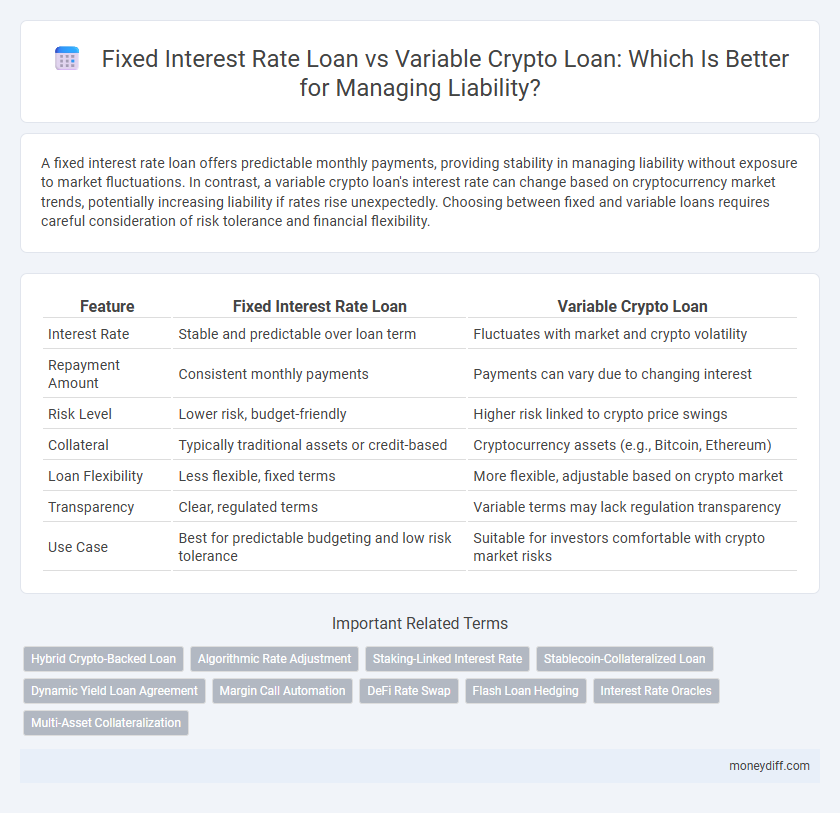

A fixed interest rate loan offers predictable monthly payments, providing stability in managing liability without exposure to market fluctuations. In contrast, a variable crypto loan's interest rate can change based on cryptocurrency market trends, potentially increasing liability if rates rise unexpectedly. Choosing between fixed and variable loans requires careful consideration of risk tolerance and financial flexibility.

Table of Comparison

| Feature | Fixed Interest Rate Loan | Variable Crypto Loan |

|---|---|---|

| Interest Rate | Stable and predictable over loan term | Fluctuates with market and crypto volatility |

| Repayment Amount | Consistent monthly payments | Payments can vary due to changing interest |

| Risk Level | Lower risk, budget-friendly | Higher risk linked to crypto price swings |

| Collateral | Typically traditional assets or credit-based | Cryptocurrency assets (e.g., Bitcoin, Ethereum) |

| Loan Flexibility | Less flexible, fixed terms | More flexible, adjustable based on crypto market |

| Transparency | Clear, regulated terms | Variable terms may lack regulation transparency |

| Use Case | Best for predictable budgeting and low risk tolerance | Suitable for investors comfortable with crypto market risks |

Understanding Fixed Interest Rate Loans for Liability Management

Fixed interest rate loans provide predictable repayment amounts, allowing for precise liability management by locking in borrowing costs regardless of market fluctuations. This stability aids in budgeting and financial planning, reducing the risk of unexpected increases in debt servicing expenses. Fixed rates contrast with variable crypto loans, which can expose borrowers to volatility and potentially higher liabilities due to fluctuating interest rates tied to cryptocurrency market conditions.

