Traditional car loans create long-term liabilities through fixed monthly payments and interest, impacting your credit and financial stability. Subscription car services offer more flexible liability with shorter commitments and bundled costs, reducing unexpected expenses. Choosing a subscription can minimize debt risk by avoiding depreciation and resale concerns tied to traditional loans.

Table of Comparison

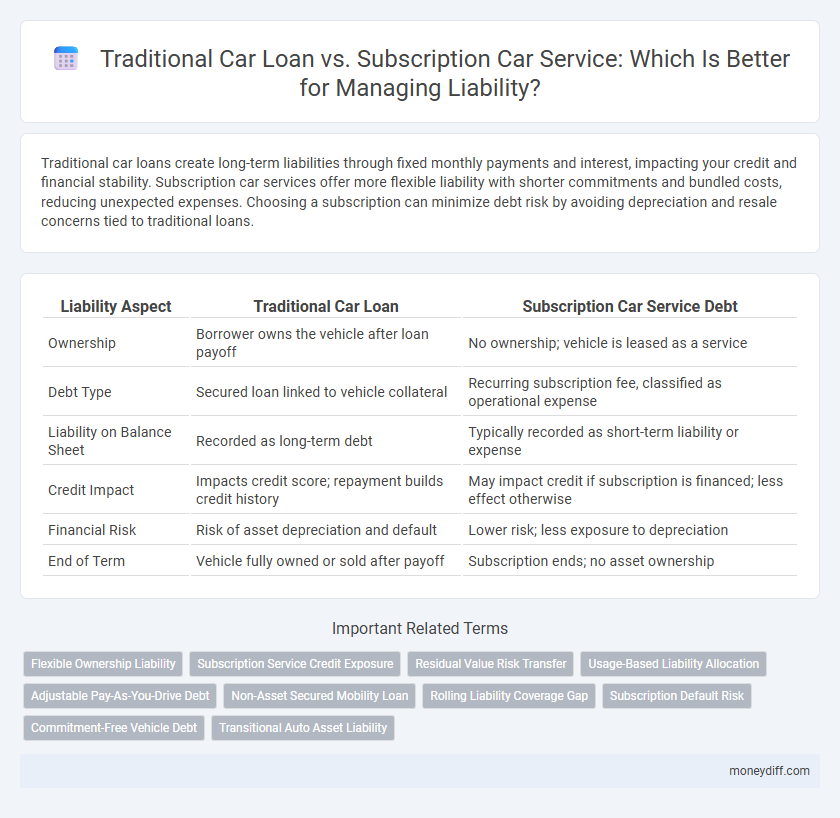

| Liability Aspect | Traditional Car Loan | Subscription Car Service Debt |

|---|---|---|

| Ownership | Borrower owns the vehicle after loan payoff | No ownership; vehicle is leased as a service |

| Debt Type | Secured loan linked to vehicle collateral | Recurring subscription fee, classified as operational expense |

| Liability on Balance Sheet | Recorded as long-term debt | Typically recorded as short-term liability or expense |

| Credit Impact | Impacts credit score; repayment builds credit history | May impact credit if subscription is financed; less effect otherwise |

| Financial Risk | Risk of asset depreciation and default | Lower risk; less exposure to depreciation |

| End of Term | Vehicle fully owned or sold after payoff | Subscription ends; no asset ownership |

Overview of Traditional Car Loans and Subscription Car Services

Traditional car loans involve borrowing a fixed amount to purchase a vehicle, creating a long-term liability that appears as debt on the borrower's balance sheet and requires monthly payments with interest. Subscription car services offer a flexible alternative, where fees cover vehicle access, insurance, and maintenance without ownership, leading to an operational expense rather than a financed liability. The key distinction lies in asset ownership and balance sheet impact: traditional loans increase liabilities through financed assets, while subscriptions categorize costs as recurring service expenses.

Understanding Liability in Car Financing Options

Liability in traditional car loans involves long-term debt secured by the vehicle, impacting credit scores and financial stability if payments are missed. Subscription car services shift liability to a monthly fee model, reducing ownership risks but potentially increasing overall expenses without building equity. Evaluating these options requires analyzing debt obligations, risk exposure, and impact on personal liability in financing agreements.

Key Features of Traditional Car Loan Debt

Traditional car loan debt requires borrowers to secure financing with fixed monthly payments over a predetermined term, often ranging from 36 to 72 months, impacting long-term financial liability. Interest rates on car loans vary based on credit score, loan duration, and lender policies, directly influencing total repayment amounts and overall debt burden. Ownership transfer and vehicle depreciation risk remain with the borrower, emphasizing the loan's impact on personal assets and potential liability exposure.

Liability Considerations with Car Subscription Services

Car subscription services typically transfer ownership and maintenance responsibilities to the provider, reducing personal liability compared to traditional car loans where the borrower assumes full financial and legal responsibility for the vehicle. With a car loan, outstanding debt and potential depreciation risks directly impact the borrower's credit and financial liability. Subscription services often include insurance and maintenance, limiting the subscriber's exposure to unexpected costs and liabilities associated with vehicle ownership.

Cost Analysis: Traditional Car Loan vs Subscription Service

Traditional car loans often involve higher upfront costs, including down payments, taxes, and registration fees, resulting in significant initial financial liability. Subscription car services typically have fixed monthly fees that cover insurance, maintenance, and depreciation, reducing unpredictable expenses and spreading liability evenly over time. Analyzing total cost of ownership shows traditional loans may lead to greater long-term debt liabilities, whereas subscription services offer more predictable liability management through bundled costs.

