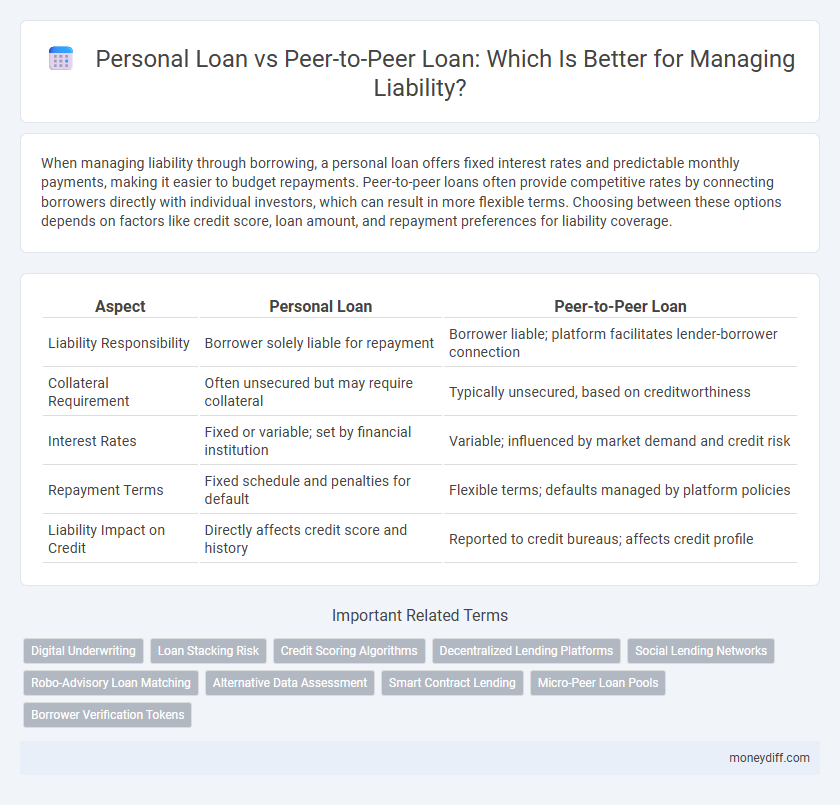

When managing liability through borrowing, a personal loan offers fixed interest rates and predictable monthly payments, making it easier to budget repayments. Peer-to-peer loans often provide competitive rates by connecting borrowers directly with individual investors, which can result in more flexible terms. Choosing between these options depends on factors like credit score, loan amount, and repayment preferences for liability coverage.

Table of Comparison

| Aspect | Personal Loan | Peer-to-Peer Loan |

|---|---|---|

| Liability Responsibility | Borrower solely liable for repayment | Borrower liable; platform facilitates lender-borrower connection |

| Collateral Requirement | Often unsecured but may require collateral | Typically unsecured, based on creditworthiness |

| Interest Rates | Fixed or variable; set by financial institution | Variable; influenced by market demand and credit risk |

| Repayment Terms | Fixed schedule and penalties for default | Flexible terms; defaults managed by platform policies |

| Liability Impact on Credit | Directly affects credit score and history | Reported to credit bureaus; affects credit profile |

Understanding Personal Loans and Peer-to-Peer Loans

Personal loans involve borrowing a fixed amount from traditional banks or financial institutions with set interest rates and repayment terms, making liability predictable for borrowers. Peer-to-peer loans are funded directly by individual investors via online platforms, often offering flexible terms but potentially higher risk due to variable interest rates and less regulatory oversight. Understanding the differences in liability exposure helps borrowers choose between structured repayment schedules of personal loans and the dynamic risk profile inherent in peer-to-peer lending.

Key Differences Between Personal and Peer-to-Peer Loans

Personal loans typically come from traditional financial institutions with fixed interest rates and predictable repayment schedules, providing a structured liability. Peer-to-peer loans, sourced through online platforms connecting borrowers directly with investors, often offer more flexible terms but can carry variable interest rates and higher risk of default liability. Understanding these key differences is essential for managing financial obligations and assessing potential impacts on personal credit and overall debt liability.

Liability Implications: Personal Loan vs P2P Loan

Personal loans typically involve liability directly tied to the borrower's creditworthiness, with fixed payment schedules and standard interest rates set by banks or credit unions, which can impact credit scores and financial obligations predictably. Peer-to-peer (P2P) loans distribute liability among individual lenders, potentially resulting in varied terms and risk exposure, often with higher interest rates due to increased default risk and less regulatory oversight. Understanding how each loan type assigns liability is crucial for assessing repayment responsibility, potential credit impact, and overall financial risk.

Interest Rates and Total Repayment Obligations

Personal loans typically offer fixed interest rates, providing predictable monthly payments and total repayment amounts, which helps borrowers manage their liabilities with clarity. Peer-to-peer loans may feature variable interest rates influenced by investor demand, leading to potentially higher or fluctuating repayment obligations over the loan term. Comparing total repayment costs reveals that personal loans often have lower liabilities due to more regulated rates, whereas peer-to-peer loans carry risks of increased financial burden depending on market conditions.

Credit Impact: Traditional Lenders vs P2P Platforms

Personal loans from traditional lenders often have a direct impact on credit scores due to strict credit checks and consistent reporting to major credit bureaus. Peer-to-peer (P2P) loans may offer more flexible credit requirements, but late payments or defaults on P2P platforms are also reported and can negatively affect credit ratings. Borrowers seeking to manage liability should consider how each loan type influences credit history and debt-to-income ratios in the long term.

