Choosing between a business bank loan and revenue-based financing for liability depends on cash flow stability and repayment flexibility. Business bank loans offer fixed repayment schedules and lower interest rates but require strong credit and collateral. Revenue-based financing provides flexible payments tied to revenue, easing cash flow pressures during low-income periods but often comes with higher costs.

Table of Comparison

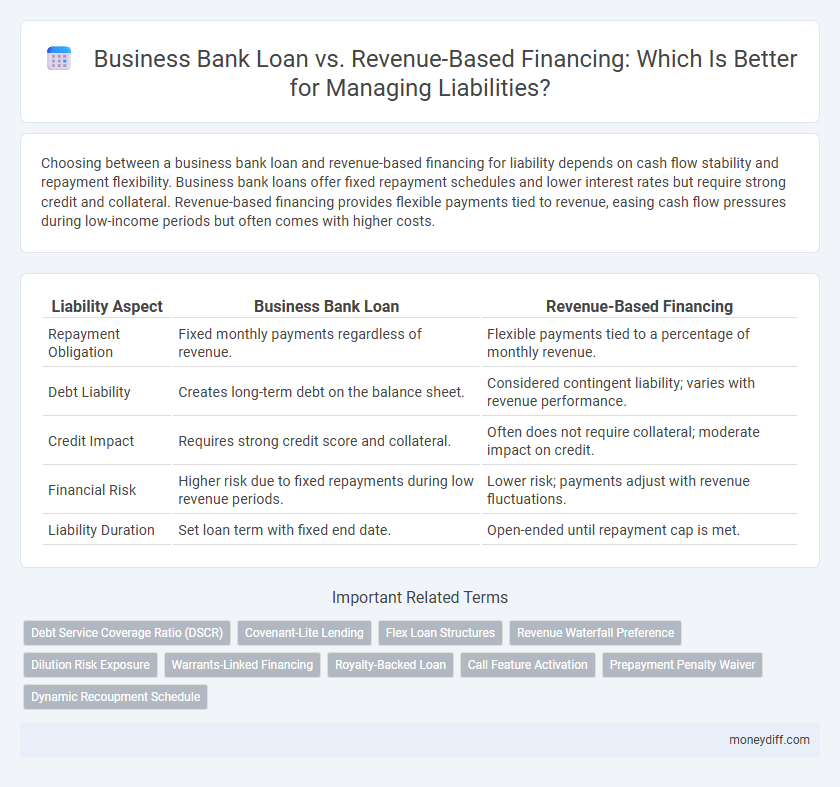

| Liability Aspect | Business Bank Loan | Revenue-Based Financing |

|---|---|---|

| Repayment Obligation | Fixed monthly payments regardless of revenue. | Flexible payments tied to a percentage of monthly revenue. |

| Debt Liability | Creates long-term debt on the balance sheet. | Considered contingent liability; varies with revenue performance. |

| Credit Impact | Requires strong credit score and collateral. | Often does not require collateral; moderate impact on credit. |

| Financial Risk | Higher risk due to fixed repayments during low revenue periods. | Lower risk; payments adjust with revenue fluctuations. |

| Liability Duration | Set loan term with fixed end date. | Open-ended until repayment cap is met. |

Understanding Business Bank Loans and Revenue-Based Financing

Business bank loans create a fixed liability with scheduled repayments and often require collateral, impacting a company's debt-to-equity ratio. Revenue-based financing ties repayments to a percentage of monthly revenue, offering flexible liability management but potentially higher cost variability. Understanding these differences helps businesses assess short-term cash flow impacts and long-term financial obligations tied to each funding option.

Key Differences Between Loans and Revenue-Based Financing

Business bank loans impose fixed repayment schedules and fixed interest rates, creating predictable but potentially burdensome liabilities for companies. Revenue-based financing ties repayments directly to a percentage of monthly revenue, offering flexible liability management that aligns payment obligations with business performance. Unlike traditional loans, revenue-based financing reduces the risk of over-leverage by varying liabilities in accordance with fluctuating income streams.

Qualification Criteria for Bank Loans vs Revenue-Based Financing

Business bank loans require strong credit scores, solid financial statements, and collateral to mitigate liability risks for lenders. Revenue-based financing evaluates consistent revenue streams and monthly sales performance, making it accessible for businesses with fluctuating income but limited credit history. Understanding these qualification criteria helps businesses choose funding that aligns with their liability capacity and repayment structure.

Impact on Business Liability Structure

Business bank loans increase a company's fixed liabilities with defined repayment schedules and interest expenses, impacting cash flow and credit risk management. Revenue-based financing ties repayments to a percentage of monthly revenue, creating variable liability that fluctuates with business performance and potentially reducing default risk. Understanding how each financing option affects liability structure helps businesses optimize debt management and maintain financial flexibility.

Repayment Terms: Fixed Payments vs Revenue Percentage

Business bank loans involve fixed repayment schedules with set principal and interest amounts due regularly, ensuring predictable liability obligations for borrowers. Revenue-based financing links repayment amounts to a percentage of the company's monthly revenue, resulting in variable liability that fluctuates with sales performance. This model offers flexibility during downturns but can lead to longer repayment periods compared to fixed-payment bank loans.

Effects on Cash Flow and Financial Planning

Business bank loans impose fixed monthly payments that can strain cash flow during downturns, requiring precise financial planning to ensure timely repayment and avoid default. Revenue-based financing adjusts repayments based on a percentage of monthly revenue, offering more flexible cash flow management but potentially leading to higher total repayment amounts over time. Understanding the impact on cash flow variability and long-term financial commitments is crucial for selecting the optimal liability structure that aligns with business growth and stability goals.