Impact on Credit and Debt Management

Traditional car loans directly impact credit scores through fixed monthly payments and debt-to-income ratio considerations, influencing overall creditworthiness. Subscription car services typically do not report to credit bureaus, minimizing impact on credit scores but potentially complicating debt management due to recurring fees without long-term asset ownership. Managing traditional loan debt tends to improve credit history if payments are timely, whereas subscription services offer flexibility with less credit risk but no opportunity for building credit through repayment.

Ownership vs Flexibility: Managing Liability Risks

Traditional car loans create a fixed liability due to ownership obligations, including depreciation and long-term financial commitment. Subscription car services offer flexible use without ownership, reducing exposure to asset depreciation and resale risks, which minimizes liability concerns. Choosing between ownership and subscription impacts liability management by balancing financial responsibility against adaptability to changing needs.

Long-Term Financial Obligations Compared

Traditional car loans typically involve fixed monthly payments over a multi-year term, creating a predictable long-term financial obligation that impacts credit and debt-to-income ratios. Subscription car services often require monthly fees without ownership, resulting in potentially higher recurring liabilities but shorter commitment periods and fewer long-term financial burdens. Evaluating these options requires understanding how each affects overall liability and long-term financial stability through factors like loan duration, interest rates, and contractual obligations.

How Each Option Affects Personal Net Worth

Traditional car loans increase personal liabilities by adding a fixed debt amount, which lowers net worth until the loan is fully repaid and the vehicle depreciates over time. Subscription car services typically require no long-term debt, preserving net worth by converting car access into an operational expense rather than a financed asset. This distinction impacts credit score and borrowing capacity, influencing overall financial stability and asset-liability balance.

Choosing the Best Option for Managing Liability

Traditional car loans create long-term liabilities through fixed monthly payments and interest, often leading to higher total debt compared to subscription car services. Subscription car services offer flexible, short-term financial commitments that reduce balance sheet liabilities and simplify budgeting by bundling maintenance and insurance costs. Selecting between these options depends on one's ability to manage debt, the desire for asset ownership, and the impact on personal or business liability profiles.

Related Important Terms

Flexible Ownership Liability

Traditional car loans create fixed liabilities with monthly payments tied to vehicle ownership and depreciation risks, while subscription car services offer flexible ownership liability by consolidating costs into a single fee and reducing exposure to long-term debt obligations. This flexibility minimizes financial risk and enhances adaptability for users facing variable income or changing transportation needs.

Subscription Service Credit Exposure

Subscription car service debt typically presents lower credit exposure compared to traditional car loans, as monthly fees encompass depreciation and maintenance, reducing unexpected liabilities. Traditional car loans involve higher liability risk due to amortized principal and interest payments, alongside potential depreciation losses impacting the borrower's credit and financial stability.

Residual Value Risk Transfer

Traditional car loans place residual value risk directly on the borrower, who is responsible for the full loan amount regardless of the vehicle's depreciation. Subscription car services transfer residual value risk to the provider, reducing liability for the user by eliminating concerns over resale value fluctuations.

Usage-Based Liability Allocation

Traditional car loans create fixed financial liabilities reflected on the borrower's credit report, demanding consistent monthly payments regardless of vehicle usage, while subscription car services allocate liability based on actual usage, allowing costs to fluctuate with mileage and driving frequency. Usage-based liability allocation in subscription services reduces financial risk by aligning expenses more closely with the consumer's driving habits, offering increased flexibility and potentially lower overall debt.

Adjustable Pay-As-You-Drive Debt

Adjustable pay-as-you-drive debt in subscription car services offers flexible liability management by aligning payments with actual vehicle usage, reducing fixed financial obligations compared to traditional car loans with fixed monthly payments. This model minimizes long-term debt risk and enhances cash flow control, making it a strategic choice for consumers seeking adaptable liability solutions.

Non-Asset Secured Mobility Loan

Traditional car loans create liability through secured debt tied to the vehicle as collateral, increasing risk if the asset depreciates faster than the loan balance. Subscription car services often involve non-asset secured liabilities, where monthly fees represent ongoing obligations without ownership, reducing exposure to asset depreciation but potentially increasing long-term financial commitments.

Rolling Liability Coverage Gap

Traditional car loans typically create a rolling liability coverage gap because the insurance coverage is tied to the loan balance, potentially leaving owners underinsured as the vehicle depreciates. Subscription car services often mitigate this gap by including liability insurance within the subscription fee, ensuring continuous coverage without exposure to depreciation-related shortfalls.

Subscription Default Risk

Subscription car service debt poses a higher default risk compared to traditional car loans due to ongoing monthly fees and lack of asset ownership, which can reduce borrower commitment and increase liability exposure for lenders. In contrast, traditional car loans typically involve fixed payments secured by vehicle ownership, offering clearer recourse options and lower default probability.

Commitment-Free Vehicle Debt

Traditional car loans create long-term financial liability with fixed monthly payments and interest that impact credit scores, while subscription car services offer commitment-free vehicle access without long-term debt, reducing liabilities on personal balance sheets. Subscription models eliminate the risk of depreciation loss and default, providing flexible vehicle use without the burden of loan obligations or residual value risks.

Transitional Auto Asset Liability

Traditional car loans create a fixed liability on the balance sheet through long-term debt tied to the vehicle's purchase price, while subscription car services classify payments as operating expenses, reducing long-term asset liabilities and enhancing cash flow flexibility. Transitional auto asset liability shifts focus from owning depreciable assets with secured debt to utilizing service-based models, minimizing residual risks and enabling more adaptable financial management.

Traditional Car Loan vs Subscription Car Service Debt for Liability. Infographic

moneydiff.com

moneydiff.com