Exploring Variable Crypto Loans in Asset and Liability Strategy

Variable crypto loans offer flexible interest rates that adjust with market conditions, enabling dynamic liability management compared to fixed interest rate loans with predetermined repayment schedules. These loans provide opportunities to optimize asset and liability alignment by leveraging crypto asset volatility, potentially reducing overall borrowing costs during market downturns. Incorporating variable crypto loans can enhance liquidity strategies while requiring careful risk assessment to manage interest rate fluctuations and preserve financial stability.

Key Differences Between Fixed and Variable Loan Options

Fixed interest rate loans provide predictable monthly payments and stable liability management by locking in a specific rate for the loan term, reducing exposure to market volatility. Variable crypto loans, conversely, tie interest rates to fluctuating cryptocurrency market conditions, introducing the potential for both lower initial rates and increased financial risk due to rate variability. Borrowers must weigh the certainty of fixed rates against the flexibility and uncertainty inherent in variable crypto loan liabilities.

Impact of Interest Rate Fluctuations on Loan Repayment

Fixed interest rate loans provide predictable monthly payments, shielding borrowers from sudden increases in interest expenses and enabling better financial planning. Variable crypto loans, however, expose borrowers to fluctuating interest rates tied to market volatility, which can significantly increase repayment amounts during periods of rising rates. Understanding the impact of these interest rate fluctuations is crucial for managing liability risk and ensuring sustainable loan repayments.

Risk Analysis: Crypto Loan Volatility vs Fixed Traditional Loans

Fixed interest rate loans provide predictable repayment amounts, reducing financial risk and ensuring consistent budgeting for liabilities. Variable crypto loans expose borrowers to high volatility due to fluctuating cryptocurrency values, increasing the risk of sudden liability spikes. Risk analysis highlights that fixed traditional loans offer stability, whereas crypto loans require careful management of market fluctuations to avoid unexpected losses.

Advantages of Fixed Rate Loans for Predictable Liability Planning

Fixed interest rate loans offer stable monthly payments, enabling precise liability forecasting and budgeting over the loan term. This predictability safeguards borrowers from market volatility and sudden interest spikes commonly seen in variable crypto loans. Maintaining consistent liability obligations enhances financial planning accuracy and reduces risk exposure.

Yield Opportunities and Risks in Variable Crypto Loans

Variable crypto loans offer higher yield opportunities through fluctuating interest rates tied to decentralized finance markets, increasing potential returns compared to fixed interest rate loans. However, these loans carry significant risks, including price volatility of underlying digital assets and platform insolvency, which can lead to unpredictable liabilities. Fixed interest rate loans provide stable repayment terms, minimizing exposure to market fluctuations but potentially limiting profit opportunities.

Cost Comparison: Total Liability Over Loan Lifespan

A fixed interest rate loan typically provides predictable total liability costs over the loan lifespan, making it easier to budget repayments without unexpected increases. In contrast, a variable crypto loan's total cost can fluctuate significantly due to market volatility and changing interest rates, potentially increasing overall liability. Borrowers prioritizing cost certainty may prefer fixed loans, while those willing to accept risk might benefit from lower initial rates in variable crypto loans.

Suitability of Loan Types for Different Financial Goals

Fixed interest rate loans provide predictable monthly payments, making them suitable for borrowers seeking stability and long-term budgeting certainty in managing liabilities. Variable crypto loans offer potential cost savings when interest rates drop, appealing to risk-tolerant individuals aiming for short-term financial gains or those expecting market volatility. Choosing between these loan types depends on one's risk tolerance, financial goals, and ability to handle fluctuating liabilities.

Decision Metrics: Choosing the Right Loan Type for Effective Liability Management

Fixed interest rate loans offer predictable repayment schedules and shield borrowers from market volatility, making them ideal for liability management when budgeting certainty is paramount. Variable crypto loans, while potentially offering lower initial rates, expose borrowers to fluctuating liabilities due to crypto price volatility and changing interest rates, creating higher risk in debt servicing. Decision metrics should weigh the stability of fixed rates against the flexibility and potential cost savings of variable crypto loans in the context of individual risk tolerance and cash flow capacity.