Cost Comparison: Interest Rates vs Revenue Share

Business bank loans typically have fixed or variable interest rates ranging from 4% to 12%, resulting in predictable but potentially higher overall costs over time. Revenue-based financing requires a percentage of monthly revenue, usually between 3% and 8%, aligning payments with cash flow but potentially increasing total cost if revenue grows rapidly. Evaluating the cost comparison involves analyzing interest expenses versus cumulative revenue share payments to determine which option minimizes liability based on the company's financial profile and growth trajectory.

Influence on Credit Score and Financial Standing

Business bank loans often require credit checks that directly impact the borrower's credit score, with consistent repayments potentially improving creditworthiness but missed payments causing significant damage. Revenue-based financing typically does not involve a hard credit inquiry, minimizing immediate impact on credit scores while repayments fluctuate with revenue, reducing the risk of default and preserving financial standing. Choosing between these options affects liability management, where bank loans increase fixed debt obligations, whereas revenue-based financing aligns repayment with income variability, influencing long-term business credit and financial health.

Risk Assessment and Liability Exposure

Business bank loans typically involve fixed repayment schedules and collateral requirements, leading to higher liability exposure if revenues decline. Revenue-based financing adjusts repayments according to business earnings, reducing liability risk by aligning debt obligations with cash flow fluctuations. Risk assessment for bank loans emphasizes creditworthiness and asset valuation, whereas revenue-based financing focuses on revenue stability and growth potential.

Choosing the Right Financing Option for Liability Management

Business bank loans typically involve fixed repayment schedules and collateral requirements, increasing liability risk if cash flow is unpredictable. Revenue-based financing aligns repayments with actual revenue, reducing the risk of default but often at a higher cost of capital. Choosing the right financing option depends on a company's cash flow stability, risk tolerance, and long-term liability management goals.

Related Important Terms

Debt Service Coverage Ratio (DSCR)

Business bank loans typically require a strong Debt Service Coverage Ratio (DSCR) of 1.25 or higher, ensuring borrowers generate sufficient income to cover debt obligations, while revenue-based financing offers flexibility by tying repayments to a percentage of revenue without a fixed DSCR threshold. Evaluating liability management involves comparing the predictability and stability in DSCR requirements of bank loans against the variable payment structure of revenue-based financing.

Covenant-Lite Lending

Covenant-lite lending in business bank loans minimizes borrower restrictions, reducing the risk of technical defaults while increasing liability exposure due to fewer protective covenants for lenders. Revenue-based financing shifts liability by tying repayments directly to cash flow, alleviating fixed repayment obligations but potentially increasing overall payment uncertainty.

Flex Loan Structures

Business bank loans typically involve fixed repayment schedules and collateral requirements, which can increase liability risk for borrowers during revenue downturns. Revenue-based financing offers flexible loan structures where repayments fluctuate with monthly revenue, reducing pressure on debt liability and aligning repayment obligations with cash flow variability.

Revenue Waterfall Preference

In liability management, business bank loans typically require fixed repayment schedules with priority claims on assets, whereas revenue-based financing aligns repayment with company revenue streams, creating a revenue waterfall preference that prioritizes investor returns based on a percentage of ongoing revenues. This structure mitigates cash flow strain by adjusting payments according to actual revenue performance, offering a flexible alternative to traditional loan liabilities.

Dilution Risk Exposure

Business bank loans typically involve fixed repayment schedules and collateral, resulting in no dilution risk exposure for the owner's equity, whereas revenue-based financing links repayments to a percentage of revenue, introducing potential variability in cash flow but no equity dilution risk. Unlike equity financing, both options maintain ownership control, but businesses must weigh the trade-off between predictable liabilities in bank loans and flexible repayments with revenue-based financing.

Warrants-Linked Financing

Warrants-linked financing in business bank loans typically increases liability by obligating repayment with interest and adding potential dilution risk through equity warrants, whereas revenue-based financing shifts repayment liability to a percentage of revenue, reducing fixed financial obligations but potentially increasing long-term payout linked to business performance. Choosing warrants-linked financing impacts liability by blending debt with contingent equity, altering capital structure and financial risk profiles in contrast to the more flexible liability tied to revenue fractions.

Royalty-Backed Loan

Royalty-backed loans, a form of revenue-based financing, tie repayment obligations directly to a fixed percentage of a business's revenue, reducing the risk of accumulating unmanageable debt compared to traditional business bank loans that require fixed monthly payments regardless of income fluctuations. This flexible liability structure minimizes financial strain during low-revenue periods while enabling businesses to leverage future earnings without incurring standard loan collateral or rigid credit requirements.

Call Feature Activation

Business bank loans often include strict call feature activation clauses that can increase liability by demanding immediate repayment upon default or covenant breaches, whereas revenue-based financing typically lacks such call provisions, allowing more flexible repayment structures tied to business cash flow. Understanding each option's impact on financial liability is crucial for managing risk and ensuring sustainable capital access.

Prepayment Penalty Waiver

Business bank loans often impose prepayment penalties that increase overall liability costs, while revenue-based financing typically offers greater flexibility with the option of prepayment penalty waivers, reducing financial risk for borrowers. Choosing revenue-based financing allows companies to manage liabilities more effectively by avoiding extra charges linked to early repayment.

Dynamic Recoupment Schedule

Business bank loans typically involve fixed repayment schedules with predetermined liabilities, while revenue-based financing offers a dynamic recoupment schedule where repayments fluctuate based on a percentage of monthly revenues, reducing the risk of default during low-income periods. This flexible liability structure in revenue-based financing aligns payment obligations with actual business performance, providing adaptive financial management advantages over rigid loan liabilities.

Business Bank Loan vs Revenue-Based Financing for Liability. Infographic

moneydiff.com

moneydiff.com