Traditional loan guarantors rely on personal creditworthiness and legal contracts, often leading to lengthy approval processes and increased risk of default in liability cases. Blockchain-backed guarantees offer a transparent, immutable ledger that enhances trust and reduces fraud by automatically verifying and enforcing guarantees in real-time. This decentralized approach streamlines liability coverage, minimizing administrative costs and improving the efficiency of loan guarantees.

Table of Comparison

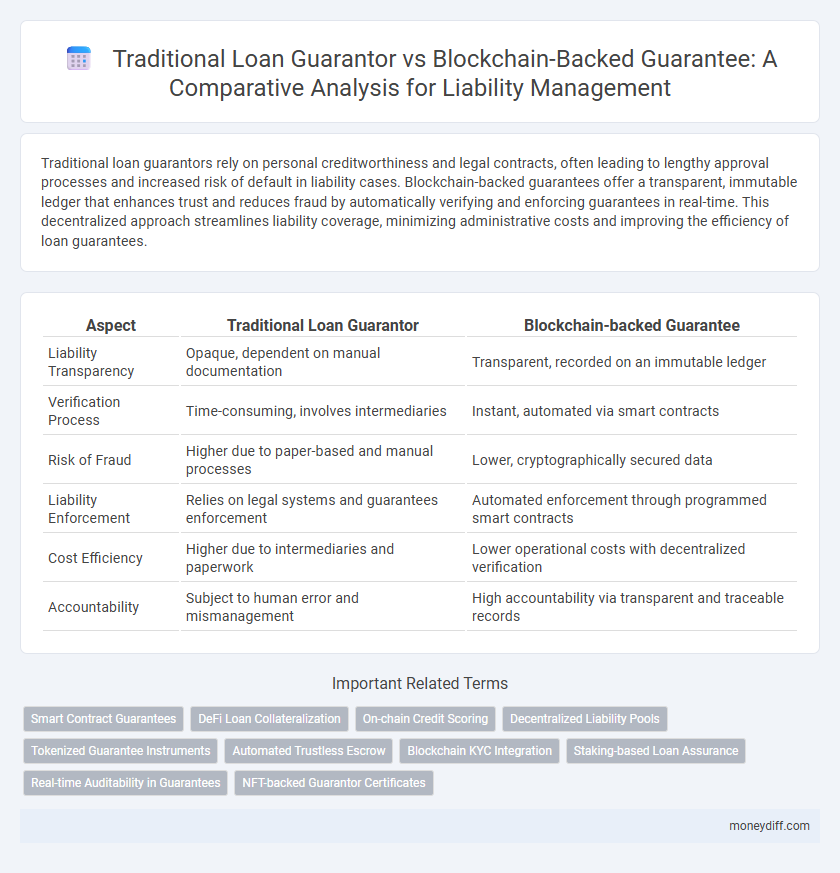

| Aspect | Traditional Loan Guarantor | Blockchain-backed Guarantee |

|---|---|---|

| Liability Transparency | Opaque, dependent on manual documentation | Transparent, recorded on an immutable ledger |

| Verification Process | Time-consuming, involves intermediaries | Instant, automated via smart contracts |

| Risk of Fraud | Higher due to paper-based and manual processes | Lower, cryptographically secured data |

| Liability Enforcement | Relies on legal systems and guarantees enforcement | Automated enforcement through programmed smart contracts |

| Cost Efficiency | Higher due to intermediaries and paperwork | Lower operational costs with decentralized verification |

| Accountability | Subject to human error and mismanagement | High accountability via transparent and traceable records |

Understanding Traditional Loan Guarantors in Liability Management

Traditional loan guarantors assume personal liability by pledging assets or creditworthiness to secure loan repayment, creating legal obligations that can impact their financial stability. Their role involves continuous risk assessment and credit evaluation to ensure borrower reliability, often leading to complex liability management processes. This conventional framework lacks transparency and efficiency compared to blockchain-backed guarantees, which automate verification and reduce dispute risks.