Related Important Terms

Hybrid Crypto-Backed Loan

Hybrid crypto-backed loans combine the stability of fixed interest rate loans with the flexibility of variable crypto loans, offering borrowers predictable repayment amounts alongside potential benefits from crypto market fluctuations. This approach mitigates liability risks by balancing fixed obligations with adaptive interest components tied to cryptocurrency asset performance.

Algorithmic Rate Adjustment

Fixed interest rate loans provide predictable monthly payments by maintaining a constant rate over the loan term, reducing liability risk from market fluctuations. Variable crypto loans utilize algorithmic rate adjustments based on real-time blockchain data, allowing interest rates to fluctuate with market demand and volatility, which can increase liability unpredictability but offer potential cost savings.

Staking-Linked Interest Rate

Fixed interest rate loans provide predictable liability costs by locking in stable payments, reducing risk exposure compared to variable crypto loans, which fluctuate with market staking rewards and can increase liabilities unexpectedly. Staking-linked interest rates tie loan costs to the performance of underlying crypto assets, creating dynamic liabilities that require careful risk management to avoid sudden financial burdens.

Stablecoin-Collateralized Loan

Stablecoin-collateralized loans with fixed interest rates provide predictable repayment amounts, minimizing volatility risks typically associated with crypto-assets and enhancing liability management accuracy. Variable crypto loans, while potentially offering lower initial interest rates, expose borrowers to fluctuating costs driven by market volatility, increasing uncertainty in long-term financial obligations.

Dynamic Yield Loan Agreement

Fixed interest rate loans provide predictable liability costs, ensuring stable repayment amounts throughout the Dynamic Yield Loan Agreement, minimizing financial uncertainty. Variable crypto loans adjust interest rates based on market volatility, potentially increasing liability but offering opportunities for reduced costs in favorable conditions.

Margin Call Automation

Fixed interest rate loans provide predictable liability management by maintaining consistent repayment amounts, reducing the risk of sudden margin calls triggered by market volatility. Variable crypto loans expose borrowers to automated margin calls due to price fluctuations, increasing the likelihood of forced liquidation and financial instability.

DeFi Rate Swap

Fixed interest rate loans provide predictable liability costs by locking in payments, minimizing exposure to market volatility, while variable crypto loans introduce fluctuating liabilities influenced by DeFi rate swap mechanisms that dynamically adjust rates based on supply and demand in decentralized finance protocols. DeFi rate swaps enable borrowers to hedge or speculate on interest rate movements, offering flexibility but increasing liability risk due to unpredictable rate changes inherent in variable crypto loans.

Flash Loan Hedging

Fixed interest rate loans provide predictable liability management by locking borrowing costs, minimizing exposure to market volatility, while variable crypto loans, especially those involving flash loan hedging, allow rapid adjustment of positions to exploit arbitrage opportunities and mitigate risks within decentralized finance protocols. Flash loan hedging enables instant, uncollateralized borrowing to restructure liabilities swiftly, optimizing debt profiles amid fluctuating crypto asset values.

Interest Rate Oracles

Fixed interest rate loans offer predictable repayment amounts unaffected by market fluctuations, while variable crypto loans rely heavily on interest rate oracles to provide real-time rate adjustments tied to blockchain data feeds. Interest rate oracles ensure transparency and accuracy in variable loan calculations but introduce dependency risks that fixed rate loans inherently avoid, impacting overall liability management.

Multi-Asset Collateralization

Fixed interest rate loans provide predictable repayment schedules, reducing liability risk by stabilizing debt service costs, while variable crypto loans offer flexible borrowing against multi-asset collateralization, allowing diversification across cryptocurrencies to mitigate potential default exposure. Leveraging multi-asset collateral in crypto loans enhances liability management by spreading risk across various digital assets, contrasting the fixed-rate loan's reliance on traditional collateral and steady interest obligations.

Fixed Interest Rate Loan vs Variable Crypto Loan for Liability. Infographic

moneydiff.com

moneydiff.com