Fee Structures and Hidden Costs Comparison

Personal loans typically feature fixed interest rates with clear fee structures, including origination fees and late payment penalties, which are disclosed upfront to borrowers. Peer-to-peer loans may present lower interest rates but often include platform fees, service charges, and potential hidden costs such as administrative fees that vary by lender. Evaluating the total cost of borrowing requires analyzing both loan types' interest rates, upfront fees, and any additional charges to avoid unexpected liabilities.

Security and Risk Considerations for Borrowers

Personal loans typically offer fixed interest rates and predictable repayment schedules, providing borrowers with a secured form of liability protection through traditional financial institutions. Peer-to-peer loans carry higher risk due to variable terms and less regulatory oversight, potentially exposing borrowers to fluctuating interest rates and stricter repayment enforcement. Borrowers must evaluate the security measures and risk factors of each option to manage liability effectively and avoid financial complications.

Legal Protections and Borrower Rights

Personal loans typically offer stronger legal protections and borrower rights, regulated by federal laws such as the Truth in Lending Act (TILA) and the Equal Credit Opportunity Act (ECOA), ensuring clear disclosure of terms and fair lending practices. Peer-to-peer loans, while facilitated through various online platforms, may lack uniform regulatory oversight, potentially exposing borrowers to varied contract terms and limited legal recourse. Understanding the regulatory environment and borrower protections associated with each loan type is essential to manage liability risks effectively.

Influence on Debt-to-Income Ratio and Financial Health

Personal loans generally have fixed interest rates and repayment terms, offering predictable monthly payments that can help maintain a stable debt-to-income ratio, which is crucial for financial health. Peer-to-peer loans might have variable rates and varying terms, potentially leading to fluctuating monthly obligations that could increase the debt-to-income ratio and strain financial stability. Evaluating the impact of each loan type on cash flow and liabilities ensures better management of overall financial health.

Choosing the Right Loan Type for Liability Management

Personal loans offer fixed interest rates and predictable monthly payments, making them ideal for managing liabilities with stable budgets and credit scores. Peer-to-peer loans may provide lower rates and flexible terms but can involve higher risk and variable repayment schedules, suitable for borrowers comfortable with alternative lending platforms. Evaluating interest rates, repayment flexibility, and credit impact is essential to choose the right loan type for effective liability management.

Related Important Terms

Digital Underwriting

Digital underwriting in personal loans utilizes AI-driven credit scoring and automated risk assessments for faster approval, while peer-to-peer loans rely on platform-driven digital verification to match borrowers with individual investors, potentially impacting liability distribution and default risk management. Enhanced data analytics in digital underwriting improve accuracy in predicting borrower risk and liability exposure across both lending models.

Loan Stacking Risk

Personal loans typically have stricter credit checks and clearer disclosures, reducing loan stacking risk by limiting simultaneous borrowing across multiple lenders. Peer-to-peer loans, while accessible, pose a higher loan stacking risk due to less centralized credit monitoring, increasing potential overlapping liabilities for borrowers.

Credit Scoring Algorithms

Credit scoring algorithms for personal loans typically rely on established financial history and fixed income verification, resulting in more predictable liability assessments, whereas peer-to-peer loan platforms incorporate alternative data and social behavior metrics to evaluate borrower risk, potentially affecting liability exposure. This difference in credit evaluation methods influences the accuracy and fairness of liability allocation between traditional financial institutions and peer-to-peer lending networks.

Decentralized Lending Platforms

Personal loans typically involve direct liability to traditional financial institutions, whereas peer-to-peer loans on decentralized lending platforms distribute liability among multiple individual lenders, reducing centralized risk. Decentralized lending platforms utilize blockchain technology to enhance transparency, mitigate credit risk, and offer lower interest rates compared to conventional personal loans.

Social Lending Networks

Social lending networks facilitate peer-to-peer loans by directly connecting borrowers with individual investors, often resulting in lower interest rates and flexible repayment terms compared to traditional personal loans from banks. This structure shifts liability management to a decentralized platform, enhancing transparency but requiring thorough credit risk assessment by both parties involved.

Robo-Advisory Loan Matching

Robo-advisory loan matching optimizes liability management by analyzing personal loan terms and peer-to-peer loan options, ensuring borrowers select lower interest rates and tailored repayment plans. This technology enhances financial decision-making by reducing overall debt burden and minimizing default risk through personalized liability assessments.

Alternative Data Assessment

Personal loan lenders primarily rely on traditional credit scores, while peer-to-peer loans incorporate alternative data assessment, such as social behavior and transaction history, to evaluate liability risk. This alternative data approach enables more inclusive lending decisions by identifying creditworthiness beyond conventional financial metrics.

Smart Contract Lending

Personal loans typically involve traditional lenders bearing the liability risk, whereas peer-to-peer loans utilize smart contract lending to automate liability enforcement and reduce default risk through transparent, immutable blockchain agreements. Smart contract lending enhances accountability by instantly executing repayment terms and collateral management, shifting liability dynamics compared to conventional personal loan frameworks.

Micro-Peer Loan Pools

Personal loans typically involve fixed repayment schedules and interest rates set by traditional financial institutions, offering predictable liability management. Micro-peer loan pools in peer-to-peer lending distribute liability among multiple investors, reducing individual risk exposure while potentially offering more flexible terms and competitive interest rates.

Borrower Verification Tokens

Personal Loan liability management involves stringent borrower verification tokens issued by financial institutions to ensure creditworthiness and mitigate default risk. Peer-to-peer loan platforms utilize blockchain-based borrower verification tokens that enhance transparency and reduce fraud, creating a decentralized accountability mechanism for liabilities.

Personal Loan vs Peer-to-Peer Loan for liability. Infographic

moneydiff.com

moneydiff.com