How Blockchain-backed Guarantees Change Liability Assurance

Blockchain-backed guarantees enhance liability assurance by providing immutable, transparent records that reduce fraud risks and increase trust between parties. Unlike traditional loan guarantors, blockchain eliminates the need for intermediaries, enabling real-time verification and automatic enforcement of guarantee terms through smart contracts. This innovation significantly decreases processing time and legal disputes, improving overall efficiency and accountability in liability management.

Key Differences Between Traditional and Blockchain-backed Loan Guarantees

Traditional loan guarantors rely onXin Yong Ping Fen , legal contracts, and intermediaries to manage liability, often resulting in slower dispute resolution and higher administrative costs. Blockchain-backed guarantees utilize decentralized ledgers for transparent, immutable records that reduce fraud risk and automate enforcement through smart contracts, lowering liability exposure. This shift enhances trust and efficiency, minimizing reliance on third parties and enabling real-time liability tracking for loan guarantees.

Efficiency and Transparency: Blockchain in Liability Guarantees

Traditional loan guarantors involve extensive paperwork and manual verification processes, often leading to delays and increased operational costs. Blockchain-backed guarantees enhance efficiency by automating verification through smart contracts, reducing processing time and minimizing human error. Transparent, immutable ledger entries provide real-time liability tracking and auditability, significantly improving trust and accountability in guarantee management.

Risk Assessment: Conventional Guarantors vs Blockchain-backed Solutions

Traditional loan guarantors often involve subjective risk assessments based on credit history, financial statements, and personal reputation, which can lead to inconsistencies and potential biases. Blockchain-backed guarantees utilize decentralized ledger technology to provide transparent, immutable records and automated risk evaluation through smart contracts, reducing fraud and enhancing trustworthiness. This shift enables more accurate, real-time liability management by minimizing human error and increasing data reliability.

Legal Implications of Traditional vs Blockchain Loan Guarantees

Traditional loan guarantors face comprehensive legal obligations, including enforceable personal liability and stringent regulatory compliance under banking laws. Blockchain-backed guarantees introduce smart contracts that automate liability enforcement, reducing disputes but raising novel legal questions regarding jurisdiction, contract interpretation, and regulatory acceptance. Regulatory frameworks are rapidly evolving to address these differences, impacting enforceability and risk management in liability cases.

Cost Comparison: Traditional Guarantor Fees vs Blockchain-backed Savings

Traditional loan guarantors typically charge fees ranging from 1% to 3% of the loan amount, adding significant costs to the borrower's liability. Blockchain-backed guarantees eliminate intermediaries and reduce processing fees by up to 70%, offering a more cost-effective alternative. This decentralized approach also enhances transparency and reduces the risk of hidden charges.

Security and Fraud Prevention in Liability Guarantees

Traditional loan guarantors rely heavily on personal credit history and legal documents, making them vulnerable to identity theft and document falsification, which can compromise liability security. Blockchain-backed guarantees leverage decentralized ledger technology to create immutable and transparent records, significantly reducing fraud risks by ensuring authenticity and traceability of each transaction. Enhanced encryption and smart contracts in blockchain systems provide automated enforcement of liability terms, offering superior fraud prevention and stronger security compared to conventional guarantor methods.

Accessibility and Inclusion: Blockchain-backed Guarantees for Underbanked

Traditional loan guarantors often exclude underbanked individuals due to stringent credit requirements and lack of transparent verification processes. Blockchain-backed guarantees enhance accessibility by leveraging decentralized ledgers that record immutable credit histories, enabling underbanked populations to build trust and gain loan access. This inclusion fosters financial empowerment by reducing reliance on conventional credit assessments and lowering barriers to entry in lending markets.

The Future of Loan Liability Management: Trends and Predictions

Traditional loan guarantors rely on personal creditworthiness and manual verification processes that often result in delayed liability settlements and increased default risks. Blockchain-backed guarantees introduce a decentralized, transparent ledger that automates contract enforcement and reduces fraud, enhancing the accuracy and efficiency of liability management. Future trends indicate that integrating smart contracts with real-time data analytics will revolutionize liability assessments, offering predictive risk management and streamlined claim resolutions.

