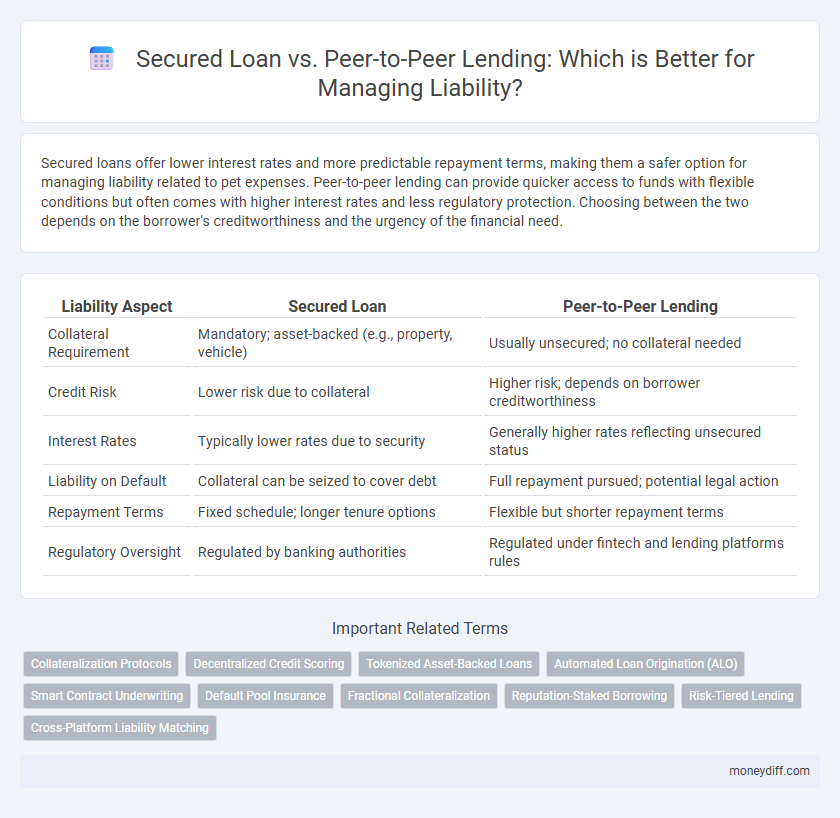

Secured loans offer lower interest rates and more predictable repayment terms, making them a safer option for managing liability related to pet expenses. Peer-to-peer lending can provide quicker access to funds with flexible conditions but often comes with higher interest rates and less regulatory protection. Choosing between the two depends on the borrower's creditworthiness and the urgency of the financial need.

Table of Comparison

| Liability Aspect | Secured Loan | Peer-to-Peer Lending |

|---|---|---|

| Collateral Requirement | Mandatory; asset-backed (e.g., property, vehicle) | Usually unsecured; no collateral needed |

| Credit Risk | Lower risk due to collateral | Higher risk; depends on borrower creditworthiness |

| Interest Rates | Typically lower rates due to security | Generally higher rates reflecting unsecured status |

| Liability on Default | Collateral can be seized to cover debt | Full repayment pursued; potential legal action |

| Repayment Terms | Fixed schedule; longer tenure options | Flexible but shorter repayment terms |

| Regulatory Oversight | Regulated by banking authorities | Regulated under fintech and lending platforms rules |

Understanding Liability in Money Management

Liability management is crucial when comparing secured loans and peer-to-peer lending, as secured loans involve collateral that reduces lender risk but increases borrower liability in case of default. Peer-to-peer lending typically offers unsecured funds, leading to higher interest rates and greater default risk, which borrowers must consider in their financial planning. Understanding these liability differences helps individuals choose the best borrowing option to maintain balanced credit and minimize financial burden.

Secured Loans: Definition and Core Features

Secured loans are financial agreements backed by collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates compared to unsecured options. The core features include a defined repayment schedule, fixed or variable interest rates, and the lender's right to seize the collateral if the borrower defaults. This structure provides liability protection for lenders while offering borrowers access to significant funding with potentially favorable terms.

Peer-to-Peer Lending: What You Need to Know

Peer-to-peer (P2P) lending allows individuals to borrow money directly from other individuals without traditional financial institutions, creating a unique liability structure where the borrower is obligated to repay the loan to multiple lenders. Unlike secured loans that require collateral, P2P loans are typically unsecured, increasing the borrower's liability risk in case of default. Understanding the terms, interest rates, and potential penalties on P2P platforms is crucial for managing liabilities effectively in this lending model.

Liability Implications of Secured Loans

Secured loans involve pledging collateral, which reduces lender risk and typically offers lower interest rates, but borrowers face the liability of losing assets if they default. This form of liability creates a direct financial obligation that can impact credit scores and result in asset forfeiture. Understanding these liabilities is crucial when comparing secured loans to peer-to-peer lending, where collateral is generally absent and liability is primarily based on creditworthiness.

Liability Risks in Peer-to-Peer Lending

Peer-to-peer lending carries higher liability risks due to the lack of traditional financial institution safeguards and regulatory oversight. Borrowers may face increased default risks, while investors bear the full impact of potential loan non-repayment without collateral protection. In contrast, secured loans mitigate liability risks through asset-backed guarantees, providing a clearer avenue for recourse in case of borrower default.

Comparing Default Consequences: Secured Loans vs. P2P Lending

Secured loans impose collateral seizure upon default, directly impacting borrower assets and credit scores due to lender repossession rights. Peer-to-peer lending risks involve loss of creditworthiness without collateral loss, as defaults are generally pursued through collection or legal action, potentially increasing interest costs and damaging future borrowing opportunities. Borrowers face higher financial exposure with secured loans but more extended credit damage and collection stress with P2P loans, influencing liability management strategies.

