oversight. Investors face direct liability for potential losses without the protection of financial institutions that typically absorb risk in traditional lending. This higher risk profile necessitates thorough due diligence and risk management strategies to mitigate financial exposure in P2P lending platforms.

Credit Assessment: Banks vs P2P Platforms

Traditional loans rely on rigorous credit assessments grounded in extensive financial history, income verification, and credit scores, minimizing liability risks for banks through established underwriting standards. Peer-to-peer lending platforms utilize algorithm-driven credit evaluations and alternative data sources, which can expedite approval but may increase default risk liabilities due to less stringent verification. Consequently, banks typically bear lower liability exposure in credit assessment compared to the more variable risk profiles found in P2P lending models.

Default Handling: Traditional vs P2P Lenders

Traditional loans typically involve strict default handling procedures, including credit score impact, collection agencies, and potential legal action, which protects the lender's interests but increases borrower liability. Peer-to-peer (P2P) lending platforms often use automated reminders and community-based approaches to manage defaults, sometimes offering restructuring options to reduce borrower liability. Data shows traditional loan defaults result in higher borrower financial penalties, whereas P2P lending defaults may lead to more flexible resolution but increased risk for individual investors.

Regulatory Protections for Borrowers and Lenders

Traditional loans offer stronger regulatory protections for both borrowers and lenders, including federally mandated disclosure requirements and established legal frameworks that ensure contract enforceability and dispute resolution. Peer-to-peer lending platforms, while innovative, often face a less mature regulatory landscape, with protections varying significantly by jurisdiction and potentially exposing participants to higher risks related to fraud, default, and unclear liability terms. Borrowers and lenders in P2P markets should conduct thorough due diligence on platform compliance with financial regulations such as borrower credit assessment standards and investor safeguards to mitigate liability concerns.

Interest Rates and Their Impact on Liability

Traditional loans typically feature fixed or variable interest rates set by financial institutions, often resulting in higher overall liability due to additional fees and stricter repayment terms. Peer-to-peer lending platforms offer competitive interest rates influenced by borrower credit profiles and market demand, potentially lowering liability through more flexible payment schedules. Understanding the interest rate structures in both lending options is crucial for managing financial liability effectively and minimizing long-term debt burdens.

Choosing the Right Lending Option for Liability Management

Choosing the right lending option for liability management requires assessing interest rates, repayment flexibility, and credit impact. Traditional loans often provide predictable terms and established legal protections, while peer-to-peer lending offers faster approval and potentially lower rates but may carry higher risk. Evaluating your business's cash flow and liability structure helps determine the optimal balance between cost efficiency and repayment security.

Future Trends in Loan Liability: Traditional vs P2P

Future trends in loan liability reveal that traditional loans continue to hold established regulatory frameworks, providing predictable borrower protections and institutional accountability. Peer-to-peer lending is rapidly evolving with decentralized platforms reducing intermediaries, which may shift liability towards individual investors and introduce new risks in borrower default management. Advances in AI-driven risk assessment and blockchain technology promise to transform liability distribution by increasing transparency and efficiency across both traditional and P2P lending sectors.

Related Important Terms

Credit Risk Assessment Algorithms

Traditional loans rely on established credit risk assessment algorithms that analyze detailed financial histories and credit scores, providing lenders with a conservative estimate of borrower liability. Peer-to-peer lending platforms utilize advanced, machine learning-based algorithms incorporating alternative data sources to evaluate creditworthiness, often resulting in more dynamic and personalized liability assessments.

Decentralized Finance (DeFi) Lending

Traditional loans impose fixed liability schedules governed by centralized institutions, often resulting in rigid repayment terms and collateral requirements, while Peer-to-Peer (P2P) lending within Decentralized Finance (DeFi) platforms enables programmable liabilities through smart contracts, offering increased transparency, reduced counterparty risk, and customizable repayment structures. DeFi lending protocols leverage blockchain technology to decentralize liability management, enhancing borrower and lender autonomy with real-time asset tracking and automated liquidation mechanisms.

Fractional Loan Participation

Traditional loans typically involve full liability assigned to the borrower and the lending institution, while peer-to-peer lending with fractional loan participation distributes liability among multiple investors, reducing individual risk exposure. This model enhances risk diversification and allows lenders to manage their liability more efficiently by sharing potential losses across a broader participant base.

Underwriting-as-a-Service

Traditional loans involve banks assessing borrower liability through established underwriting processes, often requiring extensive credit history and collateral, whereas peer-to-peer lending platforms utilize Underwriting-as-a-Service to streamline liability evaluation using alternative data and automation, reducing approval times and increasing accessibility for borrowers with diverse financial backgrounds. Underwriting-as-a-Service in peer-to-peer lending optimizes risk assessment by leveraging machine learning algorithms and real-time data, enhancing precision in determining borrower liability compared to conventional underwriting methods.

Borrower Profiling (Alt-Data Lending)

Traditional loans rely on conventional credit scores and financial histories for borrower profiling, often excluding individuals with limited credit backgrounds. Peer-to-peer lending utilizes alternative data, such as social behavior and transaction patterns, to assess borrower liability, enabling more inclusive and accurate risk evaluation.

Social Trust Scoring

Traditional loans rely heavily on formal credit scores and institutional risk assessments, which may overlook social trust factors impacting borrower reliability. Peer-to-peer lending leverages social trust scoring algorithms that evaluate personal networks and behavioral data, reducing liability risk by providing a more nuanced understanding of borrower creditworthiness.

Secondary Loan Marketplaces

Secondary loan marketplaces for traditional loans involve established financial institutions buying and selling loan portfolios, providing liquidity but often maintaining the original liability terms. Peer-to-peer lending platforms offer secondary markets where individual investors can trade loan parts, increasing flexibility but with varied liability risks depending on the platform's structure and credit assessment processes.

Automated Loan Matching

Automated loan matching in peer-to-peer lending reduces liability risks by directly connecting borrowers and investors through algorithm-driven platforms, enhancing transparency compared to traditional loans that involve intermediaries with higher default liabilities. This technology minimizes misallocation of funds and accelerates credit assessments, leading to more accurate liability evaluations and streamlined risk management processes.

Micro-Peer Lending Circles

Traditional loans often impose fixed repayment schedules and higher liability risks on borrowers, whereas Micro-Peer Lending Circles within peer-to-peer platforms distribute liability among group members, lowering individual financial burden and fostering collective credit responsibility. This shared liability model enhances credit access for underserved communities by mitigating default risks and promoting trust-based lending ecosystems.

Dynamic Interest Rate Modeling

Traditional loans often feature fixed interest rates that create predictable liabilities but limit flexibility in loan cost adjustments, whereas peer-to-peer lending platforms utilize dynamic interest rate modeling driven by real-time borrower risk assessment and market demand fluctuations, optimizing liability management through adaptive pricing mechanisms. This dynamic modeling reduces the risk of over- or underestimating liabilities by continuously calibrating rates based on creditworthiness, repayment behavior, and economic indicators.

Traditional Loans vs Peer-to-Peer Lending for Liability. Infographic

moneydiff.com

moneydiff.com