Related Important Terms

Smart Contract Guarantees

Traditional loan guarantors involve third-party entities assuming liability, often leading to complex legal processes and delayed claim settlements; smart contract guarantees on blockchain automate liability execution through coded agreements, ensuring transparency, real-time enforcement, and reduced counterparty risk. Blockchain-backed guarantees offer immutable records and automatic triggering of liability events, enhancing trust and efficiency over conventional collateral or personal guarantee methods.

DeFi Loan Collateralization

Traditional loan guarantors require personal credit assessments and legal enforcement, creating slower and less transparent processes for liability recovery. Blockchain-backed guarantees in DeFi loan collateralization utilize smart contracts and on-chain asset verification, enabling decentralized, automated, and transparent liability management with reduced counterparty risk.

On-chain Credit Scoring

Traditional loan guarantors depend on manual credit assessments and off-chain data, often leading to prolonged approval times and potential inaccuracies in liability evaluation. Blockchain-backed guarantees leverage on-chain credit scoring, providing transparent, real-time, and immutable credit histories that enhance liability assessment accuracy and reduce default risks.

Decentralized Liability Pools

Traditional loan guarantors assume liability through centralized agreements, which limits transparency and increases the risk of single points of failure; blockchain-backed guarantees leverage decentralized liability pools, distributing risk across multiple participants and enhancing security, transparency, and trust in the lending process. These decentralized liability pools also facilitate real-time tracking of obligations and automatically enforce contract terms using smart contracts, reducing default risks and administrative overhead.

Tokenized Guarantee Instruments

Traditional loan guarantors rely on legal agreements and credit assessments to assume liability, often resulting in lengthy verification and enforcement processes. Blockchain-backed guarantee instruments utilize tokenized guarantees, enabling transparent, immutable, and automated liability management, significantly reducing risk exposure and streamlining claim settlements.

Automated Trustless Escrow

Traditional loan guarantors rely on manual verification processes and legal contracts that introduce delays and potential disputes in liability enforcement, whereas blockchain-backed guarantees utilize automated trustless escrow systems that ensure instant, transparent, and tamper-proof management of liabilities. By leveraging smart contracts on decentralized platforms, blockchain guarantees eliminate intermediary risks and streamline claim settlements, significantly enhancing contractual reliability and reducing fraud.

Blockchain KYC Integration

Traditional loan guarantors rely on manual identity verification processes that can be time-consuming and prone to errors, increasing liability risks for lenders. Blockchain-backed guarantees leverage integrated KYC (Know Your Customer) protocols, providing immutable, transparent identity verification that reduces fraud risk and enhances liability security for all parties involved.

Staking-based Loan Assurance

Traditional loan guarantors rely on personal creditworthiness and legal obligations to assume liability, often facing delays and limited transparency in claim settlements. Blockchain-backed guarantees leveraging staking-based loan assurance provide automated, transparent, and real-time liability management, where staked assets secure loan performance and minimize default risks through smart contract enforcement.

Real-time Auditability in Guarantees

Traditional loan guarantors rely on manual record-keeping and periodic audits, which can delay liability verification and increase the risk of errors or fraud. Blockchain-backed guarantees enable real-time auditability through immutable digital ledgers, providing instantaneous verification of liability status and enhancing transparency for all parties involved.

NFT-backed Guarantor Certificates

NFT-backed guarantor certificates transform liability assurance by providing immutable, transparent proof of guarantee on blockchain, reducing disputes and enhancing trust compared to traditional loan guarantors reliant on paper contracts and manual verification. This digital innovation streamlines liability management, enabling real-time tracking and secure transfer of guarantee rights, thus optimizing risk mitigation processes.

Traditional Loan Guarantor vs Blockchain-backed Guarantee for Liability Infographic

moneydiff.com

moneydiff.com