Impact on Credit Score: Secured vs. P2P Loans

Secured loans typically have a more positive impact on credit scores as they involve collateral, reducing lender risk and encouraging timely repayments, which improve credit history. Peer-to-peer (P2P) lending can also affect credit scores but often carries higher interest rates and variable approval standards, potentially increasing risk if repayments are missed. Timely payments on both loan types enhance credit profiles, but secured loans offer more predictable credit score benefits due to their structured nature.

Collateral Requirements and Liability Exposure

Secured loans require collateral, which reduces liability exposure by allowing lenders to claim assets if the borrower defaults, minimizing financial risk. Peer-to-peer lending typically does not demand collateral, increasing liability exposure as borrowers remain fully responsible for repayment without asset-backed security. Understanding these differences is crucial for managing financial risk and protecting personal or business assets.

Legal Protections for Borrowers: Secured vs. P2P

Secured loans provide borrowers with robust legal protections through formal agreements that collateralize assets, minimizing lender risk and reducing default consequences. Peer-to-peer lending relies on platform-enforced contracts, which can vary in legal rigor and borrower safeguards, often offering less regulatory oversight. The disparity in legal frameworks influences liability exposure, with secured loans typically granting clearer pathways for dispute resolution and borrower rights enforcement.

Choosing the Right Option: Minimizing Liability Risks

Choosing between secured loans and peer-to-peer lending hinges on minimizing liability risks by evaluating collateral requirements and default consequences. Secured loans reduce lender risk by using assets as collateral, lowering interest rates but increasing borrower liability in case of default. Peer-to-peer lending involves higher interest rates and potential personal guarantees, elevating liability risks without collateral protection.

Related Important Terms

Collateralization Protocols

Secured loans require collateral such as real estate or vehicles, ensuring lenders can recover funds by liquidating these assets in case of default, which significantly reduces liability risk. Peer-to-peer lending often lacks stringent collateralization protocols, increasing investor liability exposure due to higher default rates and limited asset recovery options.

Decentralized Credit Scoring

Secured loans rely on traditional credit scoring methods backed by collateral, while peer-to-peer lending platforms increasingly utilize decentralized credit scoring models that assess creditworthiness through blockchain-verified financial behavior, enhancing transparency and reducing default risk. Decentralized credit scoring in P2P lending mitigates liability by providing lenders with more accurate, tamper-proof data, leading to better risk management and potentially lower interest rates for borrowers.

Tokenized Asset-Backed Loans

Tokenized asset-backed loans in secured lending provide borrowers with collateralized security, reducing liability risk through digital asset verification and ownership transparency. Peer-to-peer lending with tokenized assets enhances liability management by offering decentralized, real-time tracking of loan obligations and collateral value fluctuations.

Automated Loan Origination (ALO)

Automated Loan Origination (ALO) streamlines liability management by expediting approval processes and reducing default risks in secured loans through collateral verification, whereas peer-to-peer lending relies heavily on algorithmic credit assessments without physical collateral, impacting liability exposure differently. Advanced ALO platforms leverage machine learning to optimize underwriting for secured loans, enhancing liability predictability compared to the more variable risk profiles in peer-to-peer lending environments.

Smart Contract Underwriting

Smart contract underwriting enhances secured loans by automating collateral verification and repayment scheduling, reducing default risks and ensuring transparent liability management. In peer-to-peer lending, smart contracts facilitate direct borrower-lender agreements with real-time enforcement of terms, minimizing intermediary liabilities and accelerating dispute resolution.

Default Pool Insurance

Secured loans typically involve collateral that reduces lender risk, often minimizing the need for default pool insurance, whereas peer-to-peer lending platforms commonly use default pool insurance to mitigate borrower default risks. This insurance mechanism pools investor funds to cover losses from loan defaults, providing a financial safety net that enhances liability management in P2P lending environments.

Fractional Collateralization

Secured loans involve full collateralization, limiting liability exposure by pledging specific assets as security, whereas peer-to-peer lending often employs fractional collateralization, spreading risk among multiple creditors with partial asset backing. Fractional collateralization in P2P lending can increase liability complexity due to shared claims and variable recovery rates in default scenarios.

Reputation-Staked Borrowing

Reputation-staked borrowing in peer-to-peer lending leverages social trust and borrower history, reducing default risk and enhancing accountability compared to traditional secured loans that rely on collateral assets. This model minimizes liability exposure by linking borrowing capacity directly to reputational capital, fostering more responsible repayment behavior and potentially lowering overall borrowing costs.

Risk-Tiered Lending

Secured loans typically offer lower risk-tiered lending options due to collateral requirements, reducing liability exposure for both lenders and borrowers. Peer-to-peer lending involves higher liability risks as unsecured loans depend on borrower creditworthiness, leading to variable default probabilities and increased investor risk.

Cross-Platform Liability Matching

Secured loans typically involve collateral that limits the lender's liability exposure by enabling asset recovery in default, whereas peer-to-peer lending platforms distribute liability risk across multiple individual investors, facilitating diversified liability matching. Cross-platform liability matching in peer-to-peer lending uses algorithmic risk assessment to align borrower profiles with investor risk tolerance, optimizing the management of default liabilities compared to traditional secured loan models.

Secured Loan vs Peer-to-Peer Lending for Liability. Infographic

moneydiff.com

moneydiff.com